Energy News Beat

ENB Pub Note: This article is from Robert Bryce and his Substack. We highly recommend subscribing and supporting his work. He has amazing points on Energy and today is no exception. The world needs low-cost energy, and as I talked about Net Zero today on the Energy Realities podcast, the world is being divided. One-half of the world will have access to low-cost energy, financial growth, and prosperity, and the other side will face decline, no growth, and fiscal failure.

Soaring coal use in China and India is swamping the West’s decarbonization efforts. Here’s a climate policy reality check in nine charts.

Net zero and decarbonization pledges are a dime a dozen.

Earlier this month, the Australian government released an update to its “Net Zero in Government Operations Annual Progress Report.” The 65-page document is a marvel of bureaucratic navel-gazing. It takes a deep dive into the “Australian Public Service Net Zero by 2030 target,” including discussions of “emissions factors,” as well as scope 1, scope 2, and scope 3 emissions on everything from airplane flights to rental cars. The document has some laughably precise numbers. It claims electricity-related emissions totaled exactly 1.697 million tons of CO2 and that “38.29% of electricity consumed in 2023-24 was certified renewable electricity.”

Numerous other countries are touting their net zero plans. The German government has a target of net zero emissions by 2045. The UK’s net zero target is 2050. Canada plans to hit net zero by 2050. So does the EU, Japan, and South Korea. The Biden administration — remember them? — pledged that the US would achieve net zero “no later than 2050.” Notably, China and India also have bold decarbonization plans, with India targeting net zero by 2070, and China claiming it will hit net zero “before 2060.”

Of course, California has an aggressive decarbonization scheme. It is committed to a “just and equitable transition to carbon neutrality by 2045.” Making that happen, the state says, will require “significant” reductions in greenhouse gas emissions, removing CO2 from the atmosphere, and “working across all sectors.” California is hardly alone. According to the Clean Energy States Alliance, 24 states, Puerto Rico, and the District of Columbia, have “100% clean energy goals.”

But there’s a China-size gap between these decarbonization pledges and the ever-increasing global demand for hydrocarbons. According to the International Energy Agency’s Global Energy Review, which was released today, hydrocarbon growth again exceeded the growth in renewables last year. The report also shows that oil, natural gas, and coal provide more than five times as much primary energy to the global economy as the political darlings of the moment.

According to the IEA, oil consumption increased by 0.8%, and natural gas use jumped by 2.7% in 2024. While oil and gas are pivotal fuels, the global climate story continues to be defined by coal. Last year, global coal use increased by 1%, and power generation from coal plants totaled 10,700 terawatt-hours, a new record. The IEA’s reports show that soaring coal use and electricity demand in China (population: 1.4 billion) and India (population: 1.4 billion) is swamping all the climate policies and decarbonization efforts in the US, Canada, Europe, Japan, and South Korea.

Indeed, one of the big ironies in the IEA’s Electricity 2025 report, which was released last month, is that a significant chunk of China’s electricity demand growth — and therefore, its coal demand — is due to industrial demand for the production of the solar panels, batteries, and EVs that Western countries claim are needed for their decarbonization efforts.

China and India now account for more than 70% of global coal use, and their coal demand and CO2 emissions will continue rising for years to come. Need proof? Look at these nine charts.

The agency expects that over the next three years, global electricity demand will increase by “an unprecedented 3,500 terawatt-hours. This corresponds to adding more than the equivalent of a Japan to the world’s electricity consumption each year.” (Japan’s electricity generation in 2023 was 1,013 TWh.)

The IEA also reported that “emissions from electricity generation remain the highest of any sector” and that in 2024, greenhouse gas emissions from the electric sector set another new record: 13.8 billion tons of CO2. That’s a slight increase over the 13.6 billion tons emitted in 2023.

