Energy News Beat

Daily Standup Top Stories

DAVID BLACKMON: Trump’s ‘Big, Beautiful Bill’ Smashes Biden’s Signature Climate Law Into Pieces

ENB Pub Note: This is an outstanding article from David Blackmon on the Daily Caller, and Michael and I will cover this on tommorow’s Energy News Beat Daily Standup. We highly recommend checking out David […]

President Trump’s dilemma is now a huge political problem – Secondary sanctions to get Putin to stop the war will drive prices to $90 or $100 and is a win for Democrats.

President Trump has had people advising him on the Russia/Ukraine war who do not have all of the critical information. I have covered this in many podcasts with George McMillan, and you can check out his information […]

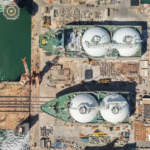

Technip Energies bags Cyprus LNG gig – and how does this impact Cyprus’s clean energy?

ENB Pub Note: Interesting about the import into Cyprus, and the Chinese equipment being used on the LNG tanker being converted to the FSRU. It is an excellent use for the older tankers to convert […]

Technip Energies bags Cyprus LNG gig – and how does this impact Cyprus’s clean energy?

ENB Pub Note: Interesting about the import into Cyprus, and the Chinese equipment being used on the LNG tanker being converted to the FSRU. It is an excellent use for the older tankers to convert […]

Northvolt to Wind Down Battery Making in Sweden: A Blow to Europe’s Energy Transition

Northvolt, once Europe’s brightest hope for a homegrown electric vehicle (EV) battery industry, is winding down its battery cell production in Sweden by June 30, 2025, following a high-profile bankruptcy. The decision, announced by bankruptcy […]

OPEC’s Latest Report: A Strategic Move to Challenge U.S. Shale Oil Companies?

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, have released their latest strategy, accelerating oil output hikes in a move that’s raising eyebrows across the U.S. shale patch. […]

OPEC’s Latest Report: A Strategic Move to Challenge U.S. Shale Oil Companies?

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, have released their latest strategy, accelerating oil output hikes in a move that’s raising eyebrows across the U.S. shale patch. […]

Highlights of the Podcast

00:00 – Intro

01:34 – DAVID BLACKMON: Trump’s ‘Big, Beautiful Bill’ Smashes Biden’s Signature Climate Law Into Pieces

05:291 – President Trump’s dilemma is now a huge political problem – Secondary sanctions to get Putin to stop the war will drive prices to $90 or $100 and is a win for Democrats.

10:15 – Technip Energies bags Cyprus LNG gig – and how does this impact Cyprus’s clean energy?

12:48 – Northvolt to Wind Down Battery Making in Sweden: A Blow to Europe’s Energy Transition

16:01 – Markets Update

18:04 – Rig Count Update

18:10 – Frac Count Update

18:49 – OPEC’s Latest Report: A Strategic Move to Challenge U.S. Shale Oil Companies?

22:14 – Outro

Follow Michael On LinkedIn and Twitter

– Get in Contact With The Show –

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Michael Tanner: [00:00:00] Why Trump’s miscalculation of Putin will drive oil prices to $100 next on the Energy News What’s going on everybody. [00:00:15][15.0]

Michael Tanner: [00:00:15] Welcome into the Tuesday, May 27th, 2025 edition of the daily energy news beat standup here are today’s top headlines. First up from good friend of the show, David Blackman, Trump’s big, beautiful bill smashes Biden’s signature climate law into pieces. Sticking on that theme, president Trump’s dilemma. Is now a huge political problem. Secondary sanctions to get Putin to stop the war will drive prices to $90 or $100 and is a win for Democrats. We’re going to have a little bit of an argument over this one, which I always love. Next up, Technip Energy’s BAGS Cypress LNG gig, and how does this impact Cypress’s clean energy? Finally, in the new segment, Northvolt to wind down battery making in Sweden, which is a blow to Europe’s energy transition. Stuart then toss it over to me. I will quickly cover what happened in the oil and gas markets. We’ve got rig count and spack frack count. Holy smokes, too. It’s it was a thrashing last week. And then we’ll finish up with OPEC’s latest report, a strategic move to challenge US shale companies. And that is a question. Who knows what the answer is. We will cover all that and a bag of chips, folks. As always, I’m Michael Tanner joined by Stuart Turley. Where do you want to begin? [00:01:33][78.1]

