Energy News Beat

ENB Pub Note: This article first ran on The Crude Truth Substack by Rey Trevino here: https://crudetruth.substack.com/p/what-is-impacting-oil-prices-today. I agree with the article and the author, but what do you think? Do you think Saudi Arabia can control production, or will it just give up? When countries that can just print money do it, what is wrong with countries just drilling more oil?

The news cycle is absolutely wild right now, and I am getting lots of questions from people across the country. What is going on in the oil market? Why are the tariffs impacting oil?

Well, let’s take a look at a couple of things that have been building in the global oil market for several years. First will be the OPEC+ membership infighting going on and even concerns that the Saudi Arabia leadership cannot control the member production commitments. They have been producing and selling in through the dark fleet due to the Biden Administration’s sanctions. The second aspect will be the demand side of the equation, as the Trump Tariffs may actually impact oil on that side of the equation.

OPEC+

- Base Cuts (2 million bpd): This is a group-wide reduction agreed upon by all OPEC+ members, initially set in 2022 and recently extended through December 2026.

- First Voluntary Cuts (1.65 million bpd): Eight key members—Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman—implemented these in April 2023. They were originally due to expire in 2024 but have been extended to the end of 2026.

- Second Voluntary Cuts (2.2 million bpd): These additional reductions, also by the same eight countries, started in November 2023 and were initially set to run through early 2024. They’ve now been extended to March 31, 2025, after which they’ll be phased out gradually, with monthly increases of about 180,000 bpd planned through September 2026.

However, actual production doesn’t always match these targets due to overproduction or underperformance. For example, in September 2024, OPEC+ output was reported at 40.1 million bpd, down 557,000 bpd from August, with Iraq, Russia, and Kazakhstan often exceeding quotas. Iraq, for instance, pumped 4.11 million bpd in September against a 4 million bpd limit, while Kazakhstan hit 1.55 million bpd despite a 1.468 million bpd quota. Meanwhile, OPEC alone (excluding non-OPEC allies) trimmed output to 27.43 million bpd in March 2025, reflecting cuts from Nigeria and Iraq.

On the flip side, OPEC+ is starting to unwind some of these cuts. As of April 2025, the group has begun easing the 2.2 million bpd voluntary cuts, with plans to add back supply gradually. Posts on X suggest an increase of 411,000 bpd in May 2025, though this is part of a longer 18-month unwind process. The UAE is also ramping up, with its production target rising by 300,000 bpd, phased in through September 2026.

So, to sum it up: OPEC+ produces roughly 40-41 million bpd currently, with total cuts of 5.86 million bpd still in place. These are split between 2 million bpd group-wide, 1.65 million bpd voluntary (extended to 2026), and 2.2 million bpd voluntary (tapering off from April 2025). Actual output varies, and the group’s influence is tempered by rising U.S. production, now over 13 million bpd, and shifting global demand.

With OPEC+ members constantly overproducing their quotas with over 1059 tankers currently in the dark fleet, the “Gray” market for oil has been very active and capable of avoiding sanctions. Countries that need more money will produce more oil and sell it to China and India at reduced rates. Don’t be shocked, but the US buys from sanctioned countries, and you can probably guess which state.

With the supply side controls broken, you have to look at demand and pricing sentiment. Saudi Arabia needs the price well over the $85 dollar mark just to pay for their social programs, and they can drill cheaper than the United States or Canada. The U.S. can no longer drill at will, and they also need higher oil prices.

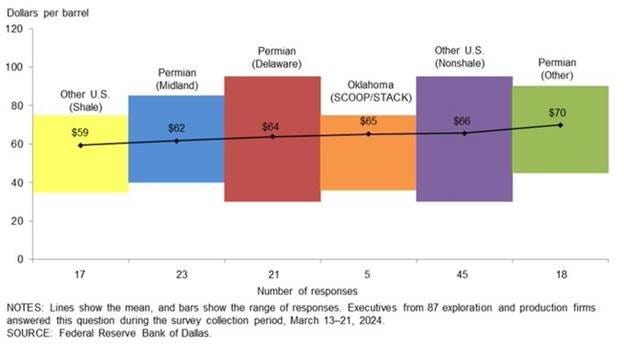

The following is a survey report summary from 87 exploration and production companies by the Dallas Fed.

We are in the middle of the Trump Tariff right sizing the trade imbalances, and that may not be the biggest impacting component to the oil pricing at this time. It will be the demand side of the equation to see how the global economies react. As we are in the middle of the tariff forest right now, we can see the trees, so to speak. It may take some time to see how the demand side shakes out.

China and India’s demand is probably the most important aspect of the global pricing sentiment and its impact on oil.

China

China’s oil consumption in 2025 is forecasted to experience modest growth rather than remaining steady, though it’s a significant slowdown from its historical pace. The U.S. Energy Information Administration (EIA) projects China’s liquid fuels consumption to increase by about 250,000 barrels per day (b/d) in 2025, up from a much smaller 90,000 b/d rise in 2024. The International Energy Agency (IEA) offers a slightly more conservative view, suggesting a total oil demand growth of around 220,000 b/d in 2025, per its January 2025 Oil Market Report. This follows a period of stagnation or decline in fuel-specific demand (e.g., gasoline, diesel, jet fuel), which the IEA notes has plateaued at around 8.1 million b/d in 2024—down 2.5% from 2021 levels.

This modest uptick in 2025 is driven largely by petrochemical feedstock demand (up nearly 5% in 2024 and expected to continue), rather than traditional transportation fuels. Factors like rapid electric vehicle (EV) adoption—displacing over 1.4 million b/d of global oil use already—and a shift to LNG for trucking have capped fuel demand growth. Economic challenges, including a sluggish property sector and weaker-than-expected GDP growth (projected at 4.8% by Standard Chartered), further temper consumption. The IEA even suggests that total oil demand might plateau later this decade, with some analysts (e.g., CNPC ETRI) predicting a peak as early as 2025 followed by a decline. So, while not declining outright in 2025, China’s oil consumption is far from robustly steady—it’s more of a cautious, uneven climb.

India

India’s oil consumption, on the other hand, is expected to grow more noticeably in 2025, outpacing China as the leading driver of global demand growth. The EIA forecasts an increase of 330,000 b/d in 2025, following a 220,000 b/d rise in 2024, making it the largest contributor to global oil consumption growth (about 25% of the total). The IEA aligns with this trend, projecting 230,000 b/d growth in 2025, driven by rising demand for transportation fuels (especially diesel/gasoil) and household cooking fuels. This reflects India’s economic expansion, urbanization, and a growing middle class, with total consumption expected to hit around 5.6-5.8 million b/d by year-end.

Unlike China, India’s transition away from oil is slower—EVs are projected to reach only 7% of new car sales by 2028 (vs. 42% in China), and coal remains a dominant energy source, delaying aggressive decarbonization. However, growth isn’t without hiccups: The IEA noted weaker-than-expected demand in late 2024 (e.g., a 300,000 b/d drop in August due to monsoons), suggesting some volatility. Still, India’s trajectory is upward, not steady, with the IEA estimating it will add 1.2 million b/d by 2030, a third of global gains.

- China: Not quite steady—expect a small increase (220,000-250,000 b/d), but it’s a far cry from past booms, with fuel demand flatlining and growth reliant on petrochemicals. A peak could loom if economic stimulus falters.

- India: Definitely not steady—consumption is set to rise (230,000-330,000 b/d), fueled by economic and demographic drivers, though seasonal or economic dips could introduce some variability.

Both countries’ oil consumption in 2025 will likely deviate from a flatline—China with a tentative uptick, India with a clearer upward trend.

We will be watching the downstream aspects of both countries and their exports. That will be an accurate economic barometer for how oil prices will fare for the rest of 2025. One of the best matrice components will be the downstream production numbers; we will report those as they are available.

I have friends that are still bullish on oil prices at the $80 to $85 range because or the Saudi Arabia economic demands they have found themselves in, and global demand looks to be slow and steady. Yet others are leaning toward $65 oil, and as you can tell from the chart above from the Dallas Fed, they will not turn on the “Drill Baby Drill” for more rigs.

We are in a cycle, and that cycle is the news cycle. – One of the wildest in modern times.

Is Oil and Gas An Investment for You?

Trading Desk

The post What is impacting oil prices today? Is it the Trump Reciprocal Tariff, or is supply and demand returning to the pricing matrices? appeared first on Energy News Beat.