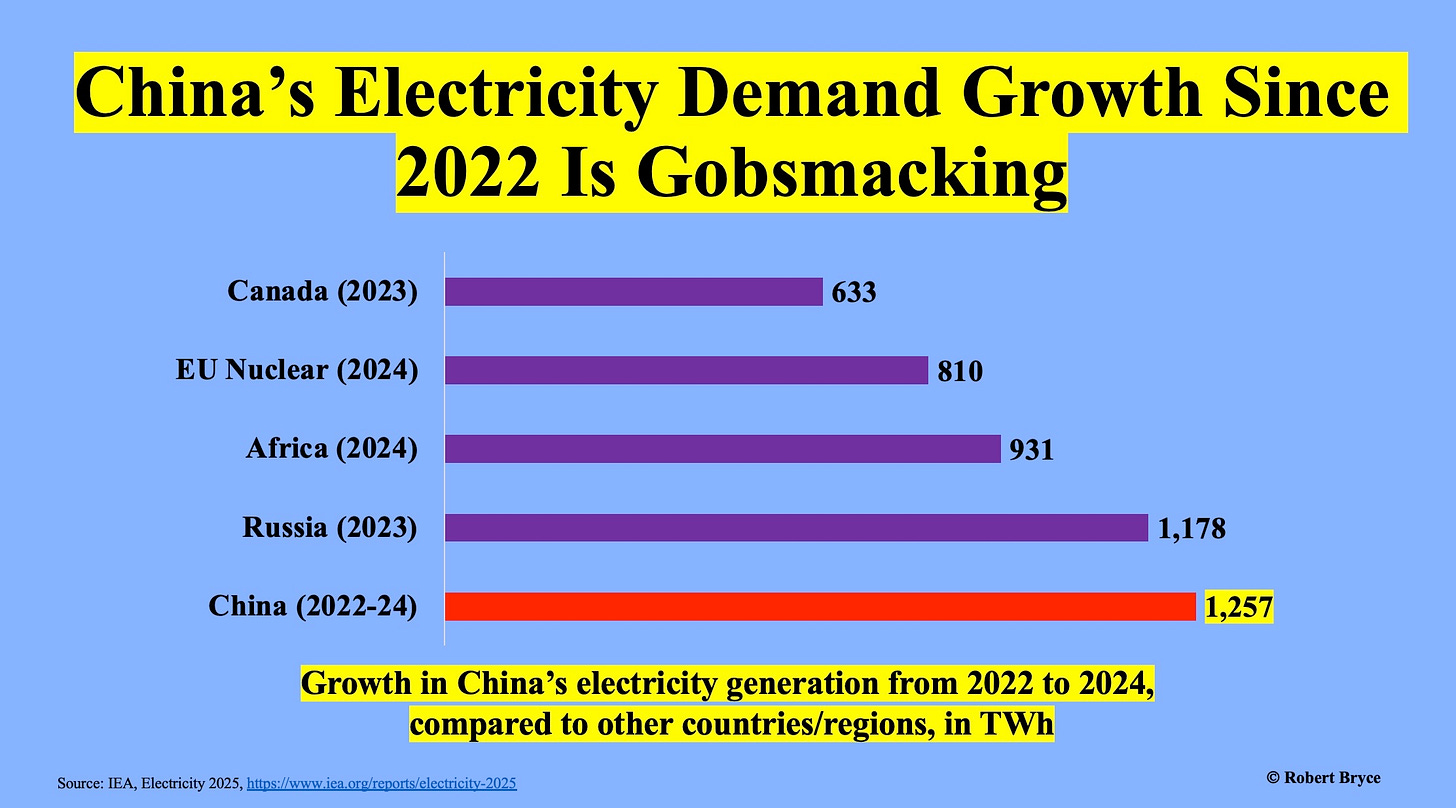

As seen above, the growth in China’s electricity use boggles the mind. Between 2022 and 2024, China’s electricity generation increased by some 1,257 TWh. Thus, just the growth in China’s electricity use was greater than all of the electricity generated in Africa in 2024. Here’s a key segment from the IEA’s report, which says global electricity use:

Rose by an estimated 4.3% y-o-y in 2024, up from 2.5% in 2023, with growth expected to continue at a robust 3.9% in our outlook period. In 2024, around 95% of the growth in global electricity demand occurred in emerging economies, with China accounting for 54% of the total. Out to 2027, developing economies will remain the engines of growth, accounting for around 85% of additional global electricity demand, with China providing more than half of the gains. (Emphasis added.)

How has China generated all that juice? The IEA says that last year, coal demand in China increased by 1.2% to a new record high and that 60% of China’s electricity came from coal-fired power plants. In the report released today, the IEA said China:

Now consumes nearly 40% more coal than the rest of the world combined, largely for power generation. Over one-third of all the coal consumed globally is burned by power plants in China. China’s influence in global coal market trends is unparalleled by any country for any type of fuel, with China’s share of global coal consumption now standing at 58%. (Emphasis added.)

The IEA expects China’s astonishing coal demand to continue. It says electricity generation in China increased by about 7% in 2023 and 2024, and it expects electricity consumption to continue growing by about 6% per year through 2027. At that rate, China’s electricity use will double over the next decade or so.