Stuart Turley: [00:01:34] Hey, let’s start with our buddy, David Blackmon, love David Blackman. He is a true energy leader and I just appreciate him. But let me start with this one where energy is concerned, the one new big, beautiful act presents a nod to the realities of a dramatically changed political landscape and to the fact that the energy alternatives favored by the previous administration won’t do the job. Elections still matter in America. I got to hand it to him, that is absolutely wonderful, but there are some holes in here where I just want to say that I’m a little bit disappointed in the big new beautiful bill and our Republicans. Enverus’s research points out that generous tax credits from the Inflation Reduction Act and the EPA’s update to 40 CFR Part 60, which mandates additional coal retirements, have significantly boosted demand for renewable energy projects across the United States. Indeed, the surge in investment and development in the past three years has been so substantial. It’s overwhelmed interconnection cues with a record number of projects seeking grid connections. This is a huge problem, Michael. [00:02:47][72.9]

Michael Tanner: [00:02:47] Well, it’s a huge problem. And I personally think this bill was haphazardly put together. It does very little to actually cut down on the debt, which is the whole thing that was Trump ran on this whole idea of Doge and we’re going to cut the debt. We’re going to do all this. There are some things in the bill I like, but like every single bill, it’s just been absolutely inundated with here’s a little handout for you. Here’s a handout for, you here’s, a little hand out for you and sure. I mean, that’s how Washington works. I guess I shouldn’t be surprised. I just find it’s, I’m slightly disappointed. I mean we, we, you know, Republicans have the white house, the Congress and the Senate, and they’re still putting through things like this. It truly. Boggles my mind from this. I mean, I mean the fact that I do like the fact that we’re moving more into nuclear as this article does point out. [00:03:37][49.4]

Stuart Turley: [00:03:37] I was about to say that. [00:03:38][1.0]

Michael Tanner: [00:03:39] If, if Inveris is right, you know, then basically there’s only 10% of these projects that are already in the queue, nuclear wise, they’re going to be able to meet this 2028 deadline that is contained in the house, this house bill. And I love this quote from David Blackman. The reality would essentially eliminate any hope that projects planned to be permitted in the future years could benefit from the IRA largesse. I mean, I think what, unfortunately, what this means is if you’re looking to allocate capital now in this space, Don’t look for things that are about to be permitted. You got to look for things that you can get into right now. And this idea of, Oh, everyone’s now going to start investing in nuclear. I mean, that’s your 20, 25 year timeframe away. And truly what’s working right now is continuing down the path that I think where capital is already flowing. So I’m very disappointed in this bill. [00:04:29][50.0]

