Energy News Beat

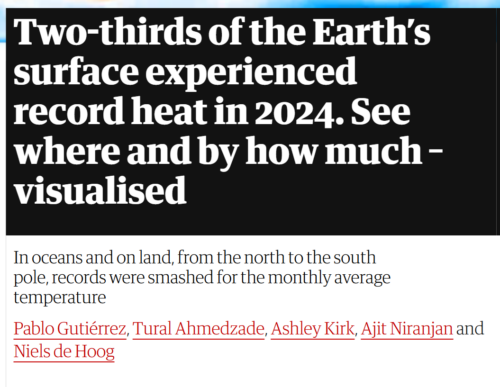

Many people in Europe either do not know, or forget that the Norwegian hydro system is not a pumped system. This means that when the water runs out it is no longer available to serve domestic customers. The lack of pumping (only 1.4 GW of the 33 GW system has any pumps and some of those have cumbersome coupling methods which mean they are only used a few times a year) means there is no way of replacing the water. Imports can only serve to displace water use, but the very short-term nature of the pricing means that Norwegian prices will only rise once shortages actually hit, and by then it would be too late.

Background to Norwegian politics

To understand what has happened in the past weeks it is necessary to understand something of the political system in Norway. Like the UK, Norway is a Parliamentary democracy with a monarch as Head of State. Unlike the UK, Norway has fixed term Parliaments – there is no opportunity to call for new elections within the four-year electoral term. There are no by-elections. The next elections to the Storting (Parliament) will take place in September. If a government collapses, the King can ask the leader of another party if he /she can form a government, until the next elections take place.

Until 30 January, the Norwegian Government was formed of a coalition of two parties: the larger being the Labour Party (considered to be centre-left) and the junior partner was the Centre Party (described as a euro-sceptic centrist party) which has the third largest number of seats in the Storting. Following the collapse of the coalition, the Labour Party will govern alone until the September elections, unless it loses a vote of no confidence, in which case, the King may approach the leader of the second largest party, the Conservatives, to see if it can form a government. Most commentators seem to assume that Labour will govern until September.

Norway is not part of the European Union, but it is part of the European Economic Area and as such is required to implement certain EU rules.

Historically, the Centre Party was more protectionist about Norway’s energy relationships with Europe, for example, Trygve Slagsvold Vedum, who was Finance Minister under the coalition, had called for the Skagerrak interconnectors with Denmark not to be renewed when they expire in a couple of years’ time. Only more recently did Labour adopt this position, and in December, both coalition partners were on the same page about not extending them and Labour saying it would campaign in the September elections to turn off the interconnectors to Denmark when they come up for renewal in 2026. This would cut cross-border capacity with Denmark by about a third.

This change of heart was prompted by high electricity prices in NO2 (southern Norway) as a lack of wind in Germany and the North Sea caused high levels of exports. NO2 prices rose to NOK 13.16 (US$1.18) /kWh in mid-December, their highest level since 2009 and almost 20 times their level the previous week. Energy Minister (of the Labour Party), Terje Aasland said “It’s an absolutely shit situation,” in uncharacteristically blunt language.

The EU is not happy with the recent negativity regarding electricity exports from Norway, with diplomats as well as politicians using increasingly strident terms to describe their opposition to the moves.

“We are not happy with Norway. The sentiment is as bad as I have known it. Norway looks selfish, trying to keep this electricity for itself even as it makes so much money from selling gas to us,”

– an EU ambassador in Oslo

But sharp increases in Norwegian electricity prices in recent winters have created a political backlash against interconnection in Norway, meaning the issue is likely to be a key subject in the upcoming elections. Polls predict that a centre-right government will emerge after the next elections. The right-wing Progress party, which is leading the polls, also wants to scrap the Skagerrak interconnectors and to reform the deals with the UK and Germany to reduce “the price infection” to Norway from elsewhere in Europe.

