Energy News Beat

Toronto single-family prices -19% from peak, back to Oct. 2021. In Montreal, Quebec City, Edmonton, and Winnipeg, prices near all-time highs.

By Wolf Richter for WOLF STREET.

Home sales in Canada jumped by 7.7% in October from September, seasonally adjusted. Compared to the beaten-down levels a year ago, home sales jumped by 30%. New listings declined by 3.5% in October from September, after the 4.8% jump in September from August, “so new supply remains at some of the highest levels since mid-2022,” the Canadian Real Estate Association (CREA) said today.

Total inventory for sale of 174,458 properties was up by 11.4% from a year ago. Given the surge in sales, supply declined to 3.7 months at the current rate of sales, compared to 4.1 months in September.

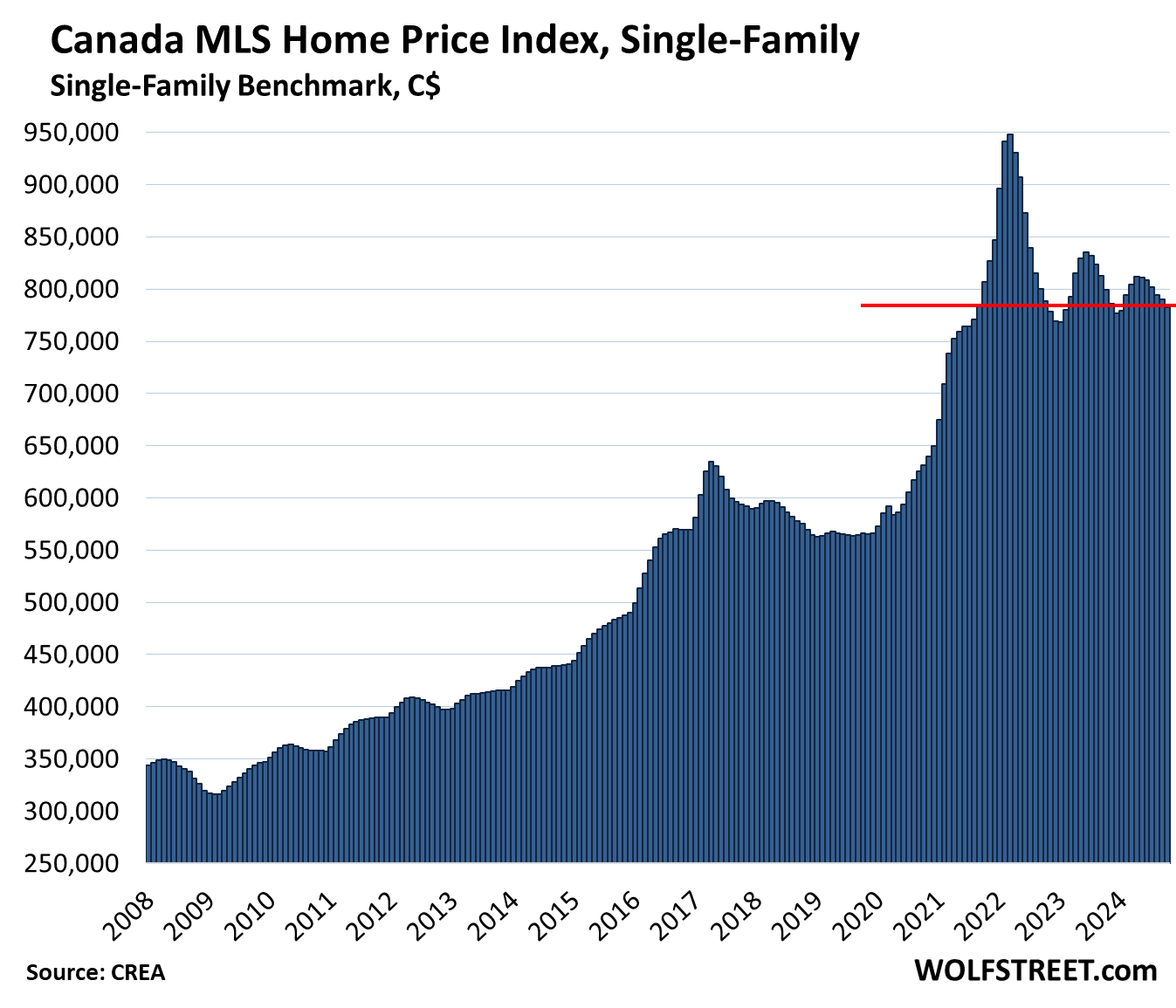

Prices of single-family properties in Canada fell 0.9% in October from September and were down 2.1% year-over-year — the sixth year-over-year decline in a row — were down by 17.4% from the peak of the spike in March 2022, and were back where they’d first been in September 2021, according to the Canada MLS Home Price Index for single-family benchmark properties released by CREA today. All prices here are actual, not seasonally adjusted, in Canadian dollars. But as we’ll see in a moment, prices are on very different tracks in different markets.

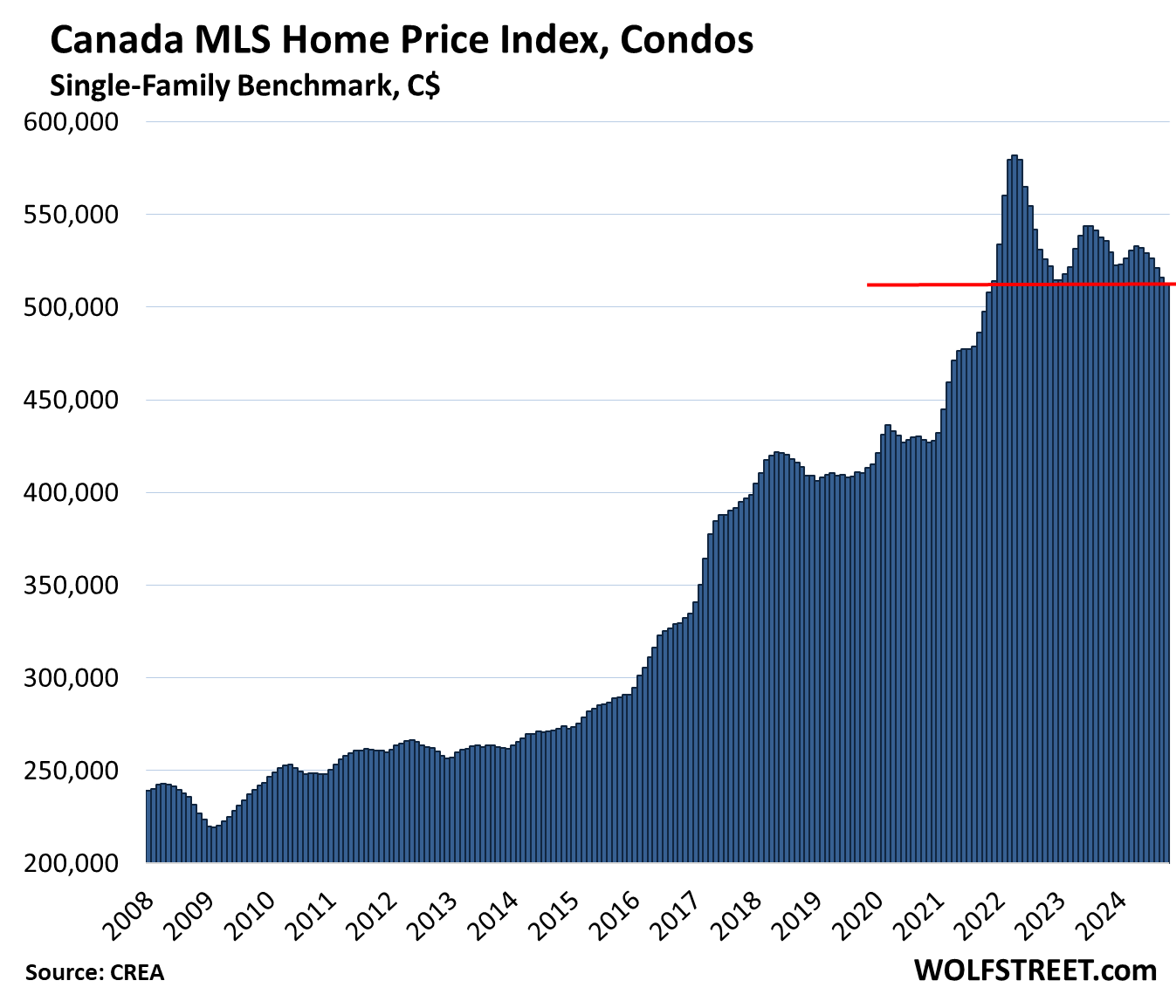

Prices of condos in Canada fell 0.8% in October from September the lowest level since December 2021. They were down 4.4% year-over-year, the sixth month in a row of year-over-year declines in a row, and were down 12.0% from their peak in April 2022.

Home prices by market in Canada.

