Energy News Beat

This is a significant story in the geopolitical energy markets, as we are witnessing a substantial shift in the global financial push for the acquisition and classification of oil, mineral, and gas fields on balance sheets. George McMillian brings up some critical points. I cannot be more blunt. The Trump Administration needs to get him hired for several different slots. He has been right for years, and has insights from boots on the ground, coupled with his academic studies, and understanding of energy.

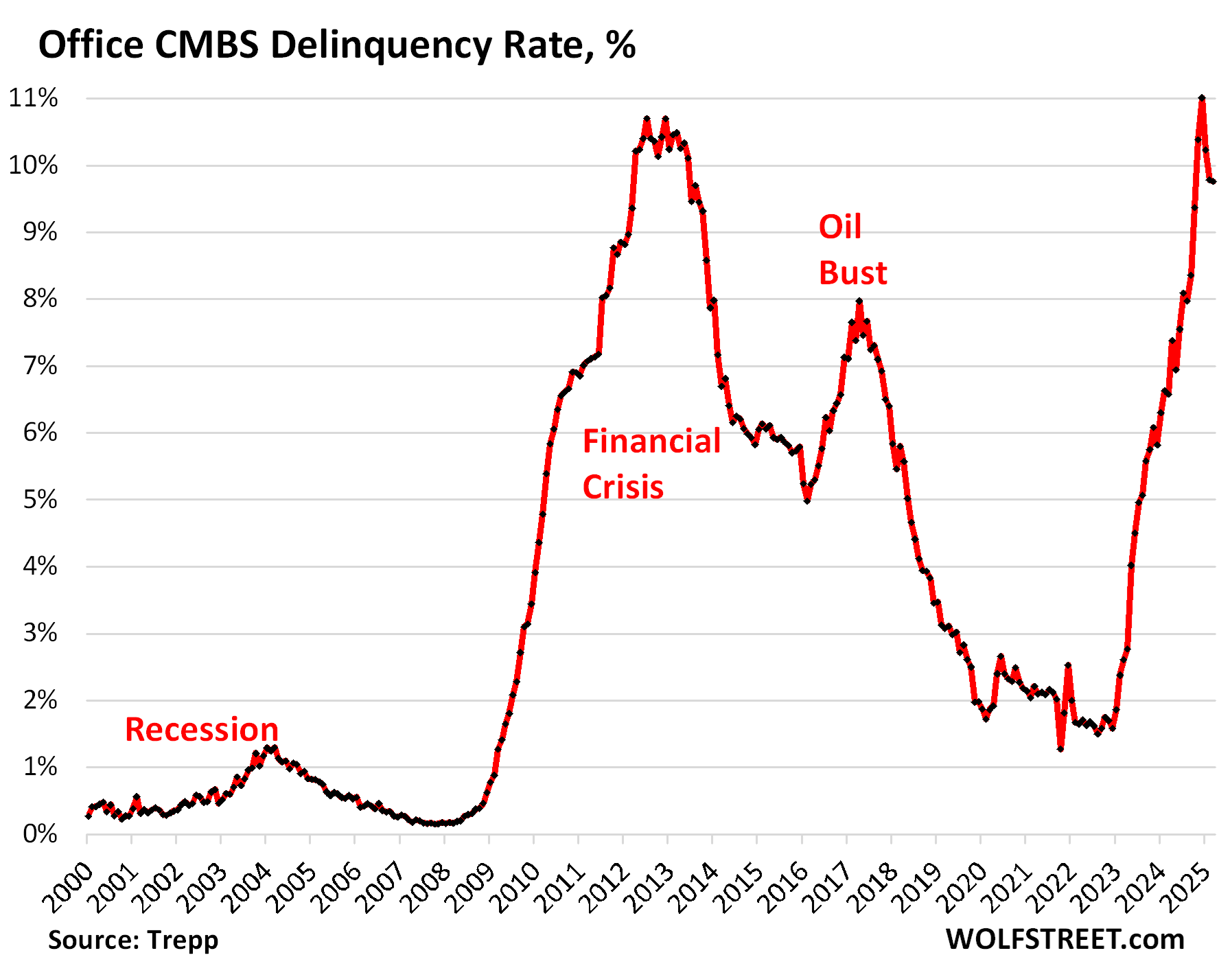

The changes we are seeing in global markets are massive, and a great deal is riding on these developments. The EU, UK, China, and the United States cannot keep up with their current path of debt-to-GDP ratios. It seems that Russia and India are the only two major growing economies at the moment.

• The European powers, particularly the UK, France, and Germany, are facing a financial crisis and are trying to acquire land and resources to collateralize their debt, including the minerals in Eastern Ukraine.

• The US, UK, and EU are using the threat of Iran’s nuclear program as a pretext to try to take control of Iran’s oil and gas resources to shore up their finances.

• However, all Putin has to do is nothing, as the European economies are collapsing, and the populist parties that are rising to power in Europe will likely restore economic ties with Russia, undermining the US and NATO’s efforts to isolate Russia. • The US and its allies are pursuing a Wolfowitz doctrine to economically and militarily encircle and disintegrate Russia. Still, this strategy is backfiring as it is causing European countries to exit the EU-NATO bloc and join the Eurasian Economic Union instead.

• The US and its allies are trying to control the global supply of energy, minerals, and agricultural commodities to maintain their economic and geopolitical dominance, but this is leading to increasing tensions and conflicts around the world.

