Energy News Beat

In the Energy News Beat – Conversation in Energy with Stuart Turley talks with Steve Goreham about the key energy challenges for 2025, including rising electricity demand driven by AI, EV slowdowns, and grid capacity struggles, alongside potential policy shifts under the Trump administration. It critiques the environmental and economic viability of renewables like wind, solar, and EVs, highlighting issues such as land use, fragility, rising insurance costs, and reliance on subsidies. Germany’s energy policy failures and California’s regulatory influence are discussed, with emphasis on the need for practical solutions over ideological approaches. Steve Goreham concludes by sharing insights from his books and promoting balanced energy perspectives.

Thank you, Steve, for stopping by the podcast for our second interview. I appreciate your leadership and books in the energy space and recommend everyone check them out. – Stu

Amazon Green Energy Breakdown https://a.co/d/aE7jZU9

‘Highlights of the Podcast

00:00 – Intro

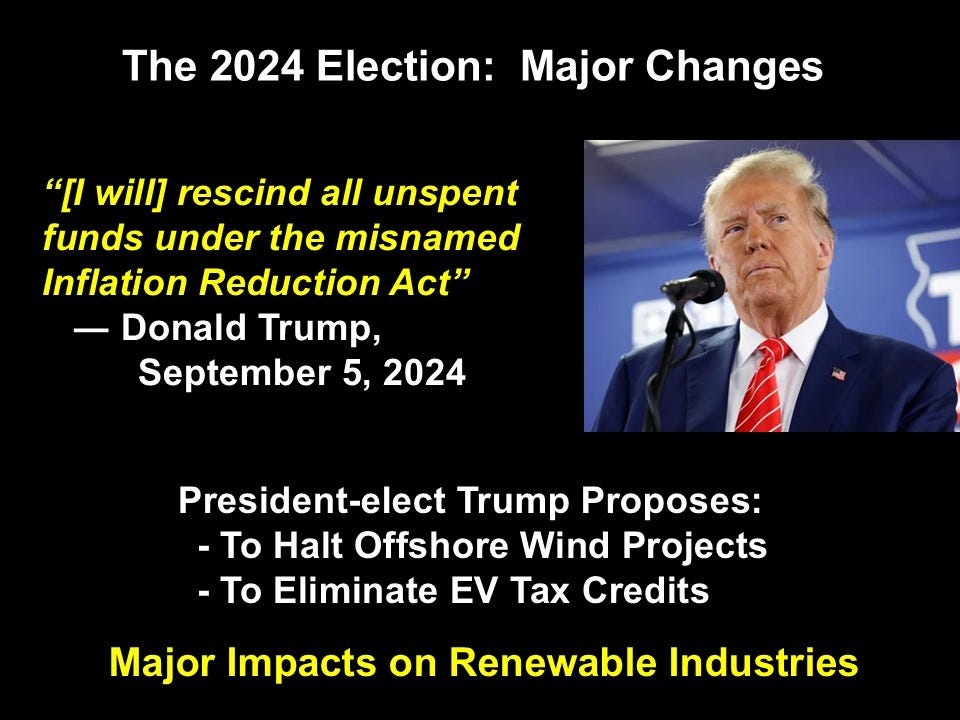

01:08 – Key energy issues: electricity demand, EV slowdown, and Trump’s policies.

02:17 – Rollbacks of emissions regulations.

04:26 – Inflation Reduction Act impacts.

05:46 – Germany’s renewable energy failures.

07:47 – AI-driven electricity demand.

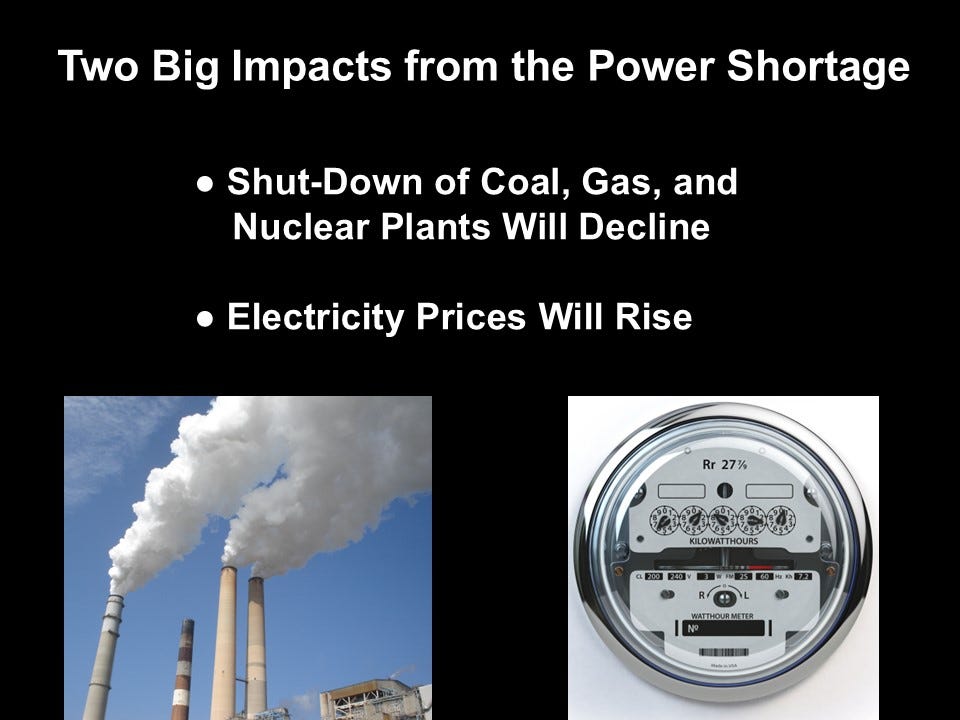

09:07 – Texas grid challenges.

