Energy News Beat

Australia’s green energy push puts turbines and solar in the wrong places, ignoring local needs, job creation, and environmental impacts.

Why are we always putting green energy assets in all the wrong places?

The main electricity demand comes from big cities and their industries, so the electricity generators should be nearby, thus reducing capital costs and transmission losses, and supporting local jobs. [emphasis, links added]

Why put wind turbines, access roads, and power lines in rural and remote areas where there is little demand for electricity, where neighbors hate them, and where they destroy forests, wipe out resident eagles, and start bushfires?

And of course, it is foolish to locate wind turbines anywhere along the cyclone coasts of Queensland, Northern Territory, or the Kimberly coast in Western Australia.

Given the Green/Teals love of wind energy, let’s put turbines on every hill or open space in electorates that support green energy, like Ryan in Brisbane, Warringah in Sydney, Kooyong in Melbourne, and Canberra, Australia’s Federal capital.

Green children will benefit as the turbines clear their green spaces of aggressive magpies and noisy crows instead of de-winging or de-capitating innocent wedge-tail eagles and other bush birds and bats.

And why plaster remote grasslands with solar panels that smother the grass and need long transmission lines that upset the locals? And why try to gild them by calling them wind and solar “farms” – they are totally anti-farming.

Cities should generate green power within their cities from every rooftop, stadium, factory, and railway station. Greens in Canberra would surely support the installation of a big wind turbine atop Parliament House and floating solar panels on the Molonglo River.

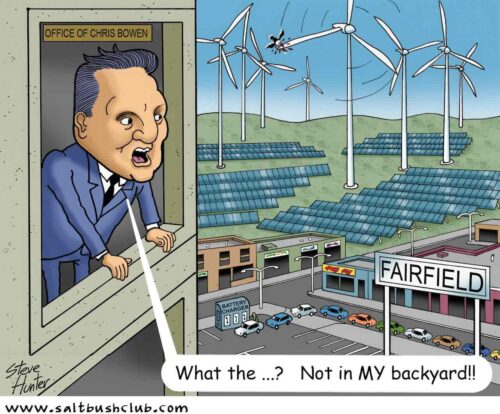

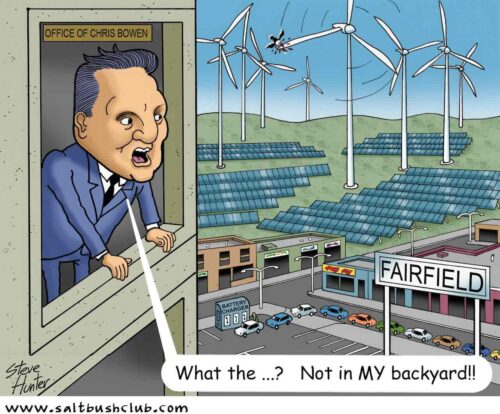

(But the problem there is that Canberra has more politically active NIMBYS than real communities with real jobs and real worries.)

And of course, there is the big problem that the solar energy union goes on strike from sundown to sunrise every day and refuses to work in rain, fog, or overcast days.

The wind energy union is far less predictable, and their strikes can last far longer. So to power windless nights or cloudy days, big batteries or stored hydro are essential, preferably located close to the cities that need the power.

But battery fires are not uncommon, and they are very hard to extinguish. So big batteries should be located beside every fire brigade shed, starting in Fairfield (the Sydney electorate of Australia’s Energy Minister Chris “Blackouts” Bowen).

No other economy has demonstrated that [net zero] will work without an established safety net of nuclear, hydro, coal, gas…

Every university should also install a big battery near their Chemistry Department so students can study the chemistry of lithium battery fires.

For ages now politicians have been trying to rush motorists into electric vehicles before there are enough charging stations or green energy to power them.

Some sneaky bureaucrats have a hidden agenda here – use smart metering to enable them to drain the batteries of electric vehicles to support the grid when wind and solar are on strike.

So instead of their car battery being charged overnight, morning commuters may find their batteries drained overnight to keep lifts, hospitals, trains, and street lights working.

The universities are great supporters of green energy so let’s make sure there is a big wind turbine outside every physics department – their PhD students can study seasonal and daily variations in wind speeds and the effects on electricity generated.

They can also study the harmonics of turbine noise and its effect on humans, whales, and other animals.

As the panels and turbines have a limited life, economics undergrads can study the feasibility of recycling wind turbine blades and solar panels. They can also study the green jobs created by using non-polluting crowbars and shovels to dig big holes to bury them.

But the biggest problem with green energy is that we have ignored the sage advice given by President Xi Jinping in 2024:

“Make sure to establish the new before abolishing the old.” —Source

Our green politicians are forever demolishing coal-fired power before demonstrating that our cities and economy can survive on wind, solar, and big batteries.

No other economy has demonstrated that this will work without an established safety net of nuclear, hydro, coal, gas, or accommodating neighbors with long extension cords.

For Australia, “net zero” is a negative sum game – an economic suicide pact.

PS: Australia’s first wind-powered generator is closing down. It will leave ruined farmland behind it.

Viv Forbes is a scientist and economic analyst who understands the importance of well-located cheap reliable energy for consumers, factories, smelters, and refineries.

The post Australia’s Green Energy Strategy Is Misguided, Misplaced, And Dangerous appeared first on Energy News Beat.