You can contact George on his LinkedIn here: https://www.linkedin.com/in/george-mcmillan-5665b015/

The Telegram / Energy News Beat interviews with George: https://t.me/GWM3_Geostrategic_EnergyNewsBeat

Stu Turley, CEO of Sandstone Group [00:00:13] Hello, everybody. Welcome to the Energy Newsbeat podcast. My name is Stu Turley, President and CEO of the Sandstone Group. I tell you what, the world geopolitical situation around the world is misunderstood, except it’s involving an underlying energy issue. And today I’ve got George McMillan with us on a regular series for what’s going on around the world with geopolitical and energy issues. Welcome, George. I’m so glad to have you here today. I’m doing great.

George McMillian, Geopolitical Analyst [00:00:46] There’s a lot going on, like we were discussing before, we want to hit three topics today. One of them is that the European powers can no longer finance their enormous debt-to-GDP ratios. Danny on Capital Cosm and his crew of Martin Armstrong, Tom Luongo, and Alex Crainer have been talking about that for several months. Wow. So… They know that they wanted the minerals, they were tying that to the minerals in Eastern Ukraine because they need to collateralize their debt. The United States can collateralize its debt with the minerals we have in North America. Britain’s a tiny island, they cannot, France is too small. Okay, next thing is now they’ve used the WMD threat, the nuclear threat in Iran, just like they did in Afghanistan for pretext to invasion. The play there is they need to collateralize their debt by taking over the all the oil and natural gas and mineral fields in central Asia specifically, you’re talking about Iran and Turkmenistan, Caspian Sea area and then up North Kazakhstan.

Stu Turley, CEO Sandstone Group [00:02:13] And the pipelines resulting therein outside going back to the European area, correct?

George McMillian, Geopolitical Analyst [00:02:20] Right. So now that then they can send, they can send the pipeline routes through Iran, through Armenia. Now they wanted to send it through Georgia. But the dream party won. That’s why rigging, I’m heavily influencing those elections in Georgia was so vital because you need control. The maritime choke points, riverine choke points the ports and the terrestrial land bridge choke points. That’s what geostrategic theory is about. Geoeconomic theory is about how to move resources. How to move resource in a perfect world where everything is a permissive environment. So geostrategy theory is about how get your rivals, how to get your allies to work cooperatively. And then thwart your rivals.

Stu Turley, CEO Sandstone Group [00:03:19] And then, and how do these play into number three?

George McMillian, Geopolitical Analyst [00:03:23] Okay, so number three is all Putin has to do is nothing because European economy is going broke. The populist parties are rising. We’ve been talking about the Iran thing, the populist parties since November and December of 2023. So this is nothing new. I’ve already explained this a few generals that are on other shows, and they didn’t get it. It went over their heads. So they’re still talking about the nuclear threat. No, that’s not who’s pushing it. And the London and Paris banks and Brussels banks can’t admit that the nuclear threats and other red herring because they don’t want to admit that they’re doing it to their debts by taking over other people’s resources. Putin now knows that if he does nothing, if all he does is nothing, the populist parties take over in Europe and the European major power banks can’t collateralize their debt and they’re gonna go into a sovereign debt crisis.

Stu Turley, CEO Sandstone Group [00:04:44] Wow. With Secretary Rubio coming out, there’s two things, George, that I have a privilege of visiting with you and your articles on energynewsweek.co. If you go to the top heading bar, you can just see George McMillan Geostrategic on the menu. And your landing page is very well trafficked there. In March, we’ve had over 1.3 million people on the site. And I can see how many people are looking at your, your traffics and everything else there. And, um, what is, is, cause I can hear you in these podcasts. I can watch Fox news and I can see the talking generals. They don’t understand what number three is. And that is all Putin has to do is nothing. They are clearly not understanding. What is going on? Do you want to start with number one and then we’ll go from one to two to three?

George McMillian, Geopolitical Analyst [00:05:46] Do it again.

Stu Turley, CEO Sandstone Group [00:05:47] Tell us about your go to go to number one tell us in more detail about why number one is so important

George McMillian, Geopolitical Analyst [00:05:56] Yeah. What’s critical here is that the Wolfowitz plan has totally failed. Right. The Wolfowitz Plan was used by the internet, by the Western banking community and the permanent state. Just a quick aside, how does that work? Well, if people just watch videos, on Sullivan and Cromwell and the Dulles brothers working for Sullivan and Cromwell during the 20s and 30s, and then going into OSS and then becoming the CIA. And then the other Dulls brother became head of the State Department, Secretary of State. So the two brothers covered overt and covert operations under Eisenhower. They’re doing that, but they’re still representing the law firms that connect the international, multinational, energy, mineral, and agricultural commodities, multinational corporations. But now they’re not just brokering these deals at a law firm between the Wall Street people. Now they’re in overt and covert operations managing this. Okay, the other example is Brown Brothers Harriman, because people are like, wait a second, how did this can’t happen here? Oh no, it’s not like it can’t happened here. This is the way it’s been working since the 20s and 30s. All right, people need to get used to that. There’s so many videos on that, that that’s the grand strategic level, that interface between the international law firms, the multinational corporations, big finance. And how they work the institutional levels of government. I mean, not just the intelligence community, the IC, not just, back then it was the Department of War, but now it’s DOD, not just a DOD but all the civilian agencies too. I don’t wanna get bogged down in that because that’s a whole separate video series. The perfect example is Southeast Asia when Jim Thompson went to Bangkok in 1945 and ended up… All the nine domains immediately flooded into Bangkok and then started fighting Ho Chi Minh and the. Okay, let’s.

