Energy News Beat

Existing home sales rise from multi-decade rock-bottom, still -34% from 2021, -22% from 2019. Supply highest for November since 2018, days on market highest since 2019.

By Wolf Richter for WOLF STREET.

Sales of existing single-family houses, townhouses, condos, and co-ops that closed in November fell to 315,000 homes, according to data from the National Association of Realtors today. During the holiday period – from November through January – sales always drop from the prior months and reach the yearly low in January, and inventories drop too as people pull their homes off the market over the holidays.

Year-over-year, sales rose by 5.0% not seasonally adjusted, from the collapsed sales that closed in November last year after mortgage rates had briefly hit 8%. But compared to November 2021, sales were down by 37%. That’s the extent of demand destruction brought about by too-high prices.

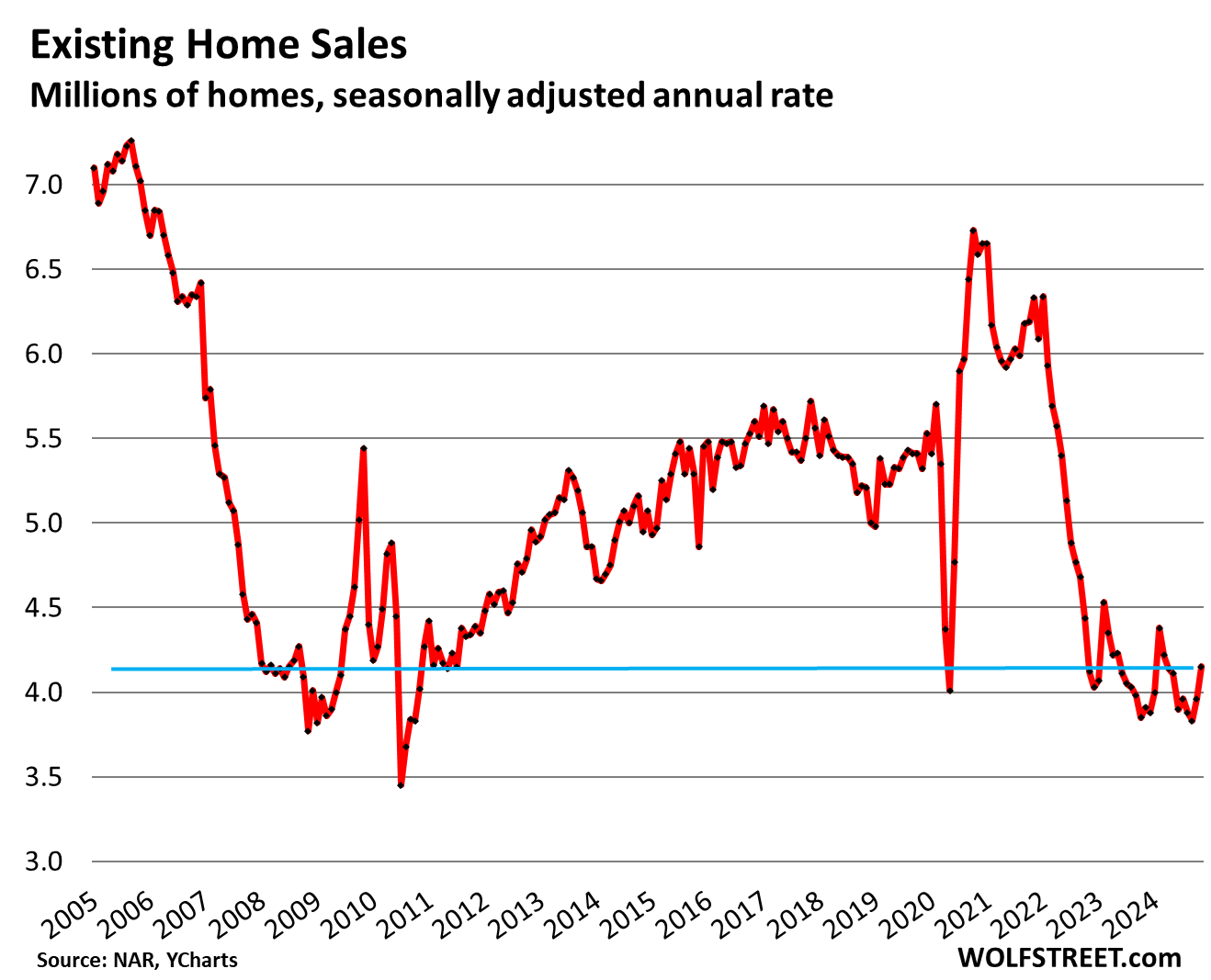

The seasonally adjusted annual rate of sales, which attempts to iron out the seasonal decline over the holidays and multiplies this out to a 12-month period, rose by 4.8% in November from October to an annual rate of 4.15 million homes. This was still down by 34% from the same period in 2021 and by 22% from 2019, wobbling along the bottom for two years (historic data via YCharts):

Buyers’ strike leads to lowest annual sales since 1995.