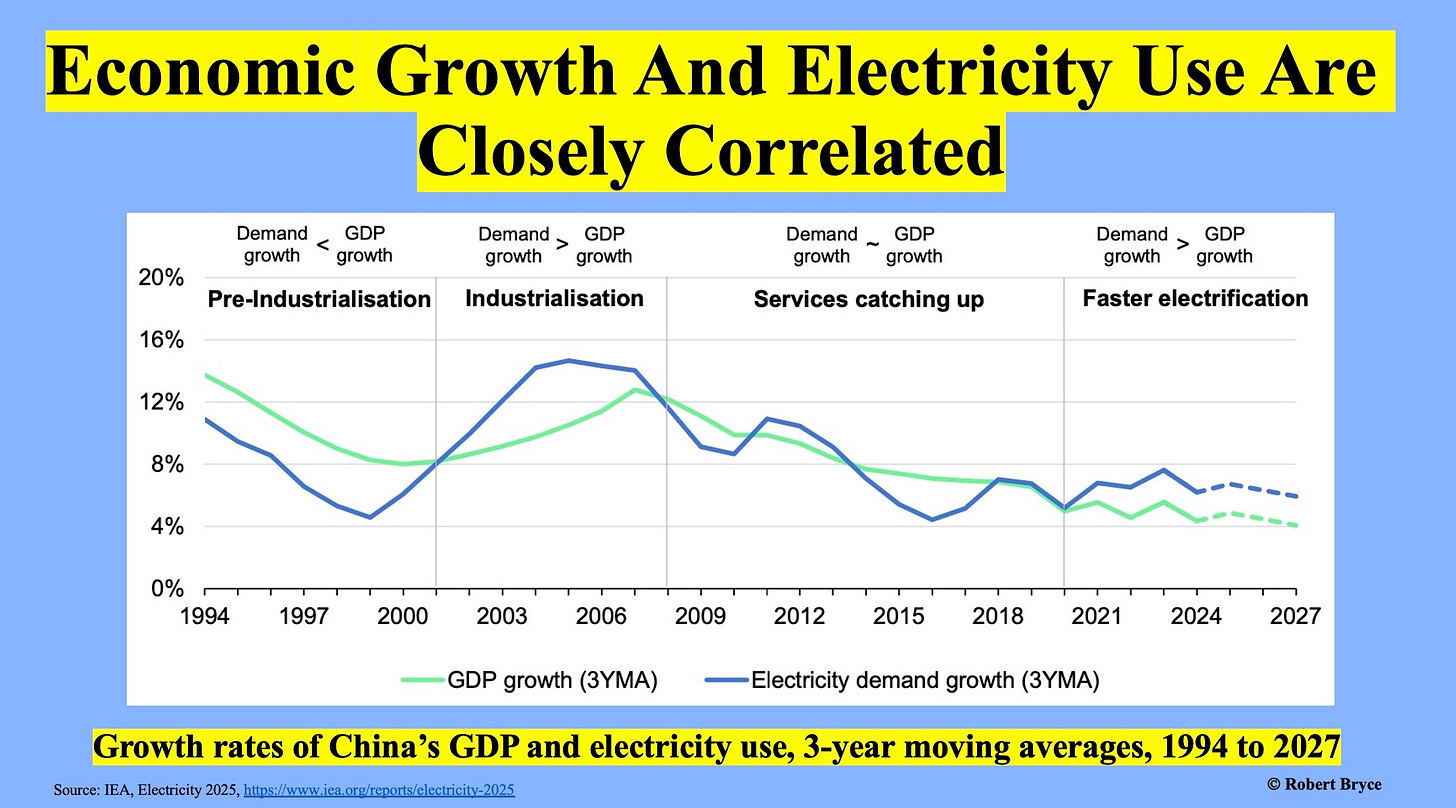

One of the most interesting graphics in the IEA report shows the close connection between economic growth and electricity demand. As seen in the chart above, sometimes GDP leads the increase in electricity demand, and sometimes it lags. But the chart shows that what’s true in China — and every other country on the planet — is that economic growth drives electricity demand, and electricity demand drives economic growth.

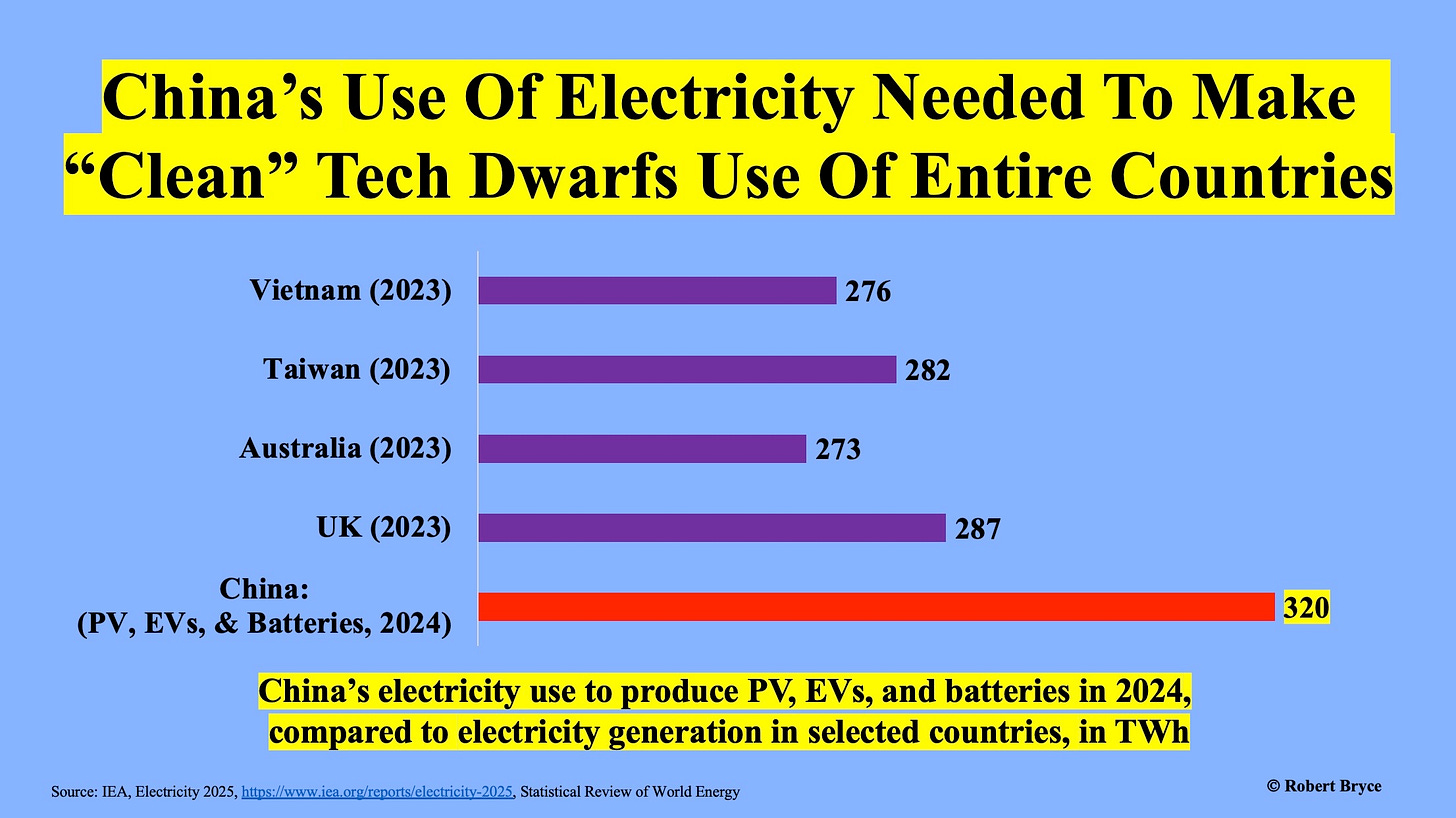

One of the revelations from the IEA’s electricity report is the staggering amount of juice China uses to produce solar panels, batteries, and electric vehicles. The IEA explains:

