Energy News Beat

The problem is in services, which account for 67% of PPI. But goods prices are re-accelerating too. The whole inflation scenario has changed.

By Wolf Richter for WOLF STREET.

The prior months’ data of the Producer Price Index were revised substantially higher today, powered by whoppers of upward revisions in the PPI for services, something that has been happening month after month, and on top of that came the price increases in November.

The PPI tracks inflation in goods and services that companies buy and whose cost increases they ultimately try to pass on to their customers. And the entire year 2024 through November has been a big acceleration.

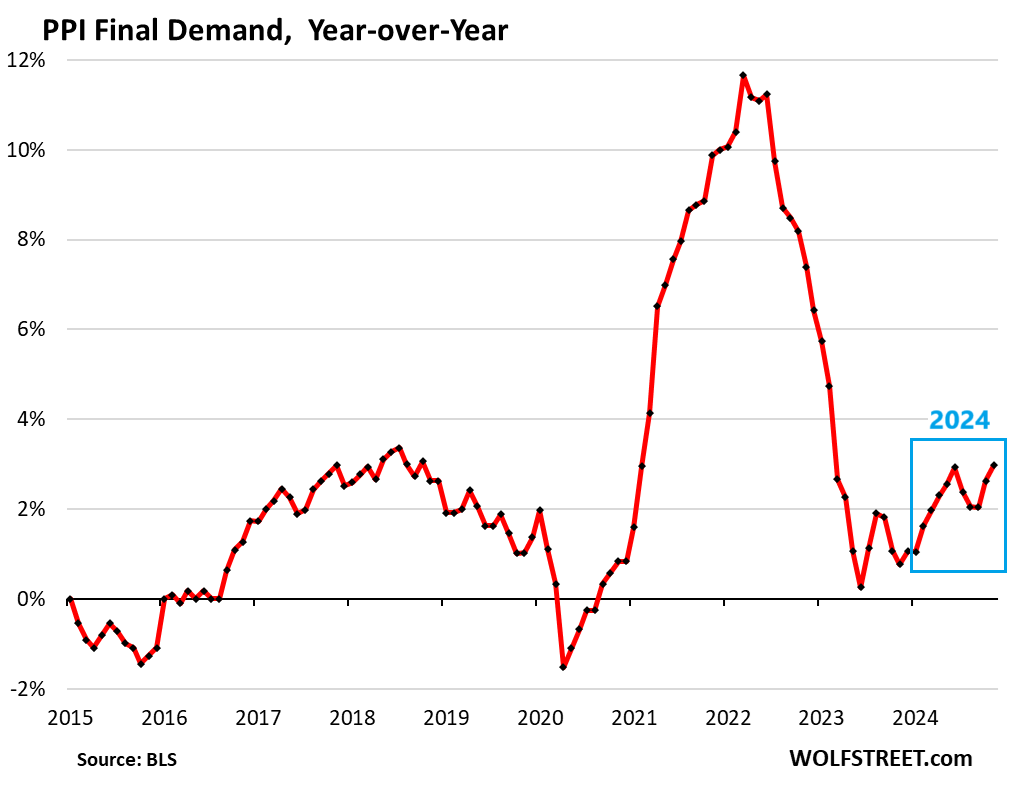

The revisions, and the additional price increases in November, caused the overall PPI for final demand to rise by 3.0% year-over-year, unrounded (+2.98%) the fastest increase since February 2023, and a substantial acceleration from October, which a month ago was reported as an increase of 2.4% year-over-year, and up from the original September increase of 1.8%. So the data went in two months from 1.8% to 3.0%: that’s a big fast acceleration.

The freak drop in July in the chart above was caused in the services index, that forms the majority of the overall PPI. More in a moment.

On a month-to-month basis – likely to be revised even higher next month – the PPI for final demand rose by 0.38% on top of the upwardly revised price levels in the prior month, according to data from the Bureau of Labor Statistics today

The plunge in energy prices from mid-2022 until recently had pushed the overall PPI down into its pre-pandemic range, and papered over the inflationary forces in services. But that is now over. On a month-to-month basis, energy prices rose in November, and food prices jumped, and other goods prices rose, and services prices rose.

