ENB Pub Note: Governments face a choice: follow energy policies that are not sustainable or go for low-cost energy and look to have a growing economy. We are seeing the green energy policies around the […]

Highlights of the Podcast

00:00 – Intro

01:33 – The UK’s Heathrow Power Outage sheds light on Net Zero Policies

05:19 – Big Oil Retreats: Europe’s Energy Giants Ditch Green Pledges

08:34 – Trump Moves To Reopen Coal Plants, Citing U.S. Energy Needs And Global Competition

11:01 – Coal Coal Baby

15:10 – Canada’s looming decision: US’ EPA Deregulatory Actions will force Canada’s hand – be competitive or be left behind

19:05 – With BP’s Megadeal Approved, Is the West Back in Iraq?

22:16 – TotalEnergies CEO Not Ruling Out Return of Nord Stream Gas Pipelines

24:24 – Outro

Follow Michael On LinkedIn and Twitter

ENB Top News

Energy Dashboard

ENB Podcast

ENB Substack

ENB Trading Desk

Oil & Gas Investing

– Get in Contact With The Show –

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Stuart Turley: [00:00:00] Here’s where the hypocrisy comes from California. 60% of their oil that they import comes from foreign sources, including Iraq and Iran. And it just came out that Iran is selling oil through Iraq because of sanctions. So, you know, this is just absolutely horrific. And you take a look at. China’s electric demand growth since 2020 to. [00:00:30][30.1]

Stuart Turley: [00:00:38] Hello, welcome to the Energy Newsbeat Daily Standup. This is the weekend edition. This is Saturday the 29th. The staff is picking the best stories of the week. We have had an absolutely crazy wild week. Michael and I were even on site at our drilling rig. We had walked out three more sites that they’re gonna drill. This is a pretty exciting time for Sandstone Group, but for the Energy newsbeat Daily standup, We hope that you sit back and enjoy the best of the stories that the staff puts together, have an absolutely wonderful weekend, hug your family, hug your pets, and we want to give a shout out to Reese consulting energy consulting. They are a phenomenal sponsor of the daily show. Have a great time. And we’ve got their information there for you. So have a great day. We’ll talk to you all soon. [00:01:33][54.7]

Stuart Turley: [00:01:33] The uk’s Heathrow power outage sheds light on net zero the second line in there is London’s Heathrow airport had a major power outages relied on biofuel backups holy smokes it was at a standstill on Friday Michael because of a power outag due to large fire nearby and a disruption It affected more than 1,300 flights in the coming days. and the cause is under investigation. Well, we found a few of those on the Texas Alliance put out there a video of a guy admitting it appears Heathrow had changed its backup systems in order to be, wait for it, net zero. Their net zero went to biofuels, Michael, and they caught on fire. And so you sit back and kind of go, this brings up a gigantic question, Michael biofueles, which is also ethanol. I put in here and did a little research on Grocon X. Why don’t we get rid of ethanol? I’ve written about this before. ethanol takes more energy to produce. It costs an average of two miles per gallon per car. Think about how much that is. And then you think about the costs. It roughly costs for 15.6 billion gallons, roughly 26.4 billion. It cost the United States every year. That’s not including car maintenance or anything else. [00:03:13][99.2]