In China, industry consumes approximately 60% of all electricity, much higher than in any other country in the world (32% on average in the OECD). Over the three-year period from 2022 to 2024, 48% of the increase in Chinese electricity demand came from the industry sector. The manufacturing of PV modules, batteries, and EVs, excluding the processing of associated materials, are estimated to have consumed around 320 TWh of electricity in 2024…which rose by more than 230 TWh over 2022-2024. During this period, new energy products made up nearly 35% of the increase in industrial electricity demand and 16% of the growth in total electricity use across China. Including the numerous electricity-intensive upstream processes associated with these products that take place in China, such as the refining and processing of the related materials, can further boost these numbers. (Emphasis added.)

Pay attention to that last sentence.

The IEA is saying that the 320 TWh estimate represents only a part of the electricity China uses to produce PV panels, batteries, and EVs. If the agency included all the energy needed to refine copper, lithium, and rare earths, and smelt the steel, aluminum, and other metals needed for alt-energy products, the electricity total would be significantly larger.

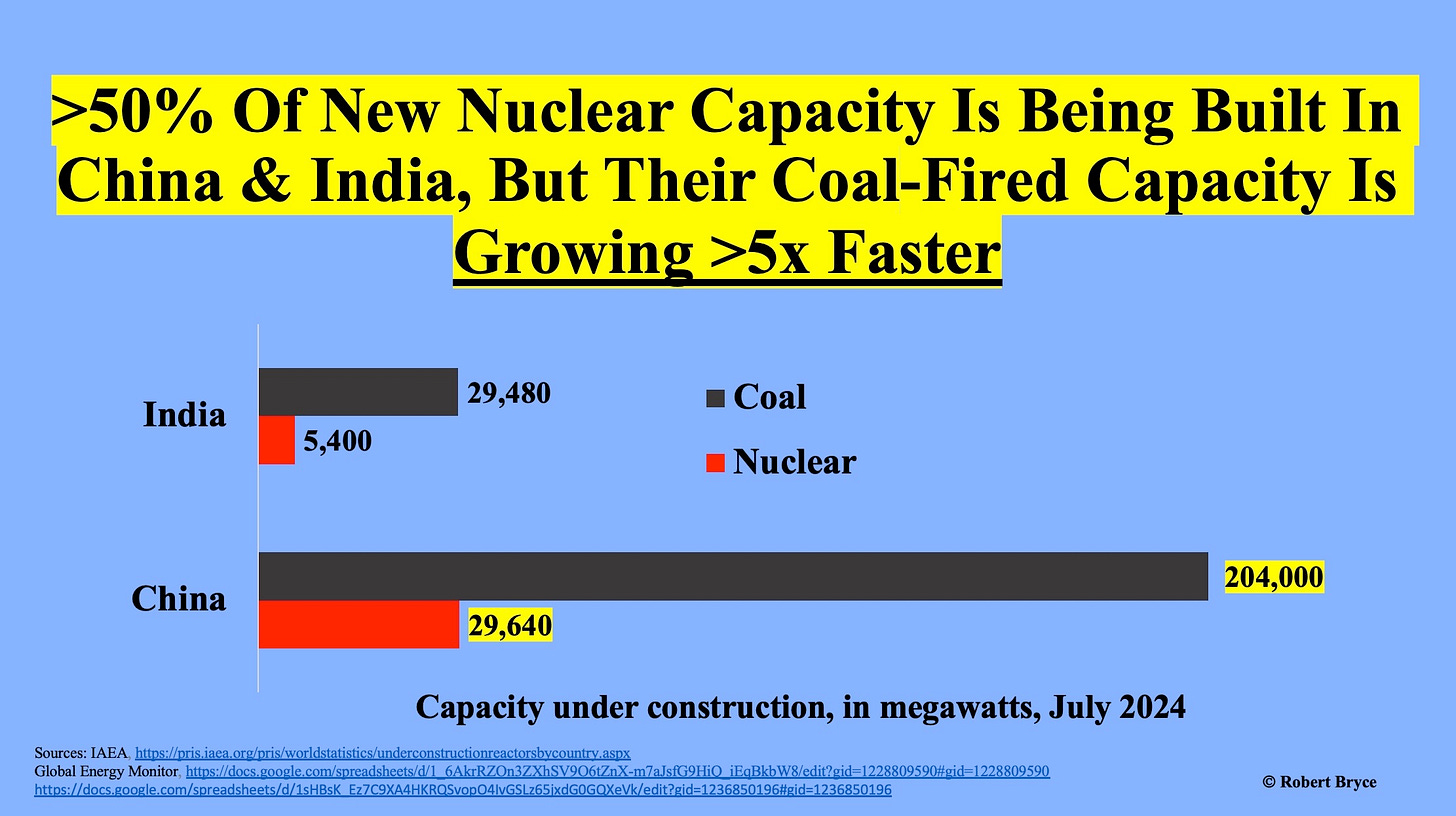

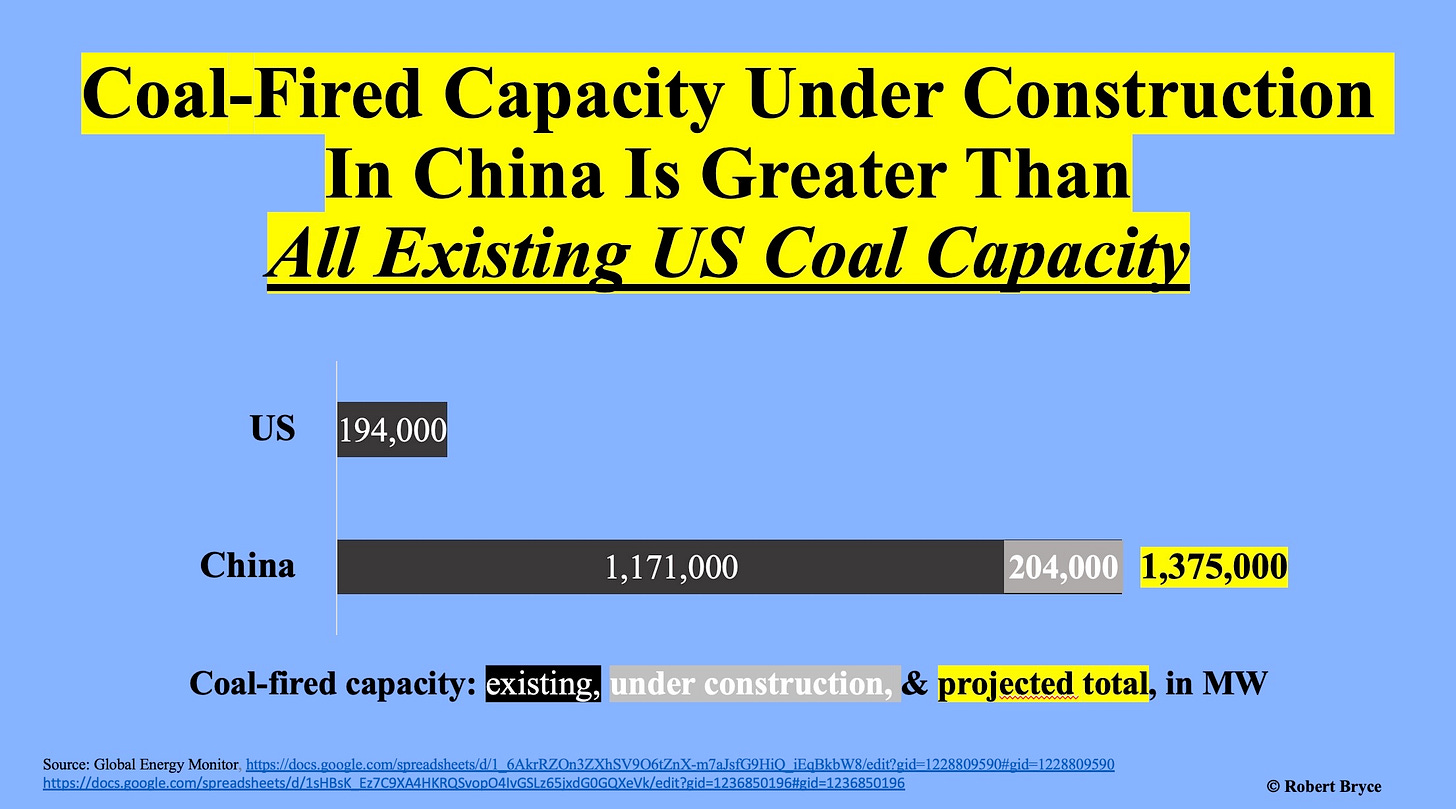

How will China meet its growing electricity demand? As shown above, according to data from the International Atomic Energy Agency, it is building more nuclear capacity than any other country. But King Coal still rules. According to Reuters, China’s coal imports hit a record high in 2024, with imports up 14.4% over 2023. In addition, the latest Global Energy Monitor figures show China is now building 204,000 megawatts of coal-fired capacity. Thus, India and China are building five times more coal plants than nuclear plants.

