Energy News Beat

ENB Pub Note: Because Energy Policies are based upon elected officials having to pay attention to lobbies with money, they have paid attention in the past. We are seeing a trend that the money is drying up, and it could lend itself to more realistic energy policies. The world will broken into two different types. Those with low-cost energy and prosperity, and those with high-priced intermittent energy and deindustrialization and fiscal failure. Right now, the UK, EU, Germany, Delaware, New Jersey, and California are all on the side leaning toward budgetary and social failure.

The Guardian is pushing climate alarmism on cyclones, but real data show Australia’s tropical storms are declining in both frequency and intensity.

A recent article at The Guardian claims that “climate denial” is increasing in Australia, shown by skeptical reactions to the claim that climate change is responsible for the recent tropical cyclone Alfred. This is nonsense. [emphasis, links added]

“Climate denier” is a false label, and those skeptics are actually correct in their critiques of common media narratives about climate change and tropical cyclones, which are not becoming worse.

In the post, “As Trump attacks US science agencies, ex-Tropical Cyclone Alfred ushers in a fresh wave of climate denial in Australia,” Guardian Australia climate and environment editor Adam Morton writes:

What they [skeptical commentators] mostly haven’t said is that the ocean and atmosphere are demonstrably warmer than even just a few years ago. Or that this means the most intense storms formed in warmer conditions carry more energy and more water. Or that the conditions under which tropical cyclones can form are moving south as the planet heats up.

The evidence is that this is making tropical cyclones less frequent but more intense. There is data suggesting they also tend to last longer. Greater intensity plus time equals heightened risk of damage and casualties. It doesn’t mean that every cyclone or extreme storm will be more damaging than in the past. It does mean that when one comes, the potential for it to carry enough energy to wreak significant havoc is rising, not falling.

The problem is that Morton’s claims are not backed by observational data, and his “evidence” appears to be just climate modeling, which is not capable of matching, predicting, or explaining tropical cyclones.

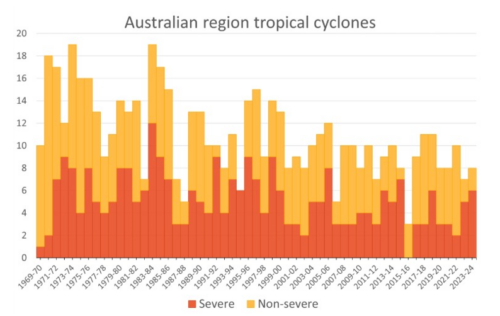

Eric Worrall posted a great essay also covering The Guardian’s claims on the climate website WattsUpWithThat.com, where he points out that real-world data show that tropical cyclones in Australia are not only decreasing in frequency but also intensity.

He provides the graphic below:

Both severity and frequency of tropical cyclones in Australia are declining as those water temperatures have supposedly modestly risen over the past few decades, though sea surface temperature readings are not very widespread and the oceans do not change temperature consistently.

Worrall suggests an explanation for how climate modelers have gotten it so wrong:

Are climate modelers putting the effect before the cause when it comes to long-term cyclone frequency and intensity vs surface temperature? Because there is a very simple possible explanation for why atmospheric and ocean surface temperature is rising but cyclone frequency and intensity are decreasing – cyclone frequency and intensity likely have an inverse relationship with ocean surface and atmospheric heat content.

Cyclones are powerful dissipaters of surface heat, an uptick in cyclones would cause an immediate and sustained drop in surface temperature.

This may or may not be the correct answer. As discussed in a few other Climate Realism posts (here, here, and here, for samples) and as Morton himself admits in the Guardian post, other factors contribute to hurricane formation and intensity, such as wind shear.

Notably, what is true of Australian tropical cyclones is also true for cyclones globally.

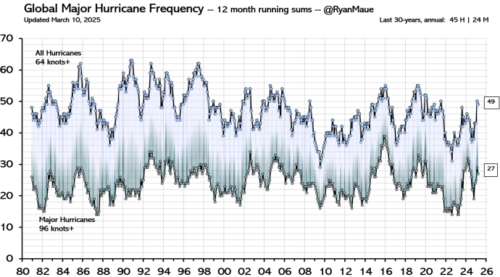

Data compiled by meteorologist Dr. Ryan Maue show that major hurricanes (called typhoons in the Pacific) are not becoming more frequent.

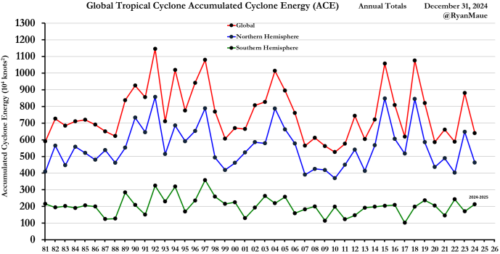

Likewise, in the Southern Hemisphere, the tropical cyclone energy totals are not increasing. (See figures below)

If there is any trend at all in hurricane frequency, it may be that these tropical cyclones in general are becoming less frequent, while the number of major storms stays more or less the same, leading to a higher proportion of major storms.

This doesn’t mean that tropical cyclones are getting worse, it still means they are getting less frequent overall.

This simply isn’t something The Guardian and their staff alarmists can win on the observational data, and every time they repeat misinformation about tropical storms they lose credibility.

It was a bit of a change of pace to see them admit that cyclones are not becoming more frequent, even if they missed the mark elsewhere; incremental shifts toward the truth are better than nothing at all.

Top image via ABC New (Australia)/YouTube screencap

Read more at Climate Realism

The post The Guardian’s Cyclone Alarmism Collides With Real-World Data appeared first on Energy News Beat.