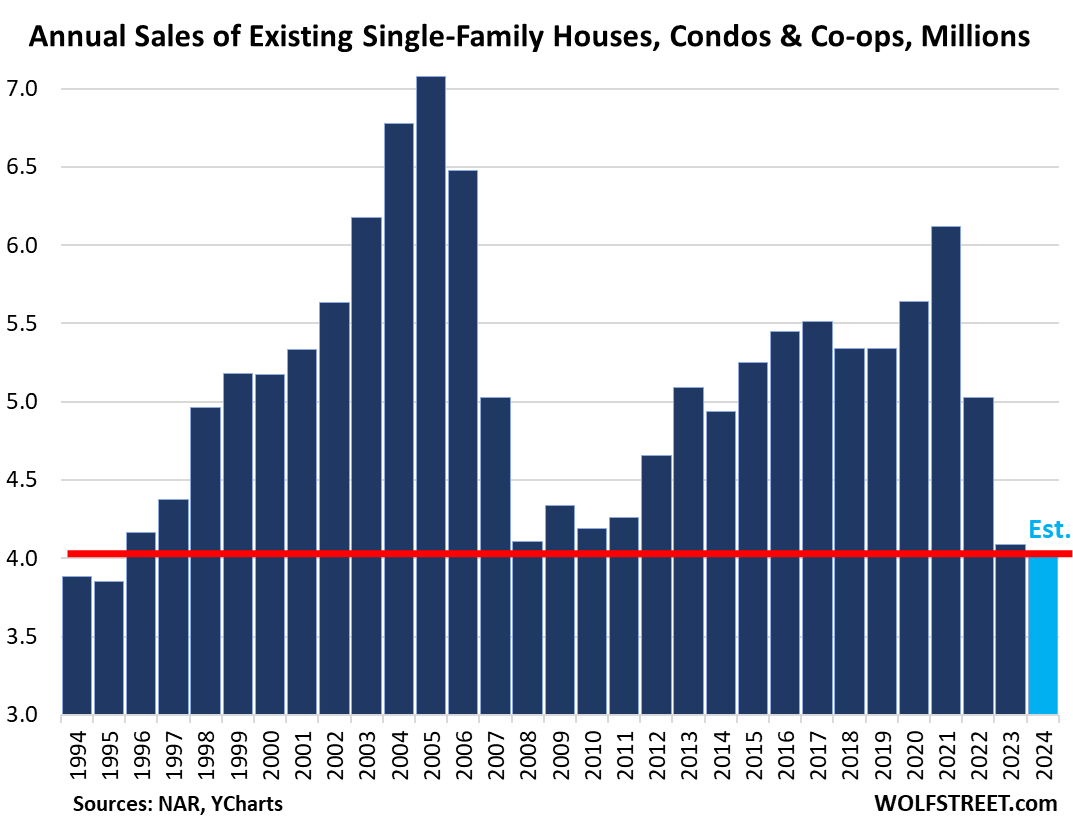

The demand destruction in 2024 has been even larger than during the Housing Bust. With today’s actual sales figures for November (not seasonally adjusted), the WOLF STREET estimate for the whole year 2024 comes in at 4.04 million sales, the lowest since 1995, below even the worst years during the Housing Bust.

During the Housing Bust, demand destruction was caused by an economic and financial meltdown that had been preceded by years of reckless mortgage lending that then came home to roost and turned into the mortgage crisis.

But the 2023 and 2024 demand destruction was caused by a gigantic spike in prices – the NAR’s national median price shot up by nearly 50% from June 2019 through June 2022 – and then in 2023, mortgage rates returned to normal-ish levels in the 6%-7% range, up from the pandemic’s free-money range of less than 3% (historical data from YCharts).

Getting used to 6% to 7% mortgage rates.

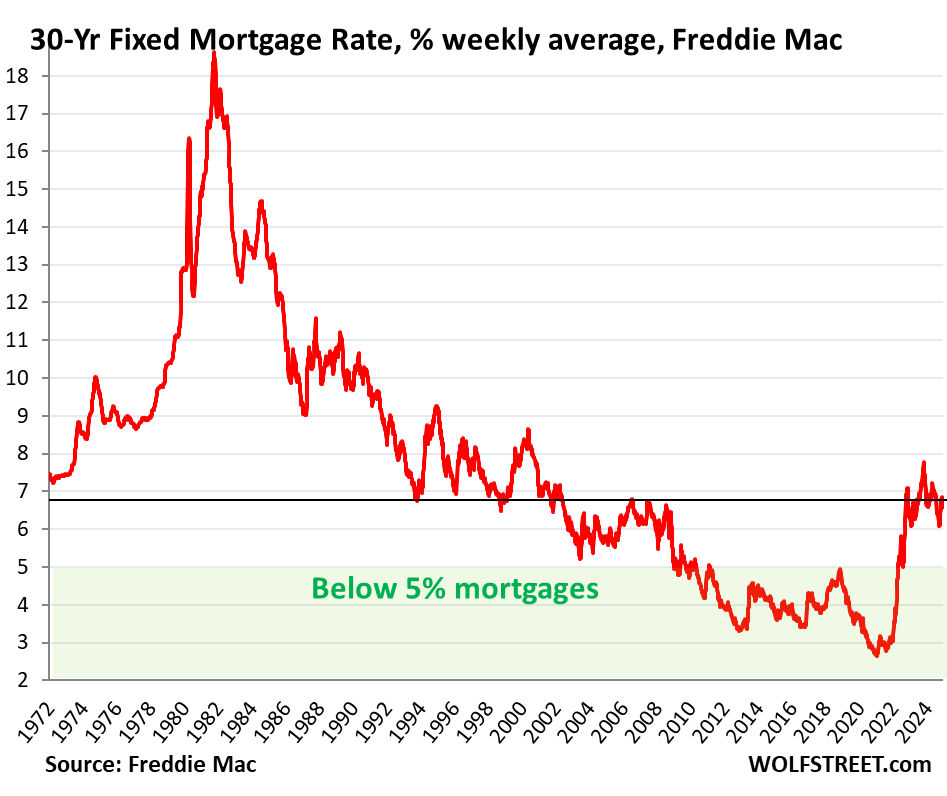

The real estate industry has now given up on trying to outwait those mortgage rates and is exhorting sellers and buyers to get used to “a new normal of mortgage rates between 6% and 7%,” as the NAR put it today.

These 6% to 7% mortgage rates are of course the old normal mortgage rates that prevailed in the decades before the money-printing era of 2008 through 2021, and they’re unlikely to go back to the pandemic range.

Fannie Mae, the largest Government Sponsored Enterprise that buys and guarantees mortgages, came out earlier this month, encouraging mortgage investors, the real estate industry, home sellers, and home buyers to get used to these 6% to 7% mortgage rates:

“It is unlikely we will again see the low mortgage rates we had during the COVID-19 pandemic,” Fannie Mae wrote in a blog post, adding that “current mortgage rates and Fannie Mae’s forecast for 2025 rates are well in line with rates over the past several decades. Since 1990, the 30-year fixed-rate mortgage has averaged 6%.”

The average 30-year fixed mortgage rate rose to 7.14% today, according to the daily measure by Mortgage News Daily.

Freddie Mac’s weekly measure of the average 30-year fixed mortgage rate rose to 6.72% today.

Mortgage rates track the 10-year but at a higher level, with a spread between them that varies. And the 10-year yield has jumped by nearly 20 basis points to 4.58% since the Fed’s rate cut yesterday.

Mortgage rates have been above 6% since mid-2022. The market might as well get used to this mortgage rates and deal with them – and lower prices, after the ridiculous spike, will bring up the volume.

