Energy News Beat

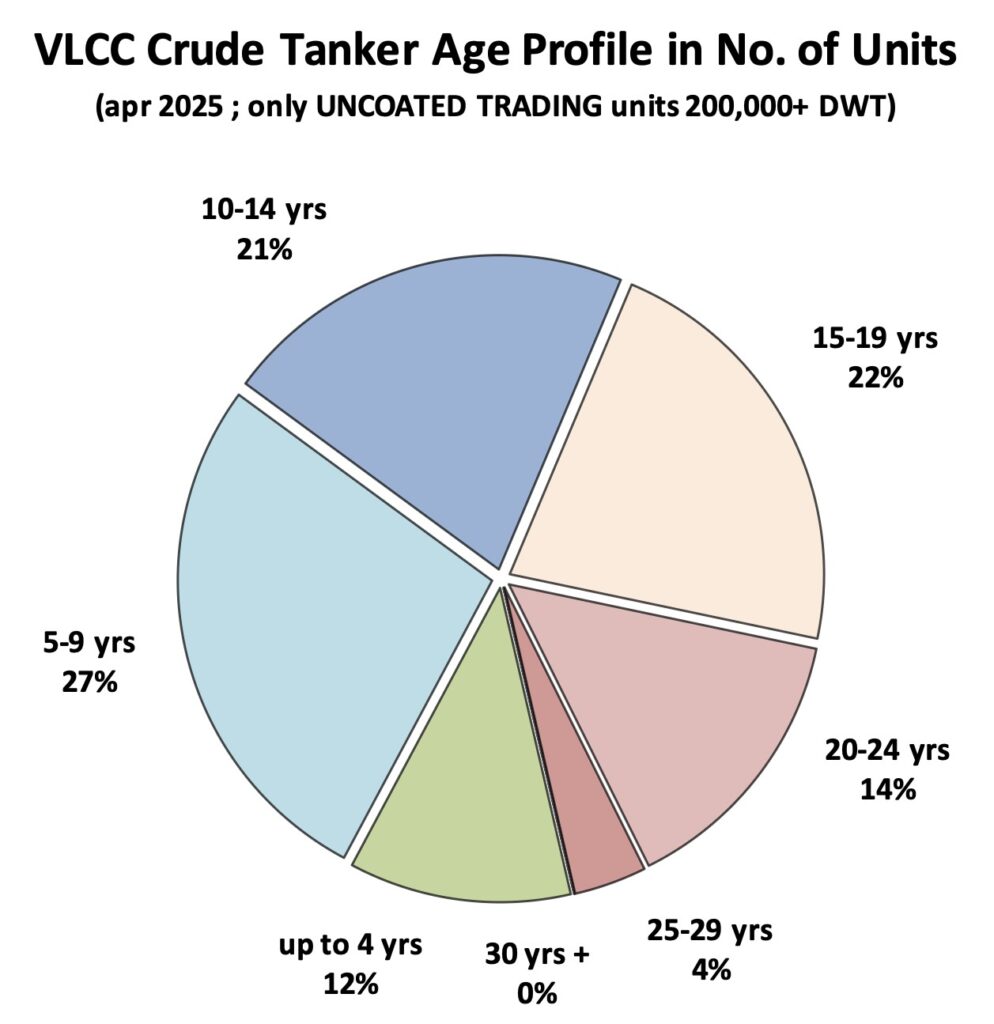

Today, there are around 130 VLCCs over 20 years old still trading, compared to fewer than 20 five years ago, according to data from Tankers International, which notes that around two-thirds of these vintage supertankers are engaged in moving sanctioned oil. Over the next four years, the number of vessels exceeding 20 years forecast by Tankers International to double, representing 21% of the trading fleet.

A very small orderbook points towards an ongoing deficit in terms of fleet replacement. Just one VLCC was delivered last year, and only five are scheduled for 2025.

Writing for Splash last month, Mette Frederiksen, head of research and insight at Tankers International, noted: The current landscape presents a paradox: while the fleet is growing in number, the effective supply remains stagnant or in decline. With shipowner indecision and shipyard bottlenecks delaying the next wave of newbuilds, and older vessels struggling with efficiency losses, the VLCC market faces a prolonged period of supply tightness.”

This supply tightness in terms of viable VLCCs able to trade worldwide has seen rates push up this month.

The TD3C route from the Middle East to Asia was up $2,100 a day to $55,000 a day yesterday.

“A shrinking list of available vessels is forcing charterers into swift action to avoid being left behind in this strengthening market,” noted a shipping report from SEB, a Swedish bank. “The gradual rate increases, unlike previous sharp spikes, are fueling owner optimism for sustained higher rates, a sentiment supported by the tighter vessel supply,” SEB added.

The post Close to one in five VLCCs trading today are over 20 years old appeared first on Energy News Beat.