Michael Tanner: [00:03:13] Yeah. Um, I mean, do you want to know the reason why we still use ethanol? And I, before I say it, I want to say, I love farmers. I think farmers are the backbone of this country, but the reason why ethanol is subsidized by the United States is because it’s really a direct subsidy for the corn industry, which is the majority of the farming that gets done in the country. So you’re, you’re at a, you know, you. You know, we need farmers, the question is, do we need them producing corn? And the problem is you have most of the agriculture in the United States still producing corn because the country and the United State is buying it to use ethanol, which is less energy efficient. So, you know, it all, and this was done. Stu, when was this done? This was on way back in your favorite president Bush era as a way to garner support throughout the middle of the country, because if you can imagine the middle of country used to be some, I mean, you now look at a map of democratic and Republicans and it’s basically red in the middle and you’ve got these little strips of blue on the outside used to not be used to be more of a checkerboard. It used to have a lot of places like Iowa and the Midwest used to Not necessarily hardcore You know, Marxists or, you know, uh, communists, but they used to definitely have some left leaning tendencies and you would find pockets of places in Iowa, pockets in places of, of Nebraska, Kansas, and throughout that Midwest where there was some left-leaning stuff. So what did, what did the administration back in 2000? I think it was like three or four do in the, in, in the midst of, I think, it was right before the 2004 election where it was, there was a chance that Kerry was going to win. you start you know encouraging ethanol it’s a direct subsidy to those people so that’s my problem ultimately from an economic standpoint of subsidies it’s hard to wind them back you can’t once you get somebody hooked on money their standard of living raises and you can’t and you can roll that back so i don’t know what to do about this ethanol thing but I agree with you. We gotta figure out something. [00:05:18][125.3]

Stuart Turley: [00:05:19] Big oil retreats from Europe’s energy giants on ditch green pledges. I found this one very interesting. Europe’s oil and gas giants are increasingly scaling back their climate goals. Norway’s state-controlled energy giant Equinor laid its roadmap to achieving net zero. We love Norway. Norway is a fantastic country, but they were going to close down all of their natural gas. Now they’re the number one supplier of natural gas to the EU. They love them some, some natural gas, the energy transition has started. This is a quote, but the opportunity for a high value growth is more limited than we anticipated. Equinor CEO Anders, uh, Opetl said on Thursday, What is the difference between the US, uh, major oil majors and the European oil majors, the US oil majors kind of stayed their course with the exception of Occidental and Occidental. really tried to play in the carbon capture and go into that route. That’s where their success was. The Shell and Equinor appears to be systematically scaling back its energy investments and doing more like the U.S. made. [00:06:38][78.5]

Michael Tanner: [00:06:38] Yeah, both have ditched their wind investments. You know, you mentioned Shell. They announced early or late last year that they’re ceasing new offshore wind investments after doing some kind of corporate restructuring under the current CEO, Whale Swan. And what’s hilarious is he’s citing, and he’s cited looking to boost profitability. So, I mean, they’re- They’re not, they used to kind of hide it in the press releases by saying, oh, well, we’re just, we’ll reorganizing to be more competitive and they used to hide now they’re just outright saying, yeah, it’s to boost profitability. So, um, I mean, it, it the funny part, um the, you know, the, the company spokesperson said, while we will not lead new offshore wind developments, we will remain interested in off-takes where commercial terms are acceptable. Now that means they’re not doing anything because they’re not going to find any commercial terms acceptable and are cautious. I mean, I’m dead serious. This is the quote and are cautiously open to equity positions if there is a compelling investment case I mean that’s is that’s as we’re that’s so I our guy of the week right there Whoever came up with that because that’s saying oh, we’re open to it But we’re not ever gonna actually do anything, but we’ll we’ll listen. We’ll take a meeting We’ll let you wine and dine us if you have some new. I mean it’s it’s unbelievable how quickly they’re running backwards from this and how they’re not even hiding it anymore. [00:08:03][84.1]

Stuart Turley: [00:08:03] Let me give you a industry translation. You say, what, what did you, what did you just say? You said we’re cautious. Read that line. [00:08:12][8.8]

Michael Tanner: [00:08:12] We’re cautiously open to equity positions if there is a compelling investment case. [00:08:20][8.1]

Stuart Turley: [00:08:21] Okay, that translates to, holy crap, Batman, the subsidies are drying up and there’s absolutely no way we can make any money, is what that translates into to an oil and gas investor. [00:08:32][11.1]

Michael Tanner: [00:08:32] YOU SAID IT BEST, LE- [00:08:33][0.9]

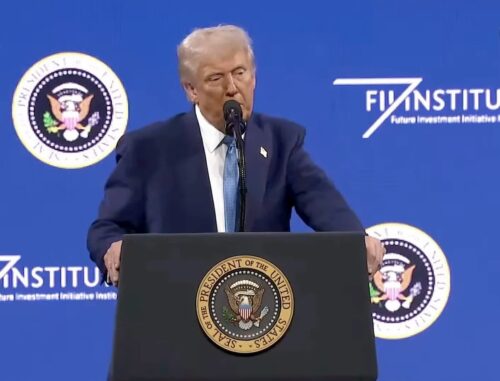

Stuart Turley: [00:08:35] Trump moves to open coal plants, citing US energy and global competition. This story goes really in line with the next story. Also natural gas driving up electrical prices. Cold Michael accounts for 15% of all power generated in the US. This is down from 50% in 2000, according to the US IEA, but on a truth social post Monday. President Trump announced that America’s trove of coal-burning power plants, once it began, will be operational. This is very, very important. Lee Zeldin said he’s rolling back to 31 environmental regulations, including some that limited pollution that can be emitted from coal- burning power plants. This critical because we cannot shut them down yet. We need to keep them open. Yeah, I think that clean coal technology is a technology that we need to uh, get better and, and export it to the countries that are going to be burning like India and China, let’s sell our great technology to them and then put energy as an export service that to me would make more sense. Let’s get clean coal going as opposed to just king coal. [00:09:56][81.0]

Michael Tanner: [00:09:56] No, you’re absolutely right. Um, we need low cost power and wherever we can get it, the free market will figure out where the best is. So I’m all with moving, rolling back regulations and saying, okay, now all different sources of energy are available. What does the free-market decide? If it decides cold, great. If it decide natural gas, great if it decides wind power. Great, but let the free market uninhibited by subsidies, uninhibiting by regulations, whether it’s harder for fossil fuels and easier for quote unquote renewables, let the free market will decide what’s most efficient and the capital will move towards that. [00:10:39][42.7]

Stuart Turley: [00:10:39] The ideal solution, in my opinion, is nuclear. As I’m sitting here for our podcast listeners with my great hat that says oil and gas executives for nuclear, I’m a nuclear kind of guy, but you know what, how can we get a nuclear plant done in the United States? UAE did one in four and a half years. We are going to have some serious problems in three years, dude. Cole, Cole baby with Robert Bryce. This is a fabulous article. In fact, I noticed also that there were several other articles. Cole is growing great again around the world net zero and decarbonization pledges are a diamond a dozen. Soaring coal use in China and India is swamping the West’s decarbanization efforts. Here’s climate policy reality check in nine charts. I put one in here just as a, the first one coming around to the block and take a look at the, somewhere around the 8,000 coal plants around the world, where they’re located. and China, the U.S. and India. And I’ll tell you what, who’s got the lowest output out there per capita? And it would be the United States. Why? Because we put extra technology on our coal plants that the others don’t. So California has an aggressive carbonization scene. It’s committed to just an equitable transition to carbon neutrality by 2045. Making that happen said will require significant reductions in greenhouse gas emissions. Here’s where the hypocrisy comes from California. 60% of their oil that they import comes from foreign sources including Iraq and Iran and it just came out that Iran is selling oil through Iraq because of sanctions so you know this is just absolutely horrific and you take a look at China’s electric demand growth since 2020 To quote Robert Bryce is gobsmacking, Canada is 633, EU nuclear is 810, but you take a look at the growth at it, it’s just unbelievable. The IEA also reports that emissions from electrical generation remain the highest of any sector and that in 2024, greenhouse gas emissions from the electric sector set a All new record, 13.8. billion tons of co2 that’s a slight increase so when you sit back and take a look china’s use of electricity needs to make clean tech dwarfs of entire countries and then you take a look at 50 percent of nuclear capacity is being built for wait for it china and india If there is absolutely anything that we take heart here, and that is the United States has to get back to being a nuclear power, we’ve got a ballpark of about 92 reactors. We’ve got the most of any, but we’ve gotta do more. China and India emissions are the real story here. CO2 emission in the 6th largest economy? And you take a look at is US is in there in that, but it’s India and China that are the problem and they’re not gonna change anything. So there’s absolutely nothing you can do. India’s coal fire is surging, electrical demand in India increased by 5.8 in 2024. Coal paste generation remains the backbone of 74% of their grid. and you take a look at the… States. The United States used to be 50% of our grid and they’re down to about 20%. But then you take a look at the other part of the statistic on there. We’ve spent trillions on renewable, but renewable energy is only 4%. So we are wasting money like you wouldn’t believe. We should be building nuclear power plants. Oh, by the way, and a shout out to Robert Bryce. Go follow Robert Bryce and support his substack. He is an outstanding author. Canada’s looming decision, US EPA deregulatory actions will force Canada’s hand. Be competitive and be or be left behind. I wanna give Terry Edam a shout out. Terry Edom, this was published over at the BOE report and Terry is just a class act. He’s one of my favorite Canadians up there and he’s got a great book. out there that I’ve thoroughly enjoyed reading The End of Fossil Fuel Insanity and when you take a look, I’ve got the link in there for folks to buy it, it seems when discussing the current global events with a particular friend and you think the ten dollar word hold your hat, come in to take a online trader, Substack Trader Ferg, he’s a great for Substack Thoughts in his weekly note. mentally taxing us to keep the news flow and what matters. Everyone is used to spotting a headline and integrating into their own framework of how the world works. Higher up the ladder you go, geopolitically speaking it’s easier because well that’s who controls the frameworks in our society. That’s also who controls THE NEWS. We have developed expectations for better or worse how the EU will act to something or Russia or China or the US. And then Trump gets elected and nobody knows what he’s going to do, which is why he is a great leader for the United States. We don’t want status quo. We want things different. So there’s no simple answers anymore, but let’s talk a bit in time five years ago when Greta roamed the land touching foreheads and curing the lame. It was a wild time for energy, particularly hard for energy writers. Describing the energy world over the past decade has required more bombastic language, which is no fun. because no one wants to be the next tabloid or canceled. And I’m tired of being canceled, but you know, Google and YouTube shut you down. I’ve even been shut down on LinkedIn. And this is just absolutely fun. Terry goes further on to say Alex Epstein does an excellent job of clarifying what many Zeldin bullet points actually mean, but there are too many to go through with significant energy policy repercussions, but few. are noteworthy for their significance. One of the Zeldin bullets sounds like a sci-fi book reconsideration of the 2009 endangerment finding. This ruling is being reconsidered declared that greenhouse gasses qualified pollutants under the Clean Air Act. This is where it’s all about and this is what is going on. The no longer defining CO2 as a LUDEN! and mandatory for the United States EPA to go forth and ruin people’s lives is critical. Terry’s point in this article is Canada’s productivity has been falling relative to other large industrial economies because of being insufficient capital investment. Nobody wants to invest in Canada when you’ve got left… leaning policies. Money is going to go where you have great leaders. And Trump has brought trillions of dollars of investment into the United States with the promises of less regulatory actions. So Canada is either going to continue going down the left wing that job and we’ve the world economic forum approved leader coming in, replacing Trudeau. You’re either gonna keep going down that road and you’re not going to get any investments. It’s going to be a tough ride for Canada. So anyway, an outstanding article. With BP’s mega deal approved is the West back in Iraq. Here is, there’s a couple key points here, Iraq approved BP’s $25 billion contract to key Hercurk oil fields. The Western mega deal may stabilize Iraq’s oil ambitions. Michael, here’s something most people don’t realize. Iraq is one of the biggest oil fields and natural gas fields, but they’ve had to install a floating natural gas LNG import facility because they don’t have the technical skills to develop their own wells. So this is a gigantic thing. This follows on yesterday’s news that Shell may be delisting, and they’re having some serious doubts about being in the UK with all of the serious problems. So if you have Shell and BP leave the UK, holy smokes, Batman, that’s good. Where are they going to go? Oh, the US. [00:20:08][569.0]

Michael Tanner: [00:20:09] Yeah. And then there’s some real interesting minute details about this, about what it takes to operate in Iraq. It’s basically a huge water flood. And if you know anything about water flood, you need a lot of water to move oil. You need a water to a little bit of oil. And when you’ve got a lot oil down there, it is a technical deal. Yeah. So I think there is a, somewhere someone was saying in this article that the water basically needs to equate for about 2% of the combined flow of the Tigris and the Euphrates River which is which is pretty unbelievable and about 6% during the low season so this does require a lot of water like you said the technical requirements of this is crazy it’s why they’ve had to resort to some offshore stuff but yeah I do think this is this is very interesting you know [00:20:57][48.2]

Stuart Turley: [00:20:58] And one bit of hypocrisy while you catch your breath there. Are you ready for this? You ready? California imports from Iraq. And this is absolutely hilarious. [00:21:08][10.5]

Michael Tanner: [00:21:08] So question here, it’s long been talked about that BP would consider moving their main listing from the London Stock Exchange to somewhere in the United States, whether I assume the New York Stock Exchange, maybe the newly, the yet to be created Texas Stock Exchange. Which I promise you, if that comes to fruition, Energy News Beat’s listed. We’re taking Energy News Be public via the Texas Stock exchange. I promise you guys that we will do that. But my question to you is, let’s just say they go through with really diving deep into Iraq. Is that gonna hurt them when they try to look to list of a stock exchange here in the United States? Are they gonna get penalized? Maybe not by investors, but obviously by the government. [00:21:54][45.2]

Stuart Turley: [00:21:54] That one is a good question because the United States buys from sanctioned countries anyway. So you know, you sit back and kind of go, they may be a sanctioned country. Take a look at California and New York and everybody else, they’re buying outside the sanctions. So the answer is… [00:22:10][16.2]

Michael Tanner: [00:22:10] I don’t think it would matter. You heard it here second, guys. US buys sanctioned oil. Who would have thought? [00:22:15][4.7]

Stuart Turley: [00:22:15] When you sit back and think about total energies, they are really pushing for Nordstream to come back online. Why? Because if you don’t have cheap natural gas, you have deindustrialization and they, Germany needs it. I saw this headline and I thought it was absolutely phenomenal. the CEO believes parts of the Nord Stream pipelines can return to operation to Europe’s needs. There were people out there all over X going, nope. [00:22:45][29.9]

Michael Tanner: [00:22:45] Well, I think what’s interesting here is, is, you know, this is really in contradiction with what other European NATO countries are talking about. Germany says it’s not coming back. Estonia is not saying that. You know, there’s other LNG sources they’re looking at. What’s funny is Trump talked about this all the way back in 2016 about weaning themselves off and it took an explosion of the Nord Stream to finally figure it out. [00:23:10][24.3]

Stuart Turley: [00:23:10] Yes. But here’s the difference though. What’s the price difference between cheap Russian gas coming in on a pipeline versus LNG? You’re talking about $14. Yeah, that’s a lot of money, baby. [00:23:22][11.6]

Michael Tanner: [00:23:22] Yeah, here’s this quote from Patrick Poyan. He’s the CEO. Quote, I would not be surprised if two out of the four came back to stream, not four out of four. So at least two will come back, possibly. [00:23:34][11.4]

Stuart Turley: [00:23:34] Now here’s the catch, the only manufacturer to the Nord Stream system are Canadian turbines and Russia removed all six that there were still. [00:23:45][10.5]

Michael Tanner: [00:23:46] So, you know, what they talk about also in this article is how the bringing on Nord Stream 2, which was never brought online officially, could be part of the negotiations of the ceasefire between Russia and Ukraine. Where do you see that? [00:23:59][12.8]

Stuart Turley: [00:23:59] I see that as a big play because when you take a look at, I did not have on my bingo card President Trump talking about taking a Russian nuclear plant, the largest in Europe, in Ukraine and having the U.S. go ahead and manage it. And Michael, our great Secretary of Energy, you know what he said? What did he say? You bet, President Trump. I’m in. [00:24:23][23.7]

Michael Tanner: [00:24:23] Absolutely. [00:24:23][0.0][1442.7]