Over the past couple of months, the Russian army has taken several major settlements, and Ukraine has moved even closer to collapse

The 2024 military campaign in Ukraine is coming to an end. It is now November, and although many Ukrainian experts had hoped that there would be a pause in combat due to mud season – normally the time when rains turn the ground into a treacherous quagmire and military operations become increasingly difficult – the fighting continues, and some of the most intense battles since the beginning of the war are taking place right now.

Why was the front moving so slowly

By the end of 2023, the situation at the front resembled the trench warfare of the First World War, only with 21st-century technology. One Russian officer described the combat as a “pornographic parody of the Battle of Verdun” which was characterized by prolonged fighting, high casualty rates, and minimal territorial gains. Advanced reconnaissance tools and an overwhelming presence of drones over the battlefields have made it exceedingly difficult to assemble the large forces needed for an offensive without being detected. Even when large mechanized units are formed, they are quickly eliminated since transport and armored vehicles are easily targeted and destroyed. Tanks have even taken on the role of mobile artillery devices, which fire from concealed positions, as all armored formations are ruthlessly attacked. In such conditions, the infantry has once again taken center stage.

Small assault groups backed by artillery, drones, and electronic warfare units often suffer horrific losses but paradoxically prove to be least vulnerable to enemy fire. Meanwhile, remote mortar devices and kamikaze drone strikes have made logistics at the front increasingly difficult. As a result, the fighting has become decentralized: small infantry units carry out attacks with a few armored groups or even individual combat vehicles and drones. Front-line logistics and the evacuation of wounded soldiers are often carried out by a few vehicles (sometimes even motorcycles or ATVs) which quickly maneuver under fire, or even by individual soldiers, colloquially known as “mules”.

This situation has made it impossible to advance faster than soldiers can move on foot. Attempts to carry out operations similar to those of the Second World War, or those we’ve seen during Arab-Israeli conflicts, result in nothing but heavy losses of equipment.

Nevertheless, adapting to this new frontline reality throughout 2024, Russian troops have confidently advanced, achieving not swift but steady territorial gains.

On a strategic level, the Russian command was also compelled to reassess existing doctrines. At the end of 2023, the Russian army launched an offensive against the city of Avdeevka. The operational plan was clear: since the settlement was partially encircled, the assault was coordinated in a classic manner: two flanking groups closed in around the city in an attempt to fully encircle it. The operation was well-prepared and backed by a barrage of firepower. However, the battle stretched on for months, resulting in heavy casualties for both sides. This costly endeavor prompted Russia to reevaluate its overall strategy, shifting its focus toward a series of parallel offensives along the lengthy front line. Successful areas of advance were reinforced, while in other cases, when the troops couldn’t carry out the task, the axis of attack was shifted.

The Russian army continues to possess superior firepower. While warplanes were badly affected in 2022-2023, they have returned to active duty, and the Ukrainian military has lost its strategic initiative. The new strategy is quite successful. A few months of intense fighting have indeed prompted thoughts of a “parody of Verdun” as fierce battles were fought for control over tiny villages. However, by summer, the Ukrainian army found itself in a very difficult situation.

Fall battles

Donbass region remained the primary front. It was divided into several operational axes, and the Ukrainian army was forced to frequently pull reserves from different areas. Additionally, battles continued north in Kharkov region and south in Zaporozhye. High casualties forced Ukraine’s military and political leadership to ramp up mobilization efforts, conscripting new soldiers by force. The best brigades chaotically moved from one section of the front to another, plugging holes and suffering heavy losses due to exhaustion. The Ukrainian infantry was made up of a great number of hastily trained recruits with low morale, which has led to further losses and the need to send new and even more poorly trained soldiers to the front.

