Energy News Beat

Despite the “Dollar’s Collapse,” the USD remains in its 3-year range and a lot higher than it was before.

By Wolf Richter for WOLF STREET.

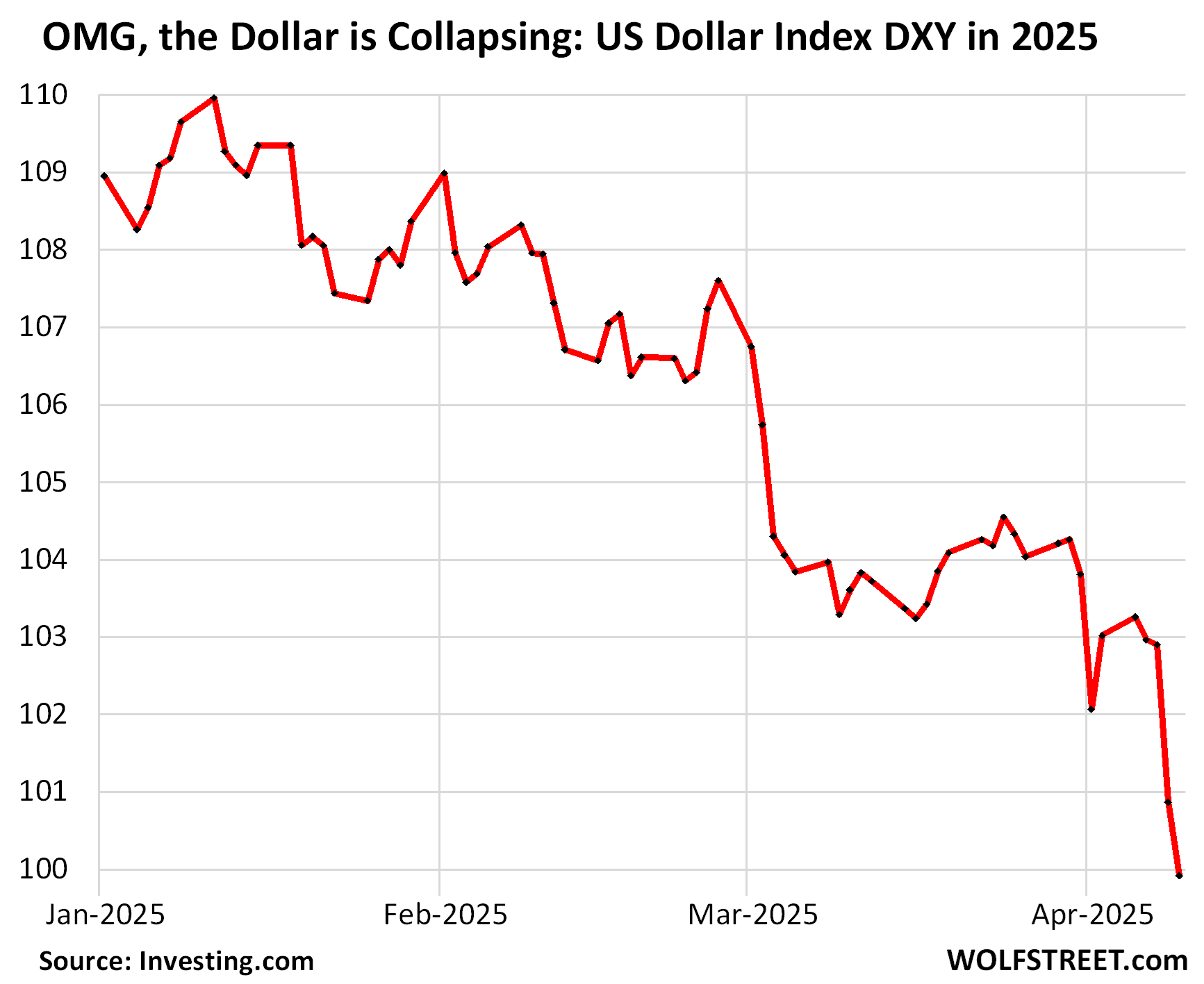

The Dollar Index [DXY], which represents a basket of six currencies dominated by the euro and the yen, the two largest trade currencies behind the USD, “plunged” or whatever to 99.78 today, down from 109 at the beginning of the year.