Stuart Turley: [00:04:29] Well, me too, but here’s the thing. The executive order I’m trying to work out some information on, but it has a couple of loopholes and this is where I’m going to go. I did a Scooby when I was reading this is a Scoobie. What does this mean? Because the regulatory process in nuclear engineering is a nightmare and the major reason for the costs in nuclear, but the big new executive order, the ad five new executive orders on nuclear can be built on federal lands and bypass the, the nuclear regulatory agency. So wait a minute. And so now those funds are available under this bill to really go after nuclear and bypass the normal procedure. You’re going to see three new reactors in the next three years. This is weird. And I got to get to the bottom of it. Absolutely. What’s next? Let’s go to this article. I had fun writing this when I was watching some TV this morning. And I realized that the talking heads on TV don’t really have a clue. President Trump’s dilemma is now a huge political problem. Secondary sanctions to get Putin to stop the war will drive prices to 90 or a hundred and as a win for Democrats. And I think this is really important when people understand that President Trump has not placed the secondary sanctions on Russia yet, because it is going to be a debacle when he does. He has lost the opportunity to bring Putin to the table with a carrot. And now he’s going to use a club. This is a club India’s role, India imports 88% of its oil needs with 40% of it’s 1.6 to 1.7 million barrels per day coming from Russia. That’s a lot. China’s role. China role is the largest in crew 1.9 million barrels of Russia, 47%. You just look at those two guys. That’s where he’s going to throw the secondary sanctions. He’s going to throw them on their, their downstream or the refineries. Guess who’s going get impacted. It’s going be the diesel production, the gasoline production, and all of the other oil and gas products that are made going back to Europe, that’s going to snowball into the United States and we’re going to see 90 to a hundred dollar oil on a global market because of this now it’d be short-lived till Russia can get his fleet. Redone and going again, but this is a dramatic problem. [00:07:13][164.3]

Michael Tanner: [00:07:14] Yeah. I’m going to push back on the idea that more sanctions are going to lead to 90 to $100 oil. I don’t disagree with the fact that I think Trump is now becoming fed up with Putin a little bit from the standpoint of, you know, what we saw happened, you know, we were recording this on Memorial Day. So what we saw last night into this morning was a massive offensive that is being put on by Russia. And it seems to be there’s like, what, 50,000 troops amassing? Along the top border there. So Trump is becoming a little bit frustrated with Putin because he probably feels like he’s negotiating in bad faith a little. Of course Putin is negotiating in bad faith. It’s like it’s the most obvious thing we could have said from the standpoint of course he’s going to tell you over the phone what you want to hear and then he’s gonna continue to do what he wants to do on the back side. So I’m not necessarily, I’m not concerned. I wouldn’t say concerned. I’m not too shocked that this is happening. I think I think the interesting thing is the reaction that Trump has. Is he going to sanction Russian oil? I doubt it because he wants prices at 55. He’s made that very, very clear. He said it out loud. Good friend of the show, Chris Wright, has said the same thing. We want $50 oil. Oil industry be damned. I mean, truly, they don’t really care. We’re about to cover frat count spread and recounts. They’re falling off a cliff profits. Q2 profits are going to absolutely be throttled because of this, but they want oil at 55 bucks. So I don’t think they’re necessarily going to do anything. You know, they may sanction oil here and there, but I don’t think they’re neccessarily going to Go for them because I think Trump also understands that Putin’s going to figure out a way to get his oil to the market, regardless if they’re sanctions. India is going to buy it. China is going buy it, so I think this idea that sanctions are going to drive prices to $90 or $100 is, I think, the bulls, the last breath of all the oil bulls grasping for something that can satisfy their need for high oil when we just need to, in my opinion, settle in for $60, $65 oil. [00:09:19][125.3]

Stuart Turley: [00:09:20] There’s a lot for me to digest and disagree with you on that boot. And when we sit back and take a look at the oil bulls, I’m an oil bull in the 70 to $80 range because that’s where it’s going to settle out. That’s where my bully is. My bull sitting in the backyard. He says, you know, he’s going, Stu, it’s gonna be around the 70 to 80 range, but that’s normally because of the, just the decline curves that are out there. Now here’s the real loser in this president. Trump is the real lose. Because he’s now backed into a corner. And if the Democrats and the rhinos have not codified any of the, the really problems that have done been found by Doge by now, they’re not going to get done and we’ve got a rhino and Democrat problem. So we present Trump is a loser. What’s next? President Trump is the loser, not a loser let’s go. I want to make sure that did not come through the transcript wrong. Let’s go to TechNIP Energy’s bag, Cyrus LNG gig. And how does this impact Cyp, Cypress is clean energy. Michael, I added this update. This bottom part of this update came in from our feed from LNG prime.com. The import terminal is part of the EU project of common interest that seeks to introduce natural gas to Cypress. Well, that caused me to think, what does that mean? And how does Cyprus play into this? You back up and that’s what I added in the top part of the article. And that is the FSRU, which is the regasification unit, which is an old tanker built and updated in China that is now being used. And they’re going to tap into the Leviathan field through new pipelines, and then that can go in through Europe. What’s in that tanker? I found out there’s Chinese equipment that can be remotely shut down. And that goes to our other article about Chinese equipment and everything else. Why would you want to put in Chinese equipment into a regasification unit that can remotely shut [00:11:23][123.5]