10:26 – Land requirements for renewables.

11:48 – Solar panel fragility and insurance issues.

13:20 – Rising EV insurance and battery costs.

15:10 – EPA waivers and California’s influence.

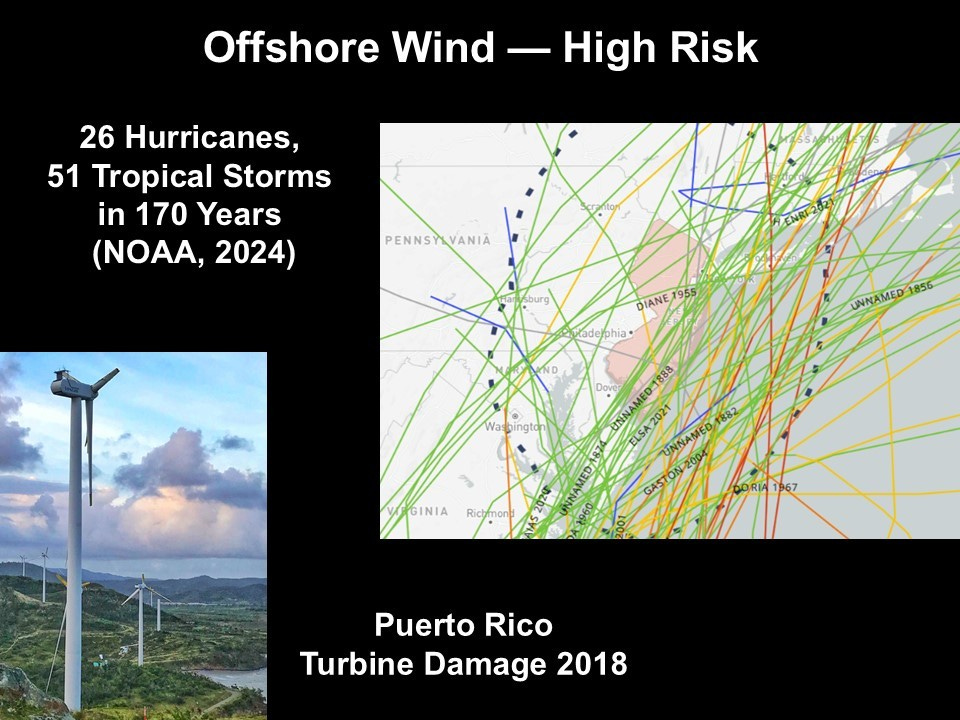

24:32 – Offshore wind turbine risks.

26:30 – Wind farm disposal and subsidies.

27:32 – Criticism of green technology’s impact.

29:05 – Steve shares contact info and promotes books.

Click the graphic to buy the book on Amazon.

Energy News Beat

Energy News Beat

We cover the global energy landscape and bring unmatched insights into the energy business. Follow us @ www.energynewsbeat.com

By Stu Turley

Stuart Turley [00:00:07] Hello, everybody. Welcome to the Energy News Beat podca st. My name’s Stu Turley, president and CEO of the Sandstone Group. Today is a special day. I’ve got a fantastic friend of the show and he is back. His name is Steve Gorham. He wrote the book Green Energy to break down the Coming of the Renewable Energy Failure. And I mean, it is a van tastic book that has aged well. Welcome, Steve. And we’re so glad you’re here today.

Steve Goreham [00:00:36] Hey, still great to join you again. Thanks so much and happy New Year.

Stuart Turley [00:00:40] Happy New Year. And I’ll tell you, with the new administration coming in, Steve, can you give us some of your thoughts on, you know, when we sit back and take a look? President Trump has said he’s going to end the E.V. mandates. And then you sit back and take a look at He’s also committed to reducing our cost of energy to consumers by 50% in the first year. Holy smokes, Batman. That is a huge commitment.