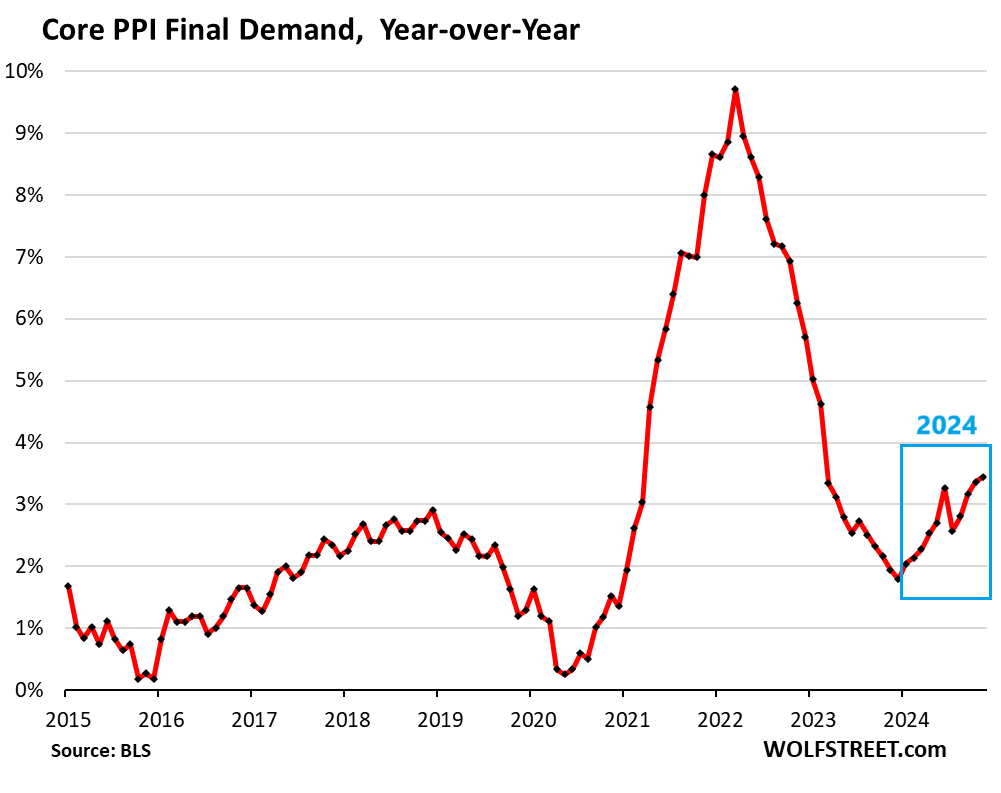

“Core” PPI, which excludes food and energy, accelerated to 3.4% year-over-year, the fastest pace since February 2023, up from the originally reported 3.1% in October and up from the originally reported 2.8% in September. On a month-to-month basis, Core PPI added 0.22% in November to the upwardly revised October price level.

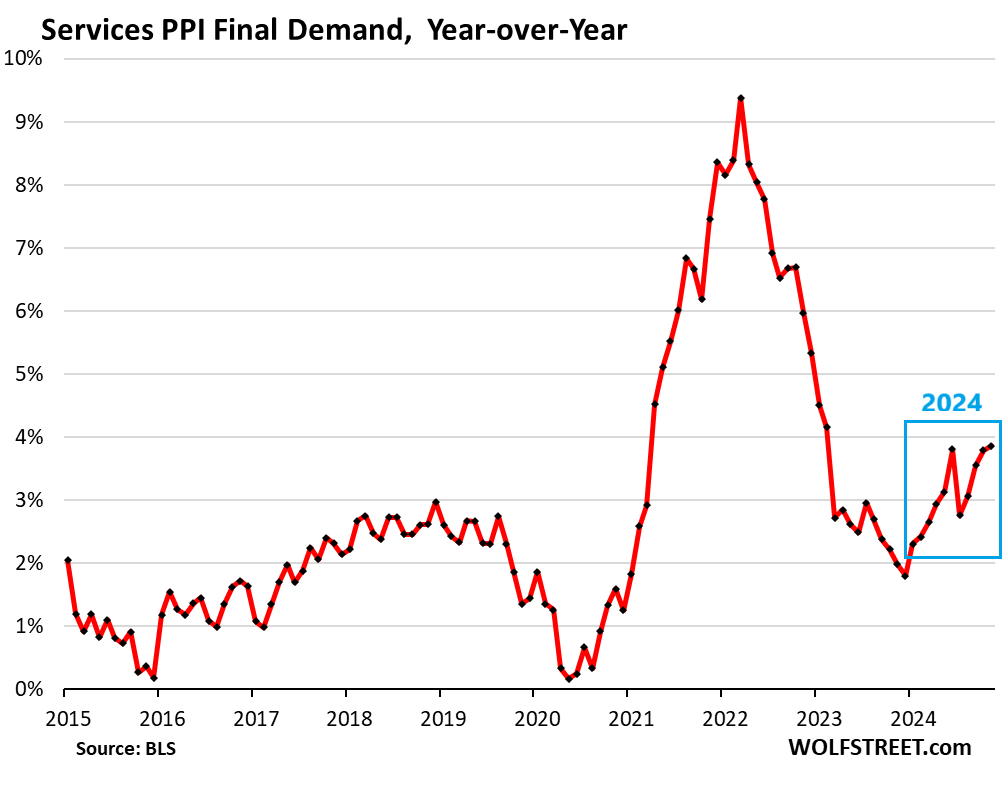

The Services PPI for final demand accounts for 67% of the overall PPI. It’s the biggie, and it’s where inflation is. And it’s where the whopper upward revisions are.