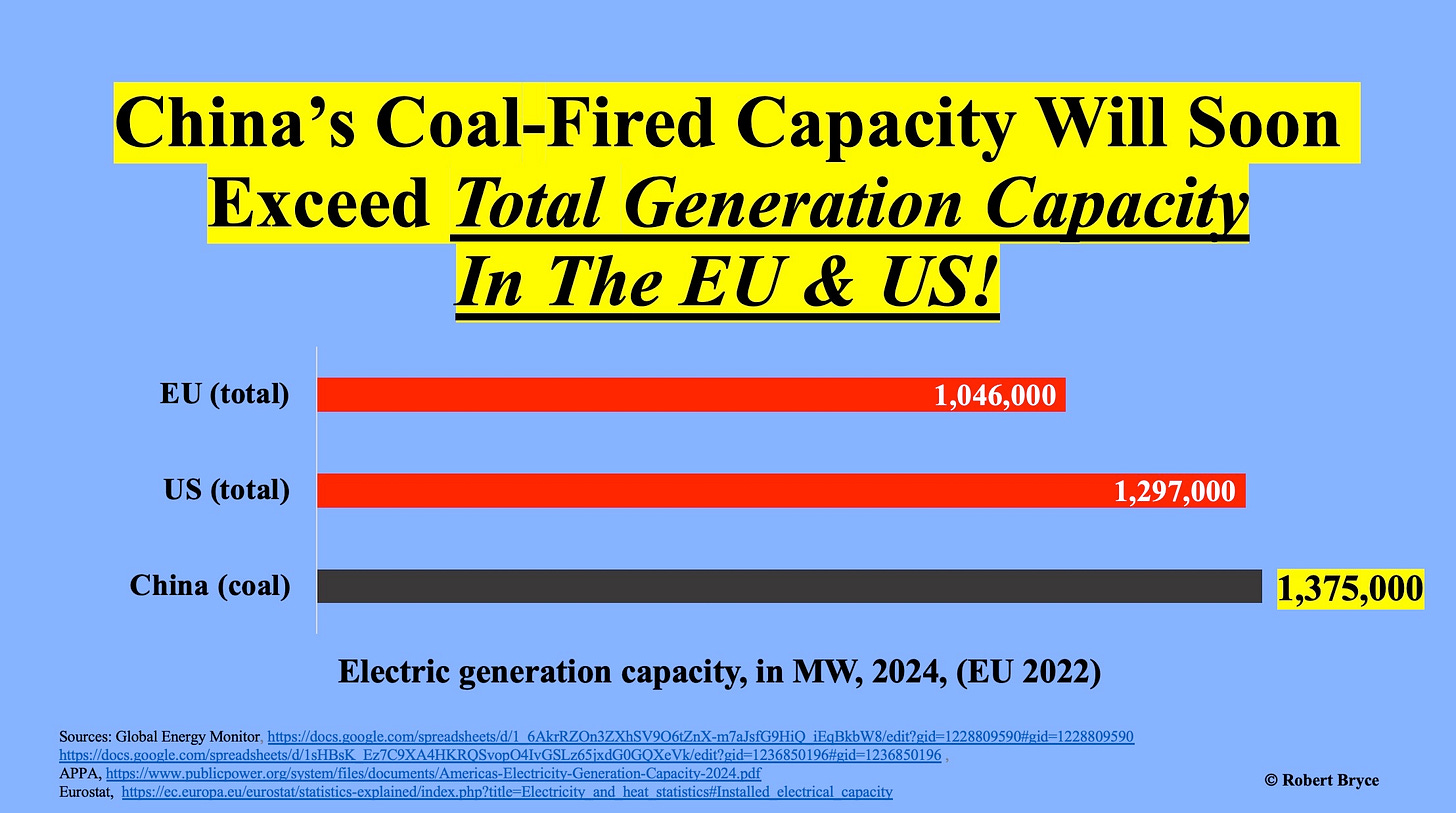

Here’s another comparison. As shown above, when China finishes the 204,000 megawatts of coal capacity now under construction, it will have nearly 1.4 million megawatts of installed coal-fired capacity. Thus, within the next few years, China’s fleet of coal plants will be larger than all of the generation capacity — including coal, gas, nuclear, solar, wind, oil, biomass, and hydro — in the US. It will also be larger than the EU’s entire generation capacity.

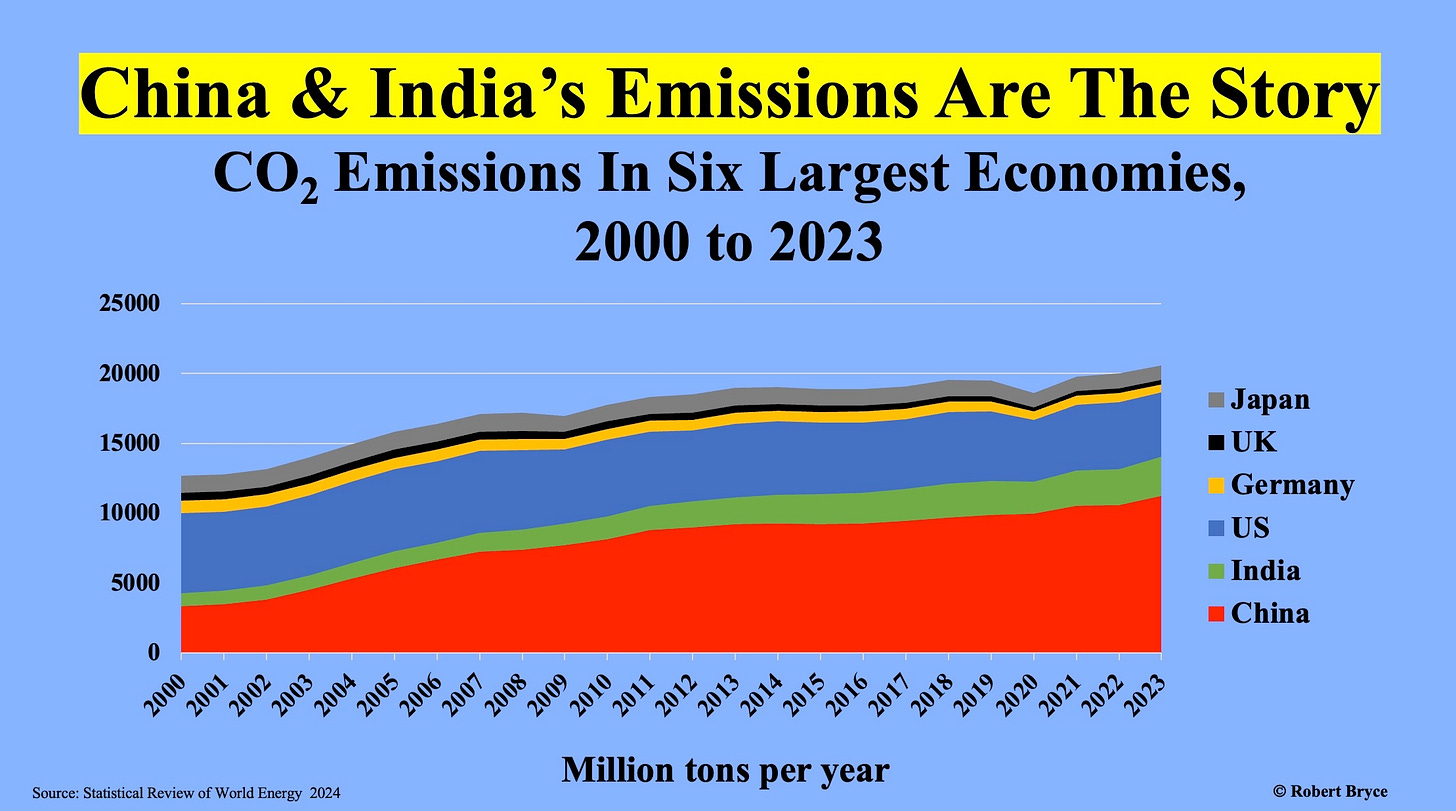

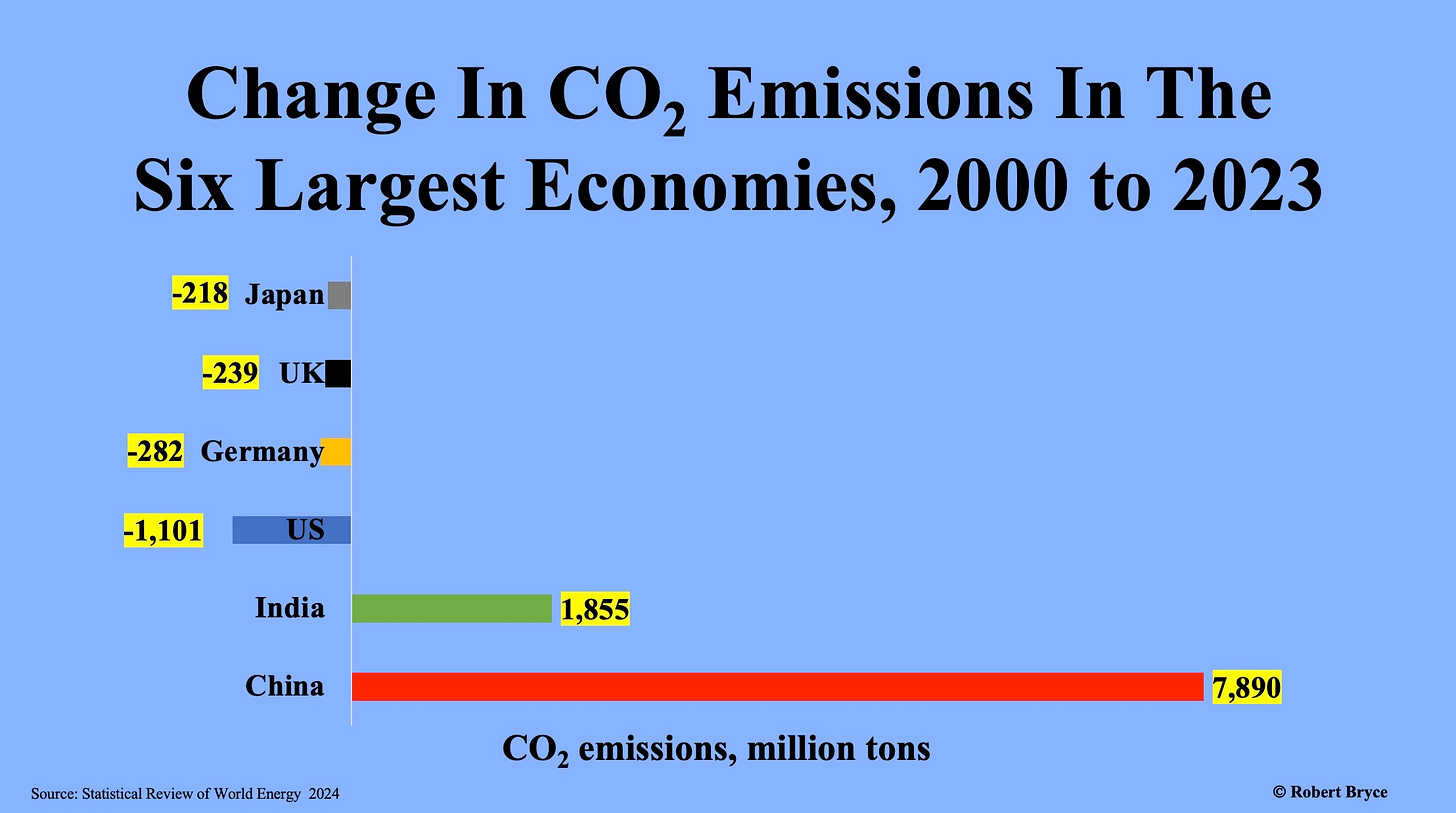

As seen above, the soaring use of coal in China and India is resulting in massive increases in CO2 emissions. The growth of those emissions is obliterating the decarbonization efforts in the US, Germany, the UK, and Japan.

This chart (which I have published several times) uses the same numbers as the preceding one but provides a higher-resolution look at the comparative numbers. While both charts use data through 2023, it is reasonable to assume that the 2024 CO2 numbers will show a similar trend.

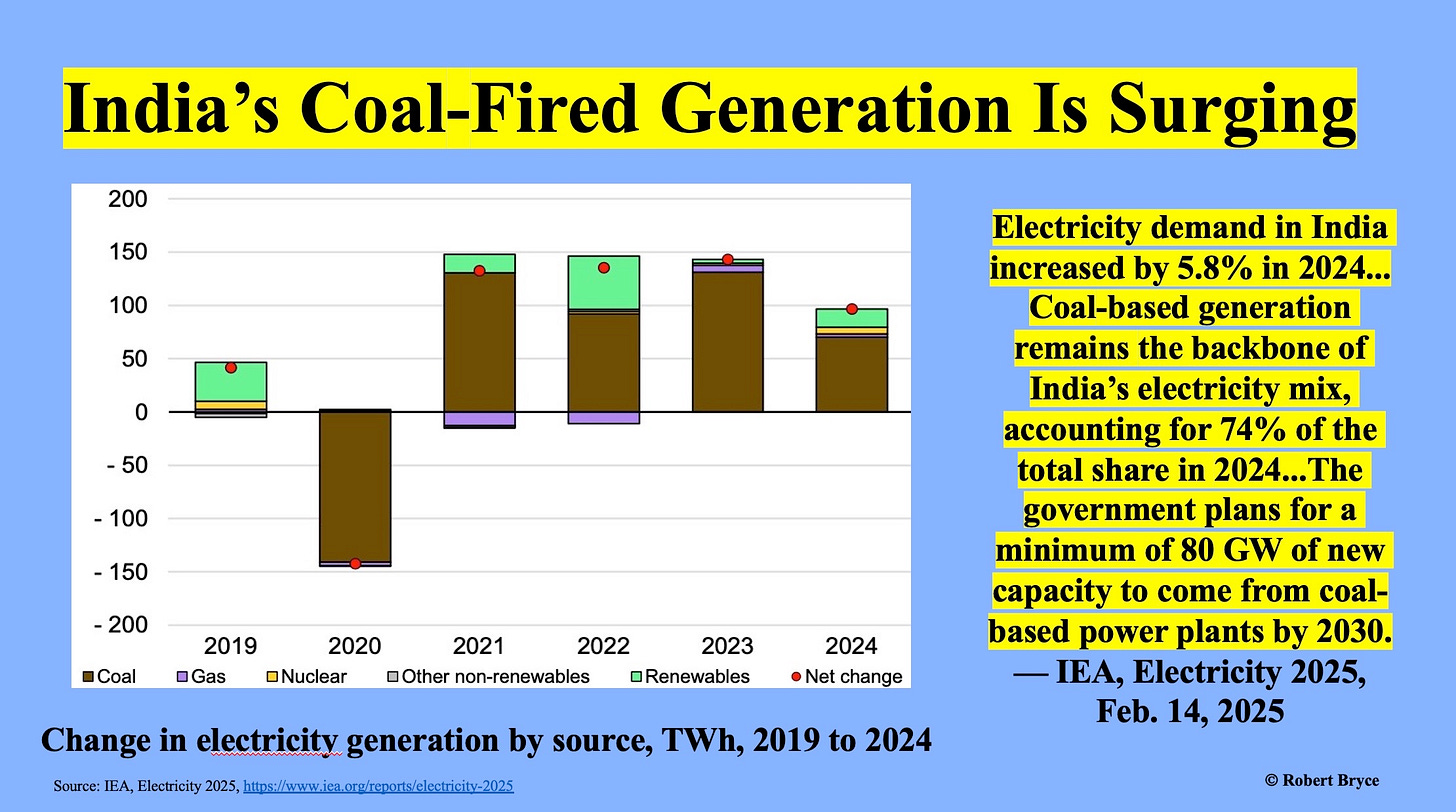

Finally, let’s look at India, where electricity use and coal consumption are soaring. The IEA reports that electricity use in the country jumped by 5.8% in 2024. That jump in electricity use was fueled by “a rapidly expanding economy that is estimate to grow by 7% in 2024.” The IEA also reported that “Coal-based generation remains the backbone of India’s electricity mix, accounting for 74% of the total.”

As Reuters explained last month, India’s coal power emissions hit a new high of 1.2 billion tons of CO2 in 2024. Reuters also reported that India is building significant amounts of alt-energy, including 29,000 megawatts of solar and 6,300 megawatts of wind capacity. But as seen above, most of the growth in India’s electricity generation is coming from coal plants, and the IEA expects “a minimum” of 80 gigawatts (80,000 megawatts) of new coal capacity to come online in India over the next five years.

While China and India are building coal plants, and lots of them, western governments are touting their moves away from coal. Last September, the last coal-fired power plant in the UK was shut down. The BBC celebrated the news, saying the UK was the “birthplace of coal power,” and it was now “the first major economy to give it up.” The UK’s energy minister, Michael Shanks, claimed that while the UK’s coal era was ending, “a new age of good energy jobs for our country is just beginning.”

I will be writing more about the coal sector in the coming weeks, including a look at President Trump’s call to open “hundreds” of coal plants in the US. I wouldn’t bet on that happening. Nevertheless, it’s clear that the climate and energy policies in the UK, US, and other developed countries are becoming irrelevant.

Unless or until China and India decide to burn less coal, global CO2 emissions will continue rising.

The post Coal Coal Baby appeared first on Energy News Beat.