Michael Tanner: [00:11:24] I mean, I wouldn’t want to do that at all. Now, I think there’s some very interesting, some very interesting things to think about this. LNG, you know, has become a huge topic over the last six months with, you know, all this Saudi and Middle Eastern money flowing in here. I do think from a European standpoint, they’re going to, they are going to go heavy into LNG. I’m curious, Stu, from an executive standpoint, You know, you’re both a oil bull and an LNG bull. And if I had to put a gun to your head and there was two projects and you could only allocate capital to one of them, where are you going? Are you going LNG or are you going oil? [00:11:58][34.3]

Stuart Turley: [00:11:59] LNG. Why is that? Because LNG has got a lot longer life cycle for volume and the volume can go for LNG look at the cruise ships, the container ships, the cargo ships, the trucks, LNG molecules will be in demand longer than the oil demand. A Cypress is a perfect example of that. They still use fuel oil to generate 10%. I believe I have to go look at their numbers. Some number of fuel oil is just like Hawaii. They got to get rid of that, get rid of the oil and use LNG or natural gas. [00:12:36][36.7]

Michael Tanner: [00:12:36] Yeah, and it’s a very easy rotation there. So I, I completely agree with you. I would be allocating capital if I was in Europe to LNG and not necessarily oil projects. Let’s, let’s move to some, some, some wind stuff. [00:12:48][11.3]

Stuart Turley: [00:12:48] Let’s go to North North volt to wind down battery making in Sweden, a blow to Europe’s energy transition. North fault actually turned out to be one of the brightest hopes for a home grown electric vehicle, EV battery. And the problem is Michael, this is not only an interesting story. This story is Kind of a trend for the renewable and the EV markets. And when you sit back and take a look, I put a goofy looking T-Rex in here. Life will find a way in Jurassic park, Michael, low cost energy will find a way or regimes or financial collapses will occur. So, I mean, I think that we’ve got to tie it at Jurassic park here. Week but we got one. But anyway, Northvolt’s rise and fall is going to be Tesla’s executives, Peter Carlson and Paolo, I apologize for butchering your name, Paolo Carute. Northvolt aimed to produce the world’s greenest lithium-ion batteries. I hope they had a self-fire stopping feature, but anyway. [00:13:53][64.3]

Michael Tanner: [00:13:52] Well, I mean, this article also points out the absolute financial mismanagement of this company, along with the fact that their co-founder, Peter Carlson, stepped down just after filing chapter 11 bankruptcy, pocketed basically $200 million that needs to be translated into whatever their, you know, sweet, whatever their dollar is. Their dollar is, but I mean that’s a pretty, talk about an ESG Griff. [00:14:18][25.5]

Stuart Turley: [00:14:18] I wonder if he’d be a sponsor of the show. What do you think? [00:14:21][2.6]

Michael Tanner: [00:14:22] Money for it. [00:14:23][0.6]

Stuart Turley: [00:14:23] Yeah, maybe we could get a new T-Rex generated picture here. [00:14:26][3.7]

