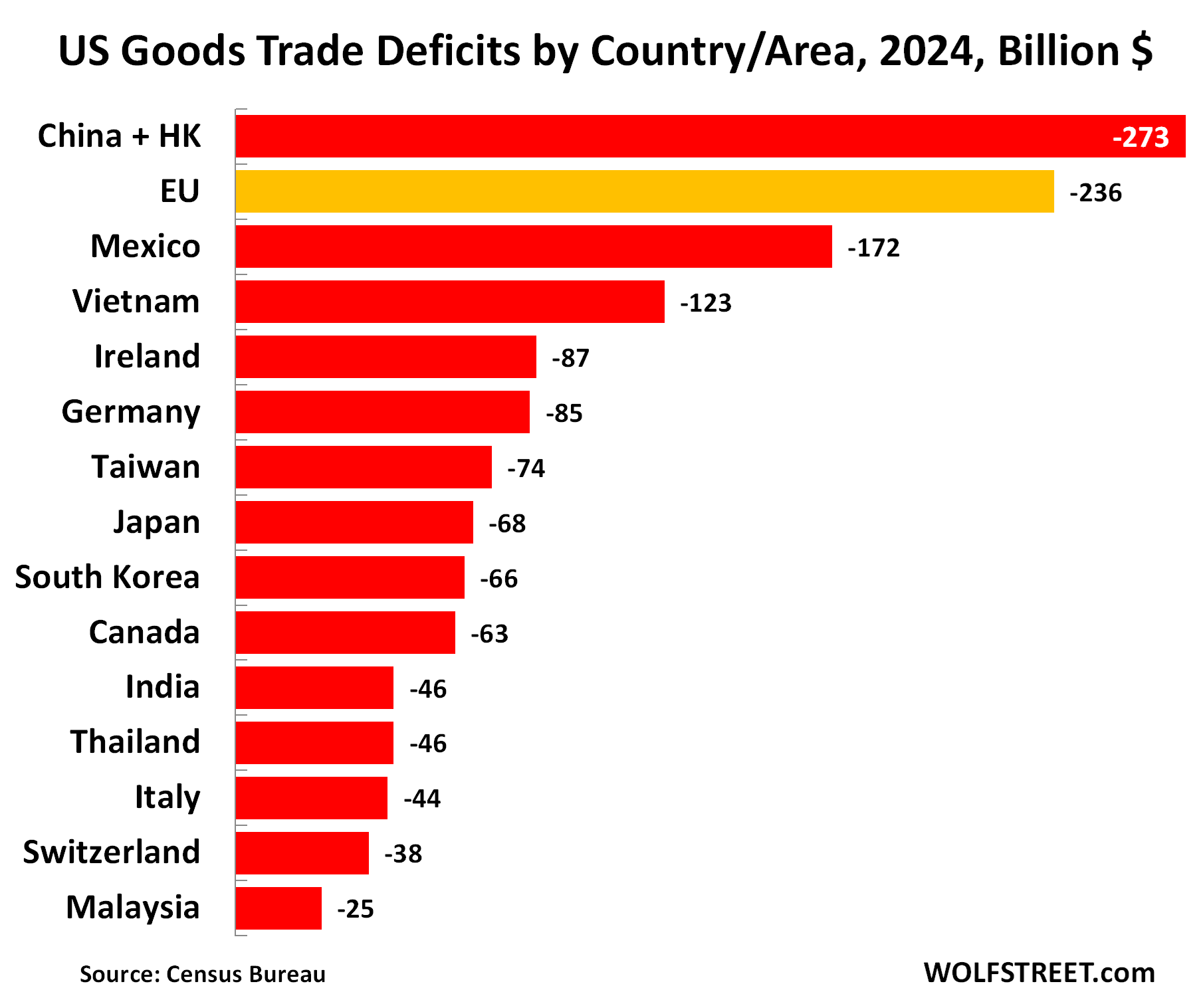

Many Latin American officials watched U.S. President Donald Trump’s tariff announcement on Wednesday with bewilderment. Trump plans to hit all countries with baseline 10 percent duties, but around 60 trade partners will face even higher rates. The Trump administration calculated the so-called reciprocal tariff rate based on the U.S. trade deficit with each country.

Countries that have tried to get close to Trump generally received no special treatment. Right-wing Argentine President Javier Milei has tilted his foreign policy toward the United States, even proposing a bilateral trade deal to Trump advisors. But Argentina was hit with the same tariff rate as Brazil, which has a left-leaning government and which Trump has criticized for protectionism.

The United States has a trade surplus with both Argentina and Brazil, so they each received the minimum 10 percent rate. Other large Latin American economies such as Chile, Colombia, and Peru also face 10 percent tariffs, lower than the new duties of upward of 20 percent and 30 percent that Washington slapped on major trading partners in Europe and Asia.

Although 10 percent tariffs are on the low end of Trump’s duties, they are still a significant hurdle for exporters. Trump said the new rates would not apply to Mexico and Canada, which face a raft of previously announced levies. But some countries in the region, such as oil-rich Guyana, received higher rates.

Latin America’s large economies avoided the worst-case outcome on tariffs in part due to Trump’s formula. But for officials in the region, Wednesday’s announcement also reinforced the value of diplomacy.

Former Brazilian Trade Secretary Welber Barral told Foreign Policy that the country’s vice president, Geraldo Alckmin, was wise to meet virtually with U.S. Commerce Secretary Howard Lutnick in March. During their exchange, Alckmin emphasized Brazil’s bilateral trade surplus and low tariff rate on many U.S. goods.

In a rare moment of unity, Brazil’s legislature overwhelmingly passed a bill this week authorizing the government to retaliate against trade duties from any country. For lawmakers on the right, the need to support Brazilian industry seemed to outweigh pressures to align with influential former President Jair Bolsonaro, who is a Trump fan.

Mexican officials, too, felt reassured about their diplomatic abilities. Among many members of the Mexican government, “the overall sense … is that this is one of the best possible scenarios” given the tariffs of previous weeks, said Matías Gómez Léautaud, the lead analyst for Mexico at Eurasia Group.

In the last few weeks, Trump imposed 25 percent tariffs on goods from Mexico before walking some of them back. Mexican President Claudia Sheinbaum has eschewed threats of heavy-handed retaliation and made significant concessions to Trump on migration and security policy.

Although Mexico was spared from new tariff orders on Wednesday, the effects of Trump’s previously announced duties, including those on car imports, are already rippling through the Mexican economy. The country is estimated to be close to a technical recession.

Automaker Stellantis, which is behind brands such as Peugeot and Jeep, announced on Thursday that it would pause production at a Mexico plant. Many would-be investors have postponed big decisions regarding Mexico until the full scope of Trump’s tariffs is clear.

