Energy News Beat

As shipping slithers somewhat apprehensively into the Year of the Snake, analysts reckon tankers – whether hauling gas or oil – are best placed to see an uptick in fortunes.

The Lunar New Year is not starting too well with many sectors struggling to break even in January.

The cross-sector ClarkSea Index, a weighted barometer covering all shipping segments, eased back by 8% last Friday to $21,128 a day, the lowest level for more than a year and with the average in 2025 so far down by 10% year-on-year, though still up 13% on the 10-year trend.

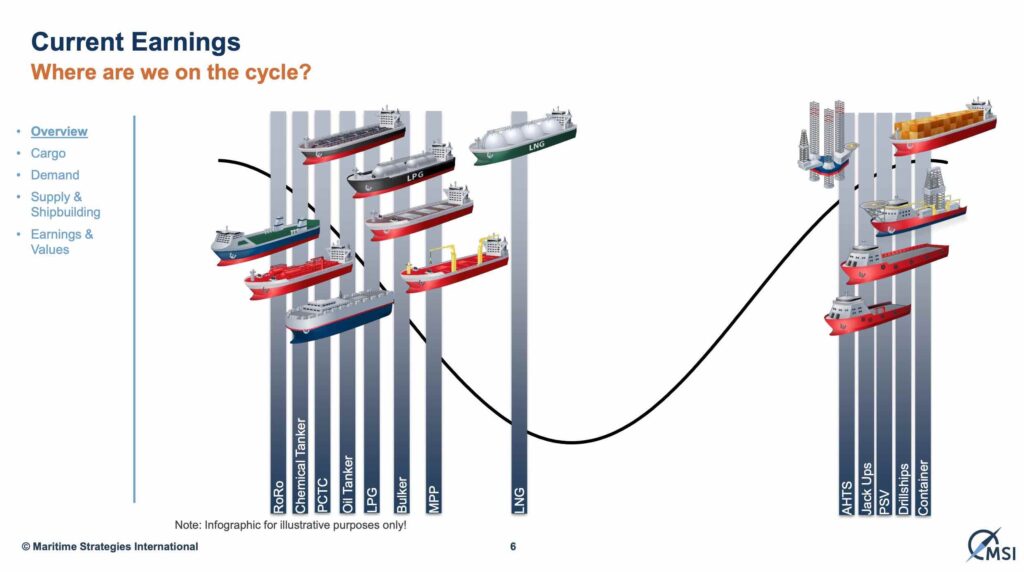

One analyst to have stuck his neck on the line with his predictions is Dr Adam Kent, the head of Maritime Strategies International (MSI), who gave delegates attending last week’s Marine Money event in London his take on where each segment is in terms of the cycle, with Kent suggesting LNG, currently experiencing record lows, is best placed for an upswing.

The average spot rate assessment for a 174,000 cu m ship fell by 31% to $14,000 a day as of last Friday, while the equivalent rate for a 145,000 cu m steam turbine unit now stands at just $2,500 a day, down 29% week-on-week. Protracted weakness, especially for older steam turbine units, is seeing more vintage gas tankers head for demolition, while many owners are contemplating lay-ups as a record volume of newbuilds readies to leave Asian drydocks.

Has the sector nearly bottomed out, and will it post a solid upswing, as Kent has forecast? Splash Extra sought the views of other shipping analysts to pick out improving segments to watch out for in the Year of the Snake.

Giuseppe Rosano, who heads up London broker Alibra Shipping, concurred that LNG ought to perform better in the months ahead. He also singled out LPG, spurred by resilient Asian petchem and regional demand as well as increased supply from the Middle East and Africa.

Tanker freight markets work on fine margins of utilisation

“Ethane and clean ammonia trade should increase too, keeping new orders for LPG vessels high,” Rosano said.

Looking closely at the MSI slide above, Mark Williams, the founder of UK consultancy Shipping Strategy, argued that oil tankers are nearer a cyclical upswing than the graphic suggests.

Williams placed his tanker optimism down to US overtures towards Saudi Arabia and Donald Trump’s plans to increase oil production, along with more Atlantic basin oil production. At the same time, Williams pointed out more tankers are turning 25 in the next few years and the fleet will shrink even as tonne-miles – if not overall tonnes – could grow.

“Tanker freight markets work on fine margins of utilisation – there is upside potential,” Williams said.

Holding similar views is Ralph Leszczynski, the head of research and consultancy at Banchero Costa, who admitted he is concerned about the “really scary” LNG orderbook, which will see more than 100 newbuildings deliver this year alone, resulting in a net fleet capacity increase of 13% year-on-year.

“I highly doubt at this point that there will be enough extra cargoes on the market and/or sufficient increase in tonne-miles to absorb all of these new vessels. Hence the supply-demand balance for LNG is actually likely to get worse rather than better this year,” Leszczynski said, who then went on, like Williams, to express greater confidence in crude tankers, especially VLCCs.

Unlike LNG, the crude tanker orderbook is very modest with Banchero Costa data showing the VLCC fleet is expected to see zero growth this year, and the aframax fleet will expand by only 1%, whilst the shadow fleet, Leszczynski argued, will increasingly struggle under harsher sanctions and controls.

“The Trump government will encourage more US crude exports, and will probably try to strong-arm both Europe as well as China to buy more from the USA at the expense of Russia and Iran, which is beneficial for tonne-miles,” Leszczynski predicted, dismissing upswing prospects for containerships and dry bulk.

Splash Extra contacted more than 20 analysts for their Snake shipping forecasts. However, with today’s incredibly volatile markets and uncertain geopolitical situation, most experts were not willing to stick their necks out.

One analyst who wished not to be named confided that with “Trump 2.0” there are so many fast and unexpected moving parts that the smart play was to adopt famous maritime economist Martin Stopford’s view of never giving a forecast.

Most shipping sectors are expected to see quieter activity levels in the coming days due to the Lunar New Year holidays. Typically, container shipping is most affected followed by dry bulk and to an extent tankers, though over the years, there have been exceptions. In 2024, dry bulk rates and tanker rates both jumped at the onset of the holiday while containers drifted downwards after a short squeeze at the start of the Red Sea diversions.

Across all three sectors this year, freight rates have been on an easing trend heading into Lunar New Year, suggesting further downside from here may be limited. Normally the post-New Year period sees the beginning of a resurgence in dry bulk, somewhat of the status quo for tankers and the start of seasonal softness for containers.

The post Tankers best placed in the Year of the Snake appeared first on Energy News Beat.