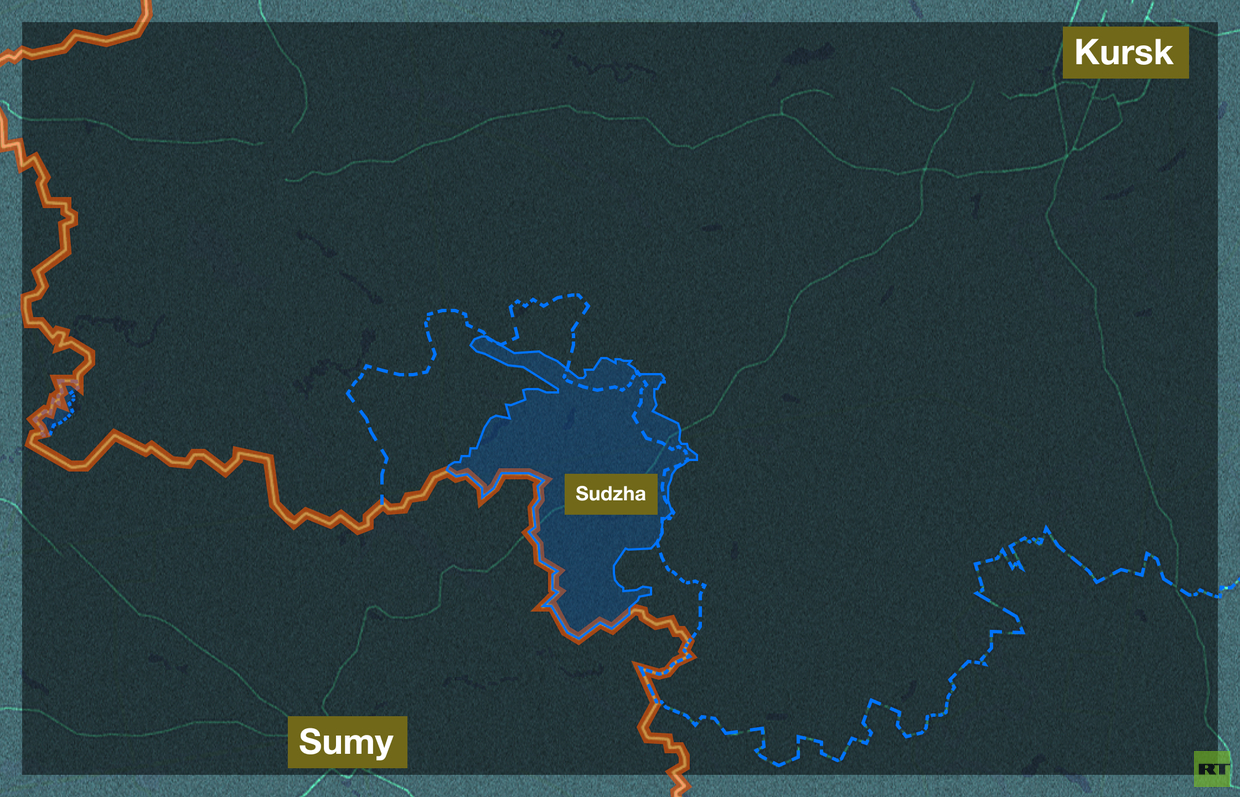

In August, the Ukrainian command decided to shake things up. The Armed Forces of Ukraine (AFU) managed to gather a solid strike force from their last major reserves and meticulously planned the incursion into Russia’s Kursk region. Although there was no particular agreement between the sides to avoid battles in that area, neither side had engaged in active combat there, and as a result, Russian generals had overlooked it. In August, Ukrainian troops launched an attack near the town of Sudzha and quickly achieved significant tactical success, inflicting painful losses on Russian forces in the area and capturing Sudzha along with several surrounding villages.

However, the Russian army responded swiftly, stabilizing the situation in a brief but intense battle. This time, the Russians improvised a sudden counterattack. The western flank of the Kursk “bulge” was unexpectedly targeted by Russian naval infantry. The Ukrainians reacted predictably, launching an attack on the flanking Russian units. However, leveraging their superior air force and firepower, the Russians managed to fend off this strike. For Ukraine, this operation was a desperate measure; if it proved successful, it could have halted Russia’s counteroffensive in Donbass. However, the Ukrainian forces lacked endurance: fierce fighting lasted a couple of weeks; after that, the Russian army continued to advance on the western side of the “bulge”, significantly reducing the area under Ukrainian control, which is continuously shrinking. Russia’s ultimate goal in this area is to reclaim Sudzha and the rest of the territory seized by the AFU.