Collapse of the coalition caused by a dispute over energy policy

On 30 January, the Centre Party left the governing coalition leaving the Labour Party to continue as the sole party in government until the September elections. While Labour will now form a minority government, this was also true of the coalition, so Norwegian parties in the Storting are used to negotiation in order to pass legislation. Norwegian colleagues tell me that Labour should not encounter too many barriers to its legislative programme for the remainder of this Parliament.

There is some debate as to whether the Centre Party left or was pushed out of the coalition. The disagreement over energy appears to be somewhat moot in that following the collapse of the coalition, Labour announced energy measures that were not that dis-similar to those being pushed by the Centre Party, not least in terms of energy integration with Europe. Labour intends to implement three EU energy directives but to defer the more controversial measures that were the real source of disagreement.

Prime Minister Jonas Støre said his Government had no plans to implement the other five parts of the EU’s clean energy package, which relate to the electricity market – while this will play well with Norwegian voters, it will not go down well in Brussels – the European Commission has given Norway until May to implement the package.

Upon leaving the coalition, the Centre Party published a statement from party leader, Trygve Slagsvold Vedum, outlining its objections to closer energy integration with Europe and a desire to regain control over Norway’s electricity market. He claims that the interconnectors are creating “price contagion” leading to high and unstable prices in Norway. This is also seen as an appeal to voters, and an effort to boost the Centre Party’s poor position in recent polls.

“The high and unstable electricity prices have created great uncertainty for people, and problems for Norwegian businesses. For the Centre Party, it is crucial that we take back national control of electricity policy so that low and stable electricity prices once again become a benefit for Norwegian households, and a competitive advantage for Norwegian businesses. In December 2024, people in parts of Norway experienced a brief period where electricity cost 13 NOK/kWh. This happened despite Norwegian reservoirs being full of water. This shows how dysfunctional the electricity market has become in Norway,”

– Trygve Slagsvold Vedum, Leader of the Centre Party of Norway

Mr Vedum went on to say that the first step is not to transfer more and more power over electricity policy to the EU, rejecting the EU’s ambition to have a common electricity market throughout Europe. He points out that several countries in the EU have weakened their electricity markets by building electricity systems that to a large extent only produce electricity when it is windy or sunny, and that the goal of the fourth EU energy market package is for Norwegian hydropower to supply the EU with electricity when it is not windy or sunny. The Centre Party believes this would create higher and more volatile electricity prices in Norway, and is therefore determined to oppose its introduction into Norwegian law.

Secondly, the Centre Party wants to “take control” of the interconnectors with the UK and Germany – the most recent to be built – by renegotiating the agreements entered by the previous Conservative-Liberal coalition government with the UK and Germany. An expert committee appointed by the Norwegian Government has described how this can be done (see below).

On the domestic front, the Centre Party believes that Norway should become more restrictive in its use of electricity, reflecting the fact that water is a scarce resource. The Party therefore disagrees with the current plans for electrification, including of the offshore oil and gas infrastructure.

The fourth EU energy market package of legislation sets targets for economy wide energy efficiency improvements, the share of renewables in the overall mix, and the energy performance of buildings, as well as broadening the powers of EU’s regulatory agency ACER. Some of this is relatively minor for Norway, for example the energy performance of buildings requirements would involved small changes to building codes, while the share of renewables is irrelevant to Norway since it already far exceeds the EU target. However, expanding ACER’s powers is more controversial, and the introduction of the REMIT regulation is no longer under consideration.

The EU has in the past been sympathetic to the slow speed of adoption of EU rules in Norway, but there are signs its patience over the 2019 energy package are running out. The fact Europe has relied on Norwegian gas since the Russian invasion of Ukraine is a source of tension – Norway is seen as profiting at the expense of the EU. This is somewhat unfair – Norway has invested heavily over the years in both its oil and gas infrastructure and hydro-electric system, and is entitled to realise the benefits of these investments. The EU’s lack of energy security should not be Norway’s problem. Given Europe’s reliance on Norwegian gas, and Norway’s wealth as a nation, it would seem that it has the upper hand in the situation, but that does not prevent the Labour Party from believing there are risks in not implementing EU laws as required.

Energy Commission suggests more needs to be done to ensure energy security in Norway

In 2022, the Norwegian Government appointed an Energy Commission led by Professor Lars Sørgard, the former Director General of the Norwegian Competition Authority to assess the challenges faced by Norwegian energy policy towards 2030 and 2050, and how different policy choices will affect the long-term development of the Norwegian power system. The commission also examined:

- How Norway is affected by rapidly changing energy markets

- Perspectives on the development of power consumption

- The potential for socio-economically profitable power

- Perspectives for the security of electricity supply

- Key conflicts of interest within the energy policy field

The Commission’s report is only available in Norwegian but I ran it through Google Translate. Here is the English version – please use with the appropriate levels of caution.

Historically, Norwegian power prices were low in wet years and high in dry years, however since 2021 when two large (1.4 GW) interconnectors were built between Norway and GB and Germany, Norway has experienced greater price volatility as a result of the impact of weather-based renewables in those countries. Norwegians, who over time invested a lot of public money into a hydro system that broadly delivered low and stable power prices, were suddenly exposed to very high prices (since these interconnectors coincided with record reservoir lows) and higher price volatility. This has become politically sensitive.

The charts above show that since the interconnectors with GB and Germany opened, prices in NO2, the region to which these cables connect, have risen significantly. Also the spread between NO2 in the south of Norway and NO4 in the north has widened. Some commentators have argued this indicates there is insufficient transmission capacity between the northern and southern regions, and in 2022, reservoir levels were better in the north, so more power lines could have mitigated the price pressures in the south.

However, in the subsequent years, when hydro levels were more normal, the spread is still very wide, reflecting the impact of British and German pricing on power prices in southern Norway. The Energy Commission made an alternative argument which was that if Germany were to split its single bidding zone into two separate zones, one in the north and one in the south, this price effect could be reduced.

People have also suggested that the high prices and high exports benefitted Norwegians and that this benefit offset the impact on bills. However the Norwegian Energy Commission agreed with Ofgem’s analysis that while profits do indeed accrue to generators, they are not shared with consumers – exporting results in a consumer dis-benefit that is not mitigated by higher generator profits.

“High spot prices provide a significant redistribution, where some manufacturers achieve a large profit while the end users pay a very high price. This is precisely the situation we have experienced in 2022 in parts of Norway, in that southern Norway has had very high prices. At the same time, power producers have had a significant profit. Part of the profits accrue to the state through the basic interest tax for hydropower. Some power producers have also entered into agreements on price hedging for parts of the production, which means that they have received a relatively low price compared to the high price of the power exchange for that part of production,”

– “More of everything – faster”, Norwegian Energy Commission report

In line with other European countries, Norway is electrifying large parts of its economy. This is driving a need for more generation capacity, and Norway has plans to develop more wind and solar power (at the time of writing, the Commission did not see nuclear as a viable solution for Norway). This leaves a dilemma for policy-makers: access to imports of cheap wind power are attractive, particularly in dry years, when the market is tight, but there is a risk that scarce water supplies are exported when wind output in Norway and its neighbours is low.

The Energy Commission believes that:

- Norwegian interests must be clearly defined based on its unique advantages and challenges. Norway should actively participate in discussions on new rules for market design and power trade to ensure a favourable trade regime for Norway, including its consumers and businesses;

- Long-term operation of interconnectors should be managed in a way that balances the interests of both parties in a power system increasingly reliant on non-regulatable renewable energy;

- A majority in the Energy Commission (members Gotaas, Heia, Ringkjøb, Roland, Rollefsen, Seim, Stubholt, Tomasgard, and Ulriksen) believes that a study should explore how interconnector exchanges can be structured to prevent price contagion from large external power markets from undermining Norwegian energy policy goals;

- When the concession period for an interconnector expires, an assessment should be made on whether its renewal is in the public interest, similar to the process for new interconnectors;

- The need for new cables or hybrid connections should be evaluated in light of Norwegian interests;

- The responsibility for interconnectors between Norway and other Nordic countries should be transferred from NVE to the Ministry of Petroleum and Energy (OED) to ensure political accountability;

- A majority in the Energy Commission (members Gotaas, Heia, Ringkjøb, Roland, Seim, Stubholt, Tomasgard, and Ulriksen) believe that Norwegian authorities must actively engage in dialogue with the EU to ensure that regulations account for Norway’s unique characteristics.

Independent research group, Sintef wrote a report, Assessment of the Power Situation 2021-2022, to examine what happened in an unusually dry year immediately following the opening of interconnectors with GB and Germany (English version, as above from Google translate). One of the findings was that forward curves consistently under-estimated future price trends (while forward curve are not a predictor of future prices, curves should nevertheless have a relationship with the expected price trajectory, for example, summer prices would normally be lower than winter prices).

This matters in Norway because generators need to decide when to use their water – if prices are expected to be lower in future there is an incentive to use the water in the short term. If these price signals turn out to be unreliable, or reflective of wishful thinking in the market, then the stock of water will be undervalued and depleted too quickly.

Sintef also simulated the development of the power system in weeks 36 to 52 in 2021, with and without the interconnectors to Germany and GB. The simulation was performed for 40 different weather years. Sintef found that in the cases with the interconnectors, reservoir levels fell more and prices in Eastern Norway (NO1) rose more than they would without the interconnectors. The cables contributed to increasing Norwegian power prices by around 15-25 øre/kWh, equivalent to between 14% and 26%. (According to Sintef, price differentials between the southern Norwegian bidding zones are small, and as NO1 has the largest demand, it decided to only simulate price development in that zone.) Sintef concluded that there would be significant economic benefits if water use was restricted to ensure security of supply by not allowing resources to be used too quickly.

The Energy Commission’s report also references research by Afry and Menon which modelled a halving of the export capacity between NO2 and GB, Germany and the Netherlands (import capacity was not curtailed). They found that the export restriction had a limited effect on reservoir filling in southern Norway, but did result in a lower power price in southern Norway. This effect increased with higher gas prices.

In the scenario where export capacity was set to zero from the south-west of Norway (Germany, GB, the Netherlands and Denmark), the minimum reservoir filling for all price areas in southern Norway (NO1, NO2 and NO5) increased. These simulations indicated that the water loss during snowmelt could be large without these export opportunities, although found a significant reduction in power prices in all price areas in Norway, particularly in southern Norway in years with high influx of water.

Afry and Menon also analysed the impact of an export tax. Where there is a relatively large price differential between the Nordics and Europe, Afry and Menon found that an export tax had to be relatively high to have an impact on trade. The effect of a high export tax on exports from NO2 was similar to the effect of limiting export capacity, both in terms of price and reservoir levels. Afry and Menon considered that export reductions would generally be contrary to current agreements on free trade, but highlight the existence of exceptions for measures aimed at preventing product shortages. However the impact of reciprocal action should also be considered ie in the case when Norway has import needs.

Afry and Menon considered the impact of increasing transmission capacity between the north and south of Norway. They examined two options: increased transmission capacity in Norway from north to south, and increased transmission capacity in the Nordic region more broadly. Greater transmission capacity would allow greater utilisation of the flexibility of hydropower; water loss would be reduced and security of supply in the south of Norway would improve. In central and northern Norway, increased transmission capacity would likely contribute to a price increase while the price reduction in southern Norway would be more modest.

The Energy Commission, somewhat randomly, decided to comment on the structure of the German power market, suggesting that splitting it into two, north-south bidding zones would benefit Norway. Given that Germany has a lot of wind generation in the north, industrial demand in the south, and insufficient internal transmission capacity, this would allow Norway to benefit from low prices when it is windy in Germany, but protect it from high prices when it is not (because it would be insulated from the price effects driven by demand in southern Germany).

The Commission concluded that so far, Norway has typically been able to import electricity when prices are low at night and export when prices are high during the day. With more weather-based production in other countries towards 2030, it sees more opportunities for Norway to import cheap energy, and although its vulnerability to dry years will change, it will not necessarily increase. Where it does see increased risk is from the greater volatility and unpredictability of power flows, as a result of the increased reliance on intermittent renewables in neighbouring countries. Net imports would likely be more variable, and net exports could be expected even when Norwegain reservoir levels are low, it wind output in these countries is low.

The Commission suggested that Europe must resolve its own energy challenges, and that it is unlikely that Europe will accept any solution linked to extended demand curtailment, meaning that Europe will invest in suitable backup for wind and solar energy. This may be optimistic – the Europe has long coveted the Norwegian hydro system as the answer to its intermittency problem, with then National Grid Chief Sustainability Officer, Duncan Burt saying in 2021:

“Norway will basically act as Europe’s battery. When we’ve got high renewables, we’ll send it to Norway and they’ll use that power, or they’ll use it to pump water and store the energy in the hydro power stations. And then when we need power in the UK, the power will flow back from Norway to the UK.”

And in 2010, Nobuo Tanaka, executive director of the International Energy Agency said:

“Norway can help Europe introduce more volatile renewable energy sources into the market by providing a sustainable backup… To have more renewables, we need more interconnectivity.”

Interestingly, there was far more such talk from Norwegian commentators than EU ones, with Statkraft CEO Rynning-Toennesen saying, also in 2010:

“For the British it [interconnection] would cost a lot less than building new power plants as a back-up for wind.”

Now of course, the tone from Norway is different.

The Commission concluded that despite possible developments in batteries, hydrogen demand side flexibility, “it cannot be ruled out that challenges may arise with access to imports during periods, or that imports become very expensive”. It went on that while current regulation of the power market gives hydro producers incentives to avoid a situation where reservoirs are drained so that there is no water left in the spring, today’s arrangements were developed for today’s power system, and not necessarily new types of risk. Changes in the power systems of neighbouring countries can happen quickly and cause events that are difficult to predict and plan for, and for that reason there are arguments for having instruments that better ensure national security of supply.

New government’s response to high electricity prices in Norway

The day after the collapse of its coalition with the Centre Party, the Labour Party announced a series of measures to support consumers with high electricity prices.

The primary measure will be to offer households a choice between a subsidy 90% of electricity prices above the threshold value of 0.75 øre /kWh excluding VAT (NOK 7.3 /MWh) based on hourly spot prices, or a fixed price tariff at 40 øre/kWh. There was a similar subsidy in 2024, with a slightly lower threshold value of 0.73 øre /kWh. In fact, after the subsidy was introduced in 2022 with an initial level of 55%, it has always been either 80% (September 2022 – March 2023, and June 2023 – August 2023) or 90%. The scheme covers ordinary households, housing associations, people connected to farm and village networks, and district heating networks, and people who live full time in holiday homes. When the hourly spot price exceeds 75 øre /kWh excluding VAT, the subsidy will cover 90% of the price above this level, for electricity consumption up to 5,000 kWh per month per meter point.

The scheme costs have been as follows:

- NOK 16.4 bn in 2023

- NOK 3.7 bn in 2024

- NOK 4.8 bn (forecast)

Now the government is also proposing a new fixed price contract (“Norgespris”) of 40 øre/kWh, excluding VAT. The proposal is for the scheme to come into effect on 1 October 2025 and will cover households and holiday homes. Those who do not opt for the fixed price tariff will receive the 90% subsidy.

The Government expects that for an average household in southern Norway (price area NO2), the Norgespris would provide support of NOK 2,800 per year, mostly in the winter when prices are high. For a household that has the current electricity subsidy, the corresponding support would be NOK 1,265, but these households will also benefit from periods with low electricity prices, particularly in the summer.

“In a situation of great instability in the European power markets, the government does not want to tie Norway more strongly to the European power system. Therefore, we are saying no to new foreign cables and are not introducing the controversial market regulations”

– Terje Aasland, Norwegian Energy Minister

In addition, the Government has proposed to cut VAT on network costs. There is high demand for grid capacity throughout Norway, but large parts of the grid infrastructure are old. Electrification and digitisation are driving a need for increased network capacity, but when more grid is built, network costs increase, raising electricity bills. To reduce this impact, the Government has proposed to reduce VAT on network costs from 25% to 15% from 1 July 2025. Households will collectively save around NOK 1.8 billion per year from this measure. The reduced rate is seen as the first step towards the full abolition of VAT on network costs, which the Labour Party proposed to remove entirely if it is elected to the next Parliament.

In recognition of the high sensitivity of the issue of greater integration with EU energy markets, Labour has committed not to introduce the EU’s “controversial” market regulations in the Clean Energy Package either in this Parliamentary term or the next.

“It is the government’s responsibility to ensure a continued well-functioning electricity supply in Norway. The instability in the power markets is great, and each directive must be assessed separately. In this situation, it is not in Norway’s interest to process these directives. It is objectively well-founded and I expect that it is something that the EU side understands. It does not challenge the credibility of the EEA Agreement itself, “

– Terje Aasland, Norwegian Energy Minister

The Government says it will, among other things, assess the EU’s work to improve competitiveness and facilitate low and stable energy prices, and evaluate and follow up on the review of the member states’ division into price areas for the purchase and sale of electricity.

The Norwegian Government also intends to initiate greater Nordic cooperation, with the aim of assessing various measures to reduce extreme electricity price fluctuations as a result of cross-border electricity flows in Northern Europe to safeguard the “well-functioning” Nordic power system. Through the Nordic Council of Ministers, the Government is working to assess the organisation of the electricity market, including changes that are being considered neighbouring countries connected to the Nordic market. This includes Germany, the Netherlands and the UK. The results are expected to be published in early 2026.

The Labour Party has also committed not to approve any new interconnectors with other countries in the current or next Parliamentary terms, and will ask Statnett not to start planning new submarine inter-island connections until 2029. Statnett’s work to consider the future of the Skagerrak cables with Denmark will continue. In December, Energy Minister Aasland outlined that Statnett will have to chose whether to abandon the renewal project or whether to proceed with an application. No license application is expected before 2026 at the earliest, and the Labour Party has said it will not authorise such an application. Should a new Conservative government emerge after the elections that supports new interconnection with Denmark, the earliest it could enter the market would be 2034.

The Labour Party has recently made its own political capital from the fact that its coalition with the Centre Party cancelled the NorthConnect scheme with Scotland which the previous Conservative government had pursued, and that the Conservatives had been responsible for the now controversial interconnectors with the UK and Germany.

What does this mean for European co-operation?

The idea of European co-operation is largely a mirage – often it boils down to countries wanting their neighbours to help when they need it, but being reluctant to reciprocate, or to compromise on their own national priorities and preferences: I will act in my own best interests and I expect everyone else to also act in my best interests. For example, did Germany consider the impact on Norway when deciding to close its nuclear reactors?

The EU appears to view the Norwegian hydro system as a huge battery that should be used to balance renewable generation elsewhere in Europe. When the lack of pumping is raised, non-Norwegians suggest Norway should invest in pumping so it can more effectively balance the European market. But there is no commensurate suggestion of contributing financially to such investments – on the contrary, it is assumed this would be “good” for Norwegians.

Yet in 2021, Ofgem wrote a report outlining that once a country becomes a net exporter of electricity there is a consumer dis-benefit to interconnection: interconnectors cause prices in the exporting country to rise. On this basis, it declined all but one of the projects in Window 3 of the cap and floor mechanism. In a meeting with senior officials at Ofgem I suggested that countries exporting to us might make a similar determination and was told that it’s important countries are not “selfish” and that interconnection is a benefit for everyone. When I pointed out that Ofgem’s decision embeds the exact protectionist mentality it had just criticised, the reaction was one of surprise. A prime example of only wanting the benefits and not the costs of cross-border co-operation!

The impact on Norway is more extreme than in other countries because its electricity is limited by the volume of water in the hydro system. The relative lack of pumping means that once the water is gone, there is limited ability to generate electricity at which point prices rise dramatically Norway has 9 GW of cross-border capacity, against peak electricity demand of about 25 GW, so there is no way that the country could meet its energy needs purely from imports if the water ran out.

Cross-border trading is based on short-term prices (day-ahead or within-day) which are generally reflective of the short-term marginal cost of generation. In the case of Norway, this does not take account of the option value embedded in the stock of water – it might be more beneficial to keep the water for use on another day, for example when prices might be higher. It also does not take account of the fact that the stock of water is limited. Only once stock levels fall does scarcity start to be reflected in prices, but by then it is too late – the scarcity is already happening. The price signals for avoiding scarcity are weak or non-existent.

This why Norway has twice amended its Energy Act to give itself powers to restrict electricity exports – initially in the case of water shortages, and now also in the case of potential water shortages. Given recent high and volatile prices, Norway is looking at its options, one of which is the imposition of export tariffs which would artificially inflate the price of Norwegian electricity available for export. This would reduce the number of hours in which Norway is a net exporter allowing it to save its water. It would similarly attract more imports, displacing the need for the use of water. Currently such imports are minimal and often occur at times of low demand, such as overnight, so the water saving is reduced.

In my view, this would be a sensible measure for Norway to take. Not only should a value be attributed to the stock of water, prices should provide signals to deter other countries from abusing the Norwegian hydro system. If Germany, the UK and others choose not to invest in dispatchable generation, they should be exposed to the full long-run costs of this decision and pay their share of the capital costs of Norwegian hydro rather than just short-term marginal costs. Outsourcing capital investment but only paying short-term operating costs is not fair or reasonable.

The EU may feel aggrieved at having to pay more for Norwegian electricity when it is also paying a lot for Norwegian gas, but it is not the fault of Norwegian tax-payers that the EU has failed to invest in its own energy security and allowed itself to depend on politically risky suppliers. Norwegians have repeatedly rejected EU membership, they should not now be forced to pay the price of poor EU decisions which they cleverly managed to avoid making themselves. While some argue that Norway is blessed with geological resources, this is not a compelling reason for it to bail out its neighbours.

France lacks any significant geological resources and made a strategic decision decades ago to invest heavily in nuclear power. It now has among the cheapest electricity prices in Europe and, ironically, among the lowest carbon generation. Like the Norwegians, the French made significant capital investments to secure their access to cheap and reliable electricity. Unlike the Norwegians, French nuclear does not risk running out although since the country took its eye off the ball in terms of renewing its nuclear fleet, it is now encountering reliability problems and faces another round of major capital investment at a time when its wider financial position is precarious.

EU countries may bluster about international co-operation, but the hypocrisy of their positions is not lost on Norwegians who have had enough of paying for the energy policy choices of its neighbours. And since Europe depends on Norwegian gas, Norway has a strong position in this particular negotiation. Europe should pay attention to the concerns of Norwegian voters and their representatives. Norway is transparently laying out what everyone knows deep down – that countries will prioritise their own national interest before any international co-operation.

Norway is also exposing the double standards at the heart of European bluster about co-operation and integration – true co-operation would require countries to consult each other before deciding to rely on intermittent generation or prematurely closing generation for political reasons (coal in the UK and nuclear in Germany). It’s hard to see any country in Europe giving up the right to make its own decisions about its energy mix. Which is fine, but they should not then expect countries which take a different approach to accommodate them against the interests (or even simple wishes, because people have the right to make choices that are not aligned with self-interest) of their voters. If Norway wants to protect the voters which actually paid for its energy infrastructure, it has the right to do so. The rest of Europe will have to lump it.

.

Three years ago I wrote the following:

“Power market trading under market coupling is intended to flow seamlessly from markets with higher capacity margins (and lower prices) to those with lower capacity margins and higher prices. As more and more markets rely on wind, this creates increasing tensions when it isn’t windy, particularly when those weather systems sit across the Continent, depressing wind output in all of the connected markets.

But on the other hand, energy policy is not harmonised – each country makes its own decisions about how much and which type of generation and transmission capacity it should build. Because it is relatively easy to subsidise renewable generation into existence, that has been prioritised, but the investments in transmission, storage and low carbon baseload generation (nuclear) which are needed to efficiently manage this new renewable generation capacity has been lacking. To make matters worse, the economics of gas generation are declining, as utilisation levels drop, pushing efficient gas plant out of the market altogether in some cases (for example the Calon CCGTs in the UK [which have subsequently re-opened]).

It is difficult to see how this situation can continue much further without significant change. In particular, it is hard to see why Norwegian consumers should be exposed to the high electricity prices that are the result of lack of investment by other European countries. So to answer the question posed at the start of this blog…can Norway be the battery of Europe…perhaps, but should it? Probably not.”

This is every bit as true now as when I wrote it, and the Norwegians are beginning to agree.

The post Norway turning away from electricity interconnection appeared first on Energy News Beat.

![]()

A historic black-and-white illustration shows a side view of the laying of a trans-Atlantic cable between two ships, with the cords sloping in a U-shape between them above the ocean floor.

A historic black-and-white illustration shows a side view of the laying of a trans-Atlantic cable between two ships, with the cords sloping in a U-shape between them above the ocean floor.

A wide coil of fiber optic wires wrapped into hose surrounds a round scaffolded space, inside of which workers move around as they install an electric submarine cable and optical fiber. A cloud-covered sky is partly visible overhead.

A wide coil of fiber optic wires wrapped into hose surrounds a round scaffolded space, inside of which workers move around as they install an electric submarine cable and optical fiber. A cloud-covered sky is partly visible overhead.

A Russian Navy nuclear submarine is seen partly submerged in the distance at a harbor beneath a hazy sky. Slightly out of focus in the foreground, two adults are seen looking out over the rounded lip of a low concrete wall. One has a small child on his shoulders, also looking at the submarine.

A Russian Navy nuclear submarine is seen partly submerged in the distance at a harbor beneath a hazy sky. Slightly out of focus in the foreground, two adults are seen looking out over the rounded lip of a low concrete wall. One has a small child on his shoulders, also looking at the submarine.

An operator in a yellow reflective vest works at the edge of the sea, his feet in the water as he reaches down to poke at a fiber optic cable that runs up the sand of the beach as well as out beyond the worker and into the water, where a line of buoys marks its path to a ship in the distance.

An operator in a yellow reflective vest works at the edge of the sea, his feet in the water as he reaches down to poke at a fiber optic cable that runs up the sand of the beach as well as out beyond the worker and into the water, where a line of buoys marks its path to a ship in the distance.

Employees are seen from overhead as they work on a massive circular coil of submarine cable that fills the floor of an entire factory room. Both workers wear matching blue shirts and red hard hats.

Employees are seen from overhead as they work on a massive circular coil of submarine cable that fills the floor of an entire factory room. Both workers wear matching blue shirts and red hard hats.

Eight workers in matching orange coveralls stand in a line as they haul part of a fiber optic cable to the shore from a large ship gloating on the water near the shore where they stand. A cloudy sky is visible overhead.

Eight workers in matching orange coveralls stand in a line as they haul part of a fiber optic cable to the shore from a large ship gloating on the water near the shore where they stand. A cloudy sky is visible overhead.