Michael Tanner: [00:14:27] I guys, let’s jump over and cover oil and gas prices, but let’s go ahead and pay the bills real quick. As always, guys, all the news and analysis you’ve heard is brought to you by energy newsbeat.com. Please continue to support the show by checking us out there on energy newsbeat dot com. You can also support the Show a great way to support Is subscribing to us on Substack, theenergynewsbeat.substack.com. If you’re so inclined, go ahead and do a paid subscription. That really helps keep this show moving forward. We’re posting a lot of great subscriber only content. You know, we had a great, great feedback from our state of the market that we did last week. We’re gonna start doing those monthly, but they’re gonna be behind the paywall. So the only way to get that. Is be a paid subscriber. Go ahead and check us out. TheEnergyNewsbeat.substack.com. Thank you to Reese Energy Consulting for supporting the show. If you’re in the upstream, midstream space and you are not working with a marketing company or need help, when it comes to all this LNG that we’re talking about, Reese Energy consulting is the place to go. That’s ReeseEneryConsulting.com And finally, guys, if you are wondering where to allocate capital in 2025, if you’re CIO, If you’re, if you’re working at a family office and you’re wondering where do I allocate capital specifically within the energy space? We have a great ebook that we have an invest in oil dot energy newsbeat.com, which will walk you through all the different ways you can invest in the energy business. And then we are happy to get with you and talk to you about what investing in energy looks like. Again, that’s investin oil.energynewsbeat.com. All the links below are in the description. [00:16:00][93.2]

Michael Tanner: [00:16:01] Let’s run through top line headlines. The markets in the US are closed. The S&P 500 and NASDAQ were both down a little bit on Friday, six tenths and nine tenths of a percentage point respectively, two and 10 year yields. Basically flat, the 10 year, the two year yield was flat while the 10-year yield was actually down about four tenths per percentage point. We did see the dollar index drop about a tenth of a percentage point. Bitcoin is, is pushing $110,000 crude oil is open today. Markets are pretty slow. We’re at 6149 Brent oil, 64, 68. That’s basically flat week over week, natural gas down about 1.8 percentage points, $3 and 27 cents XOP, which is our EMP securities contract, basically flat on Friday, 120, 84. And you know, really what has moved prices or slightly moving prices towards the positive side is three things. One, we’ve got the prospects of, of possible more sanctions on Moscow. We covered that earlier in this, in this show, obviously today being Memorial day, thank you to all of our veterans and those who have obviously paid the, the ultimate sacrifice for the United States. You know, we’ll see limited trading due to just lower volume here on Monday. But you know, always in the foreshadow is OPEC plus that is could agree to continue to push supply further. You know, really when we dive into the European union, Trump went ahead and extended the deadline for trade talks that he is having with the European union, you know, both the Brent and crude oil traded, you know, up earlier in the session. After that deadline was pushed to July 9th, which again makes, gives us a temporary reprieve on that. I love Giovanni Stavano. He said quote, Trump’s pivot by postponing higher tariffs to the and his comments on possible sanctions on Russ are moderately supporting crude prices. Trump said in a truth social post, Vladimir Putin, quote, has gone crazy in all capital letters by unleashing that large aerial attack we mentioned on Ukraine. And again, he’s weighing new sanctions, so lot going on there. We did see rig counts and frat count spreads on Friday from a rig count side, drop 10 rigs, getting pounded 566 rigs total on the frat count spread. Dropped by seven, down to 186 frat crews. So, people are reacting to this, Stu. I mean, there’s no way about it. Rigs are dropping, frat crew are dropping. Tariffs on steel have basically gotten to the point where it doesn’t make sense just to even drill wells. I mean three months ago, I would have told you that we’ll actually see rigs stay fairly flat. We’ll see frat counts drop, if only because no one will be fracking, but people will be ducking wells. People aren’t even ducking well anymore, Stu, they’re not even thinking about putting pipe in the ground. They’re pulling back. They’re only drilling their top best locations, which you’d think people do all the time, but there was a little bit of a game with these drill schedules. So very, very fascinating. Finally here, OPEC’s latest report, a strategic move to challenge US shale oil companies. They went ahead and basically released their latest strategy, which basically floats the fact that they are going to accelerate output hikes. This came in early May, as we know, adding that 411,000 barrels per day in June. And attempting to potentially bring back that 2.2 million barrels per day by November. That’s according to our friends over at Reuters. The funny part is that this is designed most likely to target US shale. And there’s a pattern to suggest this. We go back to 2014, OPEC abandoned those output restrictions that it had in order to squeeze US shales, which did hurt. We saw a lot of bankruptcies in 2016, 2017. We did also see technological advancements that allowed, you know, for more output per well on a per foot basis on a barrel per foot basis with did allow shale to, to, to pal through that did, you know, that time though, which is people think that 2014 was the time when U S shale was squeezed out more OPEC’s market share actually went down from 40 to 25% by the time we sit here today in 2025, you The theory goes today that U.S. Shale is more vulnerable. We’ve seen costs risen. A lot of the best acreage has already been drilled at what we would call sub technological limits. You know, if you drilled your, if you drilled the best Acreage back in 2020 and you drilled it at a mile and a half lateral, when you could have maybe drilled it today at a two mile lateral using bigger fracks, more sand, you could have interest, you could have, you could have theoretically gotten more barrel per foot, which I find it interesting again, you know, going back to our favorite T Rex low cost energy. Will find a way that I think is the critical piece. And I think what you’re seeing is a move towards offshore. You’re seeing a move toward, we may have to spend a lot more capital, but that capital needs to be spent on a barrel, on a, you know, that incremental barrel needs to come at the incremental lowest price and whether or not that’s offshore, onshore, we’re seeing Chevron attempt to move heavy into Ghana. So I think there’s a lot of things changing. And if you’re an investor in the space right now, it really begs the question about where do you allocate capital? It seems to be that. This move by OPEC is designed to maybe bring back market share. It could be an appeasement to Trump. I think there’s a little bit of that in there. I don’t think this is necessarily their attempt to squeeze us shale as much as it is an attempt to appease president Trump. Now in the process of appeasing president Trump, they’re going to squeeze out us shail again. But I just, I just find ironic considering, you know, we all voted for him, I’m not saying I wouldn’t do the same thing again, but the people are upset, prices are low, well, you reap what you sow. That’s somewhere in the Bible, I think. So the point of the matter is, it’s going to be interesting to see what happens, but if you’re a capital allocator in this space or looking to allocate capital in this place, you gotta think differently. Gone are the days of we’re just gonna go dive straight into the Permian or the Delaware. There’s still that opportunity, but you have to have billions and billions of dollars. And if you do, there are still plays available in that area that are worked. But I think what you’re seeing is a pivot towards conventional assets. I think what you’re gonna see is a pivot towards offshore resources and what Stu said, a pivot toward large international LNG projects. So it’s a fascinating time to be in the energy business, Stu, and we’ll keep everybody up to speed on what they need to know and how they need to continue allocating capital to space. But my favorite segment of the week, Stu, what should people be worried about this upcoming week? [00:22:17][375.5]

Stuart Turley: [00:22:18] Buckle up. What a time to be in the energy business. I mean, I love our analysis of oil wells and, and what we do to really make sure. Hey, is that well actually going to be a viable? Well, that I like that to me is fun. The news cycle. Holy smokes. I’ve lost my front teeth from drinking from a fire hose. [00:22:41][22.7]

Michael Tanner: [00:22:41] Well, the news cycle is meant to inform. The news cycle is not just the news. It’s, Hey, what, what does this mean for me, the capital allocator, person in the oil business, potential LP. So I think there’s all these different, all of these news articles funnel back into what decision I need to make. And that’s why people tune into the energy energy news beat guys. But with that, we’re going to let you get out of here, get back to work, start your short week. We appreciate everybody starting your week with the energy newsbeat for Stuart Turley. I’m Michael Tanner. We’ll see you tomorrow, folks! [00:22:41][0.0][1349.9]

The post Oil Back to $100?! appeared first on Energy News Beat.