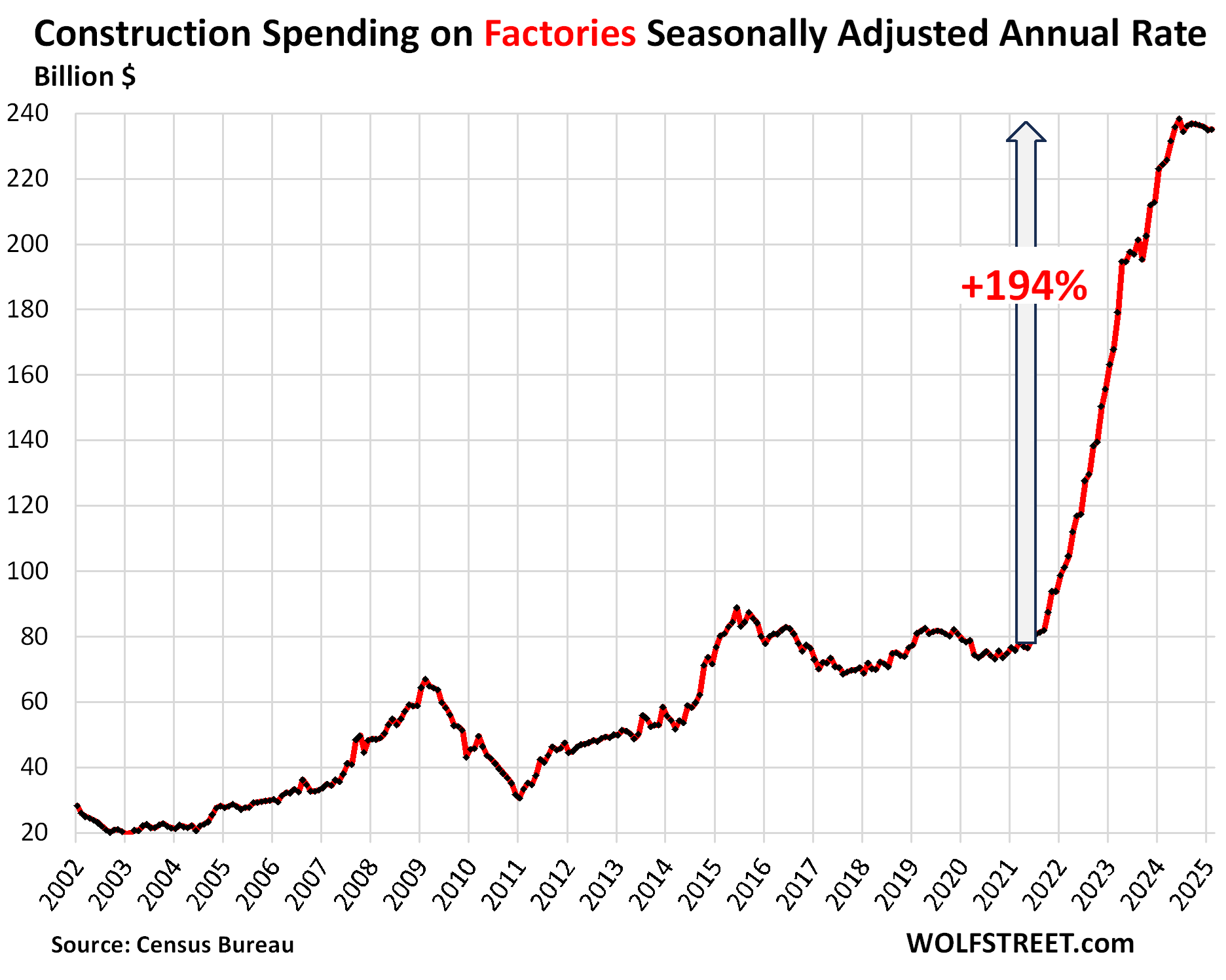

“There’s less investment, and you see that some key industries, like construction, are having significant setbacks,” former Mexican Vice Minister for Foreign Trade Juan Carlos Baker told Foreign Policy.

Latin Americans may be especially aware of the risks of Trump’s new tariffs because they echo economic policies that were popular in the region in the 1950s, ’60s, and ’70s but have largely been abandoned. So-called import substitution industrialization strategies aimed to boost domestic industries by blocking foreign competition, often with tariffs.

Some countries experienced temporary growth spurts within this framework, including Brazil and Mexico. But many policymakers eventually came to see the policies as a drag on competitiveness. That, coupled with a wave of debt crises, led them to remove many tariffs.

Panama port deal on pause. Hong Kong-based firm CK Hutchison Holdings was supposed to sign off on the sale of two Panama ports to a consortium led by the U.S. company BlackRock on Wednesday. Plans for the deal were announced last month after Trump criticized Chinese activity in the Panama Canal and threatened to “take it back.”

The announcement of the sale appeared to address U.S. concerns and put the controversy to rest. But last Friday, Chinese antitrust regulators said that they were reviewing the deal, which also includes the sale of 41 ports elsewhere in the world.

It is unusual for regulators in Beijing to review a deal by a Hong Kong-based company. A pro-China newspaper in Hong Kong recently published criticism of the deal, with one piece calling it “an act of hegemony by the U.S.”

The articles have added to investors’ concerns that China’s regulatory review may be politically motivated. It comes as Chinese President Xi Jinping has sought to pitch his country as a positive investment destination.

Ecuador election update. With Ecuador’s presidential runoff approaching on April 13, the party that represents a federation of Indigenous groups, Pachakutik, presented policy proposals to candidate Luisa González on Sunday. Pachakutik’s coordinator said in a speech that voters should not support González’s opponent, President Daniel Noboa.

But prominent Indigenous leader Leonidas Iza cautioned that the event was not a “blank check” of support for González. Iza criticized the fact that security forces repressed Indigenous activists during the government of González’s close ally, former President Rafael Correa. “We demand a different position,” he said.

Because of its clashes with the Correa administration, Pachakutik has not endorsed Correa’s movement in a presidential runoff since 2006. González said that she would study Pachakutik’s proposals, which include long-standing demands such as limiting oil drilling and strengthening bilingual education.

Polls remain tight ahead of the runoff. Noboa, for his part, has touted close relations with the United States during the campaign, traveling to Mar-a-Lago last weekend for an unofficial visit.

Gilberto Gil performs during Lollapalooza Brazil at Autodromo de Interlagos in São Paulo on March 24.

Gilberto Gil performs during Lollapalooza Brazil at Autodromo de Interlagos in São Paulo on March 24.

Gilberto Gil performs during Lollapalooza Brazil at Autodromo de Interlagos in São Paulo on March 24.Buda Mendes/Getty Images

Singing farewell. Two veteran musicians who are beloved across Latin America are on farewell tours this month. One of them is Gilberto Gil, one of the most celebrated pop music pioneers in Brazilian music history. Gil, 82, has released some 50 albums and previously served as Brazil’s minister of culture.

He has been dancing, singing, and playing the guitar across the country in front of a backup band that includes his children and grandchildren, who are also musicians. Gil’s tour bears the name of a 1984 song, “King Time.”

Another valedictory tour is that of Spanish rock artist Joaquín Sabina, who spent formative parts of his career in Buenos Aires and refers to it as his second home. Many of Sabina’s most famous ballads were inspired and embraced by the Latin American rock scene of the 1980s, and he has traveled the region for weeks of concerts, beginning in Mexico.

Sabina is currently back in Argentina. “My friends know that if they ever lose me, they can find me in Buenos Aires,” he told a concert crowd last month.

(@KarluskaP) April 3, 2025

Gilberto Gil performs during Lollapalooza Brazil at Autodromo de Interlagos in São Paulo on March 24.

Gilberto Gil performs during Lollapalooza Brazil at Autodromo de Interlagos in São Paulo on March 24.