The incursion into Kursk region, however, was not the main goal for the AFU. It’s now clear that the AFU’s primary objective was not achieved: the Russians did not withdraw troops from Donbass in response to the attack on Kursk. As for the political outcome of the Kursk campaign, it was the opposite of what Ukraine intended: the position of the Russian government did not change in any way, and its attitude only hardened, and Russian society did not opt for negotiations, but expressed an increased desire to defeat the enemy. By capturing a small town with zero operational significance, the Ukrainians had merely extended the front lines and created another problem for themselves. Their army is now trapped, since it cannot abandon the seized territory due to political considerations. The official goal of leveraging these territories as bargaining chips in future peace talks has compelled the AFU to continue fighting, even though they have no chance of achieving success on this front and have no significant operational goals there either. Apparently, the chessboard had been shaken up but the pieces have remained on the same spot, except for the opponent’s knight, which has fallen under the table.

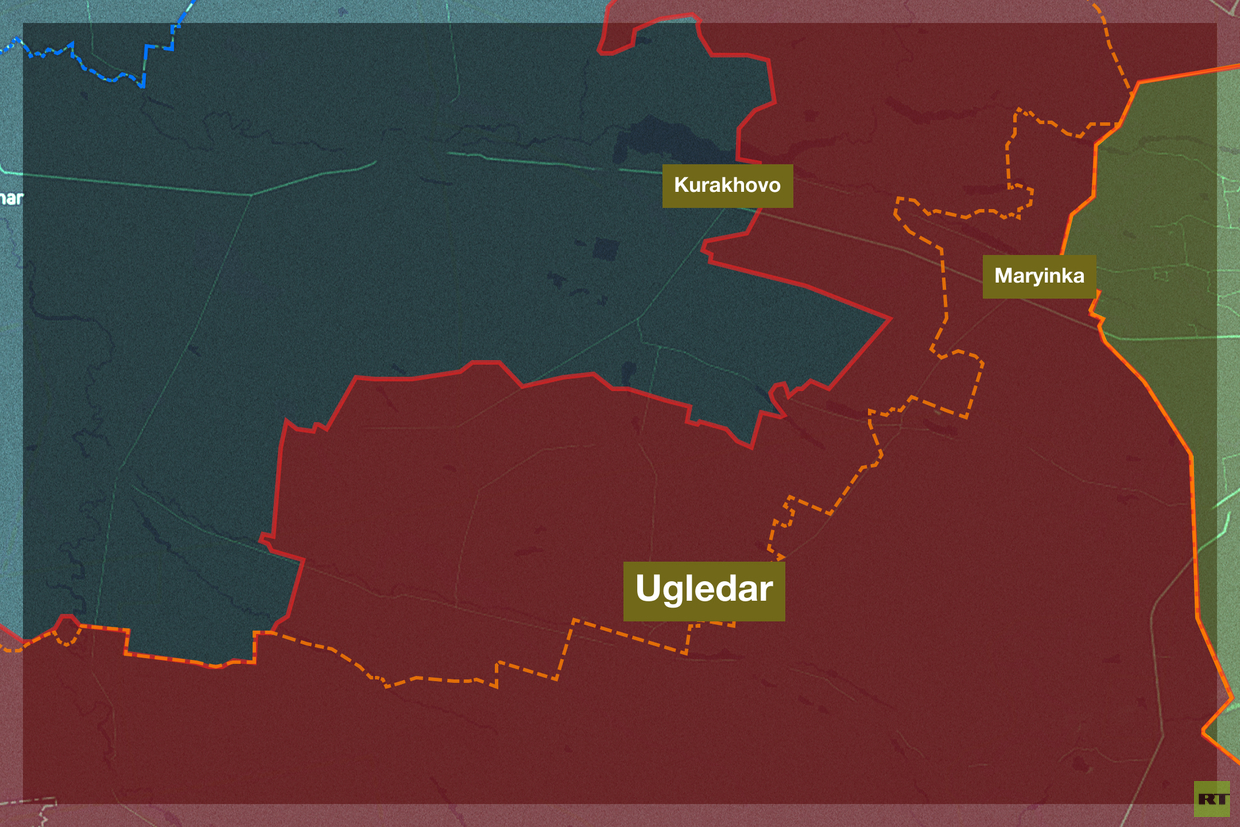

As battles rage near Kursk, the Russian army has managed to achieve results at the opposite end of the front in southern Donbass, taking control of the city of Ugledar. This area is strategically very important: it is situated on elevated ground, and this allows troops to observe and attack the flat plains surrounding it. Despite several unsuccessful assaults during the winter of 2023, the Russians have now managed to outflank Ugledar, decimate a large portion of the garrison with flank attacks, and force the surviving troops to flee.

Ugledar is significant not only in its own right but also within the context of Russia’s larger offensive in Donbass. Russians continue to “swing the pendulum”, attacking various sections of the front and identifying areas where the AFU cannot quickly deploy reserves.

This summer, the Russians advanced towards the city of Pokrovsk — a key logistics hub for Ukraine. Moscow’s army swiftly made its way through the smaller towns around it, but the Ukrainians managed to retain control over Pokrovsk. Here, the Russian command displayed unusual flexibility by shifting their attack axis further south, initially targeting the town of Selidovo, which would allow them to approach Pokrovsk from a wider arc. However, in Selidovo they encountered organized resistance and again redirected their efforts, this time heading southward.