Before the 2008-2021 money printing era, 5% mortgages had been essentially unheard of:

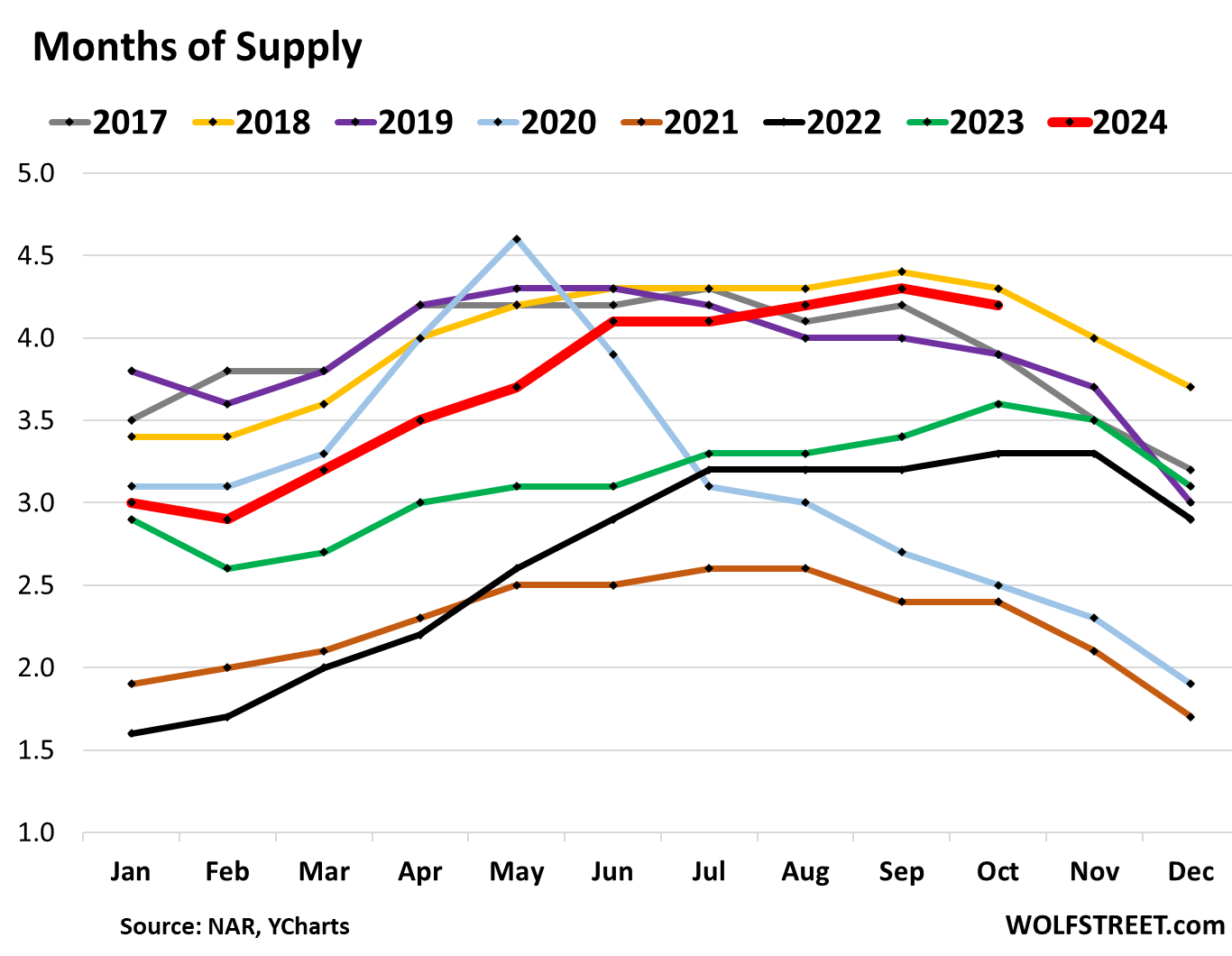

Highest supply for any November since 2018.

Supply of unsold existing homes on the market, at 3.8 months (red line in the chart below), was the second highest for any November over the eight years 2017 through 2024, behind only 2018 (yellow). And that is plenty of supply.

Unsold inventory dipped to 1.33 million homes in November, as homes got pulled off the market over the holidays and as new listings declined from the prior month, as they always do over the holiday period.