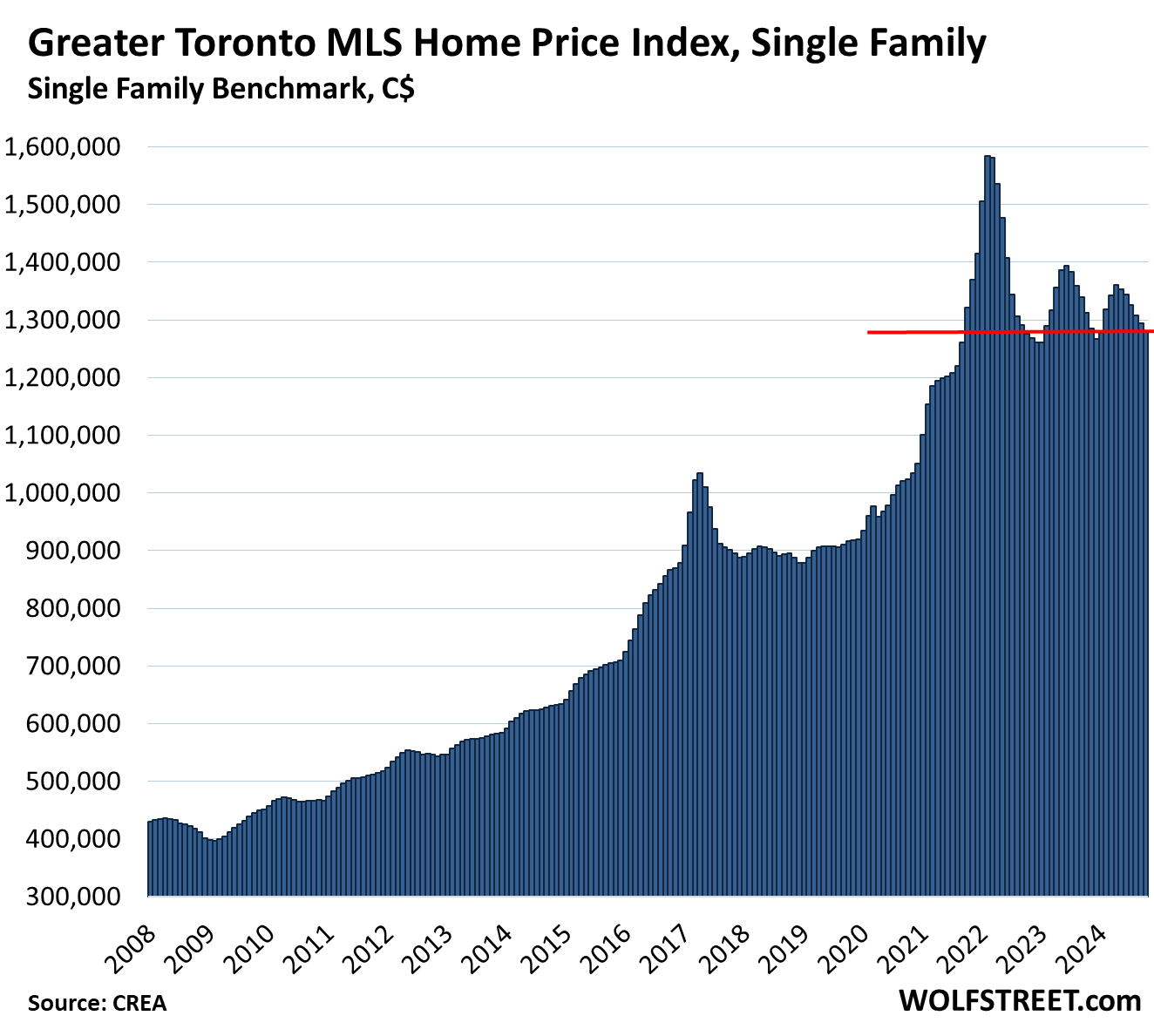

Greater Toronto Area, single-family MLS Home Price Benchmark Index:

- Month-to-month: -1.0% to $1,280,000; below October 2021

- From peak in February 2022: -19.2%

- Year-over-year: -2.5%, sixth month of year-over-year declines in a row.

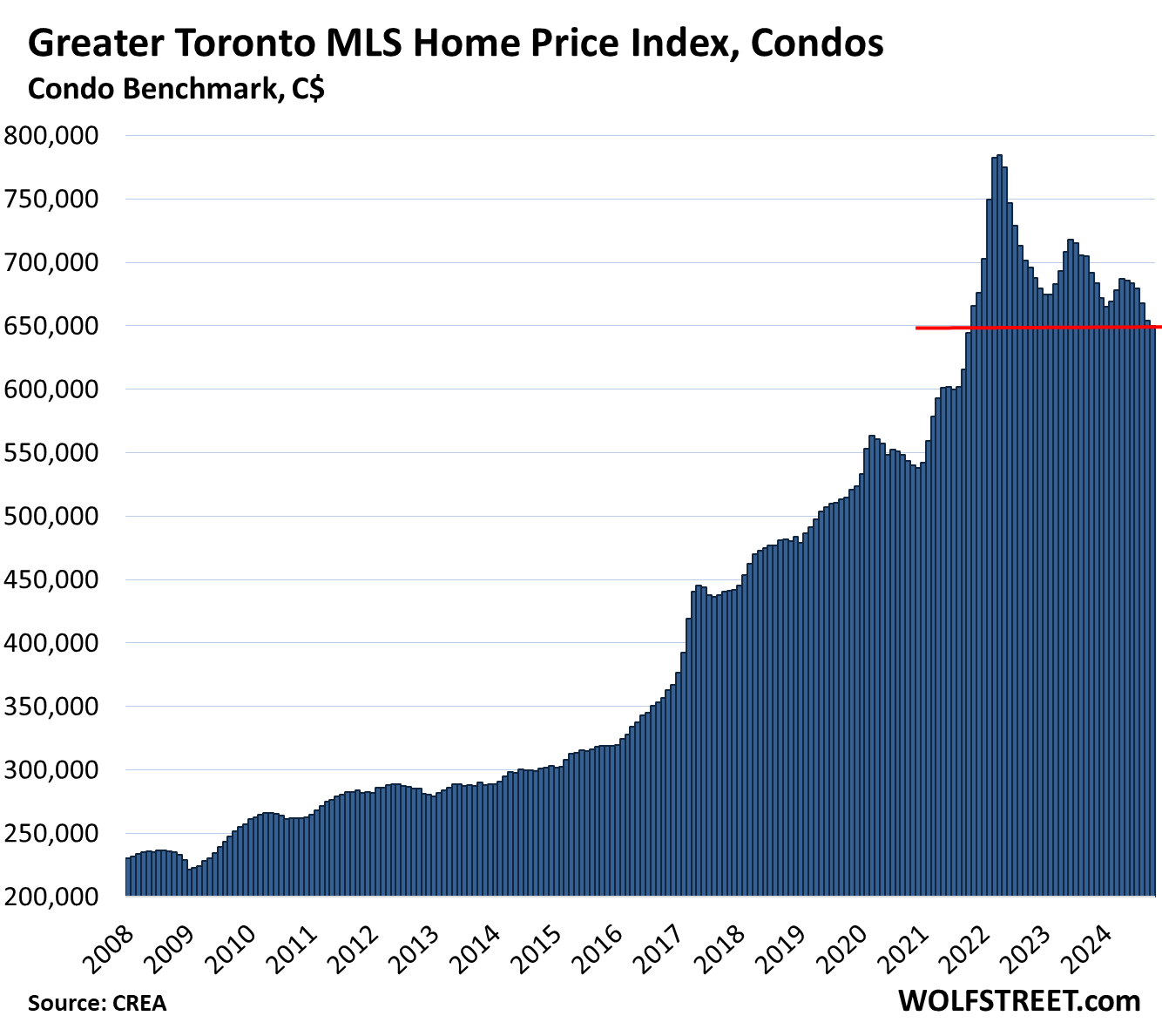

Greater Toronto Area, condo benchmark price:

- Month-to-month: -0.7% to $649,900, lowest since October 2021.

- From peak in April 2022: -17.1%

- Year-over-year: -6.1%, with 22 of the past 21 months booking year-over-year declines.

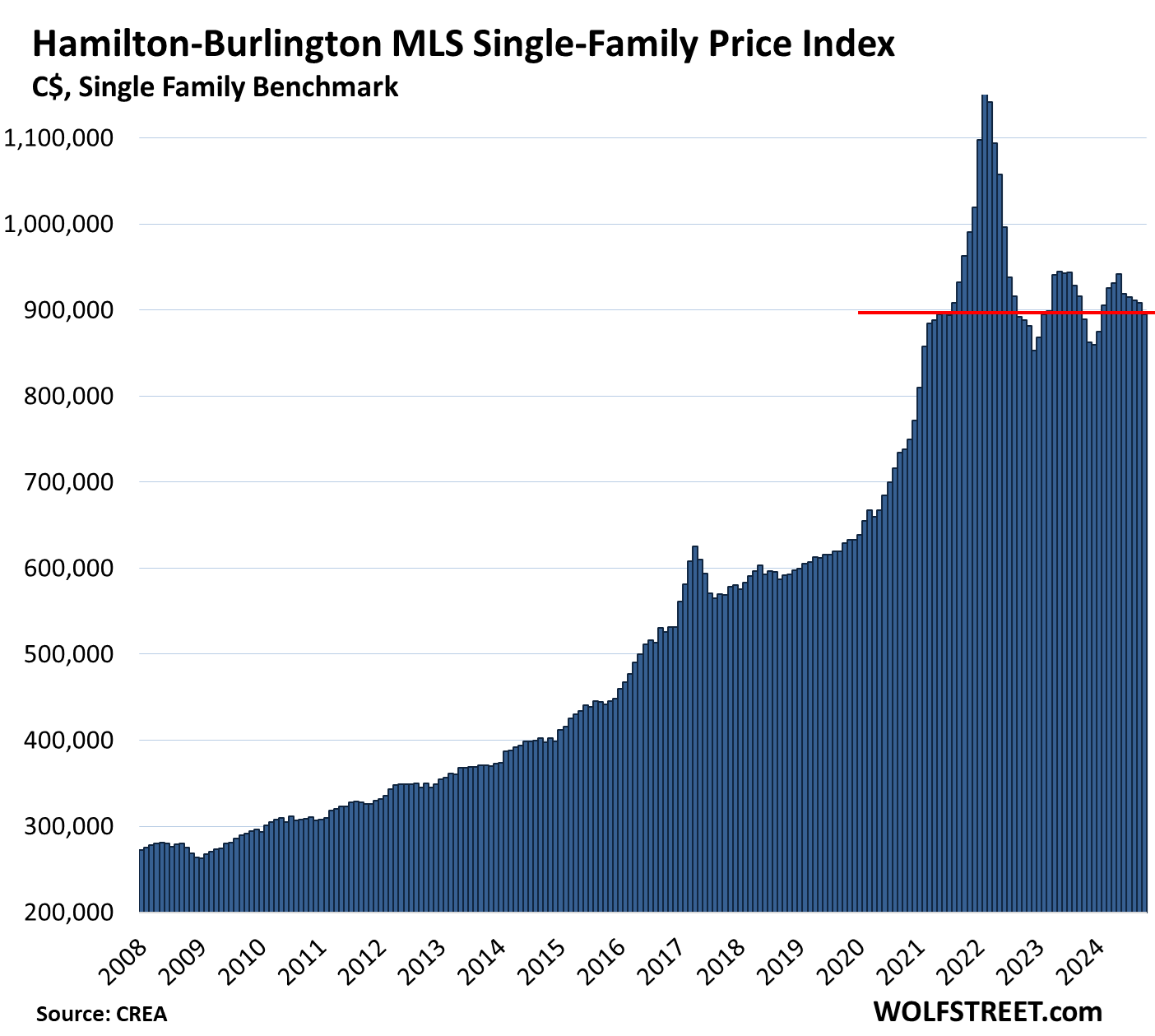

Hamilton-Burlington metro single family benchmark price (part of the “Greater Toronto and Hamilton Area”):

- Month-to-month: -1.5% to $894,600, where it had first been in July 2021

- From peak in February 2022: -22.6%

- Year-over-year: +0.6%.

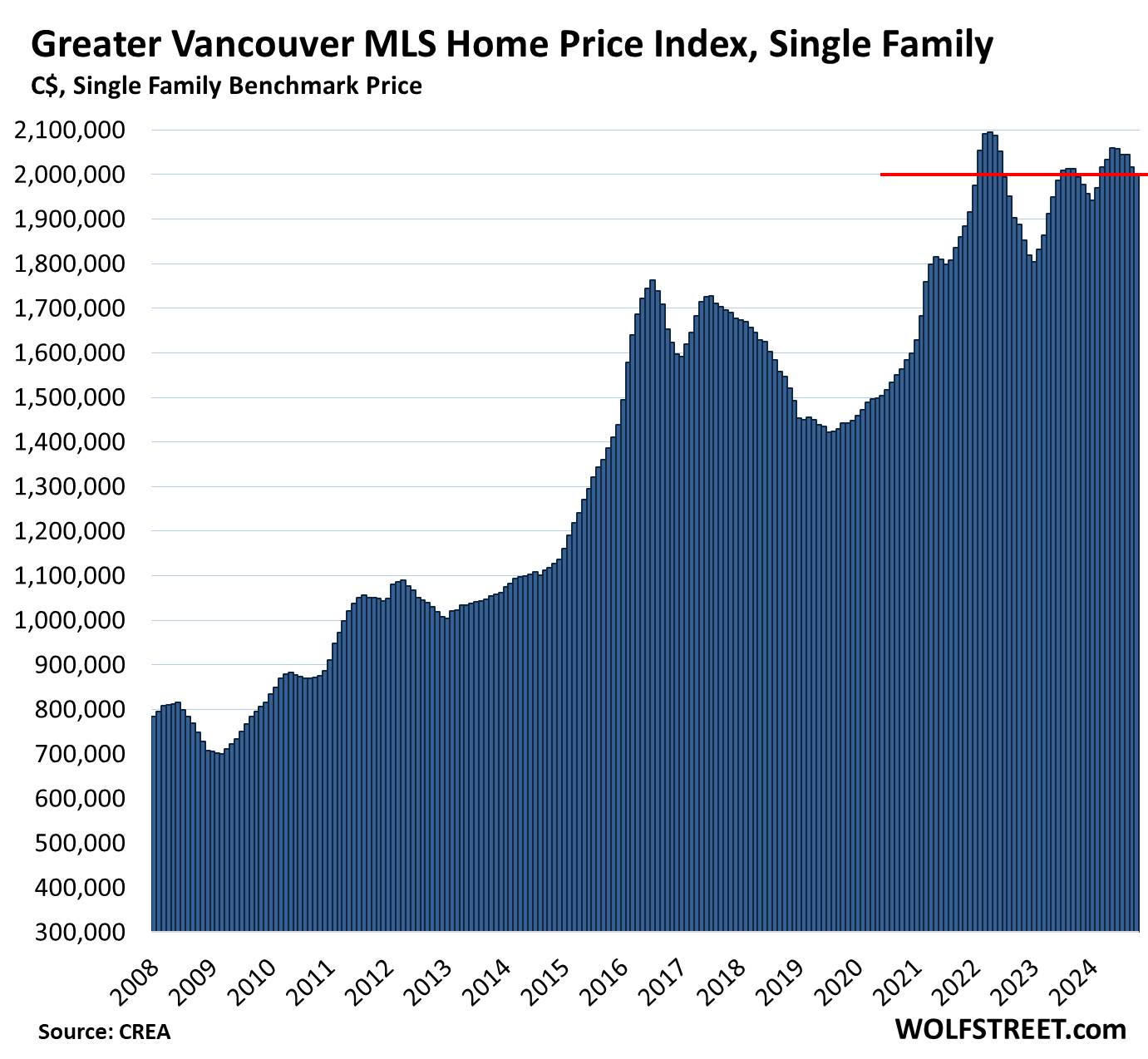

Greater Vancouver single-family benchmark price:

- Month-to-month: -0.8%, at $1,999,200.

- From peak in April 2022: -4.6%

- Year-over-year: +0.2%, same as in September, and both were the smallest year-over-year gains since the drop in June 2023.

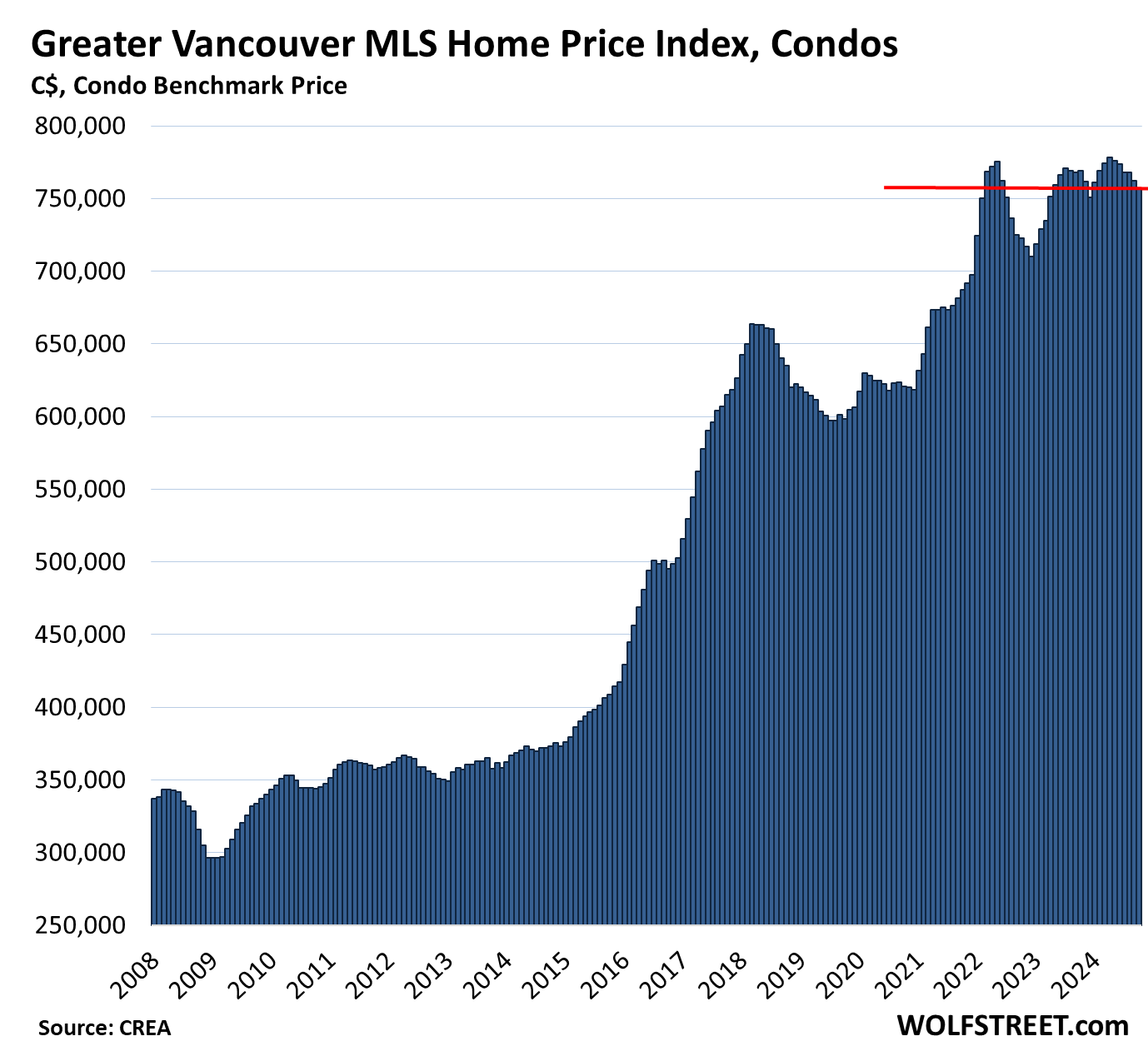

Greater Vancouver condo benchmark price:

- Month-to-month: -0.6%, to $757,200, below March 2022.

- From high in April 2024: -2.7% from high in April 2022: -1.9%

- Year-over-year: -1.6%, fourth year-over-year decline in a row.

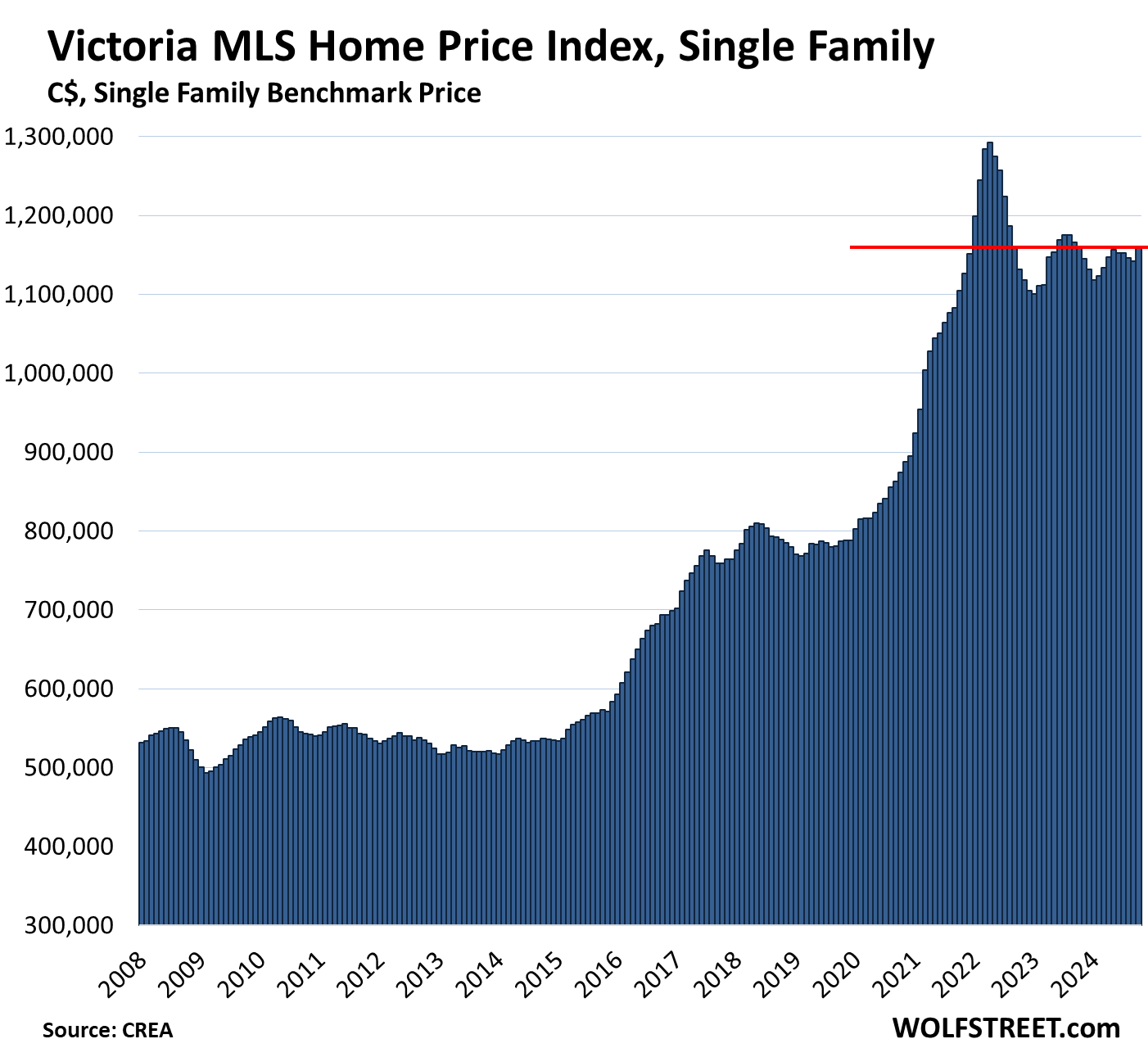

Victoria, single-family benchmark price:

- Month-to-month: +1.4%, to $1,158,400, back to about December 2021

- From peak in April 2022: -10.4%

- Year-over-year: -0.1%, fifth year-over-year decline in a row.

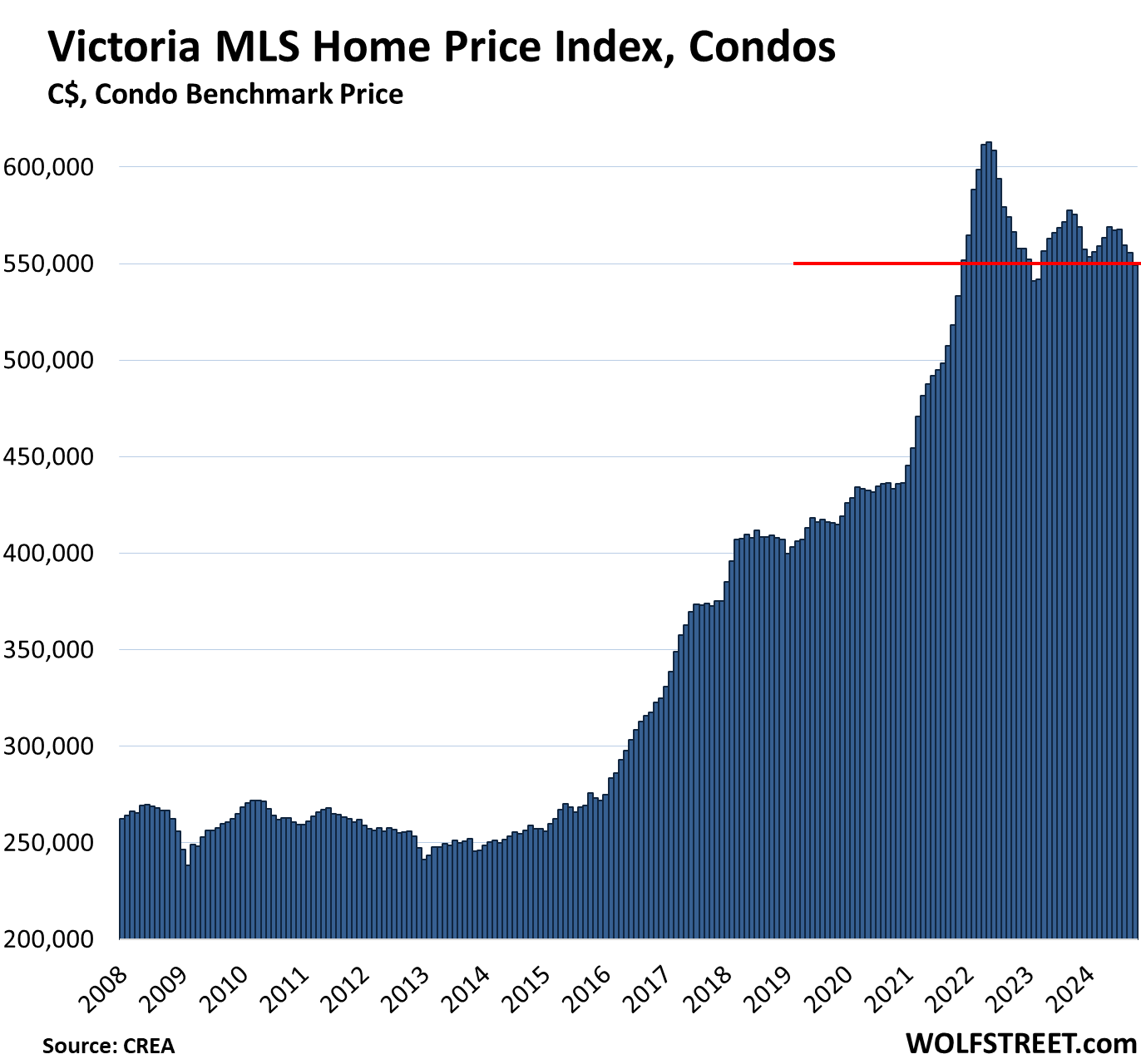

Victoria condo benchmark price:

- Month-to-month: -1.2%, to $549,300, below December 2021.