The Russians are trying to encircle the city of Kurakhovo, where a large concentration of Ukrainian forces is assembled. Russian troops coming from the side of Pokrovsk advance from the north, while those coming from the side of Ugledar now approach Kurakhovo from the south. This creates yet another operational crisis for the AFU. Meanwhile, the Russians adhere to their new strategy and attack not just in expected areas, but also at those sections of the front from which they had apparently withdrawn earlier.

All these operations are conducted at limited depth and, as we’ve said above, proceed at a soldier’s pace. However, taken together, this “thousand cuts strategy” is wearing the Ukrainian army down.

The situation in the rear and the prospects of war

Perhaps the most alarming symptom for Ukraine is that Ukrainian soldiers are deserting the army en masse. The actual number of soldiers on the front lines is significantly lower than the official figures. Up to 170,000 Ukrainian soldiers are said to have deserted their units since the beginning of the war. This doesn’t mean that all those people are currently away from the front — some have already returned. But the numbers are large, and the rate of desertion is increasing. Ukrainian soldier Vladimir Boyko wrote on his social media page that in 2024, as many people deserted from his unit in two months as would typically flee over an entire year. Moreover, many people are in a sort of “gray zone”: these individuals are officially enlisted in the army, but have bribed the authorities and never made it to the front. And then there is the infamous mass exodus of men into neighboring countries.

The reason for this is simple: the volunteers who joined the AFU in 2022 have all been to the front, and by this time, many have been killed or severely injured. New reinforcements and new brigades are made up of conscripts who are far less likely to display heroism. This situation has led to regular and unpredictable problems and even the command struggles to accurately assess the combat readiness of their units. The problem is that Ukrainian units vary significantly in quality. This leads to unpredictable situations when at crucial moments during the course of fighting, some units simply flee. This situation has been advantageous for Russian forces during two major recent operations: the capture of Ugledar in southern Donbass and the collapse of the western flank of the Kursk “bulge”. In both cases, the weakest link broke: poorly motivated conscript units fled, exposing the flanks made up of more experienced but completely exhausted brigades.

The situation appears bleak for Ukraine, but it’s interesting to see how, in these conditions, things look for Russia.

