Energy News Beat

By Wolf Richter for WOLF STREET.

The ECB took another step at its policy meeting on Thursday to speed up its bond QT program even as it announced the 25-basis point rate cut: It would step away from the bond market entirely after December 17 by removing the last remaining cap on the bond-roll-off.

After December 17, as bonds in its vast holdings mature and come off the balance sheet, they will no longer be replaced at all. Whatever matures comes off the balance sheet without replacement. And its bond holdings will shrink by the amount of bonds maturing. The effect is a further acceleration of its bond QT. By comparison, the Fed has caps in place and lowered the caps in June to slow QT.

The ECB’s last remaining cap that is now coming off slowed the roll-off of bonds in its “Pandemic Emergency Purchase Programme” (PEPP, started in March 2020). It has already removed the cap on bond roll-offs under its “Asset Purchase Programme” (APP, dating back to the Draghi years).

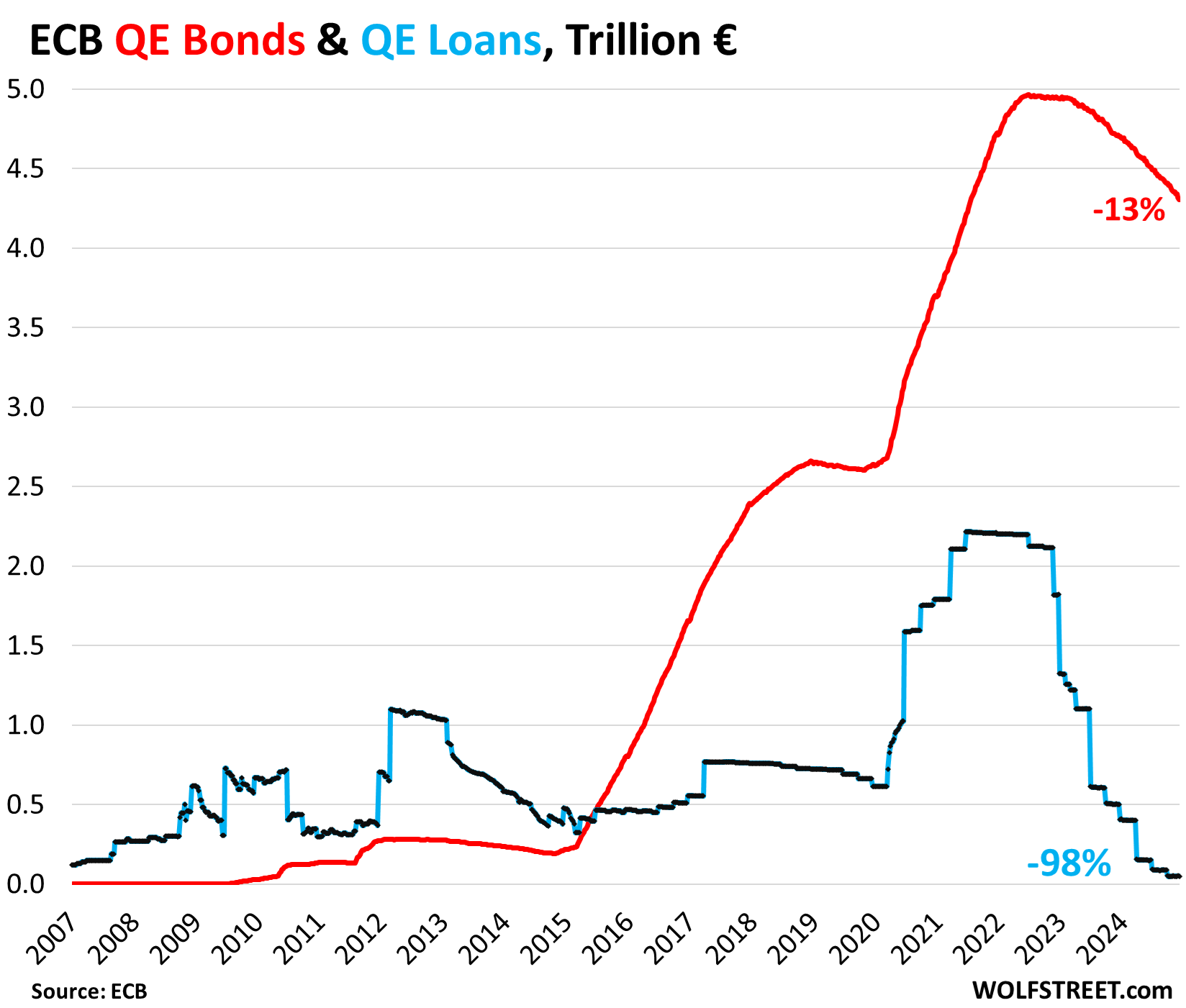

The ECB had two QE programs: Loans to banks that peaked in June 2021 at €2.22 trillion; and the bond buying programs APP and PEPP, which peaked in June 2022 at €4.96 trillion combined. Bonds under these programs include a broad range of government and private-sector securities, but mostly government securities.

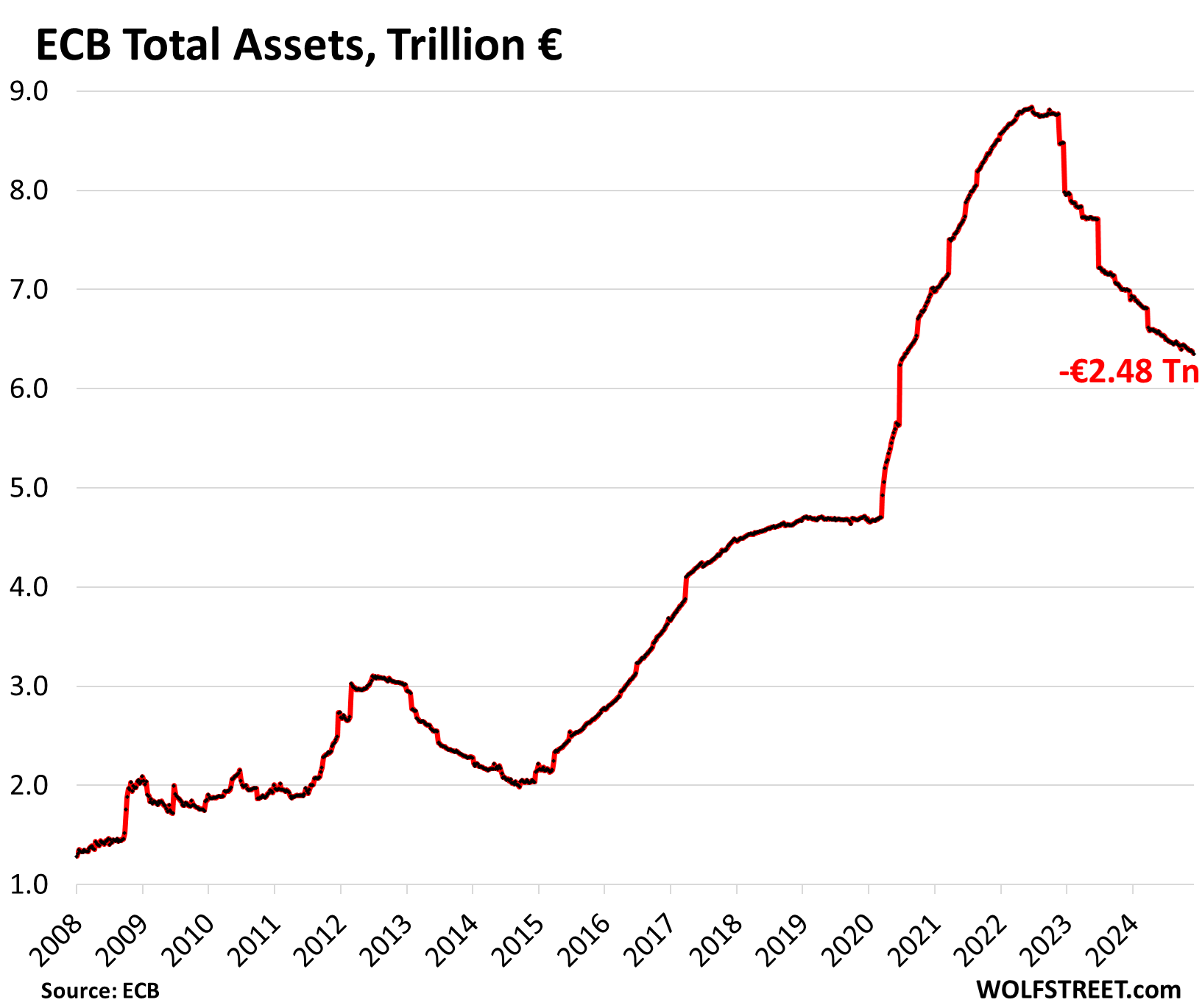

The ECB’s QT program has already reduced its balance sheet by €2.48 trillion in total, or by about 28%, since late 2022.

Loan QT – that job is done. Loan QT began in late 2022, when the ECB changed the terms of the loans to make them unattractive, and banks repaid them in large junks. As of its balance sheet this week, the ECB has unwound nearly its entire QE loan program. The balance is down by 98%, to just €49 billion, the lowest in the data going back to 2004 (blue in the chart below).

Bond QT – long way to go and accelerating. Bond QT began in early 2023, when the ECB allowed bonds in its APP holdings to come off the balance sheet when they matured without replacement. Initially, the roll-off amounts were capped, and the amounts of maturing bonds over the cap were replaced with purchases of new bonds.

In July 2023, the cap on the APP roll-off was removed and APP bonds have been rolling off as they mature. In July 2024, the ECB started allowing PEPP bonds to roll off without replacement up to a cap. After December 17, that cap will also be gone, and whatever matures rolls off and adios.

As of its latest monthly reporting on its detailed holdings, the ECB still held:

- €1.62 trillion in PEPP bonds (including €50 billion in private sector securities and covered bonds)

- €2.70 trillion in APP bonds (including €554 billion in private sector securities and covered bonds).

In total, it held €4.32 trillion in securities at the end of November. Another €14 billion rolled off in early December, bringing its total bond holdings down to €4.30 trillion as of its weekly balance sheet this week, down by 13.3% from the peak (red).

QT has reduced total assets on the ECB’s balance sheet by €2.48 trillion, or by 28.1%. Of the amount added during the mega-QE pandemic, 60% is now gone.

The fact that the ECB is speeding up its bond QT, after already completing its loan QT down to near zero, even as it cuts its policy rates amid a slowdown in economic growth, shows that the ECB may be backing away from the QE experiment.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

The post The ECB Steps Away from Bond Market Entirely, Speeds Up Bond QT even as it Cut Rates appeared first on Energy News Beat.