Stu Turley, CEO Sandstone Group [00:08:30] Let’s leave Ho Chi Minh dead and out of this conversation because my head’s exploding. I’m trying to stay on track on point number one here. No, I’m just trying to say point number one is the city of London, France and Germany have a financial problem and this financial problem is going out and acquiring land that they can actually have signed to back their finances. Is that what I heard?

George McMillian, Geopolitical Analyst [00:09:03] That’s correct. OK, the reason why I’m using the Southeast Asian example, because you need to have a historical example of how I learned this. The way that this works goes back to the original Dutch East India Company that was then copied by the British East India company. The superpower, so that back then it was the it was cpower versus cpower in the colonial rivalries, they all developed these these East India companies, right? But the first big one was the Dutch East India Company. So the banking community formed the stock market and the first multinational corporation to go act like the state actor to back then, it was spices in agricultural products. So they’re already working with all the different government branches. And I think it’s in, well, this set of papers will come out in another publication pretty soon where people read the four levels of warfare in the nine domains. But all the governmental domains started being controlled by big finance back in the East India companies. Okay. So when people say, oh wait, this can’t happen here. No, this has been going on for hundreds of years where the big law firms and financial companies work with the multinational corporations, then work with these governments to run all other institutional domains. Why do I say that? Because now that’s grafted into the superpower, colonial major power, and vassal state hierarchy.

Stu Turley, CEO Sandstone Group [00:10:59] Right.

George McMillian, Geopolitical Analyst [00:11:00] The major powers, Britain and France, don’t want a bigger trading block and military block than them. So they want to disintegrate Russia and the Central Asian Stands to take over the immense energy, mineral, agricultural commodities because they don’t Russia in as a big entity They need to break it up into tiny little oblasts because they only want to take in vassal states. They don’t wanna take in a competitor. They need break these areas up. So they use the Wolfowitz plan. And I’m not even saying Wolfowitz even invented this strategy to do that. I’m just saying develop the strategy of no near peer powers. So the United States would be a superpower, and then the other entities and the RAND 2019 documents overextending and unbalancing Russia, people please read that, that’s the 12 pager. You can read it.

Stu Turley, CEO Sandstone Group [00:12:10] While they’re trying to back their finances if the UK is in such financial disarray and they’re having to get additional and I see this happening with President Trump where he’s actually annexing or putting back onto the books the United States coal reserves as well as the oil and gas reserves And if he was doing that, it would be my opinion that he would be wanting to get rid of the Fed, which I think he should, by having natural resources on the books. And so if we take a look at the city of London, we took a look in the city of France or Paris and Germany, and they’re doing the same thing, there’s enough rumors out there, George. That President Zelensky met with the UK and as well as the EU and already signed away the Ukrainian minerals deals for them to put on their books. And so, holy smokes, that is a gigantic pattern going on around the world.

George McMillian, Geopolitical Analyst [00:13:39] To get an economy back to the economics part, you need to get your minerals, your energy, and your agricultural commodities out of the ground. You need to put them in the industrial processing, refining, manufacturing process to make consumer products out of them, and then you got to distribute them. If you have all those things in your country, that’s fine. If you’re missing an ingredient to make a key product, Then you need to partner with another country. That turns economic development theory or growth theory into geo-economic theory once you get international partners.

Stu Turley, CEO Sandstone Group [00:14:21] Or you take them over.

George McMillian, Geopolitical Analyst [00:14:22] Once you start to need to bring a whole bunch of materials into one spot to make a consumer product, then you create logistical supply round vulnerabilities in a strength, weakness, opportunities, threat analysis. So then you want to secure those logistical supply rounds for you and your allies, and you want them to block them as much as possible For your rivals, right? Oh in this case You have the U.S., U.K., bye-bye’s, E.U., NATO, trading block and military alliance. And they, what they’re trying to prevent, and I have very long papers that will soon appear somewhere. Okay. They’re very, very long and they’re very very dense. And yes, if someone has already has an MBA and already has decades of experience and in the energy business, yes, they need to know this theoretical modeling. Once they see it and once they get through that learning curve, they will not be able to unsee it. All right.

Stu Turley, CEO Sandstone Group [00:15:35] Eye-opener, I’ll tell you.

George McMillian, Geopolitical Analyst [00:15:36] So you need, because people with independent subject matter expertise can’t see the big picture. I focus on integrated methodologies and integrated methodologists only. It’s another story for another day how that came about. But what they want to, what they wanna prevent is, is Russia from integrating with China, the mineral, you know, the big commodities producer with the big coastal rimland industrial power. And then China’s already built their infrastructure integration to the Central Asian stands, so they are integrating Eurasia. To make themselves autarkic against the maritime choke point encirclement strategy. So what I argue in these papers is if there was any doubt that the United States was pursuing a Wolfowitz doctrine, a Brzezinski-Wolfowitz doctrine to strangle, well, economically, will encircle physically, economically strangle, and then disintegrate Russia. The 2014 Euro made hand revolution removed all doubt. And for the backstory on that, if people just Google, well, Mahan, McKinder and Spikeman theories, but also Google, other YouTube producers call them Atlanticist versus Eurasianist strategies. So you can, people can Google that too and they get ground on this. Yeah, I’m sorry. My analytical methods take prerequisite courses. Propaganda tries to hide those sources. I’m telling people where to go get the information because I want people to go down the learning curve. I want to people to double check me.

Stu Turley, CEO Sandstone Group [00:17:28] Exactly. This is a lightweight conversation, George. And when we take a look at this plan as it rolls out, the finances of energy dictate the world.

George McMillian, Geopolitical Analyst [00:17:45] Like we said it, we’ve been talking about this since December of 2023, right? Energy is your multiplier coefficient in economics. Why is that? Because people make more with hand tools than you do without tools. People make, people are way more productive with power tools than hand tools. So people make The more technology you have, now you’re going into, you know, Robert Fogel’s theory, you know and solo growth theories, the more technology that you have. The more, the more, technology you have the more your labor productivity growth increases. Right. And then that increases your, while your GNP and GDP and all the other P’s. With Pamesi and dime analysis, that increases your national instruments of power rating. And then that increases your geopolitical.

Stu Turley, CEO Sandstone Group [00:18:49] So with these three points that we’re on here, the first one, financial and economic, that the UK is leading up to the second point. And because they’re in such a financial crisis, they’re scrambling to get the minerals, the pipeline methodology and everything else. And you said you had talked about the Iranian situation with the false flag narrative. Of potentially wanting to invade Iran as a horrific, stupid idea that’s not needed.

George McMillian, Geopolitical Analyst [00:19:29] Oh yeah. Okay. There’s so many points in here. There are so many aspects because, okay, Trump does not have a geostrategic person on his staff. He doesn’t.

Stu Turley, CEO Sandstone Group [00:19:40] It is clearly evident.

George McMillian, Geopolitical Analyst [00:19:45] They’re treating these as independent countries, okay? Ostensibly, they are, ostensibly they are. What you need to look at it is from a geopolitical, a geostrategic perspective is Russia is sitting there and China is sitting in there. They’re like, we need to protect this flank or that flank. So for Russia, they need to protect their Southern flank, which is Iran. Their southern flank is another country. So they’re going to pack. And I put it in a short six-pager paper that they’re gonna be sending Iran ISR, IADS, and SAMS, and C3I. These acronyms are command communications, control. And then, well, IAAS is integrated air defenses, SAMs are surface to air missiles, ISR is intelligence surveillance reconnaissance. So they’re gonna be giving all this support to Iran because they know that the Iran nuclear deal is a total red herring. They know that real motive of London and the UK is to collateralize that debt with those oil and gas resources. So they know it’s complete BS. So again, the third point is all Putin has to do is nothing, which has been the theme of our shows since December or anywhere or something like that. So now Putin has a chance to step on their throats because they were trying to bankrupt and disintegrate him. Read the Wolfowitz 1992 paper of the 93, 94 fiscal year paper that the New York Times published. Why did the New york Times published? Because Bush 41 thought it was so crazy that he declassified it and sent it the New York Times, so it would be fully published. And mocked, so nobody would ever do it. OK, what’s the problem with that? Bush 43 implemented it. And then, say, You know, the American Enterprise Institute pushes it with Frederick Hagen there. Robert Hagen’s over at Brookings and then over at Washington Post. He pushed it. Before that, him and Bill Kristol started Project for New American Century. And then Kimberly Hagen and Bill Kristol and that whole crowd with John Bolton, Elliott Abrams, and a few other people started the Institute for Study of War. They’re the ones that feed the scripts to General Jack Keane and for General Petraeus to read. They just write the scripts, and they just read them. Because once you understand what the underlying geoeconomic and geostrategic and unrestricted warfare packaging is, how that’s selected, you know that they’re just reading scripts.

Stu Turley, CEO Sandstone Group [00:23:03] Exactly.

George McMillian, Geopolitical Analyst [00:23:04] They’re not explaining how to integrate these three areas of economic development theory. Geo-strategic planning is sabotage theory. And then sabotage is you’re looking at strength, weaknesses, opportunity, and threats in a logistical supply route formation. And then that’s how you’re selecting your targeting packages. And then you’re using your information warfare domain. Because you want to spout the cover for action narrative and you want to kill anybody that’s actually doing strategic modeling that can figure it out.

Stu Turley, CEO Sandstone Group [00:23:44] Uh, secretary, uh, Rubio this week, uh saying that we are not in, this is, uh not a United States war. Yeah. You’re not, uh uh, is very telling to me that they’re frustrated. Um, and it’s because they don’t understand that all Putin has to do is nothing and he’s already won. Right. But By them trying to solve the problem, they’re helping the EU that has actually tried to destroy Trump.

George McMillian, Geopolitical Analyst [00:24:23] Oh, yeah. Exactly. Boy, there’s there’s just we could talk for hours on each one of these points. All right. Kellogg has no idea what he’s actually physical. Like I wrote, people need to go read my Why the Kellogg Plan is DOA series of papers that we posted up already. Right. They might want to seriously read the Russian natural gas and global realignment pages of papers before they read that.

Stu Turley, CEO Sandstone Group [00:24:53] And the 7P plan, dude, I’m going to brag on you for half a second. And I don’t mean to be nice, George. And I apologize for being, I just, you know, I am more of a bonehead than I am being nice. But the 7 P plan tells there’s the underlying reason why all this happened. It starts with a 7P plan and then migrates onto the other plans for implementation. But when we sit here and we take a look at this in this next step, with Secretary Rubio admitting that, then he came out and said, the United States will recognize Crimea as Russian territory. That sent President Zelensky into an absolute tiff. I think we’re coming down to the wire on this that President A, Ukraine does not need to be in NATO. Whether or not the United States is in NATO needs to be in question, in my opinion, as well too.

George McMillian, Geopolitical Analyst [00:25:59] Right. If we’re back to what we’ve been talking about for since December of 2023, been talking, about this is if the populist parties, and I focused in on the AFD in Germany and the FBO in Austria, if they rise to power, they refurbish the Nord Stream pipelines, they buy Russian natural gas and then they’re not only feeding Germany and Austria, but really the whole German world, because Switzerland is tied into the German pipeline system since Alfred Herr Hosset of Deutsche Bank. Okay, Liechtenstein is just a little country, but it’s connected to Austria. So it’s the whole German speaking industrial world. Now, Switzerland will do that and not tell anybody and hope nobody talks about it, but they’ll do it. But then when that happens, then the Slavic Danube River Valley countries are gonna hop onto that too, because the pipelines were built by Krohassen and the Siberian pipelines since 1982, or since the 70s. So those backflow it, and then you’re gonna have 10 countries in the Danube river, because the Danubian River Valley goes up into Bavaria. You’re gonna to have all these countries exiting the EU NATO and leaving the petrodollar because you can’t buy Russian natural gas and dollars anymore because of US and Western sanctions. So now they’ve got to totally exit the petro dollar. So that’s going to backfire. So when I say that the Wolfowitz plan is backfired, all these little sanctions to encircle and strangle, economically strangle Russia are now backfiring, where people now have to leave the EU-NATO trading bloc, military bloc alliance, and join the Eurasian Economic Union, which is exactly the opposite of what’s intended.

Stu Turley, CEO Sandstone Group [00:28:15] Exactly. And this makes my head explode with what is the other around the world. There are discussions of when President Trump said to Secretary of Energy, who’s one cool cat, Chris Wright, would you mind managing a Russian nuclear power plant in Ukraine? He goes, Yes, boss. I sure would. I love that. And as energy as a service is born as managing, then the rumors in the last two weeks have surfaced about having the United States manage not just the Nord Stream rebuild, but all natural gas coming in and out of Russia as this is now becoming a global topic. Where this… My head explodes, George, is that then you would have the US managing Russian natural gas in US petrodollars. The US would be the middleman and the godfather, if you would, the gatekeeper and making money on it. At what point does Trump help the EU stay in business, or does he become more like and say… All Putin has to do is nothing. Trump would be almost better off to step out of the Ukraine war and let the EU fail. Did I just say that?

George McMillian, Geopolitical Analyst [00:29:49] Yeah, absolutely. Yeah, and I’ve been saying that since January because it’s the same Stefan Halfer, Alexander Downer people, it’s same Oxford geopolitical crowd, the same International Institute for Strategic Studies crowd, that’s where they all congregate, that has been trying to prevent all populace from taking over and coming to power. Because they don’t want the populace to keep on buying cheap Russian gas because if Russia goes through their export led growth strategy and becomes economically autarkic and fuses with China and China fuses in with the Central Asian Stands and they all work together, then you have a functional European Economic Union. What makes it functional? Well, the infrastructural integration and diplomatic cooperation and economic cooperation. It’s maturing. If that integration occurs, then the EEU, the Eurasian Economic Union, is going to merge with ASEAN in the south. If they merge with Asia on in the South, that becomes a mega trading block military lines. Now follow me here.

Stu Turley, CEO Sandstone Group [00:31:22] I’m trying to talk.

George McMillian, Geopolitical Analyst [00:31:23] If the optimists win up and down the Danube River Valley in Central Europe and they start buying Russian natural gas again, guess what? Those 10 countries or so are effectively joining the E.E.U. ASEAN mega-union.

Stu Turley, CEO Sandstone Group [00:31:43] Exactly.

George McMillian, Geopolitical Analyst [00:31:45] Then the EU and NATO go kaput. The London and Paris are no longer major colonial powers anymore. They become vassal states. So that’s why they’re trying to do those color revolutions all over the place in central Europe. Well, they’re try to ban Farage. They’re law-faring the hell out of Marine Le Pen. They’re trying to bear the hell out of Alice Vito They’re trying to do the same to Herbert Kickle in Austria. They’re outlining the conservative TV shows in Poland. They’re tying to oust Viktor Orban. They already tried to shoot Robert Fico. OK, they’re trying to prevent the conservative parties in Croatia from rising to power. Again, Alex Kramer is from Croatia. He said if they had an open referendum. He says people would leave the EU today. So they’re heavily influencing the elections in Croatia. Slovenia, which is where Trump’s wife’s from, she’s from Maribor, Slovenia. They’ve always been tied. That’s really a German area. Her last name’s Knaux. They’ve always been part of the Austrian-Hungarian Empire, always. Their economies have always been tied to Austria. If Austria leaves the EU and starts buying Russian natural gas again, guess what? Slovenia goes, too.

Stu Turley, CEO Sandstone Group [00:33:40] Exactly.

George McMillian, Geopolitical Analyst [00:33:41] All right, so then you’re going to have all the Danube River Valley countries. Except for Bosnia-Herzegovina, because, well, that’s up into play. That will disintegrate. The Serbians want to go back to Serbia. On a narrow road, we’ll go back to Serbia and buy the Russian natural gas from there. So you expect a lot. I’ve traveled in this area extensively, by the way.

Stu Turley, CEO Sandstone Group [00:34:10] And when you take a look at this from a US dollar standpoint, we’re almost in a no-win situation for President Trump trying to keep the US dollar as the gold standard, if you would. He can still do it. I think that he can. I think, in my personal opinion, And I think ending the Fed would be the first step in doing so. Um, because that is a private organization that has lost its value and no longer an American facility, a facilitator, but it more a, uh, launderer money laundering scheme for the elite. I mean, that to me, if we could get rid of that, the U S dollar could remain solid in a better trading partner.

George McMillian, Geopolitical Analyst [00:35:08] I need to hit a very important point here.

Stu Turley, CEO Sandstone Group [00:35:11] Okay, cool.

George McMillian, Geopolitical Analyst [00:35:12] The financial community at the grand strategic level. I’ll use the example of Sullivan Cromwell and Brown Brothers Harriman. They’re using our military to socialize the losses and then privatize the profits. The Fed facilitates that.

Stu Turley, CEO Sandstone Group [00:35:37] Exactly. So your articulation of the problem is much better than I was able to say it in my Texoke. But you sit back and kind of go, President Trump has got to get either A, you hired, or someone like you, and I prefer you since I’ve had personal conversations with you. Because his staff is from a monkey sitting in a lazy boy watching the news. I can tell his people don’t have a full picture of this.

George McMillian, Geopolitical Analyst [00:36:16] No, Doug McGregor was on redacted last night talking about Kellogg, Rubin, Waltz are clueless as far as this area goes. And yeah, that ecosystem of Danny Davis and Doug McGregor and the Durand folks and the Judge DiPolitano folks, that ecosystem there, they’re now starting to refer to Kellogg, Rubio, and Walsh as the three blind mice.

Stu Turley, CEO Sandstone Group [00:36:48] Oh, yeah. Okay. You and I have never been derogatory other than saying that they don’t have the right information. I mean, we’ve never called them that.

George McMillian, Geopolitical Analyst [00:37:01] Walsh’s background is a Green Beret. They are trained at the tactical training level only. All right, he’s got to be a colonel. So he’s doing operational planning and tactical level. From experience, he knows something about the theater strategic level on the third level just from going back and forth so much. But the grand strategic level where finance runs the multinational corporations, and again, so vital for people to understand. They’re using the superpower, I’ve got to say it again, the superpower major power vassal state hierarchy to expand the EU into the Eastern European vassals states because they need to take over the energy, mineral and agricultural commodities. They need to the commodities over, send them to the Western owned financial manufacturing processing plants And in order to send the profits of the commodities back to the Western banks. It’s got to go through that cycle.

Stu Turley, CEO Sandstone Group [00:38:09] In order for them to peel their money out.

George McMillian, Geopolitical Analyst [00:38:12] Right. So now they’re desperately trying to move these trading blocks into these areas to take over the commodities so then they can out process them. I was in several years ago, I was at an economics conference in Dubrovnik where they keep on talking about, well, they take our ideas, they take out resources and they send it to a processing facility someplace else. We want it to stay here. So you’re back to the old structural functional dependency school arguments of Raoul Prebisch and Hans Singer. See, the younger generation doesn’t realize these old school works have been talking about this for a long time. Well, they were talking about it, trying to fix it. Especially Richard Artie, a guy from Wales, at one of those U.K. Universities, wrote the resource Curseterian. In 1994 about mineral extraction in northwestern Africa. Well, instead of using it to fix the problem, like Orwell, they used it as an owner’s manual so they can put tyrants and oligarchs in charge. Because that brings the resources into one central spot where they can be sent to the factories that are already owned and the profits then go back to the banks. They need to control the commodities areas, plus they need to the logistical supply routes. So that’s how geoeconomic and geopolitical theories intersect. Trump does not have one person on his team that can do that. Let me say this one thing. Witkoff is now doing this very complex material on the fly. And if people want to know how complex these issues are, go read the articles I posted. I got a Telegram site with all my articles from Energy News Beat linked in one place so people can find them. You can post a Tele gram. Um…

Stu Turley, CEO Sandstone Group [00:40:30] I’ll put it in your notes.

George McMillian, Geopolitical Analyst [00:40:31] Joe notes. Okay. So people can just go and just click on it. If people read what I got published so far, they’ll start to realize, no, you need to sit down and you need to read this and think about it. Because I’m going to your audience is going to know two thirds of it. They’re going to need a third, a different third, but it’s going be a different third for everybody. People need to sit. People have the pieces to the puzzle. I’m supplying basically the border of the puzzle where then people can say, oh, this is where the pieces go. That’s basically what I’m doing with this analysis. All right, or actually, it’s a synth.

Stu Turley, CEO Sandstone Group [00:41:15] Your modeling has been very, very scientifically thought out as you’ve been turning these in as an Energy Newsbeat contributor. I appreciate the thoughtfulness and the effort that you’ve put in forth on all of these. And I can tell the number of people that are hitting your articles and everything else and the people that don’t like your articles, I get that as too which means It tells me that you’re spot on based on what I’ve seen in the past.

George McMillian, Geopolitical Analyst [00:41:51] If you listen to Fox News, okay, the negative commenters, you can tell, they listen to CNN or Fox or whatever.

Stu Turley, CEO Sandstone Group [00:42:00] Which means you’re right.

George McMillian, Geopolitical Analyst [00:42:02] They’re like, oh, wait a second. But Stuart Varney said they don’t realize they’re repeating the false cover for action narrative. The reason why it’s almost we’re both under such time constraints. We don’t have time. But in a theoretical sense, I would I’d love to go over my 200 page. Southeast Asia slide set so people can see this in a historical example. And then once you see the historical example, then all of a sudden you see it everywhere. If you don’t see the pattern, once you’re aware of the pattern then you then then stuff happens. Okay, let me bring up an example. Um, the, uh, on Clayton Morris, cause I love his show.

Stu Turley, CEO Sandstone Group [00:43:01] I love Clayton. Clayton’s cool cat.

George McMillian, Geopolitical Analyst [00:43:03] Yeah, he’s good friends with Michael Yon and Ann Vandersteel and all those people, right?

Stu Turley, CEO Sandstone Group [00:43:08] A whole bunch of good people.

George McMillian, Geopolitical Analyst [00:43:10] Yeah, yeah, yeah. Absolutely. But he Sunday on Easter, or was it Saturday, whenever he put that video out, he says, Oh, Putin’s blinked. Rubio said that if they don’t come to the table, they’re going to leave. You know, the US is going to leave. And Putin blinked, he immediately came back with a ceasefire for Easter. And I watched the show and I just wrote real quick in the comments section, I said, No, I think that’s just an Easter ceasefire. He’s going to want to go back and the Wolfowitz plan failed. He’s gonna want to, go ahead and bankrupt London and Paris and have the populist politicians come to power because then you not only have the EU that’s integrated with ASEAN, then you’re going to have the, what I’m going to call the Danube river Valley trading block also joining the EU. Okay, if that happens Can Japan and South Korea’s automobile business stay in power without Russian natural gas? We’ve been saying no since December of 2023. That’s in the original Russian natural cast series of papers. So it’s not like we just. If you know the role of energy as the multiplier coefficient in economics. Then you understand what that, you’re gonna be globally competitive if you’re connected to cheap natural gas. Well, cheap natural anywhere. Okay, I’m not just saying cheap Russian natural gas, the businesses are gonna have to move to where the natural gas is. And if you have a woke left government that won’t let countries produce their natural gas fields, they’re gonna go out of business.

Stu Turley, CEO Sandstone Group [00:45:02] The regime won’t change if you don’t have cheap energy.

George McMillian, Geopolitical Analyst [00:45:07] So someone said, oh, Argentinian Russian natural gas is going to kill Russian natural gas. Well, no, you can’t send pipelines to Europe. That does nothing to keep the populace from gaining power in Europe. OK, what it does do in Argentina is if companies want to relocate their manufacturing facilities to where the gas is.

Speaker 4 [00:45:38] Exactly.

George McMillian, Geopolitical Analyst [00:45:39] For people that don’t fully understand this, my father explained, cause we used to drive back and forth through Pennsylvania, he was like, it takes twice as much coal to produce steel as iron ore. So you have to bring the iron ore to where the coal is. Okay, same difference. You got to bring the other commodities to where the natural gas is. If you’re bringing them too far, it’s not worth it. So, Argentinian best use its natural gas on the international markets is to get the commodities in South America to go to Argentina and build the manufacturing places and then send it throughout the world it’s not to send the gas it’s to send everything else, but it’s got to be relatively close, otherwise the cost differentials are too much.

Stu Turley, CEO Sandstone Group [00:46:32] And that’s what I visit with NJ Anut, who is the head of the African Energy Chamber. And that is exactly what he wants to do, is to build the manufacturing in Africa next to the natural gas, build the products there and make jobs and have the economy there. And that is a better trading partner. To have. I think I love that’s the way it’s better for everyone as opposed to going out and stealing somebody else’s natural wealth and then having the banks centrally hold it because then somebody else makes all the books.

George McMillian, Geopolitical Analyst [00:47:20] I’ve got to reiterate this point because it’s very, very, very important. They take over the commodities, energy, mineral, agricultural, because it has got to go to the manufacturing facilities that they own so the products go back to Wall Street, City of London, Brussels, and Paris. So they’ve been collateralizing their debt. This way ever since the East India companies. It’s been like this. It’s coming to a close.

Stu Turley, CEO Sandstone Group [00:47:56] And the financial crisis is coming to a head.

George McMillian, Geopolitical Analyst [00:48:02] This is the degree that we’ve been talking about this for, you know, since December, well, November of 2023, whenever you actually physically got the videos out is gonna be in December. But we’ve talking about for that length of time. So here’s the big question, how did the Kellogg plan, well, how was that allowed to go forward? He’s got his advisors, like Doug McGregor was saying yesterday, are absolutely, totally incompetent when some of the people in that chain had my papers in January. And they withheld that information. And those people know who they are. So I won’t be getting Christmas cards from them anytime soon.

Stu Turley, CEO Sandstone Group [00:49:01] But no but you have you have cause and effect george because you’ve got a model and a methodology that you’ve talked about and you’ve got a service that is quite honestly i think of value to the united states especially in the academia world where you should be hired to absolutely rework the academia environment out there. You’re too valuable of an asset. I’m sorry for being nice, but I see what needs to be done. So we’ve got about 10 more minutes here. But what are some of the things that you would recommend to the team right now besides reach out and hire you?

George McMillian, Geopolitical Analyst [00:49:50] Oh, well, what we’ve been talking about since, I don’t know, December, January, there’s always a lag between when we do a video when it actually comes out.

Stu Turley, CEO Sandstone Group [00:49:58] Let’s all do well tomorrow.

George McMillian, Geopolitical Analyst [00:50:00] Yeah, okay. All Putin has to do is nothing and just watch the European economies collapse. We’re back to that just by talking about what’s increased since we’ve been talking about it, let me put it in those terms, is the debt to GDP ratio in England, France and Germany have increased. That’s what’s changed. My model stayed the same, but different aspects of their situation got worse. So now, we’re more desperate. And the whole reason for the global war on terror was to move in and collateralize the assets in the Middle East. The whole seven countries in five years, but the United States is already in Afghanistan, so it’s really eight countries in 5 years. It’s about taking over energy, minerals, agricultural commodities, and the logistical supply routes. If somebody looks at the Middle East and the South Caucasus, they want the Georgian plain from Baku to Tbilisi to Batumi. They want that land bridge. Erdogan’s got the Anatolian Peninsula land bridge to Bulgaria. What they really want to add is the Iranian land bridge. That connects the Caspian Sea to the Persian Gulf. If the International North-South Trade Corridor comes through to Chavaharport, they need from Cash to Chabahar Port, they needed 365 miles or something like that, kilometers, a railroad track two years ago. I don’t know where they are with that, but it’s- Let’s just say they need 100 more miles, 100 more kilometers rather left.

Stu Turley, CEO Sandstone Group [00:52:10] You know, Jack, I thought I saw somewhere. I will fact check that. But I believe it’s at 100 to 150 range. It’s not far.

George McMillian, Geopolitical Analyst [00:52:19] As it’s getting closer, as it gets closer to completion, now they need a ran hit for a second reason. It’s A2AD, area access, area denial. They need to deny access to that area from that railroad. Because otherwise… Once the railroad is, you can at least export crude back and forth to China. It doesn’t have to go through, that’s, well Chava Harport is outside the Strait of Hormuz. Every time they get a port. Is on the Indian Ocean or Persian Gulf, then they don’t need to send their ships through the Straits of Malacca. All right, next point. If they can strike, if the Persians can strike a deal with the Baluch in Sistan, Baluchistan for autonomy, and they get a piece of the action for that pipeline going through Sindh province into Gujarat, India, if they get the natural gas and oil pipeline going to India and they pay off Pakistan. Whoops all right so why is there’s all this underlying activity covert operations going on in that area. If you know what pipeline projects and railroad projects and port projects are in that area, again, maritime, riverine, port and terrestrial land bridges, if you know, what those projects are in those crucial areas, all of a sudden there seems to be color revolutions and insurgencies. And…

Stu Turley, CEO Sandstone Group [00:54:13] For our podcast listeners, I will have maps and things in the transcript for the written articles.

George McMillian, Geopolitical Analyst [00:54:20] Oh yeah, I’ve been to most of these places, so yeah.

Stu Turley, CEO Sandstone Group [00:54:23] Yeah, I’ll make sure I drop those in there because while we are going to be at 2.2 million downloads in 2025 for our podcast, we’re well on track for 18.5 million transcripts read. So the people really will read the transcripts. And it’s just amazing to me that it is that much of an add-on to a podcast, George.

George McMillian, Geopolitical Analyst [00:54:54] It’s and and if they watched our podcast there’s no way that the Kellogg plan would have ever even been considered so it’s kind of mind-boggling that all they had to do is watch our shows and read my papers and they would have been like all Putin has got to do nothing instead instead they went from this this you were going to deal with Putin from a position of strength Nope. Oh, yeah. Okay. Yeah. All right. Yeah, yeah, okay

Stu Turley, CEO Sandstone Group [00:55:23] and the light at the end of the train is actually heading to your Asia new trading block. Oops.

George McMillian, Geopolitical Analyst [00:55:32] You know, I went to Rutgers, you know, decades ago. I read these books from Latin American professors. Well, professors, yeah, some of them are Latin American. But professors on Latin American economic and modernization theories, where this comes from. The, you, know, Andres Gutierrez-Franc and Raul Prebisch and Hans Stenger, a whole bunch of other people, they already went through this during the Great Depression. They got to build bigger, more. Our target is what they call it, uh, regional geoeconomic independence is what they’re after to shield them from great depression shocks or, you know, when the recession happens in the UK or the United States, you have the United States needs it so they don’t catch cold. So nothing I’m saying is new. I’m going back to the old school books, right? That’s all I’m doing is just going back to the all school books and reapplying it. That’s what I’m

Stu Turley, CEO Sandstone Group [00:56:31] Well, well, George, how do people get a hold of you?

George McMillian, Geopolitical Analyst [00:56:36] Oh, post that Telegram post or they can go to LinkedIn.

Stu Turley, CEO Sandstone Group [00:56:41] I’ll link to the show notes for your telegram channel on energy Newsbeat. You’ve organized all of the articles. So you can go to energy newsbeat.co and then take a look at all of your articles when you just search for George and your landing page will even come up very easy or go to LinkedIn and search for george Macmillan. And again, George, I really appreciate your time and realize it if. The Trump administration chose to listen to you. We wouldn’t be where we are now. So I do appreciate you as a true American patriot. Thanks for your time.

The post How can the Trump team negotiate with Putin when they don’t have all the key data points? appeared first on Energy News Beat.

![]()