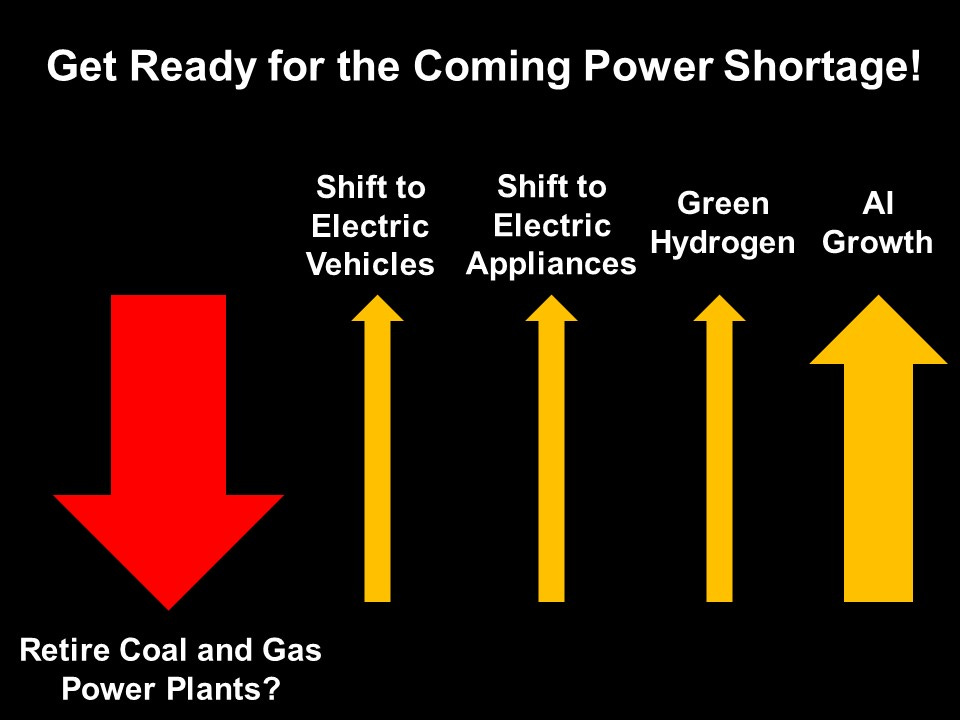

Steve Goreham [00:01:08] Well, that would be that would be special. He tends to exaggerate a little bit the new president. But yeah, 2025 could be the year that doom is green energy, not only in the United States but around the world. We have four big or big things going on. One is, is the rise of electricity demand driven by artificial intelligence. The second is the electric vehicle slowdown around the world, everywhere but China. Wind, solar and battery problems in many, many places on the grid and elsewhere. And then the new Trump administration policies. So it could be a big, big year of change.

Stuart Turley [00:01:40] I like the way you say big, big year of change. We’re as we are recording this, Kamala Harris got to be the first woman to ever certify her own loss as a presidential candidate. That was pretty cool.

Steve Goreham [00:01:56] Yeah, that is a special one. I like the way Mr. Trump has moved forward. You can see he’s learned so much from the first administration, as I recall, in 2016. It took him about six months to even get his cabinet people nominated. Now he’s got everybody all the way down 2 or 3 levels that have been proposed. Yeah, So it’s moving. They’re moving much, much faster than they did two terms ago.

Stuart Turley [00:02:17] You know, and when you take a look at the trifecta, Doug Burgum for Interior, Lee Zeldin for EPA and Chris Wray for Energy secretary, that three Musketeer group is phenomenal. And I think that you take it rid of the regulatory issues and you got Chris right, who knows energy inside and out and everything from nuclear to oil and gas. And I mean, he is a top notch guy. I think you’re going to have a heck of a team on the energy front.

Steve Goreham [00:02:53] Well, I think so. We’ll have to see how much they can do. Lee Zeldin, for example, there are three big things that the EPA put forward this year. Collections on power plant emissions. And those are being challenged in court by about 20 states. Regulations on vehicle emissions, automobiles to get like 60% by the year 2032. That’s being challenged by a number of companies. And then the California waiver that’s been granted on heavy trucks and on EVs and other things. Right. Those are all things that I think could be reversed or the they by the Trump Justice Department may not choose to defend these court suits. I mean, they may just let them fall away. We’ll just have to see. So there are some really, really big changes that could happen as far as the EPA. Right. And then, as you know, we have this inflation reduction act passed in 2023 that is just doubling vast amounts of money into renewables. It was the Cato Institute that’s estimating well, during the the first the Biden administration, it was about $15 Billion a year in subsidies, tax credits, other things going to renewables went down. Some under President Trump’s come up again under Biden. But with the Inflation Reduction Act, the Cato Institute says it’s going to be $80 billion in fiscal year 2025. Just huge amounts of taxpayer money going to all these crazy projects like carbon dioxide capture and storage, carbon pipelines, charging stations, offshore wind. And I think Mr. Trump has said he’s going to reverse a lot of that now since that’s a congressional act. They’ll have to pass some acts limited, I think. Right. And we’ll see if they can get that through Congress.