- From high in May 2022: -10.4%

- Year-over-year: -4.5%, fourth year-over-year decline in a row.

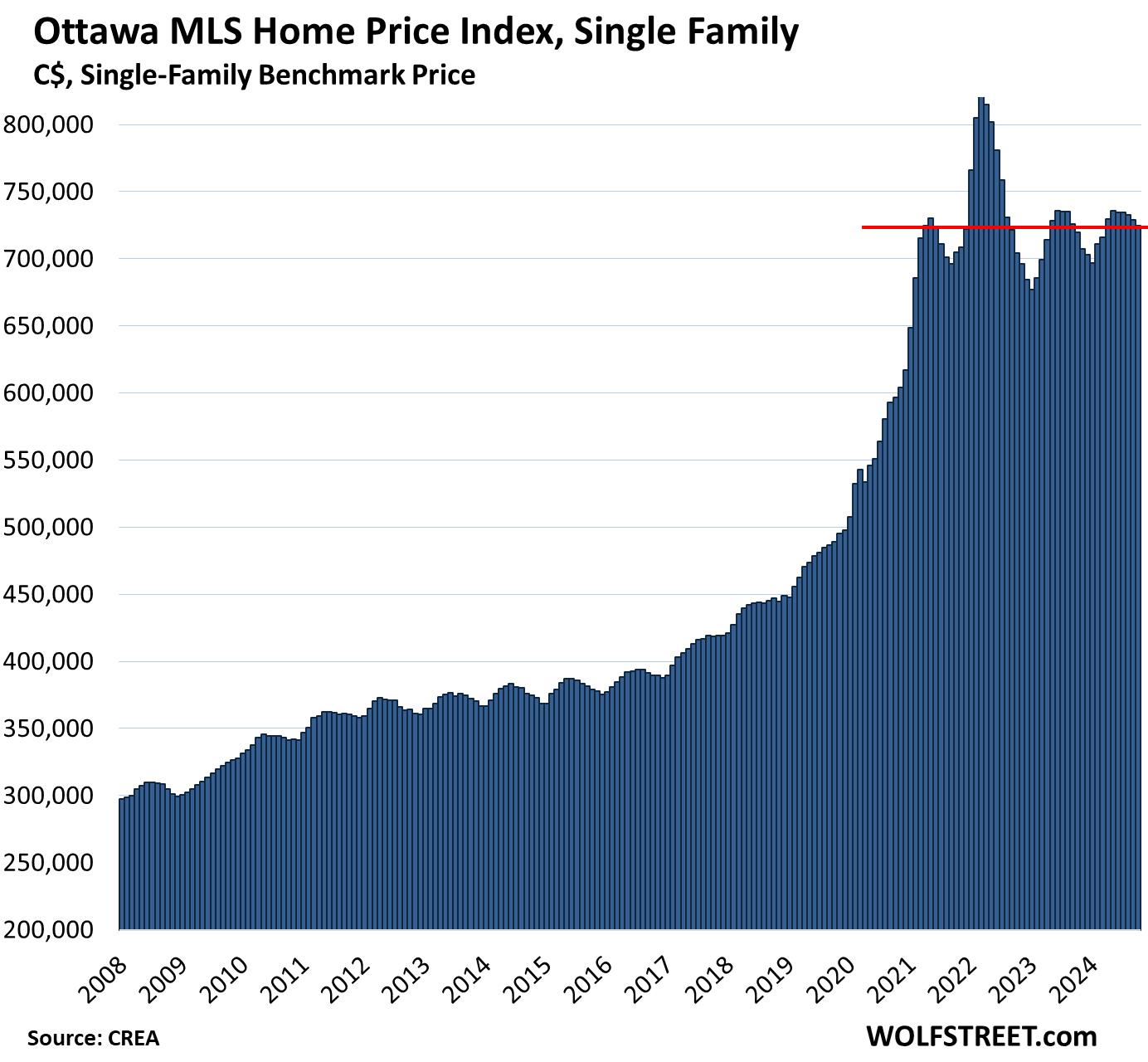

Ottawa, single family benchmark price:

Ottawa, single family benchmark price:

- Month-to-month: -0.6% to $724,400, back to April 2021

- From peak in March 2022: -11.7%

- Year-over-year: +0.6%.

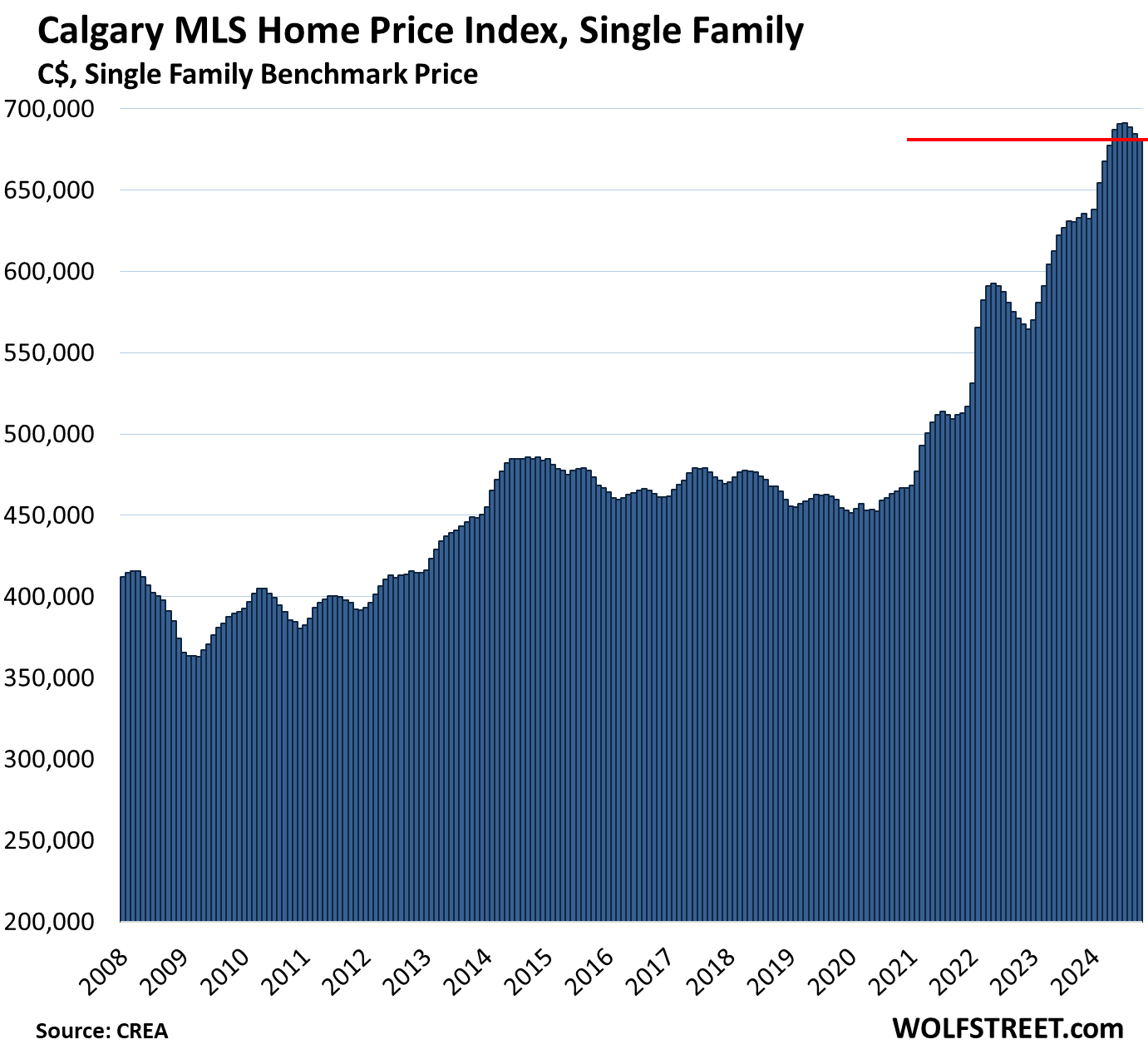

Calgary, single family benchmark price:

- Month-to-month: -0.5%, third month of declines from the all-time high, to $680,900.

- Year-over-year: +7.6%, the smallest gain since July 2023.

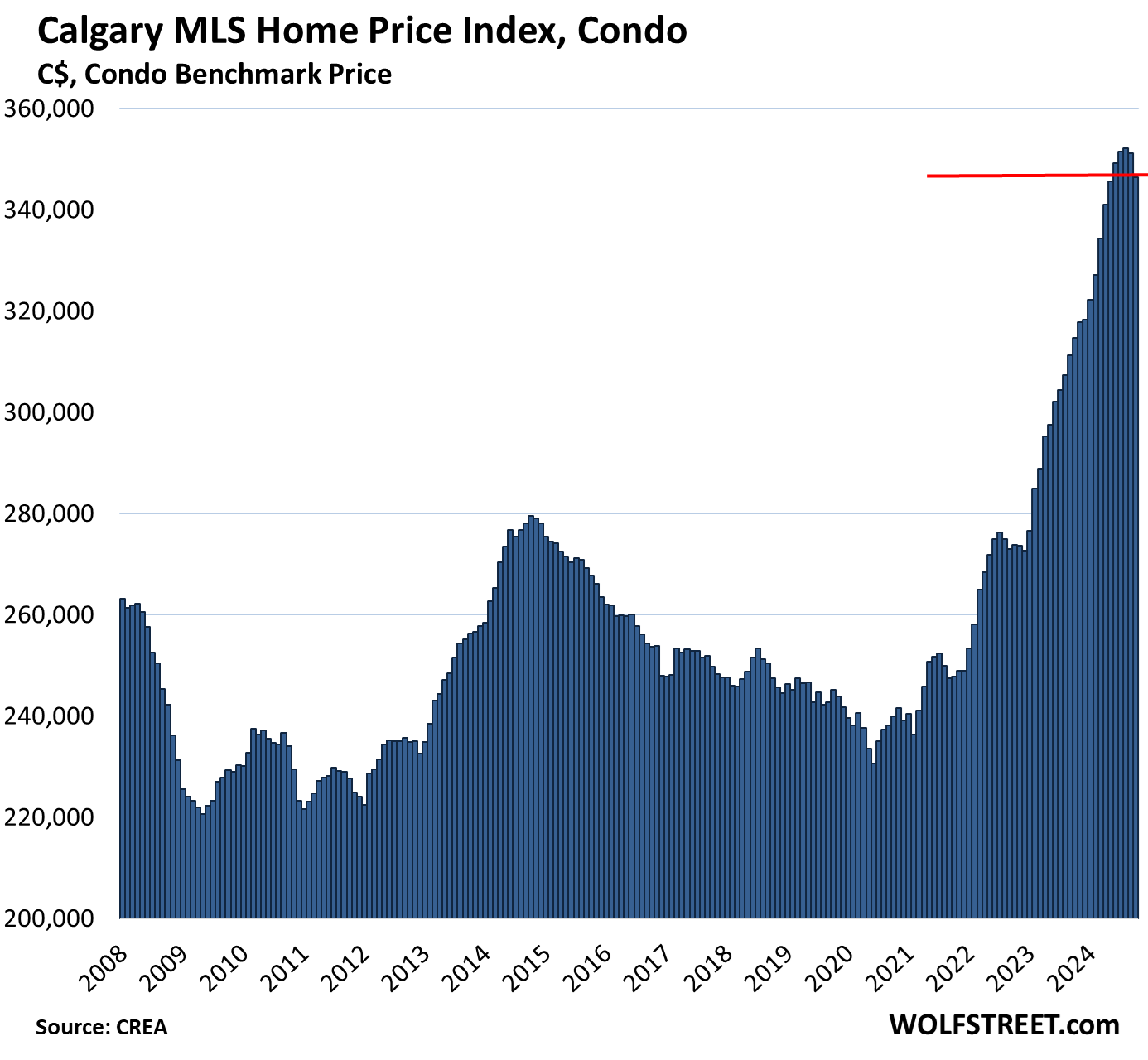

Calgary, condo benchmark price:

- Month-to-month: -1.3%, to $346,500.

- Year-over-year: +10.1%, the smallest gain since June 2023, with gains having ranged from 10.2% to 16.7%.

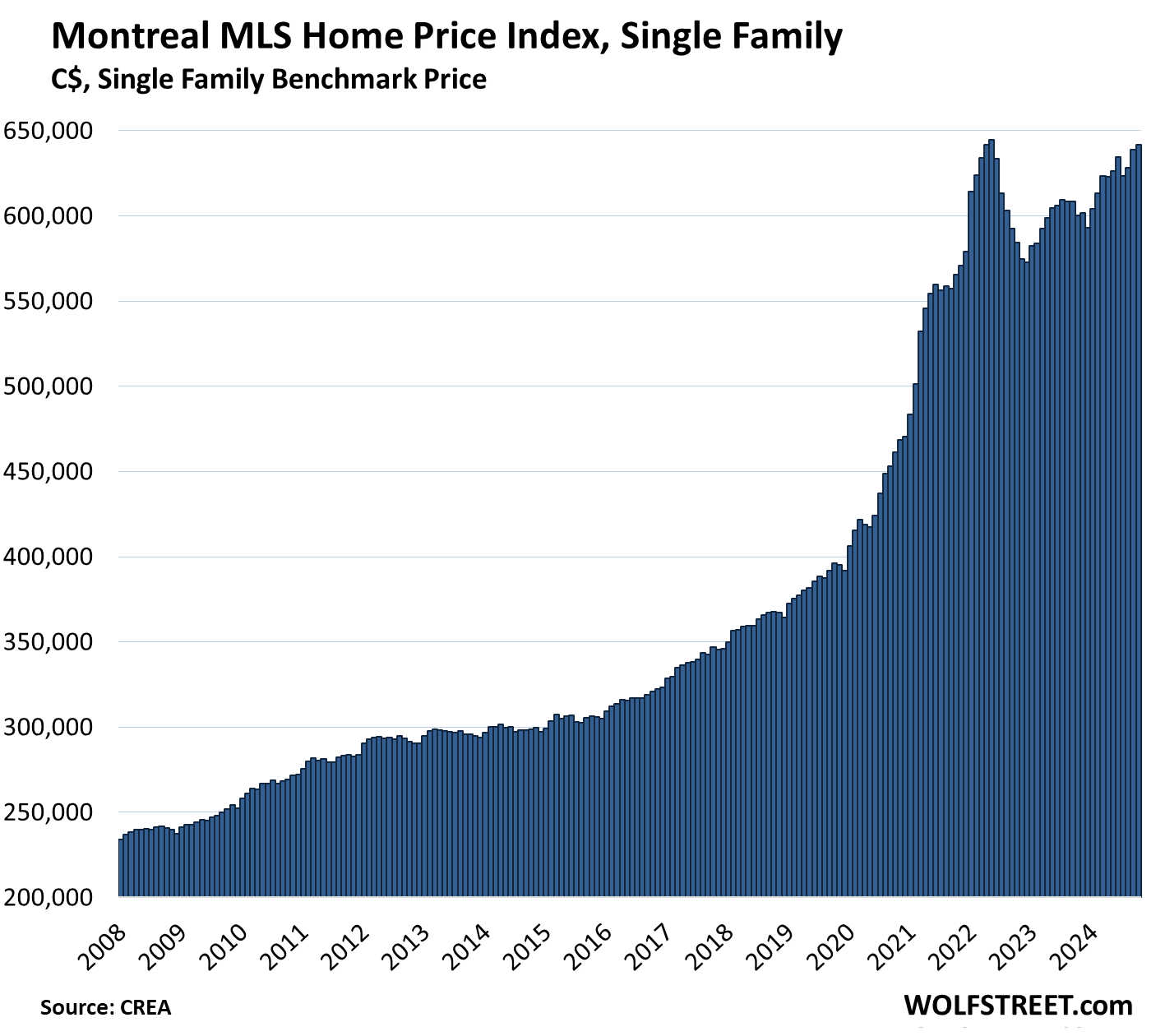

Montreal, single family benchmark price:

- Month-to-month: +0.4%, to $641,600.

- From peak in May 2022: -0.5%

- Year-over-year: +6.9%.