On the Russian side, the situation isn’t absolutely optimistic either. On the one hand, the current situation seems favorable for Russian troops, and in the coming months they can continue to fight without losing momentum. The intensity of combat remains high. Judging by the footage of lost armored vehicles and artillery, the number of casualties is close to that of the summer of 2023, when Ukraine launched a major counteroffensive to push back Russian troops in Zaporozhye and turn the tide of the war. However, Russia’s military industrial complex is operating at full capacity. Moreover, countries which had been deemed “outcasts” by the West have unexpectedly become valuable allies. The military industries of North Korea and Iran have proven crucial. Additionally, the appointment of economist Andrey Belousov as Minister of Defense has brought about certain changes. Moscow is focused on the successful operation of its defense industry and frequent missile strikes on the enemy’s rear.

October attacks on the port of Odessa – the largest in Ukraine – correspond to this broader strategy of attrition warfare. Furthermore, Russia is steadily but surely damaging Ukraine’s energy infrastructure. Nuclear power plants remain untouched for obvious political and humanitarian reasons, but overall, there seems to be a concerted effort to exhaust Ukraine’s economy, either making it an unbearable burden for the West or forcing it to capitulate.

However, the fighting is also a heavy burden for Russia. This war has a peculiar characteristic: the Kremlin is trying to keep ordinary people – those who are not involved in combat – away from its direct effects, so they won’t feel it in their everyday lives. This is particularly evident in the fact that Russia has sought to avoid further mobilization at all costs. The benefits and financial bonuses promised to those willing to enlist in the army under contract are quite substantial, and for the country’s poorer regions, the sums of money are huge. But the number of volunteers isn’t infinite. The majority of them are already on the front lines. The same goes for soldiers who were called up during the partial mobilization in the fall of 2022. By now, both volunteers and conscripts are severely exhausted. The troops are suffering losses, which means there’s a pressing need to recruit new personnel and at least support the worn-out fighters.

Russia’s economy is currently focused on war-related needs. So far, this hasn’t significantly impacted consumption. Moreover, the departure of many people from the workforce (coupled with generous monetary compensation) has triggered an increase in wages. However, this can’t continue indefinitely, and the ongoing exodus of people from the real economy into the armed forces is negatively affecting the national economy. The central bank is combating inflation and other negative trends with very harsh measures, such as a staggering 20% interest rate. All of this is taking a toll on the country’s economy.

Against this backdrop, it’s no surprise that Western media and politicians are increasingly talking about the chance that the conflict may be frozen. The idea that Kiev may have to cede some territory has taken root in the minds of the Western establishment, while in Ukraine itself, the idea of fighting until the country is able to reclaim its internationally recognized borders is becoming less popular. It’s clear that Ukraine’s military leadership still has room for “creativity,” and despite heavy losses and desertion, the army can still hold the front line. However, the war is being fought on Ukrainian soil, causing immense damage to the country’s economy, society, and demography – in other words, its future. Russia continues to insist that Ukraine must fulfill a series of stringent demands (territorial concessions, a reduction in the size of its armed forces, and a non-aligned status), which seem exceedingly burdensome for Ukraine. Yet Moscow appears ready to push forward (and has the capacity to continue its military operation in the foreseeable future). Overall, Russia’s strategic imperative seems to be, “As the fat one dries, the lean one dies.” While Russia discusses a potential second wave of mobilization, Ukraine is bracing itself for a winter with power and heating outages, and continues to hunt down conscripts on the streets.

The year 2024 has been quite dismal for Ukraine. The loss of personnel and equipment is hard in itself, but the worst part is the uncertainty regarding the future. Currently, it does not inspire hope, and there’s a sense of fatigue in the air.

The war has been painful for Russia as well. Its reserves are not endless. The idea that Russia has an endless number of soldiers is merely a stereotype. In reality, Russian forces are also grappling with personnel shortages, especially in infantry, while the economy suffers from a lack of workers. However, Russia’s economic, industrial, and military reserves are still substantial enough to continue fighting. A war of attrition is highly disadvantageous for Ukraine. Russia announced its demands long ago, and honestly, they are quite stringent. But Moscow believes that if Kiev doesn’t agree to them now, in the future the situation will only become worse. War fatigue doesn’t accumulate in a linear manner, and at some point, it might turn out that it’s already too late to surrender.

Source: Rt.com

We give you energy news and help invest in energy projects too, click here to learn more

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack