Energy News Beat

Comparing the price of Russian natural gas delivered via pipeline to liquefied natural gas (LNG) imports in 2025 involves several factors, including production costs, transportation, market dynamics, and geopolitical influences. As of March 30, 2025, one can analyze based on available trends and historical data, though exact prices fluctuate due to real-time market conditions and regional variations.

I have been talking about the importance of Russian Natural gas for years and had George McMillian and other guests on the show discussing the impact of ending the war. We spoke of Total Energies CEO last week wanting to start the Nord Stream Pipeline, and Germany’s new Chancellor wants to rebuy Russian Natural gas. Natural Gas is needed for commercial and electrical generation. LNG or via pipeline is cheaper than wind and solar as you do not have to build a redundant baseload. Check out all of George’s articles and interviews here: https://energynewsbeat.co/george-mcmillian/

Russian pipeline gas has traditionally been cheaper than LNG imports due to lower transportation and processing costs. Pipelines deliver gas directly from production fields to consumers, avoiding the energy-intensive processes of liquefaction, shipping, and regasification required for LNG. Historically, Russian pipeline gas prices to Europe averaged around $5–6 per million British thermal units (MMBTU) or approximately 15–25 €/MWh before the significant disruptions following the 2022 Ukraine invasion. By 2025, despite reduced flows to Europe, Russian pipeline gas prices to remaining buyers (e.g., via TurkStream to Turkey or Power of Siberia to China) are estimated to hover around $6–8/MMBTU (roughly 20–27 €/MWh), based on reports of discounted rates to non-European markets like China, where prices were projected at $271.6 per 1,000 cubic meters (~$7.6/MMBTU) for 2024, with a slight uptick possible in 2025.

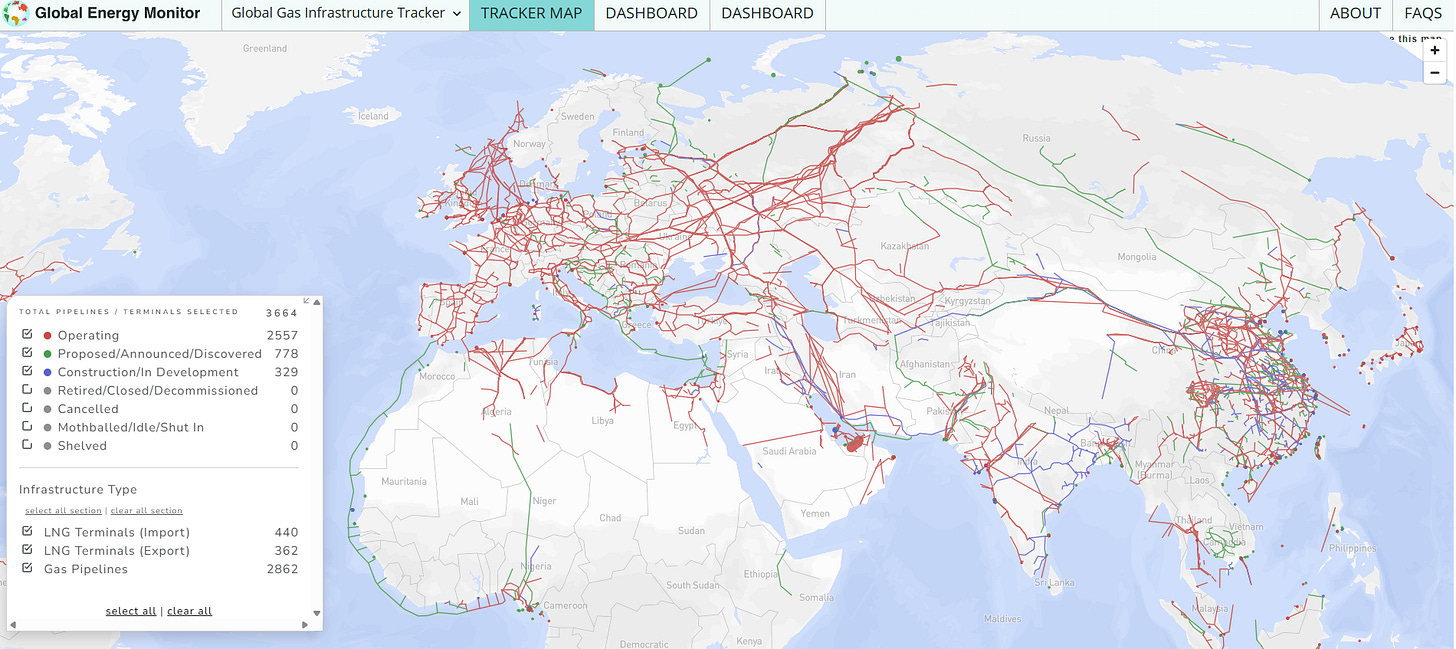

Note that in the proposed pipelines and existing pipelines, Russia has an easy deployment to the Asia markets, and they only need 35 miles to complete a pipeline to Japan. North Korea has been in alleged talks, and you can see it on the map.

LNG imports, particularly from the U.S., which has become a dominant supplier to Europe, are notably more expensive. In 2024, U.S. LNG prices delivered to Europe were around $15/MMBTU (50 €/MWh), though spot prices at hubs like the Dutch TTF fluctuated between 30–45 €/MWh in early 2025, reflecting global supply-demand balances and new LNG capacity from the U.S. and Qatar. The higher cost stems from liquefaction (adding ~$3–4/MMBTU), shipping ($1–2/MMBTU), and regasification (~$0.5–1/MMBTU) on top of the base gas price (e.g., U.S. Henry Hub at ~$3–4/MMBTU in 2025). Thus, LNG import costs typically range from $10–15/MMBTU (33–50 €/MWh) depending on shipping distances and market premiums.

In Europe, the shift from Russian pipeline gas to LNG after 2022 increased energy costs significantly. Pre-2022, Russian gas via pipelines like Nord Stream was often 30–50% cheaper than U.S. LNG, a gap that persists into 2025. For instance, posts on X and analyses suggest Russian gas could be priced at ~11 €/MWh versus TTF LNG prices of 42 €/MWh, though these are anecdotal and context-specific. Meanwhile, China benefits from Russian pipeline gas at lower rates than Europe pays for LNG, with 2025 projections suggesting a price of ~$8/MMBTU versus LNG imports there at $10–12/MMBTU.

In summary:

- Russian Pipeline Gas (2025 estimate): ~$6–8/MMBTU (20–27 €/MWh), depending on the buyer and route.

- LNG Imports (2025 estimate): ~$10–15/MMBTU (33–50 €/MWh), with U.S. LNG to Europe at the higher end.

These figures are approximate and vary by region, contract terms, and market volatility. Russian pipeline gas remains cheaper, but its availability to Europe is limited due to geopolitical shifts, forcing reliance on costlier LNG.

Contracts and energy security are critical factors when weighing the price difference. Steve Reese, the CEO of Reese Energy Consulting, has made some hugely impactful statements on my podcast about energy security and the cost of natural gas vs LNG. Add in the ability to offset trade barriers to the United States, and that price difference shrinks even more.

This will be one of the topics that Steve and I discuss on this month’s CEO Corner with Steve Reese. That will be a great podcast with a special guest.

The post How cheap is Russian natural gas via pipeline compared to LNG imports? appeared first on Energy News Beat.