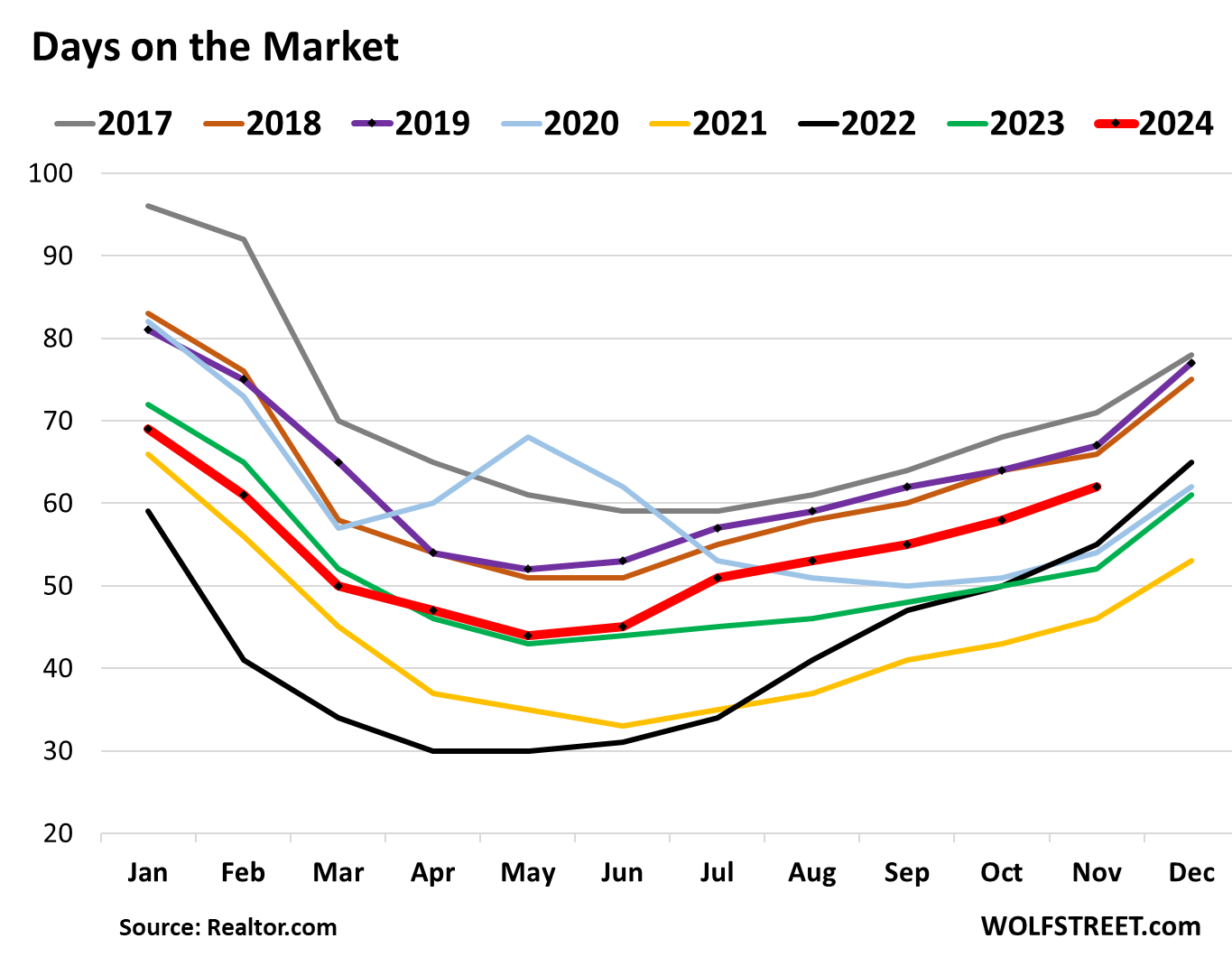

Days on the market keep rising.

The median number of days before the home is either sold or pulled off the market because it failed to sell rose to 62 days in November, the most for any November since 2019, and up from 52 days a year ago, according to data from Realtor.com.

This is in part a measure of how motivated sellers are by letting their home sit on the market when it doesn’t sell right away.

Prices are way too high.

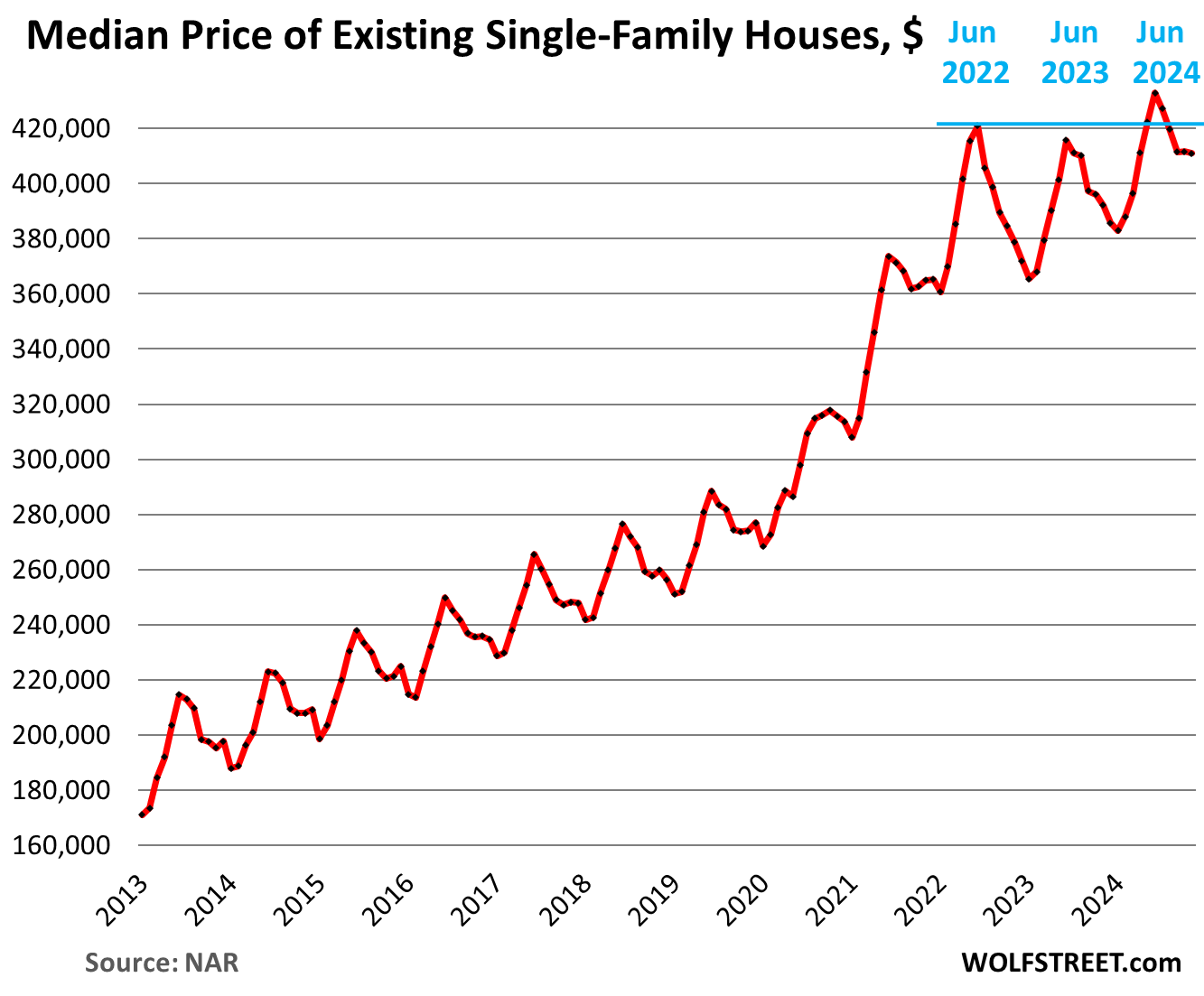

The median price of single-family houses edged down in November to $410,900, with the past three months in roughly a holding pattern, in line with pre-pandemic seasonality over those months through December. This seasonal pattern is usually followed by a big drop in January. Year-over-year, the price was up by 4.8%.