And all kinds of theories have been concocted why this dollar-collapse scenario is playing out:

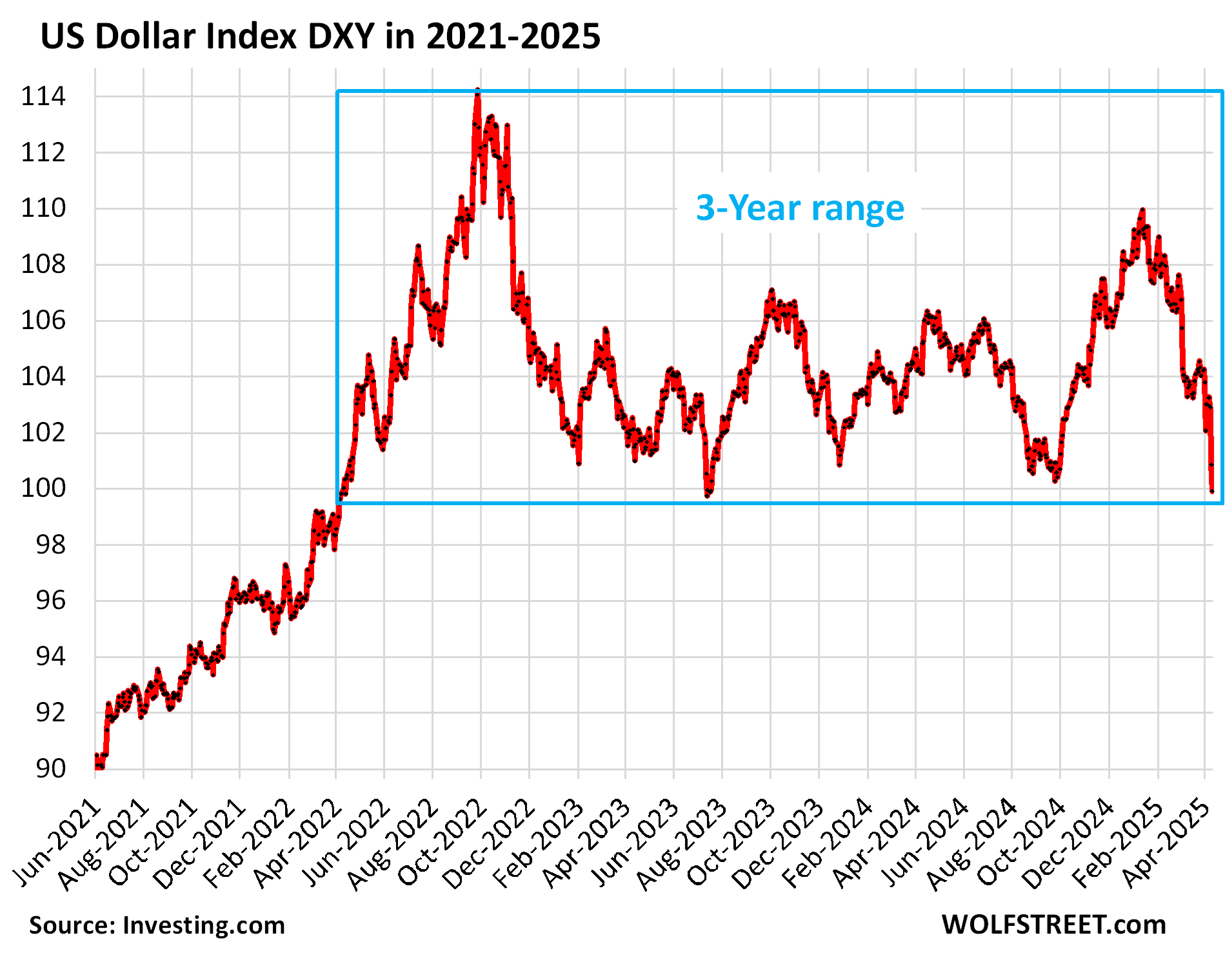

OMG the dollar is still in the three-year range: The DXY’s range from April 2022 through today went from 99 to 114. In July 2023, the dollar was lower than today, and at the beginning of April 2022, it was lower than today.

Today was the first time the DXY plunged below 100 since… July 2023.

And it’s far higher than it was before that 3-year range. In early 2021, the DXY was climbing out of the basement, after having dropped below 90.

Just a few months ago, in late 2024, people were complaining how the dollar was way too strong and was killing earnings from US companies with business overseas, and was killing US exports, and emerging market debts, and whatever parade of horribles a strong dollar engenders, and that the Fed needed to do something to whack down the dollar:

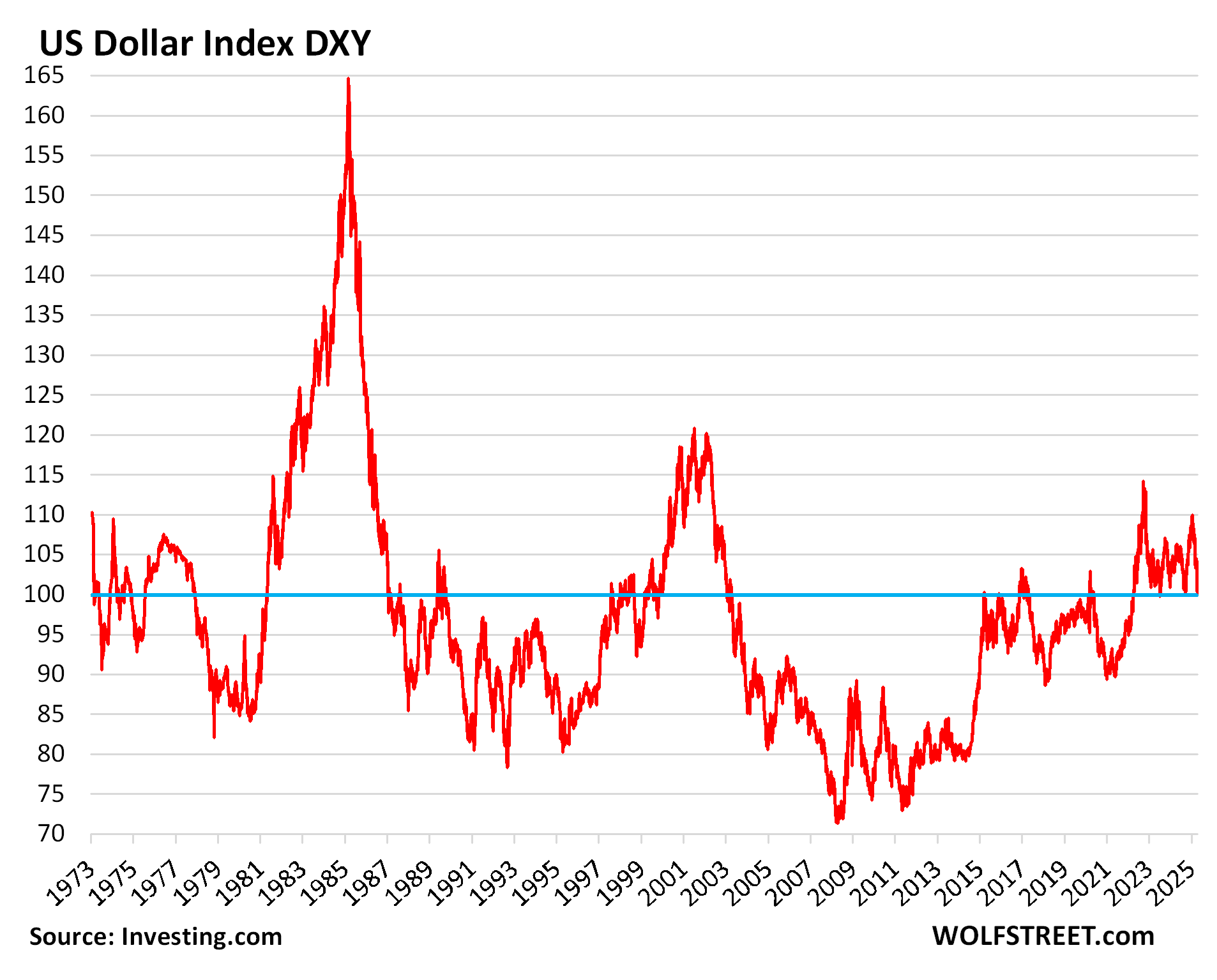

OMG the dollar is still fairly high historically. For a lot of time since the 1970s, the DXY was below 100, and for some periods below 80, and as low as 71. So over the long term, at around 100, the DXY is in a “good place,” as the Fed would say.

Look, I was having a little bit of fun here with the dollar collapse theory? Chaos is never good. And now there is chaos. More chaos than most people are comfortable with. Entrenched businesses hate chaos and love high and continually rising stock prices. Everyone loves those. Free money, but from the private sector.

But chaos is also good because it allows for new stuff to germinate, for new ideas to elbow their way to the surface. And it pushes entrenched companies to change. The US economy is most dynamic when jostled a little. Businesses adjust. And lower asset prices – maybe as foreigners lose interest in gobbling up US assets at whatever prices? – after 15 years of the most astounding Everything Bubble, caused by money-printing and interest-rate repression, aren’t that surprising. And a return to some sort of normalcy might not be such a bad thing. And the dollar is just fine, doing its job indefatigably day-in and day-out.

In terms of the dollar as the dominant reserve currency, well, it still is, with a share of 58.7%, and well ahead of the next one in line, the euro with a share of 20%, and well ahead of a gaggle of smaller currencies, but that dominance has been declining very slowly: Status of US Dollar as Global Reserve Currency: Central Banks Diversify into Other Currencies and Gold

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The post OMG the Dollar Is Collapsing, or Whatever appeared first on Energy News Beat.