Energy News Beat

PBS and AP push climate alarmism, ignoring data showing CO2 benefits, declining climate and disaster deaths, and stable marine ecosystems.

The Public Broadcasting System (PBS) recently published an article by Seth Borenstein of the Associated Press (AP), titled “Scientists say EPA just needs to look around the world to see the growing dangers of climate change,” which says that proof of catastrophic climate change is found in obvious “growing dangers” evident for all to see. [emphasis, links added]

This is false.

Borenstein’s story, which PBS didn’t bother to verify or even question, paints a false picture of an impending climate catastrophe, citing everything from worsening wildfires to supposed ocean acidification, while conveniently ignoring the very real benefits of increased atmospheric carbon dioxide (CO2).

“As President Donald Trump’s administration looks to reverse a cornerstone finding that climate change endangers human health and welfare, scientists say they just need to look around because it’s obvious how bad global warming is and how it’s getting worse,” says the AP’s Borenstein.

Obvious in what way? It is certainly not obvious looking at the available data on weather trends or measurements of human welfare like lives lost to weather-related disasters and temperatures.

PBS fails to acknowledge that the climate has always changed and there is little evidence to support the notion that human activities have altered climate in a way that is leading us toward disaster.

Let’s break down some claims in the AP/PBS article and counter them with real-world data.

One of the most misleading claims in the PBS article is that climate change is “acidifying the ocean.”

This is a classic case of alarmists misrepresenting basic chemistry to scare the public. First, the ocean is not turning acidic—it remains alkaline. The proper term would be a slight decrease in alkalinity, and even that is overblown.

Studies show that while atmospheric CO2 has increased, ocean pH levels have not dropped anywhere near a level that would threaten marine life. The term “ocean acidification” is largely a misnomer used to create fear rather than inform.

A study published in the journal Nature Geoscience reinforces the idea that marine ecosystems are not on the verge of collapse due to small changes in pH. The ability of marine life to evolve and adapt over time is a critical factor that climate alarmists often ignore.

Moreover, research compiled by Climate Realism demonstrates that phytoplankton, the foundation of the marine food web, are not in decline due to ocean pH changes.

Instead, they have remained stable or even increased in some regions, contradicting claims that marine ecosystems are on the brink of collapse.

If the ocean were truly becoming inhospitable due to CO2 levels, we would see significant disruptions in marine populations.

Instead, fisheries worldwide continue to thrive, and coral reefs have shown remarkable resilience. The Great Barrier Reef, for instance, has experienced record-high coral cover in recent years.

Nor is climate change resulting in more deaths due to extreme weather or non-optimum temperatures.

As Climate Realism has discussed when refuting dozens of other false articles, climate change, contrary to the AP/PBS report, is not causing an increase in human diseases or health complications.

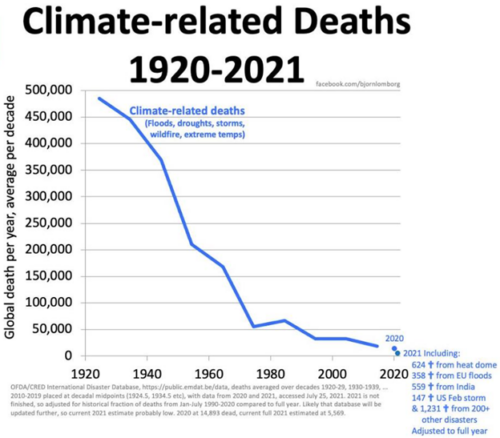

In addition, data clearly show that human mortality resulting from extreme weather events and other natural disasters has fallen by more than 99 percent over the past 100 years, as discussed in Climate Realism posts here and here.

Extreme weather events killed nearly 500,000 people annually in the 1920s, but by 2021 only 7,790 deaths were attributable to extreme weather events. (See the figure)

Deaths related to extreme temperatures are also in decline as the Earth has modestly warmed, according to multiple large-scale peer-reviewed studies in top journals.

For example, multi-country studies covering multiple decades published in The Lancet show that cold temperatures kill far more people each year than hot temperatures.

They also demonstrate that as temperatures have modestly warmed, the number of deaths tied to non-optimum temperatures has declined.

Concerning hunger and malnutrition, also mentioned in the PBS/AP article, research cited in more nearly 200 articles posted at Climate Realism show that as carbon dioxide levels have risen, crop production has boomed for almost every crop one cares to discuss in nation after nation spanning all parts of the globe.

As a result of this fact, hunger and malnutrition have declined more sharply in the latter part of the 20th and early 21st century than in any other period in history.

In point of fact, while the AP and PBS fixate on the easily debunked perils of climate change, they conveniently ignore one of the most significant positive trends: the greening of the planet. Increased atmospheric CO2 has led to a dramatic rise in plant growth worldwide, an effect known as global greening.

According to NASA satellite data, over the past several decades, the Earth has become measurably greener, with vegetation expanding across deserts and arid regions. This is due to the fertilization effect of CO2, which enhances photosynthesis and allows plants to use water more efficiently.

Increased CO2 has led to record-high crop yields, helping to feed a growing global population. Data from the UN Food and Agriculture Organization (FAO) confirms that crop production has consistently set new records.

Wheat, maize, and rice—staple crops that feed billions—have all seen significant increases in production over the past 50 years, thanks in part to higher CO2 levels.

If PBS were truly interested in honest reporting, they would acknowledge that the net effect of more CO2 has been a more food-secure world—not a climate apocalypse.

PBS also links to an associated article tying climate change to recent wildfires. Yet, in doing so, PBS ignores the fact that data from NASA and the European Space Agency show that the total global area burned by wildfires has declined markedly in the United States and globally over the past century.

To the extent that some areas have seen a spike in wildfires in recent years, research cited at Climate at a Glance shows that [fires are] largely driven by land management practices, not climate change.

In the United States, decades of fire suppression policies led to excessive fuel buildup, combined with a sharp decline in logging and active forest management in recent years, has made fires more intense when they do occur.

PBS and AP may prefer their narrative of climate doom, but the data and facts tell a different story.

As for hurricanes and extreme weather, the data simply does not support claims that they are becoming more frequent or severe.

The Intergovernmental Panel on Climate Change (IPCC) acknowledges that there is no significant trend in global tropical cyclone activity.

The United States has experienced long periods without major landfalling hurricanes, and the overall trend does not indicate an increasing crisis.

PBS argues that contrary to what the Trump administration is expected to do, the U.S. Environmental Protection Agency (EPA) should uphold its 2009 finding that carbon dioxide endangers public health and welfare.

To support this they write:

“[n]ew research and ever more frequent extreme weather further prove the harm climate change is doing to people and the planet, …

[as a result] ‘There is no possible world in which greenhouse gases are not a threat to public health.’”

Yet, as the evidence presented above shows, such claims are false.

To the contrary, with the assertions that weather and health trends are worsening being abjectly false, the EPA’s endangerment finding and the regulations that it has spawned are wholly unjustified now, as the finding itself was when the former President Barack Obama administration imposed it.

PBS follows a familiar script: cherry-pick extreme weather events, misrepresent ocean chemistry, and ignore the overwhelming benefits of CO2 to justify heavy-handed government intervention.

PBS and AP may prefer their narrative of climate doom, but the data and facts tell a different story. The reality is that climate trends are far more nuanced than Borenstein, the AP, and PBS admit.

Data suggest that CO2 is not an existential threat but rather a net benefit for agriculture and ecosystems.

Rather than stoking fear, we should be focusing on adapting to natural climate variations, improving energy efficiency, and embracing the undeniable positives of a CO2-rich atmosphere.

Read more at Climate Realism

The post PBS Pushes Climate Doom, Ignores Real Data Debunking Global Warming Hysteria appeared first on Energy News Beat.