In the three years between June 2019 and June 2022, this national median price had exploded by nearly 50%, on top of the large price gains in prior 10 years, and this — driven at the time by the Fed’s interest-rate repression and money-printing schemes — has become the #1 problem in the housing market today:

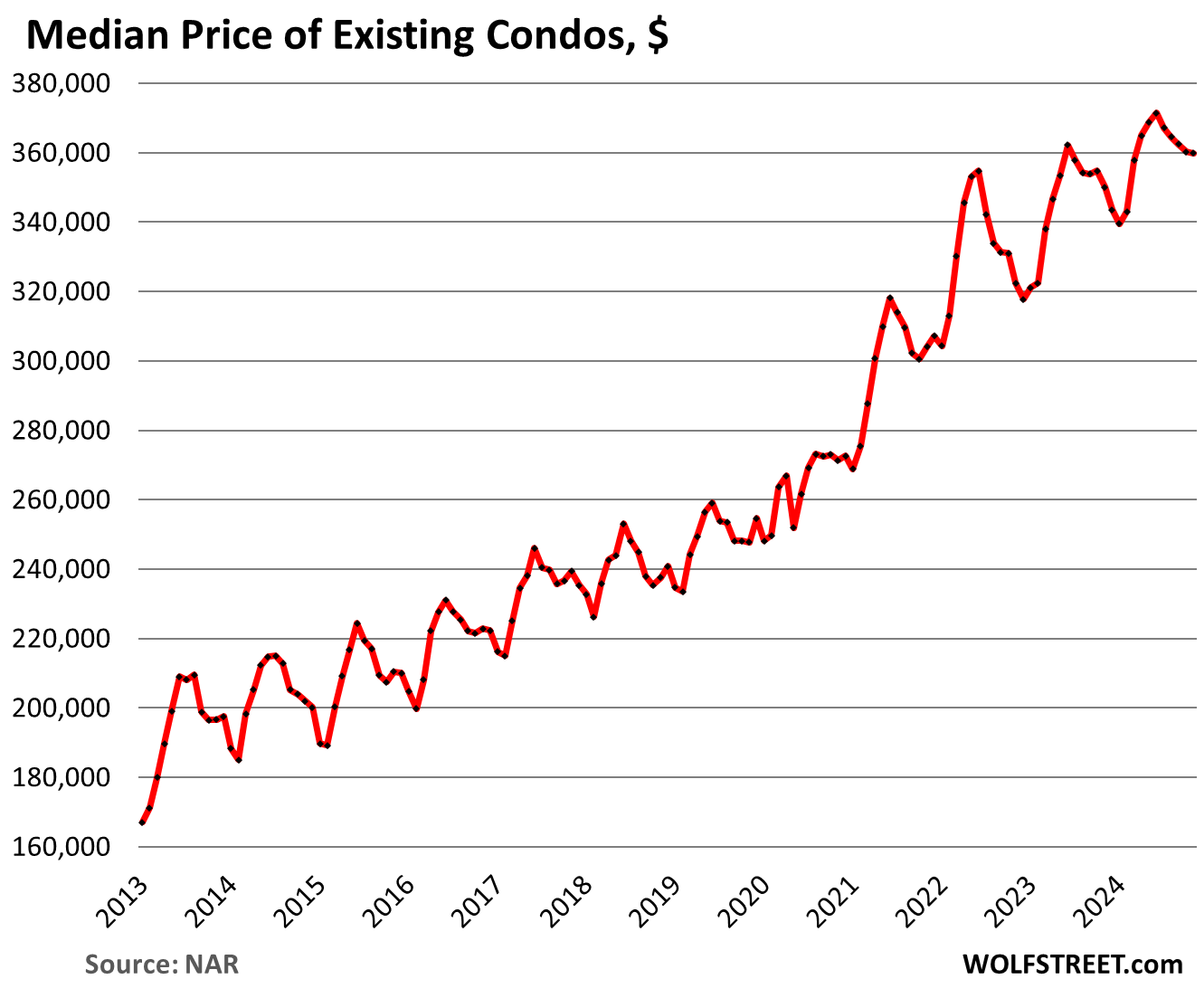

The median price of condos and co-ops dipped to $359,800 in November, for a year-over-year gain of 2.8%. Unlike single-family house prices, the median condo price didn’t experience any outright year-over-year declines in mid-2023.