Stuart Turley [00:04:27] That’s going to be a tough one. And I love Dan Bongino when he calls it the poor keyless bill. I absolutely love that. You know, Dan Bongino is just a cool, cool cat. But when we sit back and take a look like the today when we’re recording this podcast, President Biden put the moratorium on oil and gas drilling. And even though everybody’s saying, Trump can go ahead and turn it back around, you know, it’s going to take years to unwind the way that they have done this, from what I understand. And. It is a absolute despicable act. It’s not going to stop drilling for tomorrow. It’s not going to stop drilling in the next month. But it is a slowdown of years in, quite honestly, natural gas length. Steve, let’s take Germany for half of the sake. Germany, with their evil policies and their green energy policies have failed. They got rid of their nukes. They tried to do wind and solar. They had to fire their, their coal plants back up. And and they have gone into full de-industrialization mode. And they’re a poster child for your book. They used to be the poster child for war. Clean, clean energy.

Steve Goreham [00:05:46] Yeah, they’ve they’ve really ruined their energy and they’ve relied, as you said, on two things. One is wind and solar and the other is imported natural gas, which they were getting for many years from Russia. What happened was the wind and solar has been having problems blowing in 2021. People don’t realize before the Russians invaded Ukraine, there was a summer when wind output was down more than 20%. And so in 2021, they burn natural gas all year. And by the end of the year, the price of natural gas in Europe had gone up by a factor of five, five times as expensive as it was. And then Russia invaded Ukraine and it just skyrocketed. And so if it wasn’t for the US and Qatar shipping liquefied natural gas, people would have been without heat all during the winters. And and but yeah, as you say, right now, natural gas is about three times the price in the US, electricity in Denmark and Germany where they have all those wind turbines three times the US price amongst the highest in the world and their industries can’t make it, many of them moving out chemicals and fertilizer and a lot of other things.

Stuart Turley [00:06:48] It’s just they lost the oldest steel mill. And I mean, that is that’s how you make cars. The engineering they’ve d industrialized.

Steve Goreham [00:06:58] And their auto industry is in terrible shape as well. They have a lot of problems with electric vehicles. Now EVs are down in Europe. They lost share in this last year and they have all these mandates and the consumers just don’t really want them except for maybe the wealthy or somebody with a second car. And so they just they’ve created all sorts of problems and they keep you know, they keep doubling down on all this stuff.

Stuart Turley [00:07:22] Do you in this past week, it was pretty amazing. I would have never I did not have on my bingo card that I think Saturday when I saw that Germany has bought more uranium. They haven’t even fired their coal, their their nuclear plants back online or failed to turn them back on. But they’re already buying the uranium because they know they’re going to need it from Russia.

Steve Goreham [00:07:47] Interesting. Yeah, that’s interesting. There’s a lot of talk about about a nuclear resurgence. We should talk a little bit about the demand in the United States. Yes, the demand is for electricity is something that’s new and it’s really going to stop the green energy movement in its tracks. So over the last two decades, we’ve had basically flat electricity demand in the United States, about 4.2 million gigawatt hours, almost no change. Right. But all of a sudden, we have well, there’s a number of green things going on and they want to shift to electric vehicles. They want to shift to heat pumps and away from gas appliances. And the US government, in all its wisdom, wants to produce billions of kilograms of green hydrogen. And every every kilogram of green Green hydrogen requires 50 to 55 kilowatt hours of electricity about running a house on two days. But then biggest of all is this new drive for artificial intelligence, said GPT came out about two years ago and all of the utilities in United States are blindsided. Texas, for example, recorded a record load in 2023 of 85GW. But because of the high, they’re now projecting they’re going to need 150GW. They’re going to need to almost double it by 2030. And, you know, they don’t know how to do this. Virginia, how do you.

Stuart Turley [00:09:00] How do you double that Texas Ercot grid in five years? Steve Well, I don’t know how we do that.

Steve Goreham [00:09:07] I know I don’t know how they’re going to do it. So you’ve seen the headlines. So what’s going on? There’s there’s a bunch of things happening. The first off is the nation’s going to have to stop shutting down coal plants. And we’re already seeing that, you know, they’re extending the nuclear plants. Those are the ones getting all the headlines. There’s a new nuclear plant being or other a nuclear power plant being restarted in Michigan. The Palisades plant, a Microsoft is contracted for a restart of one of the Three Mile Island generators for the utility.

Stuart Turley [00:09:36] They’re not have that on my bingo card.

Steve Goreham [00:09:38] You know, they’re extending the the Diablo Canyon plant in California. So they’re extending all these nuclear plant and nuclear plants. And then we’re having this we’re seeing the same thing with coal plants. Other one, two, two plants in Utah, two plants in Wyoming, two plants in West Virginia that have been extended that were scheduled for shutdown. And now we’re looking at Tennessee and Maryland and other places to extend these coal plants. And we’re still not going to have enough. So the Green Movement already sees this coming and they’re starting to wheel in their teeth. So so the wind and solar just can’t handle this? No, it takes 100 times the land to get the same output from wind and solar as a coal, a nuclear or a natural gas plant. There’s just no way you can do it. And so this is going to stop the green movement, its tracks. And when Mr. Trump comes in and pulls all the subsidies out, too, it’s going to further, further shift the dynamic.

