Energy News Beat

Diamondback Energy, Inc. (NASDAQ: FANG) on Tuesday announced a deal to buy Double Eagle IV Midco in an acquisition valued at about $4 billion, which gives the buyer increased presence in the Midland Basin in the top-oil producing U.S. formation, the Permian.

Diamondback Energy has signed a definitive purchase agreement to buy certain subsidiaries of Double Eagle IV Midco, LLC in exchange for approximately 6.9 million shares of Diamondback common stock and $3 billion of cash, the company said, confirming earlier reports of the acquisition.

“Double Eagle is the most attractive asset remaining in the Midland Basin,” Diamondback chairman and CEO Travis Stice said in a statement.

“With 407 locations adjacent to our core position, this largely undeveloped asset adds high-quality inventory that immediately competes for capital.”

Diamondback expects to fund the cash portion of the transaction through a combination of cash on hand, borrowings under the company’s credit facility and/or proceeds from term loans and senior notes offerings.

For Diamondback, this would be the second major deal in a year, after it took over Endeavor Energy Resources in 2024 in a deal with a price tag of $28 billion.

Concurrent with the Double Eagle deal, Diamondback also announced today it is committing to sell at least $1.5 billion of non-core assets to accelerate pro forma debt reduction in order to maintain a strong balance sheet. Diamondback expects to reduce net debt to $10 billion and, long term, maintain leverage of $6 billion to $8 billion.

Last year, the shale space saw a flurry of mergers and acquisitions, with the total hitting $105 billion. That was lower than the $192 billion in deals struck in 2023 but still a substantial sum.

This year, a slowdown in M&A, due to a lack of available reasonably-priced targets, is set to continue, according to energy analytics firm Enverus. Merger activity fell in the last quarter of 2024, but natural gas opportunities could help acquisitions rebound this year, Enverus said.

By Charles Kennedy for Oilprice.com

From David Blackmon’s Subsack –

Andrew Dittmar, Director at Enverus, said in an email that the deal means “Diamondback has taken over the mantel of being the premier large Permian pure play with broadly comparable scale to Pioneer at the time of its sale.” Diamondback’s market capitalization with the Double Eagle value added in would amount today to roughly $50 billion as compared to the $59.5 billion value of ExxonMobil’s buyout of Pioneer.

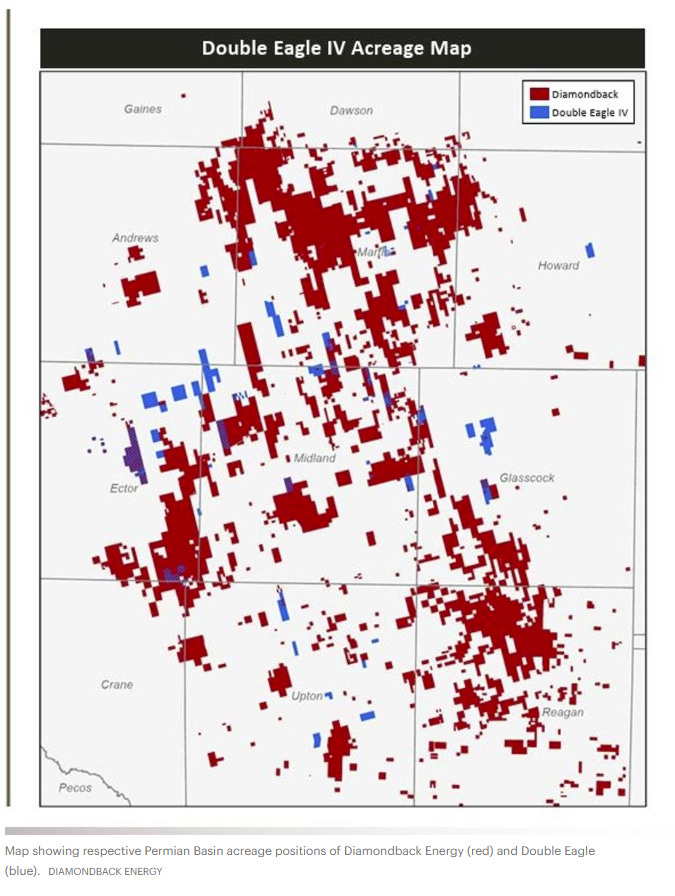

In its release on the deal, Diamondback highlighted the fact that the deal means it now holds roughly 40,000 net acres with a long-term run rate of 27 Mboe/d, of which 69% is oil, in the central fairway of the Midland Basin. Dittmar points out that this enhanced position means Diamondback ranks as the second-largest Midland Basin acreage holder behind ExxonMobil.

The deal for Double Eagle is in keeping with the overarching “bigger is better” trend that has largely driven the rapid consolidation in the Permian region over the last half-decade. Diamondback Energy has been a leader in this process, growing via a succession of acquisitions involving highly contiguous acreage positions to enhance economies of scale and drive down overall costs.

Noting that Diamondback appears to have paid a premium for the Double Eagle acreage and production, Dittmar says that is “not surprising given demand for assets in the Permian contrasted with few opportunities.”

As the number of Permian-focused corporate producers has diminished over time, acquiring companies have increasingly sought out privately held producers for growth opportunities. But now, after several years of that trend holding dominance, Dittmar points out few similar opportunities remain.

“Buying private assets has been fundamental to Permian Basin M&A, but after three years of furious consolidation there are very few remaining opportunities,” Dittmar writes. “Remaining private companies with high-quality drilling inventory like Fasken Oil & Ranch in the Midland Basin and Mewbourne Oil in the Delaware Basin are multi-generation family companies not necessarily interested in a sale like the private equity-built E&Ps.”

Dittmar also points out that, “in the past, private equity firms would reenter the play after a sale, but with inventory increasingly locked up by big companies not interested in selling, that has become far more challenging.”

Calling Double Eagle “the most attractive asset remaining in the Midland Basin,” Diamondback Chairman and CEO Travis Stice added that his management team has “worked tirelessly over the last thirteen years to position Diamondback to have the longest duration of high quality, low-breakeven inventory; a position we are solidifying with today’s announcement.” Stice also committed to divest at least $1.5 billion of non-core assets to accelerate pro forma debt reduction as part of the transaction.

The Bottom Line

A sober assessment of remaining Permian targets indicates this may be Stice’s last chance to announce a big transaction for awhile. Unless one of the family-owned independents decides the time has come to sell, or one of the really large independents like Devon Energy or Diamondback itself becomes a takeover target, the era of “bigger is better” could entering its final stages.As Dittmar pointed out in late January, “finding a good strategic fit between assets and getting management team alignment has gotten more challenging. The industry will continue to consolidate, but likely not at the same breakneck pace seen during the last two years.”

Still, it is important to keep in mind something a wise industry colleague told me years ago: The only thing certain in the oil and gas industry is that nothing is certain.

The post Diamondback Boosts Midland Basin Presence With $4-Billion Acquisition appeared first on Energy News Beat.