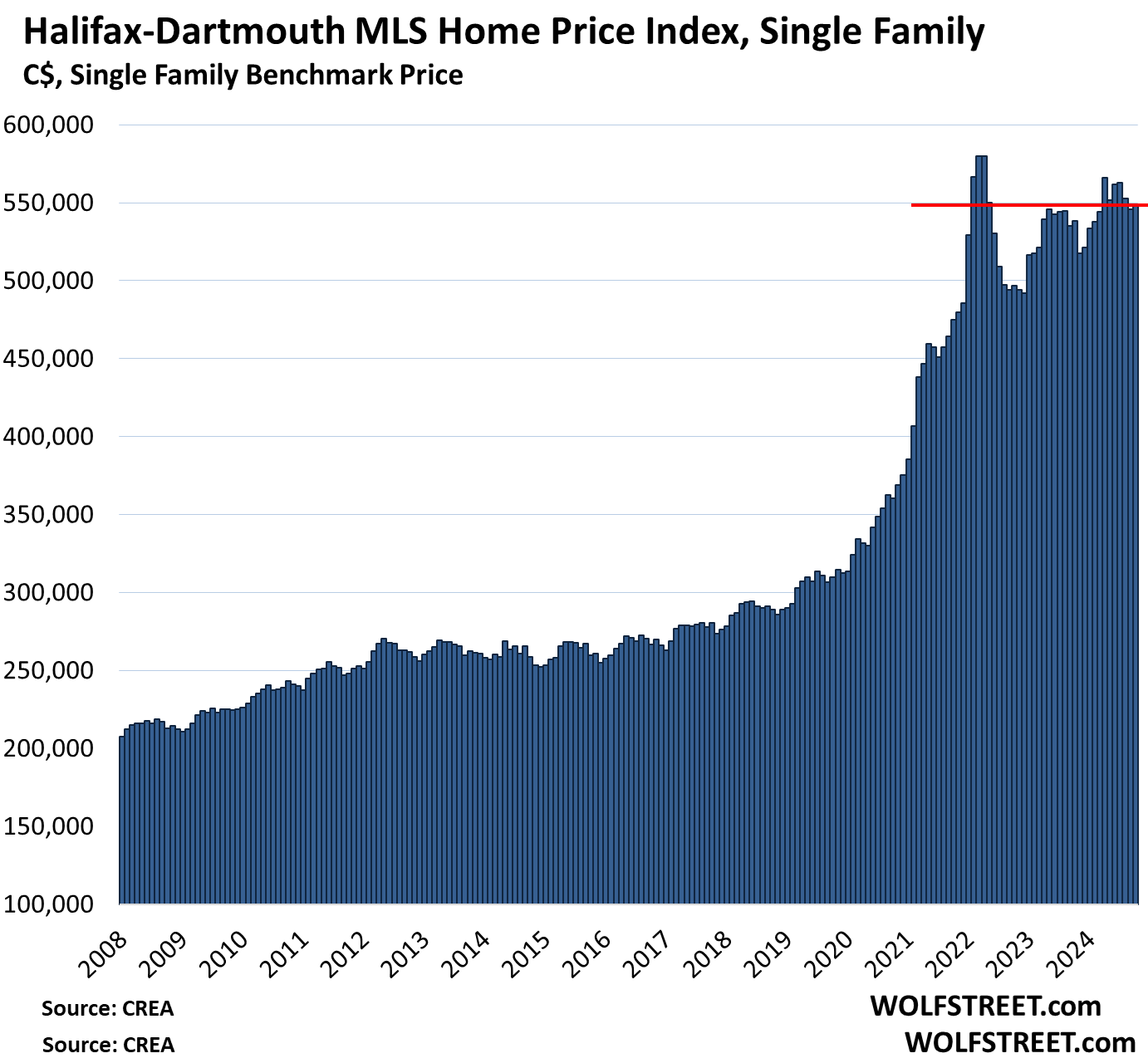

Halifax-Dartmouth, single family benchmark price:

- Month-to-month: +0.4% to $548,100

- From peak in April 2022: -5.5%

- Year-over-year: +1.8%.

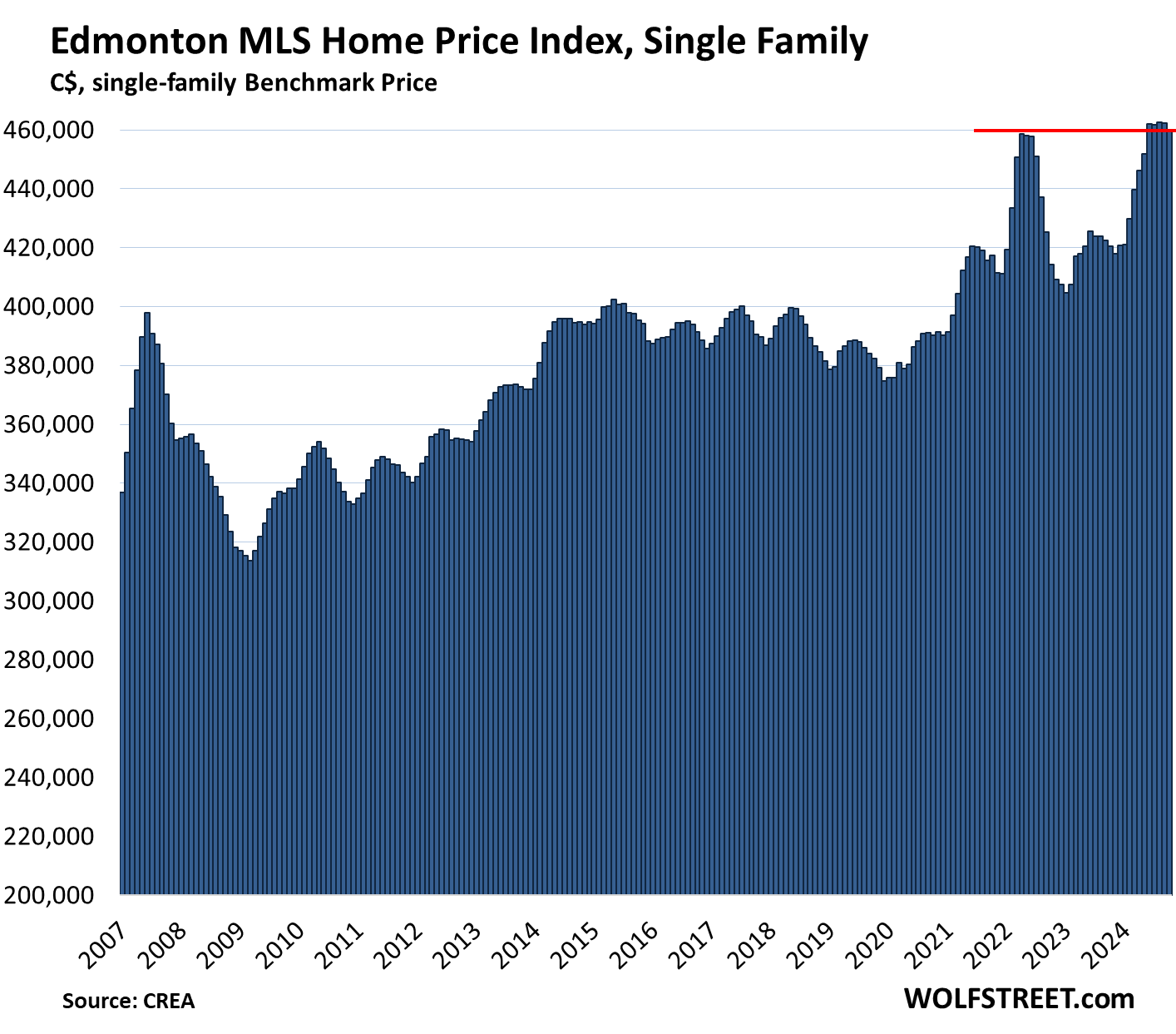

Edmonton, single-family benchmark price:

- Month-to-month: -0.6% to $459,800

- Year-over-year: +9.3%

- In the 17 years since the peak of the prior bubble in June 2007, the index is up 16%.

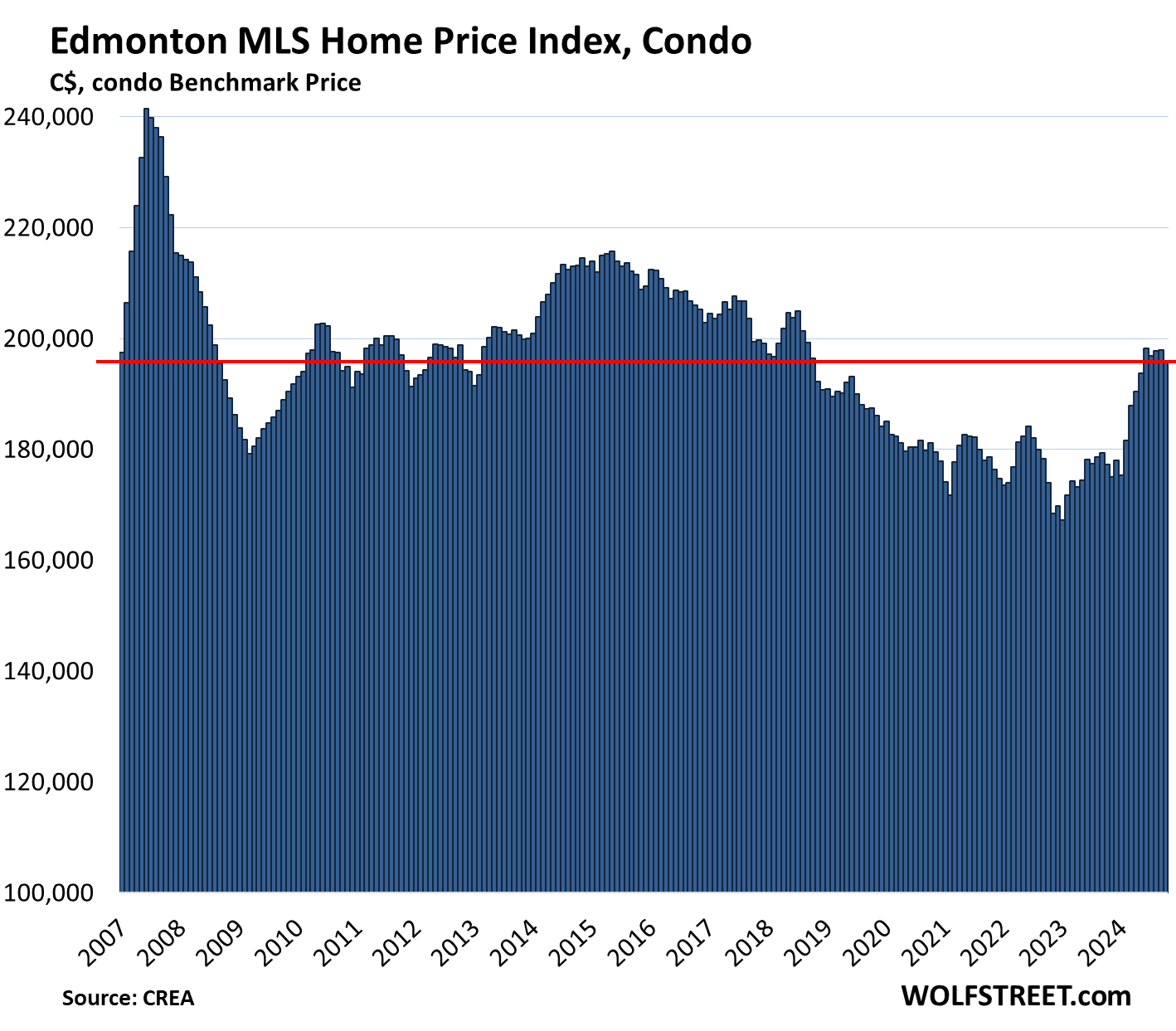

Edmonton, condo benchmark price:

- Month-to-month: -1.0% to $196,000, first seen in January 2007.

- From peak in June 2007: -18%

- Year-over-year: +10.5%

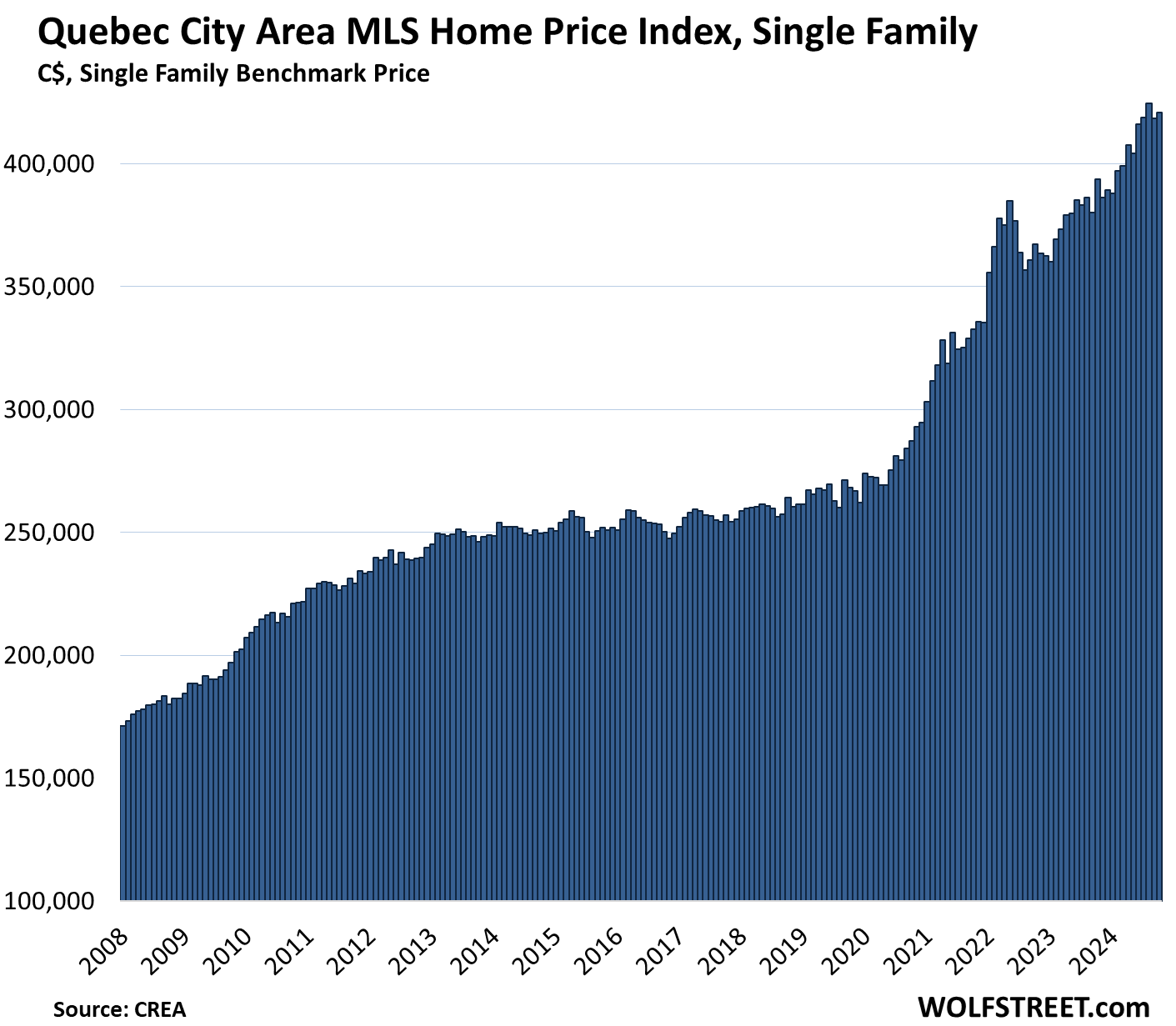

Quebec City Area, single-family benchmark price:

- Month-to-month: +0.6% to $421,000

- Year-over-year: +6.9%

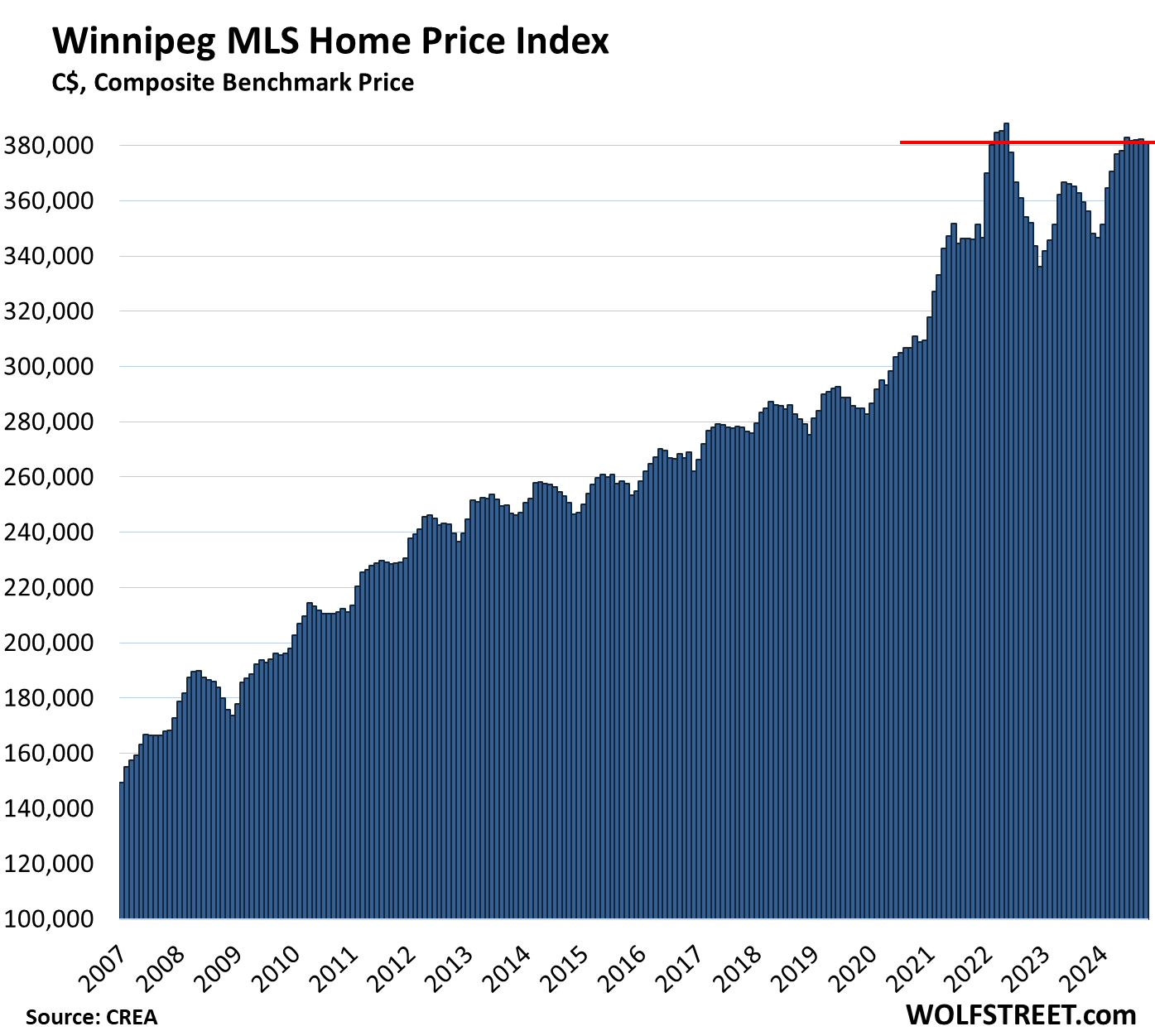

Winnipeg, single-family benchmark price:

- Month-to-month: -0.3% to $381,000

- From peak in March 2022: -1.8%

- Year-over-year: +6.9%

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

The post The Most Splendid Housing Bubbles in Canada, Oct. 2024: Single-Family Prices Drop Most in Toronto, Vancouver, Calgary, Ottawa. Condo Prices Hit 3-Year Low appeared first on Energy News Beat.