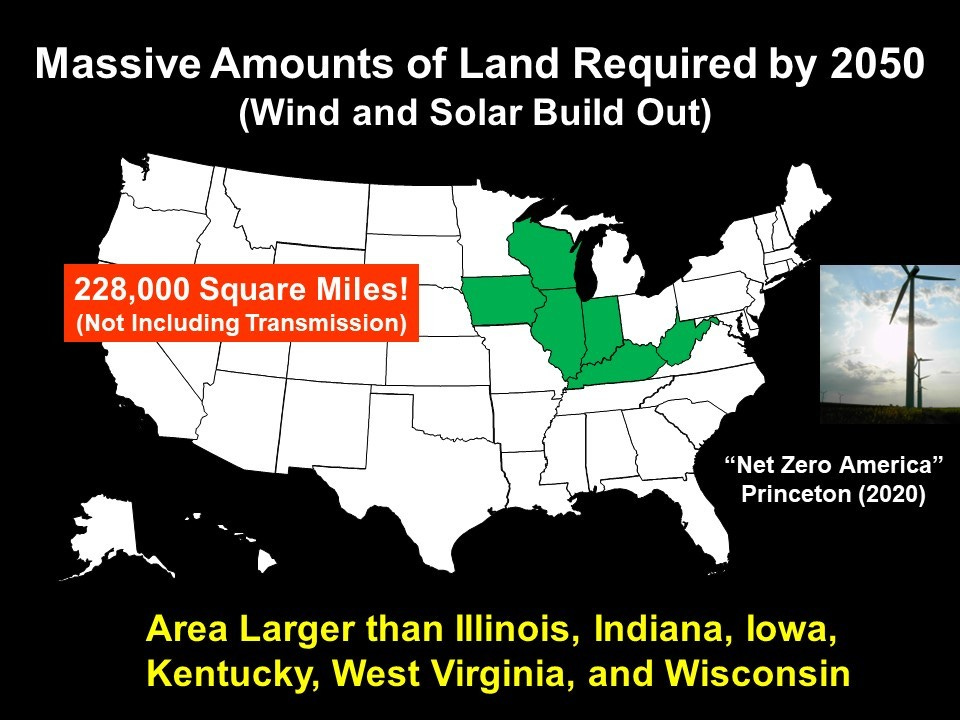

Stuart Turley [00:10:27] You sent over a graphic and the massive amounts of land required by 2050, wind and solar is 220,000mi². You’ve got the whole almost the the the states. We’re going to have this brought in in this podcast for our listeners. That’s almost all the swing states.

Steve Goreham [00:10:47] Yeah. This was about it’s worth about six states. So this was from a study called Net zero America by Princeton University in 2020. And Princeton is a renewables fan. But they said to go from 10% renewable electricity at that time to 50% renewable by 2050 would require 228,000mi² of incremental land. And that’s more than six states. I mean, this is something that is never going to happen.

Stuart Turley [00:11:12] No.

Steve Goreham [00:11:13] And we’re already see a lot that we’re seeing a lot of local local opposition. I’m trying to think of a gentleman who tracks this.

Stuart Turley [00:11:19] And Steve, I read something the other day that the solar panels you also sent over a storm damages to solar farms is incredible. I mean, a hail farm in Texas just wipes it out. Sorry, but edit hail farms, find a way to do that. And I read somewhere that they were saying that the solar panel farms can absolutely be more devastating to the environment than nuclear waste than our nuclear fleet.

Steve Goreham [00:11:48] Well, they do blanket the blanket, the area. And, you know, I mentioned this 100 to 1 land difference that comes from scientists by name of Clive Small in Canada. He actually wrote it wrote a book that looked at the the footprint of different electrical power sources. And he counted everything. He counted pipelines and waste pits and mines and everything. And he found that if you set a nuclear at about one unit of electricity for one unit of land, natural gas and coal are about the same. But solar and wind require more than 100 times the land to produce that same one unit of electricity. So so these are just these are just huge, huge costs in terms of land and build out. And then, you know, you can’t use enough land. There’s no way you can be able to serve the the air revolution on this. And you mentioned you mentioned the weather fragility. One of the things about about having you know, if you if you put coal or nuclear, you put it in a site, a building or gas. Yeah. And, you know, it’s pretty well protected from something like hail. But we’re now having more and more solar fields that are being destroyed by hail. So, you know, we’ve had three major ones in the last year that have been completely trashed. And the the insurance claims for hail damaged for solar or solar averaged about $58 million per claim. And they are going up and up. And the cost of of insuring these these solar facilities has gone up by as much as 400% in some cases. Or they put a limit on the policy coverage of like 10 or 15 million. So again, just another reason why why wind and solar have are having these problems.

Stuart Turley [00:13:20] Now, insurance also in the EV space has been a huge, huge issue because those things a way bunch their tires way more and the everybody’s complaining about the insurance on an even quadrupling I mean it’s been nuts.

Steve Goreham [00:13:38] Yeah the number I had is that on average good spots of yours are 70% more expensive in the US and in the UK, I think they’re much, much more expensive. And the other thing is, you know, if you get into a minor accident and you damage the battery in any way, there’s no way to to fix the battery, you have to replace the whole thing. And that’s like a 4000 to $20,000 charge. And so you have people like Hertz Rental that is getting rid of all or even, say, in a matter of fact, the CEO, I forget his name, but he was forced to step down because he he committed to buy all these electric vehicles from Tesla and others. And then when they.

Stuart Turley [00:14:09] Hit the market, did not like him for.

Steve Goreham [00:14:11] No. And they have to mark them down. You know, Hertz is in the not only the rental business, but they’re in the auto business as well. They buy cars and then they resell them. Right. And and in one year, the price of their their car, their EV car stock went down 30% and they had to write all that off. And so, yeah, they got rid of the CEO at Hertz, but there’s just a bunch of a bunch of issues with these things. But again, the problem is that we have we have many state governments and the Biden administration that wants to force everybody to get an electric vehicle thinking that they can stop the rise of the oceans if they do that. And that’s that’s 100 superstition. And now it’s it’s all sort of caving in.

Stuart Turley [00:14:47] In that in that well. And you have Governor Newsom in the I believe there’s what, 17 states with Governor Newsom that have state laws that have California and acts and EPA of a something. They can follow along on theirs. So he has reach through the follow along state legislatures. It’s just amazing to me about that reach.

Steve Goreham [00:15:11] Well, that’s a problem. The EPA has been granting waivers to California for many years on air pollution. It was it was set up in the 1970 Clean Air Act, I believe, because California already had some laws about air pollution, which was fine. But it’s become a situation where the EPA rubberstamp everything that California does. And then we have a bunch of other states that follow it as well. So we got all these crazy rules about things like heavy trucks, which are going to be impossible to electrify. But we’ll see. We’ll see what the Trump administration does. I think this maybe some of these may be a rollback or they may they may remove those waivers and that’s going to cause some big, big changes.

Stuart Turley [00:15:49] I’ll tell you, I’m I’m trying to get together some things for Doug Burgum, for the interior, as well as Lee Zeldin and Chris. Right. Chris Right. Has been on the podcast and he is a cool cat.

Steve Goreham [00:16:02] Yeah.

Stuart Turley [00:16:03] Absolutely. Love Chris. Right. And if we can get a panel together and some things I’d love to lean on you on some of these things and help see if we can help tee it up for them because I don’t know that they’re going to need every, every arrow in their quiver to help overcome the Biden administration landmines, if you would.

Steve Goreham [00:16:26] It’s going to be difficult. Bunch of those are guaranteed by X and in the case of the EPA, by the rulemaking, which takes a long time, but there’s many, many things could be done. Chris Right. First off, he needs to kind of purge all the the Department of Energy websites and say, you know, we’ve got all this global warming thing and if we do, all these things will stop the oceans from rising.

Stuart Turley [00:16:45] Is not a global warming friendly person at all.

Steve Goreham [00:16:49] I mean, that’s that’s one of the things that needs to be done. I mentioned three things about the EPA, the power plant emissions, car emissions, and then the waivers to California. Those need to be rolled back. Yep. The the ban on export terminal. So Mr. Trump put into place a natural gas export export terminals. As we were talking earlier, I presented to the Pennsylvania Independent Oil and Gas Association this last year the price of natural gas in Pennsylvania is so low that they can’t make any money on it. They have so much gas and they can’t get it to market. States like New York have block pipelines. They’ve got to send it down to the Gulf. What we really need is a natural gas export terminal on the Delaware River. And we could ship a lot of the gas all over the world. We could reduce pollution from things like burning wood and charcoal and things that are causing problems for people. So that would be a big thing that could be done. What a.

Stuart Turley [00:17:40] Great idea. And putting a floating station in could happen quick.

Steve Goreham [00:17:44] Yeah, maybe. I don’t know the details on that, but but possibly they’re doing some of that in Europe. I think the floating stations for offloading.

Stuart Turley [00:17:50] Like Vietnam just put in a LNG import direct to power. So that is a very, very smooth and fast way to a power station by bringing in a floating import facility. It it it’s faster. And I and I love what President Trump has said. If anybody is going to be investing in the United States and you want to bring in did you see when he was interviewing that or bringing forward that gentleman that was bringing in billions of dollars, 100 billion? And then he stood there and he says, are you going to invest 100 billion? What about making it 2 million?

Steve Goreham [00:18:26] 200?

Stuart Turley [00:18:28] They get 200 billion. I love President Trump for doing that. That was funny. But that’s the kind of thing your comment bringing in a gas facility for Pennsylvania to be able to to get up to New York. But Governor Hochul just signed the the bill that is climate reparations against the oil companies. Yeah, she is an absolute I got to make sure I don’t lose my podcasts and nut job, I think is what I was going to say.

Steve Goreham [00:19:03] Well, I think this is the second time a state has done it. I think Connecticut did it recently as well. We’ve had a lot of these suits in the past, but typically they’ve been cities or counties. Right. Of the city of New York, Chicago, San Francisco, Oakland, a lot of these different cities, I think Denver, Colorado, or counties have have sued the oil companies, claiming that they’re getting rid of snow. They’re doing all sorts of things, causing dangerous climate change, causing the oceans to rise. Those have all been defeated. I don’t think there’s a single case in the United States when monetary damages have been awarded to a group away from the oil companies. The only place where where legal action has been successful, I think, is when groups sue the states and force the states to reconsider. The courts have said, well, state, you have to reconsider. But but in the case of Connecticut, in New York now, this is the first time that states have actually brought suits against and we.

