Energy News Beat

Failure to scale up suitable quantities of well-priced green fuels has blunted a projected rush to retrofit ships with cleaner engines, a delay that will potentially bring a bottleneck at repair yards further down the line, according to a new study from Lloyd’s Register (LR).

The British classification society has updated its engine retrofit market study, originally published in 2023.

The original engine retrofit report published by LR identified a market of around 13,500 existing vessels that may need engine conversions to use alternative fuels. A key assumption of the original report’s modelling was that all vessels built beyond 2027-2030 would be capable of using zero- and near- zero emissions fuels.

“Without further effective drivers to take up these fuels or visibility on alternative fuel availability, that date could be pushed back – meaning that more vessels need to be retrofitted in a shorter timeframe [to meet the International Maritime Organisations green targets], exacerbating strains on retrofitting capacity,” LR warned in the new study published yesterday.

The early 2020s were dominated by conversions to LNG and a concentrated retrofit campaign in the LPG carrier segment following the introduction of new engine technology. In 2022, hydrogen retrofits began on small passenger, offshore and harbour vessels.

Following the first projects in 2024, methanol conversions are set to become more prevalent over the next four years, driven primarily by confirmed orders from the container segment.

While some ammonia conversions have already taken place – on two offshore vessels and one tugboat – these are pilot installations of fuel cell and small engine technology that is not transferable to the wider fleet of large merchant vessels. Further ammonia retrofits are likely once large engine technology has been introduced, LR suggested.

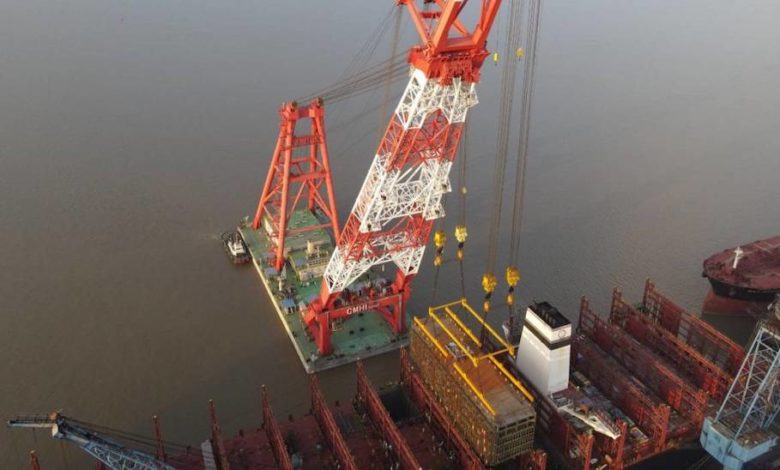

LR now reckons there are 27 yards around the world, predominantly in China, identified as capable of carrying out engine retrofits. Combined these 27 yards could handle up to 465 vessels a year, enough to satisfy early demand, but still falling well below the required capacity in years of peak demand, when LR is predicting more than 1,000 conversions a year could be anticipated.

“Engine builders will need to balance the demand for newbuild engines with the growing demand for engine retrofit packages, with a similar constraint on providers of engine subsystems such as injectors and fuel systems including supply and storage equipment,” LR stated, in listing further bottlenecks shipowners might face when opting for an engine swap.

According to engine manufacturer MAN, lead times for retrofit project construction currently stand at over 18 months. MAN is aiming to reduce this to under 14 months.

Claudene Sharp-Patel, LR’s global technical director, commented: “The technology and shipyard capacity to retrofit vessels is improving, but without decisive action to scale up alternative fuel supply chains, shipowners will face increasing compliance costs and operational uncertainty. We need greater regulatory clarity and investment to bridge the gap between ambition and action.”

The post Case for engine retrofits clouded by lack of green fuels appeared first on Energy News Beat.