The PPI services accelerated to 3.9% year-over-year in November, the fastest pace since February 2023,, and there were whoppers of upward revisions for October to 3.8%, from the 3.5% reported a month ago, and for September to 3.6%, from the 3.1% reported two months ago. So from 3.1% to 3.9% in the data in two months. That’s quite a trip. We’re now eagerly awaiting the upward revisions for November.

The freak drop in July occurred because the month-to-month reading of July 2023 of +9.9% annualized fell out of the 12-month period, and was replaced by the -2.8% reading of July 2024.

The Services PPI month-to-month increased by 2.9% annualized (+0.24% not annualized) in November, on top of the upwardly revised October level.

And those were the whopper revisions, month-to-month annualized:

- October revised to +3.9% today, from the +3.2% reported a month ago

- September revised to +4.9% today, from the 2.0% reported originally two months ago

- August revised to +5.8% today in serial revisions from the originally reported 2.6% three months ago.

Double-decker luxo-whopper upward-revisions going back months! In other words, PPI inflation in services is not only getting worse, but has been much worse than previously reported.

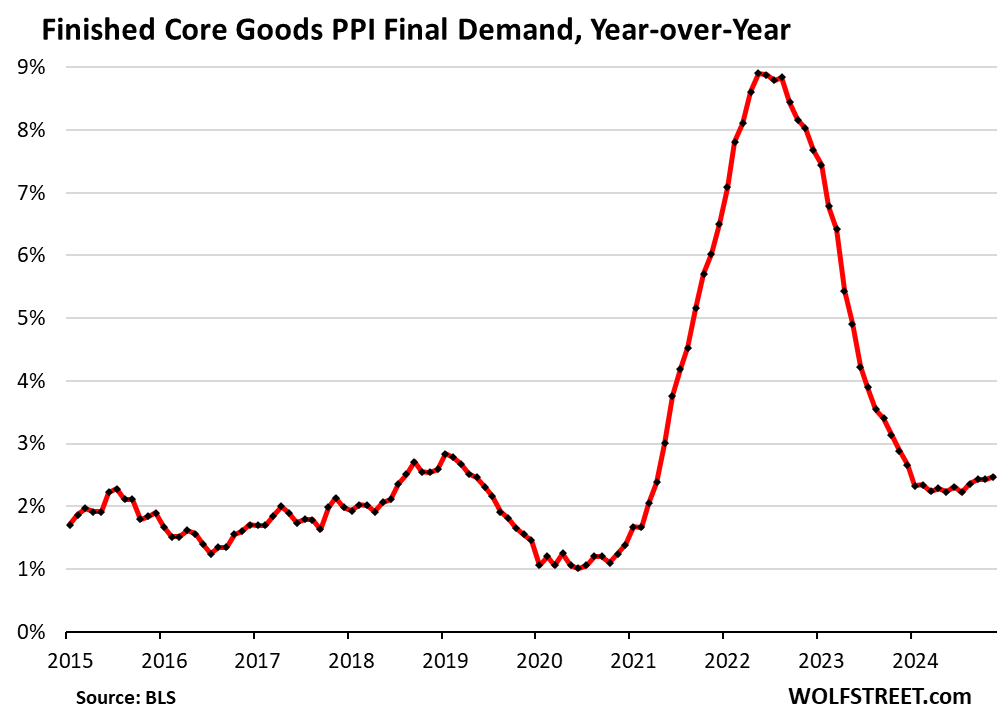

“Finished core goods” PPI has been relatively tame and with only small revisions, compared to the inflationary mess going on in services. Some prices have been falling, others rising.

Year-over-year, the index rose by 2.5% in November, an acceleration from 2.4% in October, and the fastest increase since December 2023, and up from the low of 2.2% in May. The index has been all year in the upper portion of the pre-pandemic range.

On a month-to-month basis, the index rose by 3.1% annualized in November, and this year has been in the range from +1.5% to +3.7%.

But in terms of overall inflation, the problem is that the finished core goods PPI stopped decelerating this year, and instead started to softly accelerate again. It was a big contributor to the deceleration of the PPI last year, and that is now over.

The PPI for “finished core goods” includes finished goods that companies buy but excludes food and energy products.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

The post PPI, “Core” PPI, “Core Services” PPI Inflation Much Hotter after Whopper Up-Revisions Going Back Months appeared first on Energy News Beat.