Stuart Turley [00:19:54] Don’t know the judges that may be either Obama or Biden. Appointed judges. It may end up in law fair.

Steve Goreham [00:20:03] Well, this is not a you know, it’s it’s like this ocean race thing. If you go to a site on Nassau. Nassau estimates that oceans have risen 120m since in the last 20,000 years, 390ft. And we’ve only had human carbon dioxide emissions since about 1940. And the oceans have risen about four inches since that time. So four inches out of 390ft. Yeah, everybody everybody’s out there suing them for sea level rise. You know, this is just this is beyond anything sensible. This is modern superstition.

Stuart Turley [00:20:33] Have you ever seen the. I just saw this on tech talk over the weekend. A guy has got a glass of water. He puts a big ice chunk in it. Yeah. Puts and he starts melting that big ice jug and the water stays the same level.

Steve Goreham [00:20:50] It doesn’t change much. No. Well, that’s the case for the Arctic, which the ice is floating. What climate scientists will tell you, though, if the Greenland ice melts or the Antarctic ice and seals are on land masses, that would cause a big rise in ocean levels. Right. But again, there’s really not any evidence that the only rational solution to ocean rise and even to climate change is adaptation. You do it. Netherlands has done for centuries now. They build seawalls. They build islands. Right. Thinking we’re all going to drive an electric car and we’re going to stop the oceans from rising. That’s that’s just foolish stuff.

Stuart Turley [00:21:23] And Spain has had horrific flooding right now, but now nobody is asking the question, Steve, The U.N. mandated Spain take 200 dams out to make it more natural and that eliminate flood control. So it was no climate change. It was dam change.

Steve Goreham [00:21:48] Well, that’s what California is in the process of doing. And Washington’s considering, too. And they all say, well, you know, this is but they don’t think about the flood control issue. You know, I used to present what happened in 1861, the great California flood of 1861.

Stuart Turley [00:22:03] Yeah.

Steve Goreham [00:22:03] They literally got a year’s worth of rain over a few days. And in in January, the Mojave Desert looked like an ocean. They got something like like, well, I forget what the totals were, but there was a there was a guy who toured the the by the way, they had ten foot of water in Sacramento and the government was moved to San Francisco till the water went down. And then in this in the Sacramento Valley, the water got up to the the poles. These were telegraph poles at the time. It was 20ft high from the western mountains to the eastern mountains had flooded thousands of farms. A fifth of the cattle in California were killed from that one incident. And that’s the power of what weather can do, what nature can do. Since then, they built a lot of dams, and I think that makes a big difference. But if you start pulling those out, you may end up with problems again.

Stuart Turley [00:22:49] And it’s why so many people died in Spain and everything else. And you just have to sit back and go. What happened to logic, Steve? I mean, when you and I grew up, things were a little bit more logical than they are now.

Steve Goreham [00:23:01] Yeah, well, the ideology of climate system is powerful, and the fear that people get of of that comes from all the media and everything else. And education is powerful. But, you know, we’re going to see this turn around in the next few decades. We could have a couple of decades of cooling. You never know. It’s very hard to predict future global temperatures, I think.

Stuart Turley [00:23:18] And, you know, one of the things that I found very disturbing is if we if we would get rid of geoengineering and I and I know that geo everybody says, Kim trails are are that there’s too much evidence out there of all of them just absolutely let’s not spend any money or get all that money out if it isn’t happening. It just seems nuts to me that they’re spending all that money.

Steve Goreham [00:23:44] Well, we’ll get we’re going to get big changes here and we’ll just have to see what what goes on with the new administration. You know, these these offshore wind turbines are another thing. Yeah. We have Massachusetts and Rhode Island and Connecticut and New Jersey and New York and a bunch of states building these things offshore. But, you know, we had one wind turbine break up off the coast of Massachusetts, a single blade that was 300ft long fell off a wind turbine, and it produced five truckloads of plastic debris on the beaches. That was a single blade. Wait till we get a hurricane that goes through some of these these these fields of of Virginia Beach or or Long Island or wherever. They’re going to have a just a massive mess. These things are not in Europe. They have a lot of these, but they don’t get the storms that we got. So just another another problem waiting to happen.

Stuart Turley [00:24:33] With this in the in the microplastics that come off of those blades. What was horrific after talking to a marine biologist about this is the marine biology, the people that actually know science. We’re just absolutely stunned by how dangerous the wind farms are.

Steve Goreham [00:24:52] Well, the again, we’re not and they do take measures, you know, to protect these blades. They have the. The blades, turn in the wind and be feathered. The problem is that near the eye of a tropical storm of a hurricane, the winds change instantaneously from one direction to another and too fast for anything to react. So I shipped you a slide that shows all the from from Noah, that shows all these storm tracks around New Jersey. And in 170 years, there were 77 hurricanes or tropical storms. That’s about one every two and a half years. Boy, you have one of those come through a wind farm and they’re going to have a mess far beyond what they saw in Massachusetts this year.

Stuart Turley [00:25:29] My goodness. Yes. We will definitely have this in the show notes and they will be there. That is a heck of a storm pattern. Add to it 26 hurricanes, 51 top tropical storms and 170 years. Well, you know, and you sit back and your map, your data and your research is amazing when you consider they they are never a wind farm is never fiscally responsible from day one. The only reason it is able to be put up is because of subsidies and tax incentives. And then after five years, the maintenance numbers that I’ve been able to pull together, the average farm is applying for new money so they can upgrade the turbines and get more particulates. I mean, inflation reduction money. So instead of lasting 20 and 30 years, they have the best potential of 5 to 10.

Steve Goreham [00:26:31] Yeah, I think the tax cut is going to run out in ten years as well. So they they need to renew to get those. Yeah.

Stuart Turley [00:26:37] And it’s just amazing.

Steve Goreham [00:26:39] What do you do with the blades when they run out to you? You know, right now we have the blades that come from Iowa. Wind farms are being shipped to Nebraska because none of the landfills will take them. And I think, well, there are two big.

Stuart Turley [00:26:49] Ones sort.

Steve Goreham [00:26:50] Of in Europe right now, which, you know, doesn’t help with their emissions numbers.

Stuart Turley [00:26:54] I did not see that. Now, I saw that Scotland had taken out 14 million trees, you know, in order to put their wind farms in. And then they got because their wind turbines are turbines, they have to have diesel generators in their design in order to keep them turning enough to get to a certain speed. And when the speed gets up, then they can shut their diesel generators down. And so, you know, here it is. They’ve ruined the wood, they’ve destroyed this, and then they’re burning all this diesel to get the wind generation going.

Steve Goreham [00:27:32] Now, it’s it’s it’s real fortunate, you know, And again, it’s this it’s the basis of all this is to try and reduce CO2 emissions thinking that we can control the climate if we do that. But the climate is much more complex and it it.

Stuart Turley [00:27:45] Is was the shame your forward was by Mark Mills and I absolutely love Mark Mills Mark Mills that book and I’ve had the pleasure of interviewing him twice. And again I’m highly recommending everybody go out and buy this book now tell him Stu sent you and then this is absolutely a net. Zero is nothing more than a wealth transfer, in my opinion. I think net zero is absolutely a financial fiscal policy club The the administration has been using around the world.

Steve Goreham [00:28:21] Thanks.

Stuart Turley [00:28:21] To it isn’t.

Steve Goreham [00:28:22] It is a fun paperback. It’s got a whole bunch of color sidebars in it. A great stories about the one professor that says we should all lead human flesh to control global warming. There’s a there’s another one about a Southern California cosmetic surgeon that was taking tissue from his patients and turning it into his vehicle fuel. He was he was actually prosecuted. That’s not legal to do. But we’re just we’re just filled with crazy energy and climate things in this world right now. And it makes it kind of fun.

Stuart Turley [00:28:47] It does. In fact, there’s a picture of a boneyard wind turbine blade waste near New York. And in Texas, they got a boneyard out there in Texas. And these things are just absolutely horrifically bad for the environment. How do people get a hold of you, Steve?

Steve Goreham [00:29:05] They can go to my.

Stuart Turley [00:29:05] World.com.

Steve Goreham [00:29:07] Ingram Goram AMD com. I’ll send him a signed copy of this book or any of my other three. There’s one called The Mad Mad Mad World of Climate tism. If you have kids in junior high or high school, they need this book to get a more balanced, balanced view.

Stuart Turley [00:29:20] And green outside the green box.

Steve Goreham [00:29:23] Yeah, that’s about sustainable development. And it talks about how the four and the four horsemen, the environmental apocalypse, overpopulation, resource depletion, climate destruction and global pollution. If you look at all of those, the trends are really good. And all of those despite what you read in the press. So it talks about a little broader discussion of all those areas.

Stuart Turley [00:29:42] Right? Well, thank you so much for stopping by the podcast. We’re going to have the staff roll this out as soon as we possibly can. So thank you very much.

Steve Goreham [00:29:50] Stu, always at your service.

Stuart Turley [00:29:51] Hey, we’ll talk to you soon. Thanks.

The post The Renewable Energy Reckoning: Challenges, Failures, and 2025 Policy Shifts appeared first on Energy News Beat.

The six-week Maha Kumbh festival began in India on Monday, a Hindu event that is celebrated roughly once every 144 years and is thought to be the world’s largest gathering of humanity. Some 400 million Hindu pilgrims from around the globe set to bathe in and around the Ganges River.

The six-week Maha Kumbh festival began in India on Monday, a Hindu event that is celebrated roughly once every 144 years and is thought to be the world’s largest gathering of humanity. Some 400 million Hindu pilgrims from around the globe set to bathe in and around the Ganges River.