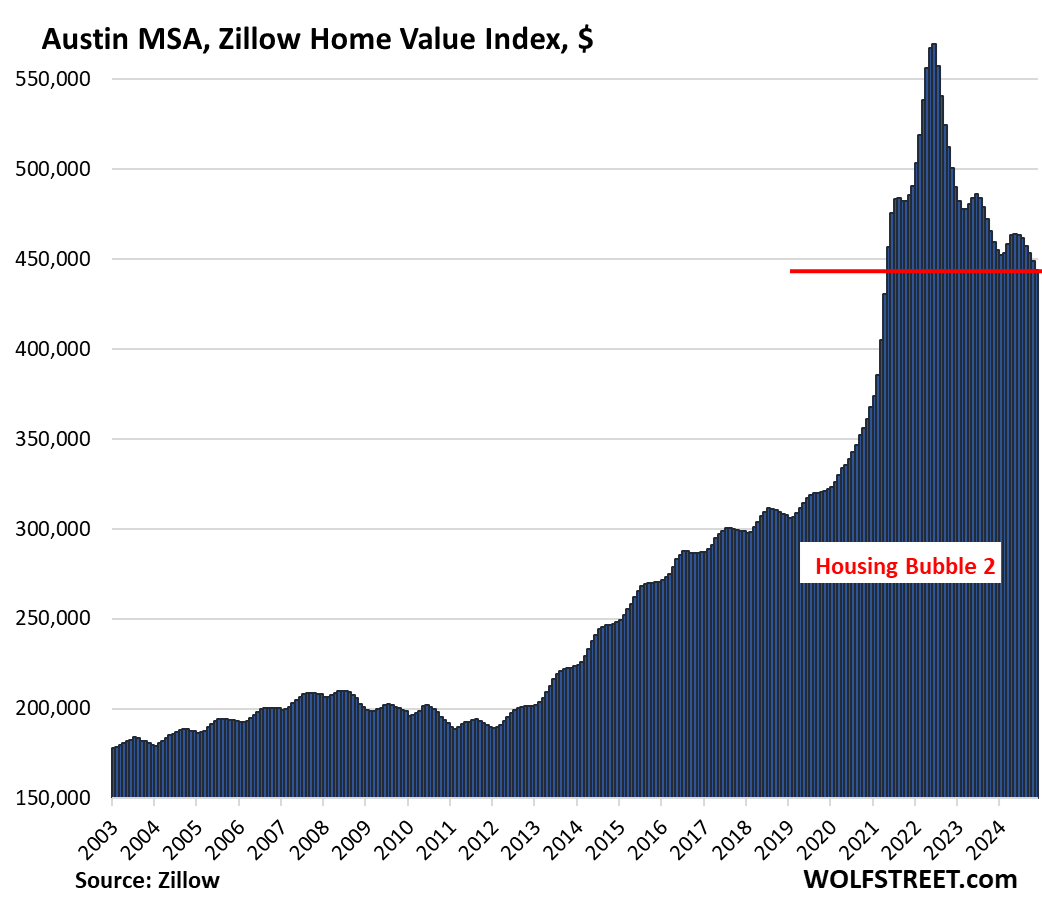

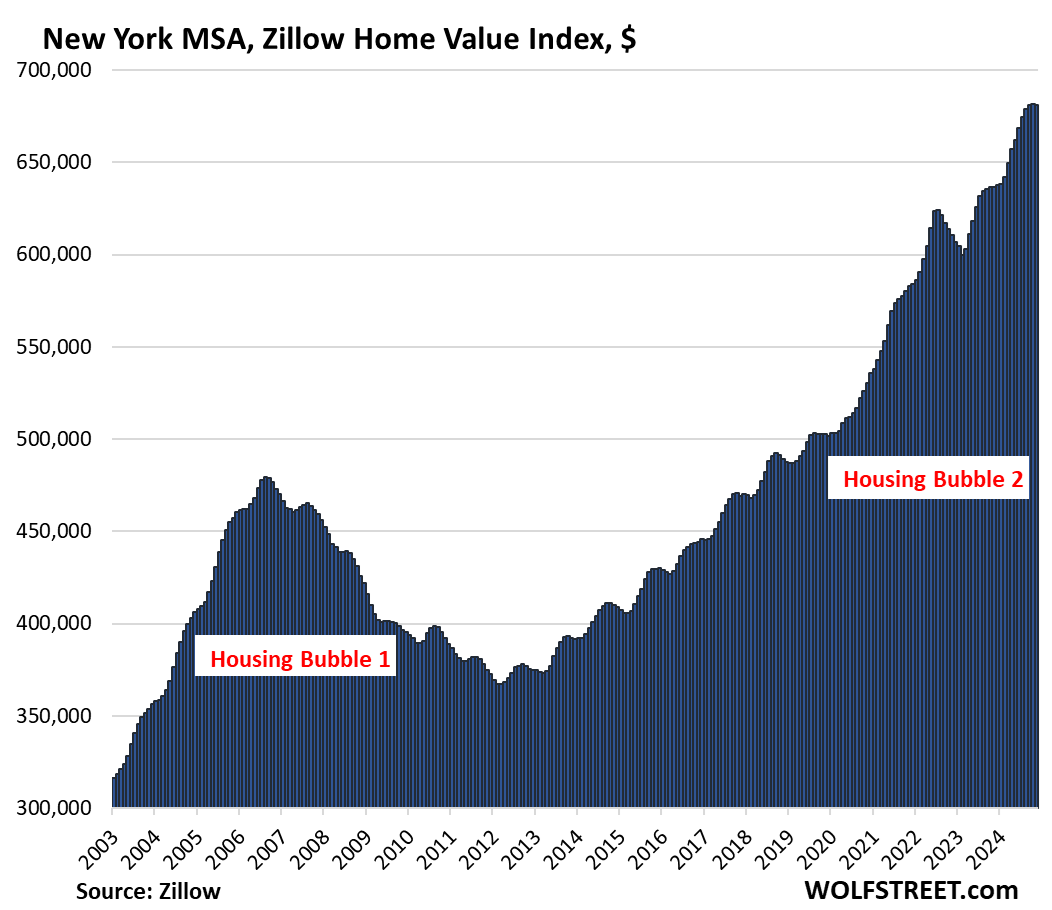

But home prices vary widely by metro. They have been dropping in some metros since 2022, but continued to rise in other metros through the summer, with declines now getting started in metros even where prices are not seasonal, based on Zillow’s “raw” mid-tier home price index. The two bookends of our series covering 33 markets, The Most Splendid Housing Bubbles in America, show the divergence, with Austin prices having plunged by 22% from the peak in mid-2022, while prices in the New York City metro eked out gains through October before seeing the first dip:

Demand destruction by region.

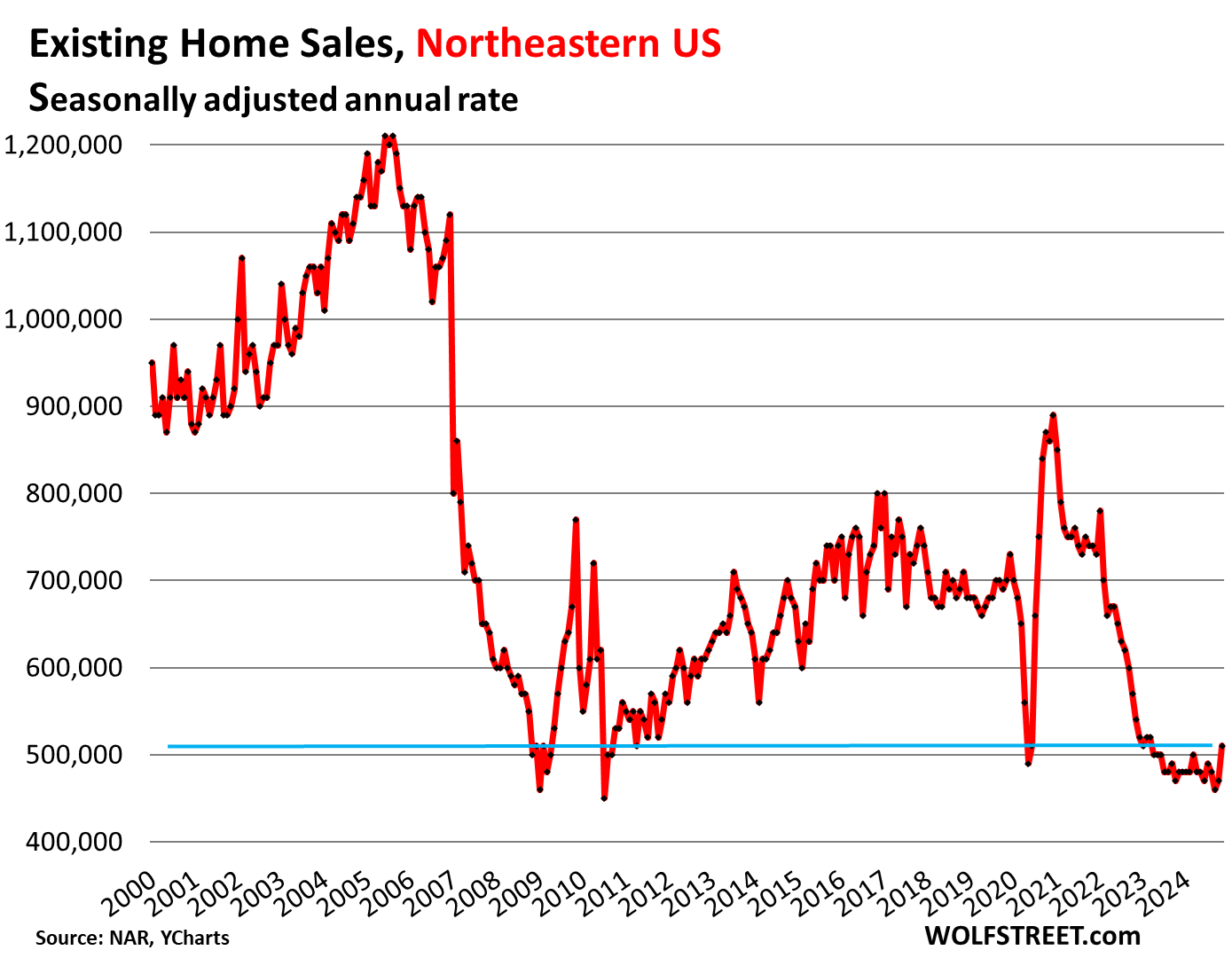

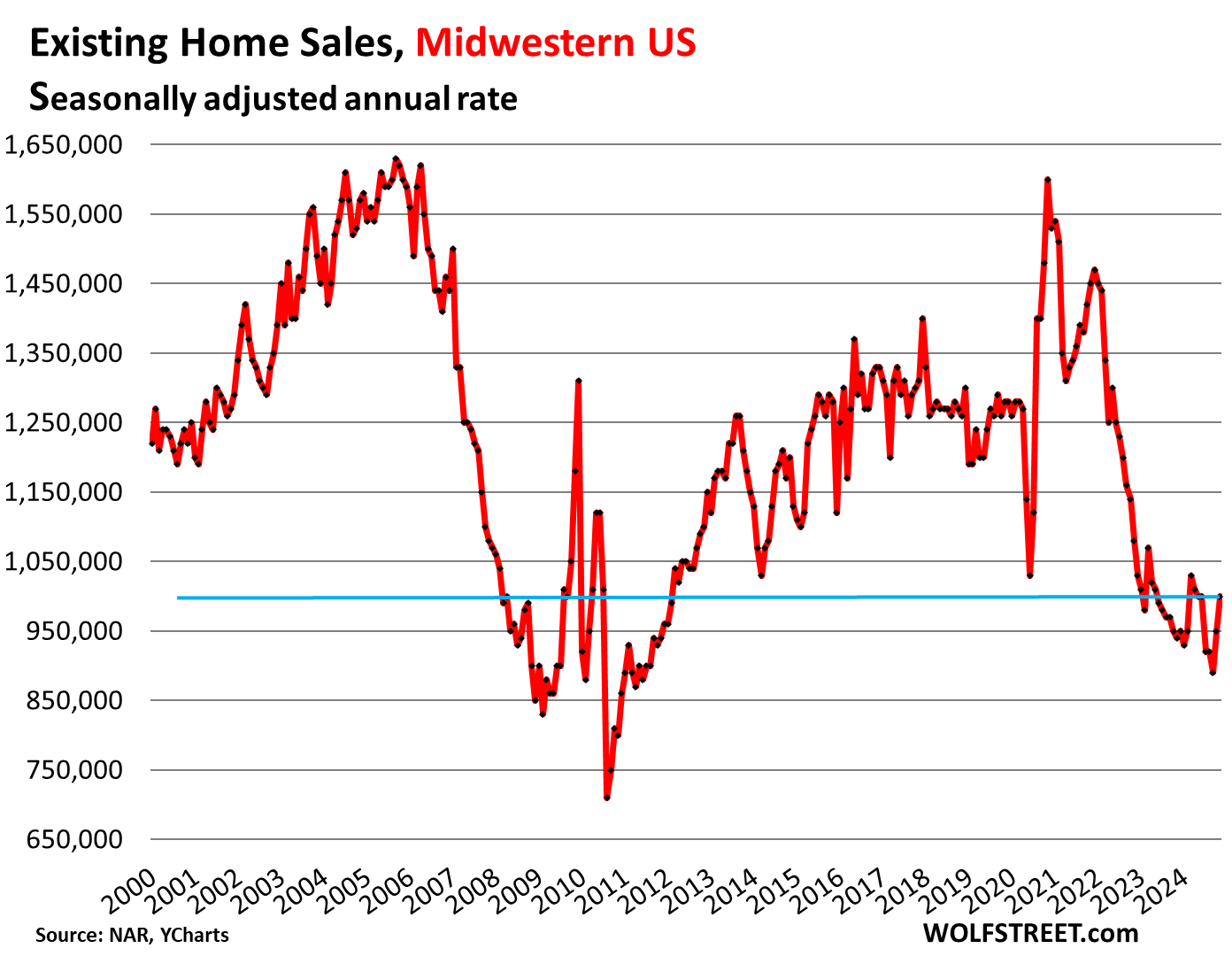

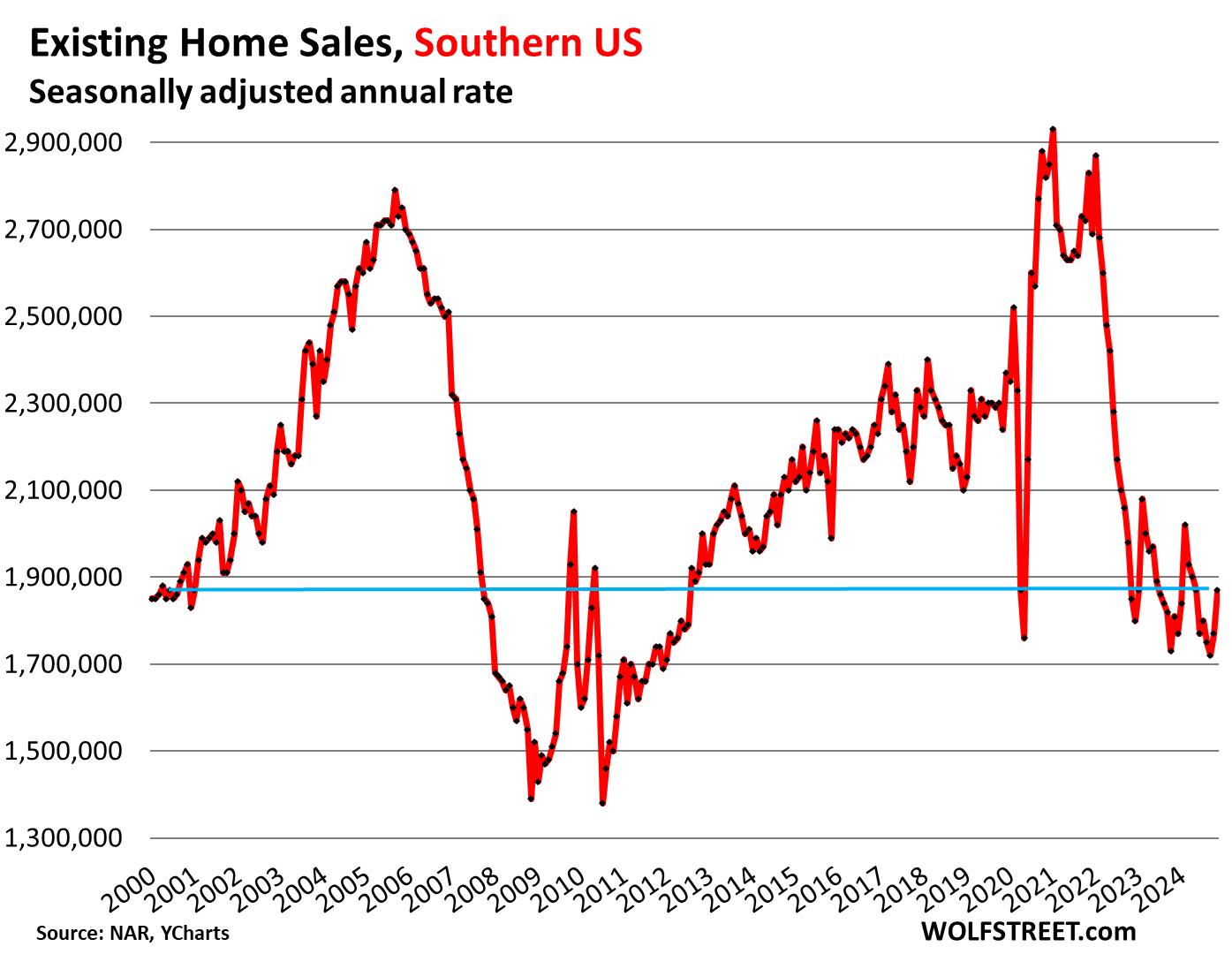

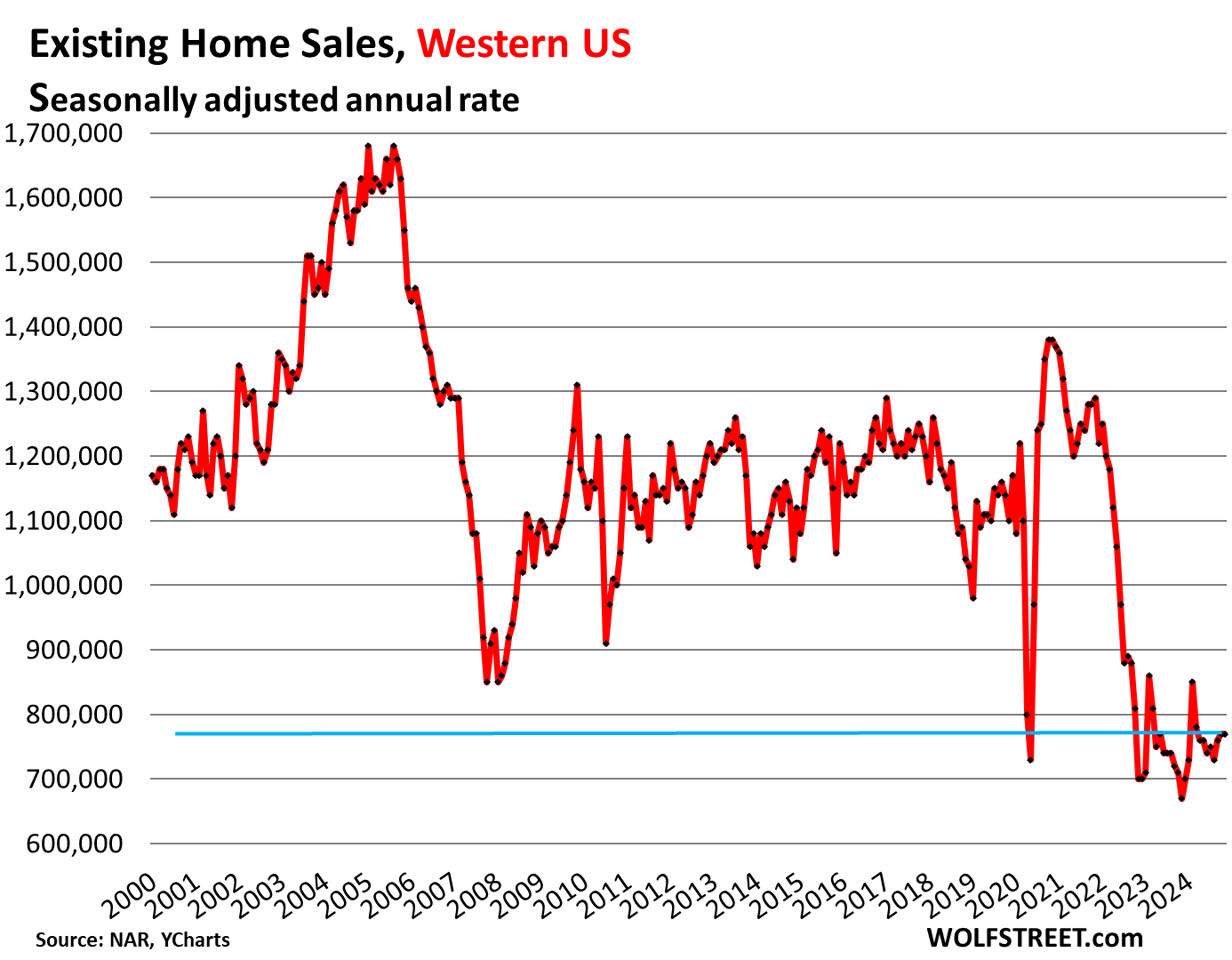

The charts below show the seasonally adjusted annual rate of sales, released by the NAR today, in the four Census Regions of the US. A map of the four regions is in the comments below the article.

Northeastern US: The seasonally adjusted annual rate of sales rose to 510,000 homes:

Midwestern US: The seasonally adjusted annual rate of sales rose to 1,000,000 homes.

Southern US: The seasonally adjusted annual rate of sales rose to 1,870,000 homes.

Western US: The seasonally adjusted annual rate of sales unchanged at 770,000:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

The post Home Sellers, Home Buyers, and Brokers Getting Used to the “New Normal” Old Normal 6-7% Mortgages? appeared first on Energy News Beat.