Energy News Beat

Authored by Simon White, Bloomberg macro strategist,

The market’s point of focus in the UMich data is the higher-than-expected inflation expectations figure, which potentially brings more risks to bonds.

One-year inflation expectations rose to 4.4% from 4.2%.

But more saliently for the bond market, the long-term median of inflation expectations rose to 3.2%, its highest since 2011.

As we saw yesterday with the weak 30-year auction, the Treasury market is facing mounting challenges with oversupply and poor liquidity.

Rising consumer inflation expectations compound the issue as the household sector has become the marginal buyer of USTs as other sectors retreat.

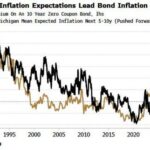

Household’s rising inflation expectations therefore point to higher term premium (chart above), i.e. the US government will likely have to accept a bigger discount on its issuance to compensate for the household sector’s inflation outlook.

Loading…

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack

The post Rising Inflation Expectations Heap More Risks To Treasury Market appeared first on Energy News Beat.